Hello, and welcome to the IVA Weekly Brief for Wednesday, January 15.

There are no changes recommended for any of our Portfolios.

Last week, investors were reminded (once again) that sometimes good economic news is bad market news (at least temporarily).

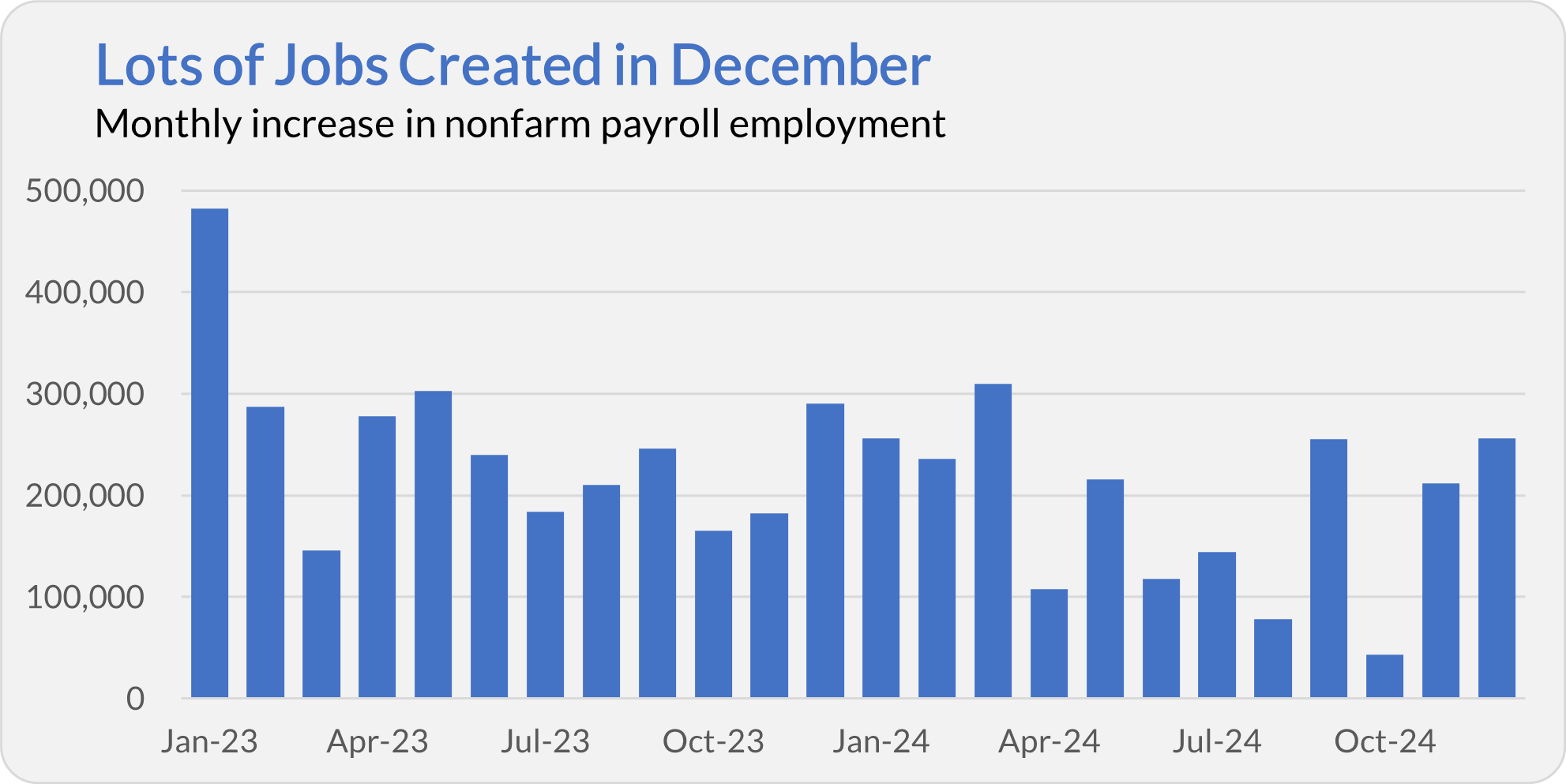

On Friday, the Bureau of Labor Statistics (BLS) reported that the unemployment rate fell to 4.1% as 256,000 jobs were created in December. It was a solid unemployment report by any measure and well above expectations.

