Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, February 22nd.

There are no changes recommended for any of our Portfolios.

As I’ve reported the past few weeks, the recent economic data has generally been positive, suggesting that a “soft landing” or even no landing—meaning no recession at all—could be in the offing. The exception this week was that applications to purchase new homes fell to the lowest level since 1995—a sign that the housing market, which is a big part of the economy, is not out of the woods quite yet. Still, the data this year has generally pointed toward continued economic growth, not recession.

You’d think that avoiding a recession would be good news for the stock market. After all, it would be better for corporate earnings if the economy continued to expand. But perversely this seems to be a moment, like so many we’ve experienced in the past, where good news becomes bad news in the investment markets as traders assume that a growing economy will lead Federal Reserve policymakers to hike interest rates even higher. And with the yield on the 10-year Treasury pushing 4%, higher bond yields are once again seen as a headwind for stocks.

Over the past week (as of Tuesday night), Total Stock Market Index (VTSAX) declined a little over 3%. Growth stocks led the way down—with Growth Index (VIGAX) falling 4.4%. Is the stock market’s hot start to the year over? Will we revisit the lows hit last October?

We’ll only be able to answer those questions with the benefit of hindsight. That doesn’t mean we should avoid investing—there’s always uncertainty about what the market will do in the short-term—but one lesson is to stay diversified.

Muni Money Market Yields on the Rise (Again)

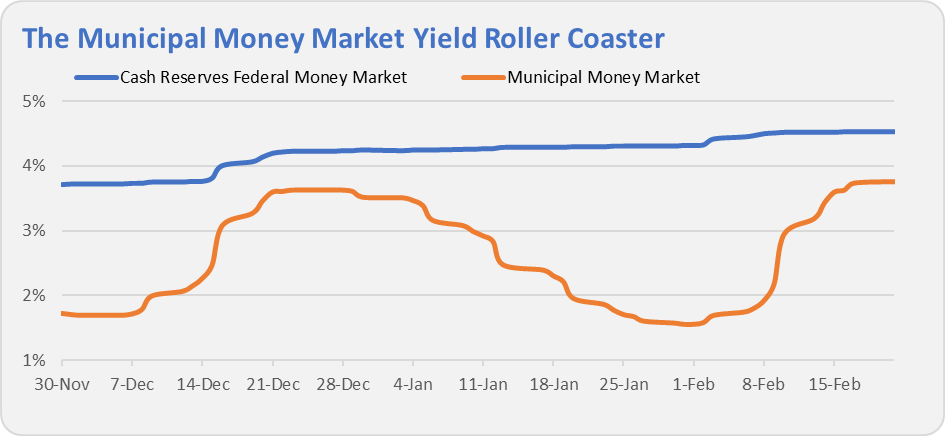

Yields on municipal money market funds—like Municipal Money Market (VMSXX)—have been on a roller coaster ride the past three months. I reported on the rise and fall in yields here, here and here.

Frankly, I thought that would be the end of the story … but then municipal money market funds’ yields more than doubled over the past three weeks. As you can see in the chart below, Municipal Money Market’s yield has risen from 1.55% at the start of February to 3.76% by Tuesday. By contrast, Cash Reserves Federal Money Market’s (VMRXX) yield has only inched higher over the period.

So, what is going on? Well, I think yields overshot the mark and are trying to find an equilibrium. Let me explain.

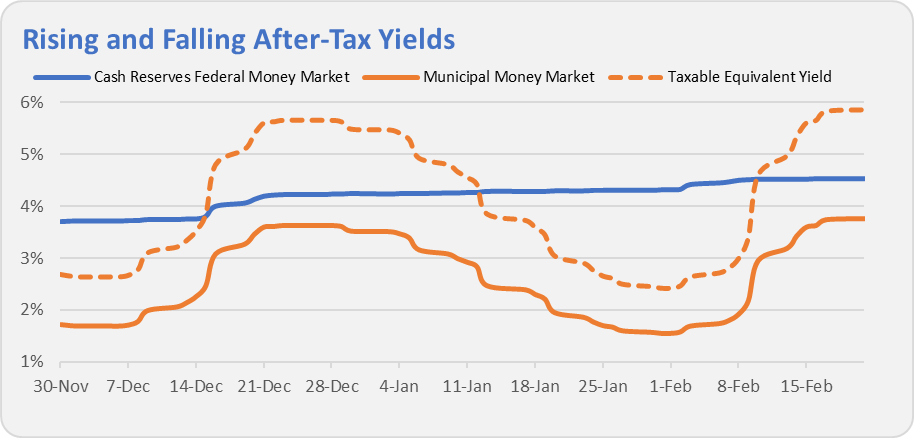

This goes a bit into the weeds, but if you are deciding between buying a taxable money market fund and a municipal money market fund, you can’t just look at their stated yields. You need to take taxes into consideration. And typically, a municipal money market should yield less than a taxable fund because the income is tax-free (at least at the national level). To put some numbers on it, you should expect the tax-free fund’s yield to be about 30% to 40% lower than the taxable fund’s yield—most of the time.