Over the summer, lackluster employment figures had pundits concerned a recession was approaching, leading Federal Reserve policymakers to lower the fed funds rate in the fall. Last week’s strong employment report is just the latest sign the economy is on solid footing. No recession means no hit to corporate earnings, which you’d think would be good news.

And yet, following the report, stocks and bonds of all shapes and sizes tumbled—Total Stock Market Index (VTSAX) fell 1.5%, Total International Stock Index (VTIAX) dropped 1.7% and Total Bond Market Index (VBTLX) slid 0.6%. The only Vanguard funds to gain ground on Friday were Commodity Strategy (VCMDX) and Energy ETF (VDE), which gained 2.2% and 0.4%, respectively. (The firm’s money market funds and Ultra-Short-Term Bond (VUBFX) were flat on the day.)

Why the sell-off? It’s an old tale but the good employment news poured cold water on traders hoping for further interest rate cuts from policymakers. If the unemployment rate is falling (or holding steady), Fed Chair Powell and company will be hesitant to lower the fed funds rate further—particularly with inflation sticking above their 2% target.

Inflation On the Rise

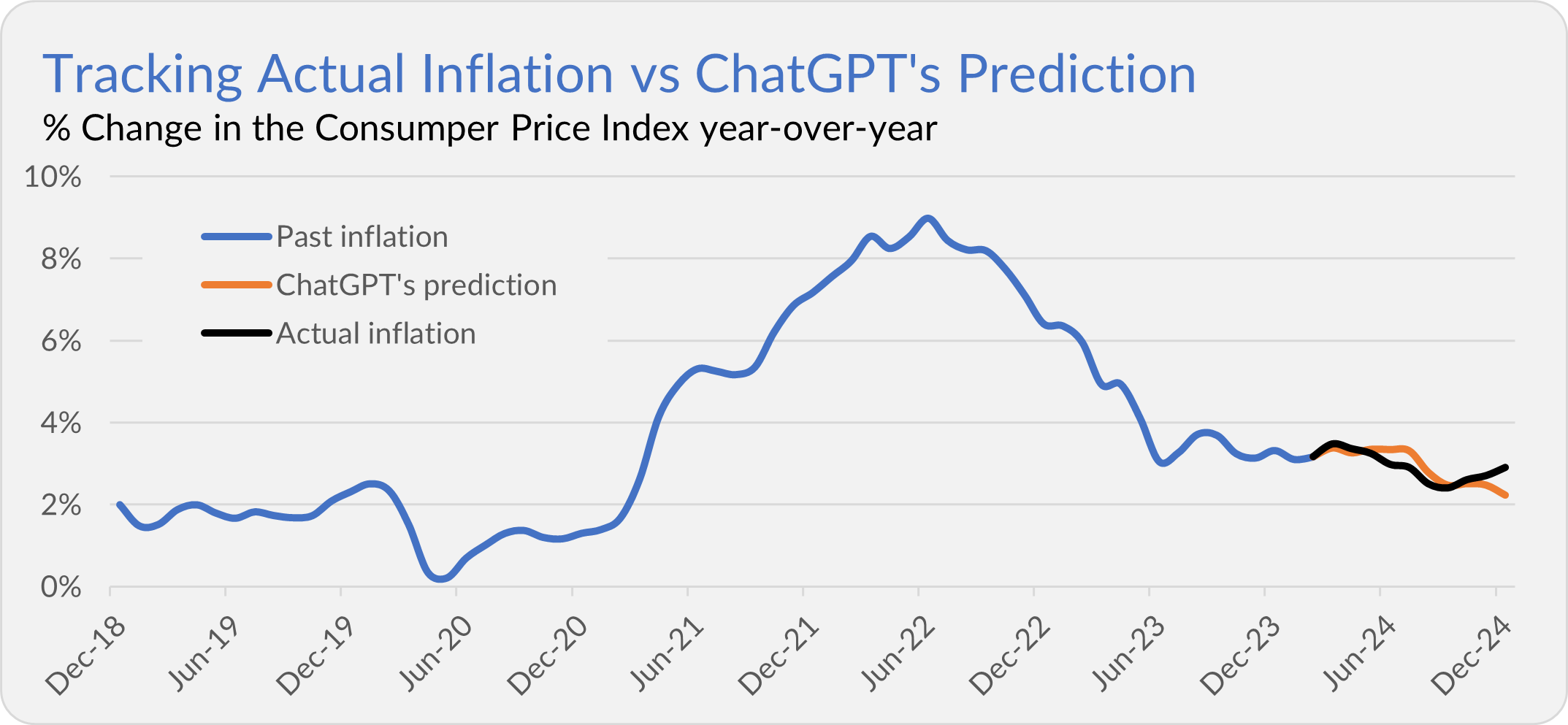

Speaking of inflation. Today, the BLS reported that the Consumer Price Index (CPI) increased 0.4% in December and rose 2.9% in 2024.

For the last time, let’s examine OpenAI’s ChatGPT’s inflation forecast for 2024. As a reminder, I first asked ChatGPT to predict inflation in April 2024. The chart below shows that the computer’s forecast was pretty good, at least until the fourth quarter when the model failed to predict the uptick in inflation to close out the year.

As I've said all along, I was never looking to trade on ChatGPT’s inflation prediction. My goal was to have a little fun. I’ll continue to explore and test AI tools over time, cautiously taking all results with a hefty dose of salt.

Chart or not, I don’t need artificial intelligence to tell me that inflation isn’t automatically going to return to the pre-pandemic sub-2% level (which is effectively what the computer was forecasting) anytime soon. So, with unemployment holding steady at around 4% and inflation in the 3% range, it's reasonable for policymakers to sit on their hands and assess the situation before taking further action.

If you ask me, traders are a little too focused on Fed policy. It was only six months ago that the fed funds rate was around 5.50%, the economy was growing and the stock market was doing just fine. So, should traders really fear a Fed on hold or even raising interest rates?

Friday’s sell-off was a knee-jerk response that you and I have the luxury of ignoring because, unlike traders, we are investors with a long-term view.

One Year Later

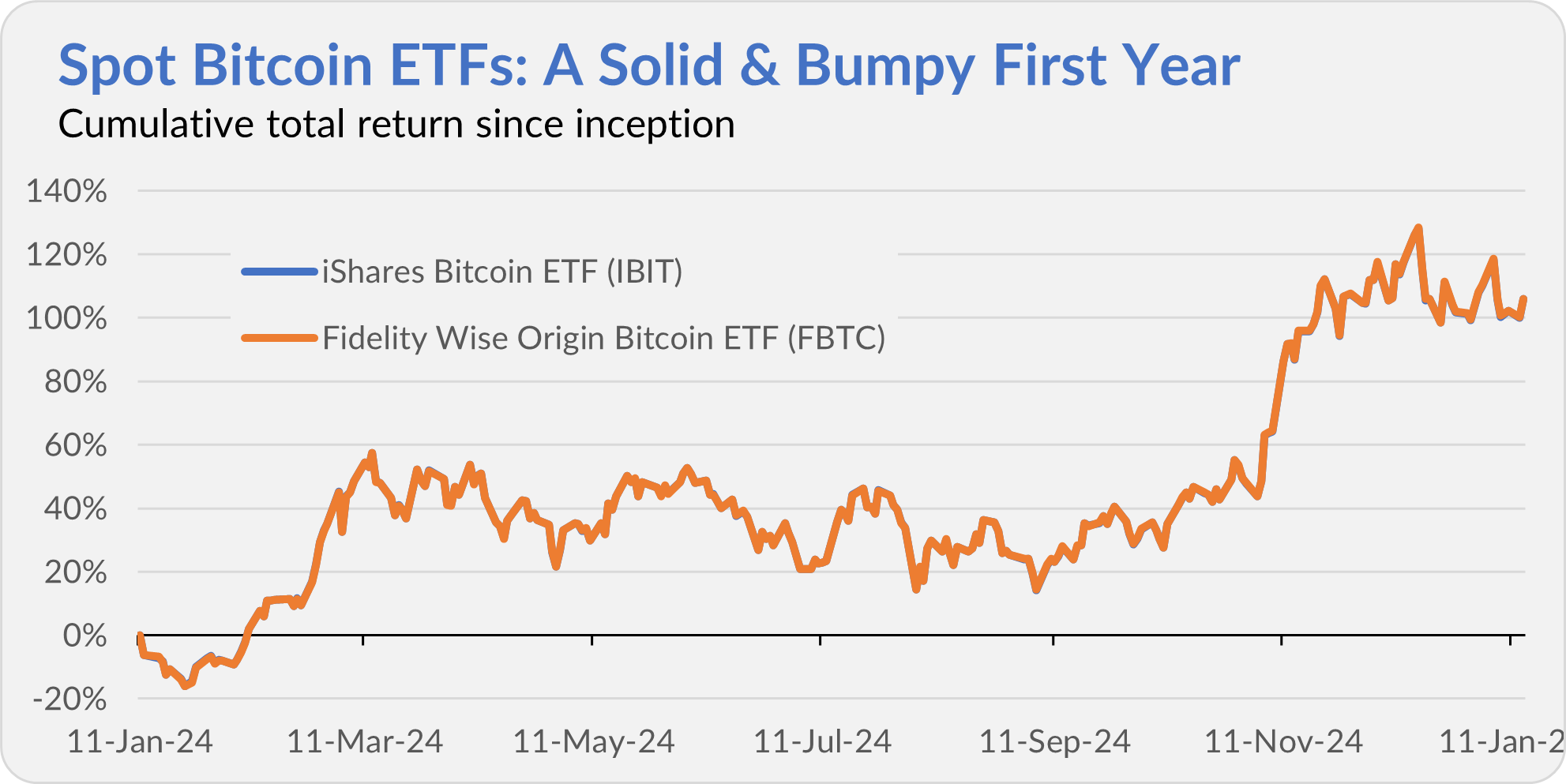

I don’t want to spend much time talking bitcoin, but it’s been just over one year since spot bitcoin ETFs launched (on January 11, 2024). This means it’s also a year since Vanguard took a bold stance and barred all bitcoin and cryptocurrency ETFs from its platform (see here).

From an investor standpoint, anyone who bought one of the spot bitcoin ETFs on the day they were introduced has done very well. Spot bitcoin ETFs, like those from BlackRock (IBIT) and Fidelity (FBTC), have about doubled since their launch.

Even more success has come to the companies launching those spot bitcoin ETFs. BlackRock and Fidelity have been the big winners, taking in around $50 billion and $20 billion in new money, respectively. (That translates into revenue of $125 million and $50 million for the firms.) Several other providers (Ark, Bitwise and VanEck) have pulled in more than $1 billion, with three others (Coinshares, Invesco and Franklin) within shouting distance of that level.