A common way to compare taxable and tax-free fund yield on even ground is to calculate a “taxable equivalent yield” for the municipal fund. This is the yield you would need to earn on a taxable fund to give you the same after-tax yield of the tax-free fund. Don’t worry, you don’t have to do the math, because each month I report taxable equivalent yields for all of Vanguard’s tax-free funds (at varying tax rates) in the Performance Review tables.

Getting back to the recent rise-and-fall-and-rise of municipal money market yields, I added the taxable equivalent yield for Municipal Money Market to the next chart. (I assumed a 32% tax bracket, plus a 3.8% health care surtax.) Here you can see that the taxable equivalent yield has at times been way below Cash Reserves Federal Money Market’s yield … and at others way above. Generally, you’d expect the municipal fund’s taxable equivalent yield to be close to the taxable fund’s yield.

As I said, I think there is some motion here trying to get back to equilibrium.

So, from an investor’s perspective, should you hop from fund to fund chasing the better after-tax yield? Frankly, I wouldn’t. Chasing the higher yield would’ve meant starting with the taxable fund, swapping to the tax-free fund for about a month, coming back to the taxable fund for about a month and changing back to the tax-free fund. That’s four money market fund trades inside of three months!

I understand wanting to maximize the return on your cash and portfolio overall. And being able to pick up more than 1% in after-tax income by changing money market funds is compelling—though the difference in yield usually isn’t that dramatic.

But is tracking yields day-to-day something most investors can or even should do? Is it worth your time and energy to constantly monitor and change how your cash is invested? If you have a huge cash balance, then maybe it’s worth it. But for most of us, it’s not where we need expend our resources.

The bottom line for me is that choosing one money market fund over another isn’t going to make or break whether I achieve my financial goals. How much money I allocate overall to stocks versus bonds versus cash, is going to have a far bigger impact on my results.

Our Portfolios

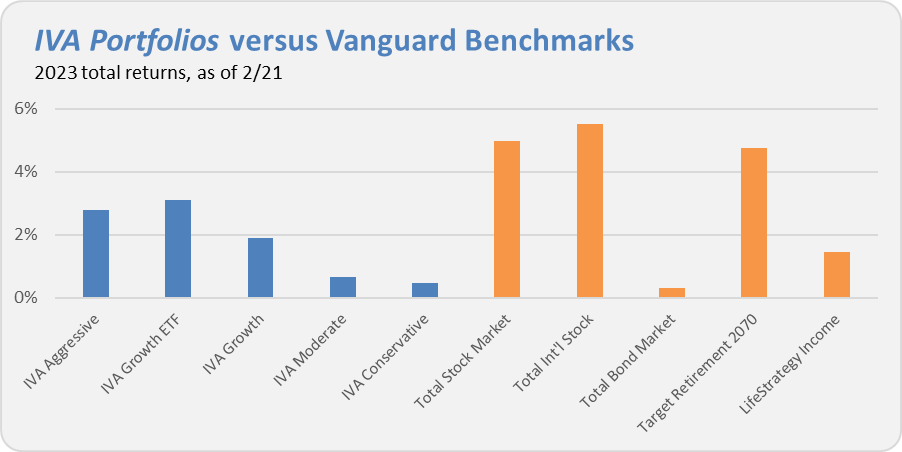

Our Portfolios are showing positive absolute but lagging relative returns for the year through Tuesday. Dividend Growth (VDIGX) and Health Care ETF (VHT) are the main culprits for the underperformance so far this year—though Dividend Growth has started to demonstrate its value recently.

The Aggressive Portfolio is up 2.8% the year, the Growth ETF Portfolio has gained 3.1%, the Growth Portfolio has returned 1.9%, the Moderate Portfolio is up 0.7% and finally the Conservative Portfolio is up 0.5%.

This compares to a 5.0% return for Total Stock Market Index (VTSAX), a 5.5% gain for Total International Stock Index (VTIAX), and a 0.3% return for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 4.7% for the year and its most conservative, LifeStrategy Income(VASIX), is up 1.5%.

Until my next Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.