As for Vanguard, well, the decision to block bitcoin ETFs rankled many cryptocurrency advocates. However, despite claims that “Vanguard’s days are numbered,” Vanguard did just fine in 2024 as investors poured over $200 billion into Vanguard mutual funds and ETFs last year—more than they did in 2023 or 2022.

Where does bitcoin’s price go from here? I don’t know—no one does. Since hitting a record $106,401, the cryptocurrency’s price fell nearly 15% and now sits about 7% below its high-water mark—so volatility remains high. But Vanguard’s stance against cryptocurrencies isn’t an existential threat.

New Fund and Manager Changes

As I told Premium Members last week, Vanguard plans to launch a new actively managed bond ETF in early April, Short Duration Bond ETF (VSDB). Premium Members can read more here, but the fund is a wait-and-see for me.

On Tuesday, Vanguard made a few manager changes, which is typical as the fixed-income team often shuffles responsibilities early each year.

First, Thanh Nguyen replaced Daniel Shaykevich as a portfolio manager on Ultra-Short-Term Bond (VUBFX) and the ETF version (VUSB). Nguyen has joined Arvind Narayanan as a co-manager. This duo will also manage the new Short Duration Bond ETF when it launches.

While I rate Shaykevich highly—he may be the best emerging markets bond manager no one has heard of—he is a named portfolio manager on many funds. Taking something off his plate is reasonable. It seems that Nguyen and Narayanan will be Vanguard’s de facto short-term bond experts.

Second, Grace Boraas replaced James D’Arcy as a co-manager alongside Adam Ferguson of California Intermediate-Term Tax-Exempt (VCAIX). As Boraas already co-managed several of Vanguard’s other state-specific municipal bond funds, I’m not concerned by the change.

Finally, Vanguard added Nathan Persons as a co-manager at Short-Term Treasury (VFISX), Short-Term Federal (VSGBX), Intermediate-Term Treasury (VFITX) and Long-Term Treasury (VUSTX). This move simply adds depth to the manager ranks at these funds.

Our Portfolios

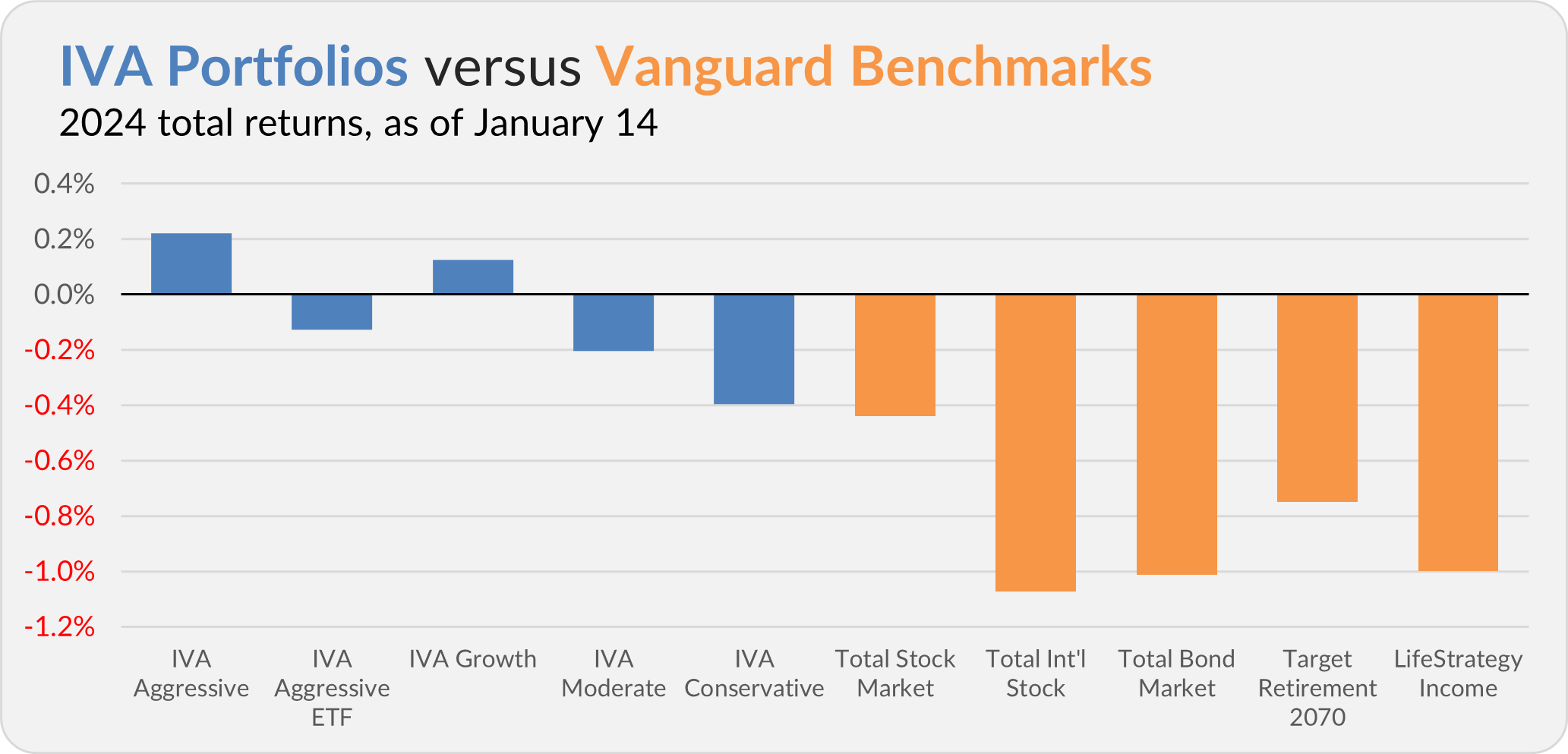

Our Portfolios are off to a relatively good start this year. Through Tuesday, the Aggressive Portfolio is up 0.2%, the Aggressive ETF Portfolio is down 0.1%, the Growth Portfolio is up 0.1%, the Moderate Portfolio is down 0.2% and the Conservative Portfolio is down 0.4%.

This compares to a 0.4% decline for Total Stock Market Index (VTSAX), a 1.1% drop for Total International Stock Index (VTIAX), and a 1.0% decline for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is down 0.7% for the year, and its most conservative, LifeStrategy Income (VASIX), is down 1.0%.

IVA Research

Yesterday, I shared my assessment of Jean Hynes’ tenure managing Health Care (VGHCX) with Premium Members.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.