Hello, and welcome to the IVA Weekly Brief for Wednesday, November 20.

There are no changes recommended for any of our Portfolios.

It’s been a busy two weeks since the election. In the first week, stocks rallied—500 Index (VFIAX) gained 3.5% from election night through November 12. In the second week, stocks slid, with 500 Index falling 1.1% as of Tuesday’s close.

Only four of Vanguard stock funds delivered positive returns each week: Utilities Index (VUIAX), Energy (VGENX), Energy Index (VENAX) and Consumer Staples Index (VCSAX). All of them were sector funds.

No. I don’t think you should read too closely into this. The only takeaway is that we should expect more ups and downs as traders adjust to the incoming administration.

I know that, in theory, the market is generally efficient and incorporates all available information immediately into stock and bond prices. But in reality, this is not always the case, and it will take some time for traders to adapt.

Meanwhile, as investors, we have the luxury of taking the longer view, and despite the turmoil of one “up” week and one “down” week, the two-week period was a net positive by 2.4%.

More Muni Bond ETFs

Vanguard’s first two actively managed municipal bond ETFs—Short Duration Tax-Exempt Bond ETF (VSDM) and Core Tax-Exempt Bond ETF (VCRM)—began trading yesterday.

Premium Members can read my take on the new funds here.

The short story is that Vanguard offered just one municipal bond ETF two years ago, and now it has six. So, if you’re an “ETF investor,” this is a step in the right direction. But, if you’re a Vanguard investor looking at both mutual funds and ETFs, the choice of municipal bond options is getting a little overwhelming—don’t worry, I’ll help you cut through the noise as these ETFs get up and running.

Money is flowing to ETFs and away from mutual funds, so expect Vanguard to launch more in the coming quarters. I’m on the lookout for actively managed ETFs, both stock and bond funds.

Flight #3

On Monday, I told Premium Members that Vanguard was expanding and evolving its proxy voting pilot program in 2025. As a reminder, the pilot program, co-navigated by Broadridge Financial Solutions, aims to give mutual fund and ETF shareholders more input in how their votes are cast on proxy statements of the companies their funds hold.

The most significant news is that Vanguard has also changed the voting options shareholders can choose from. Again, Premium Members can read more about it here.

Vanguard doesn’t offer proxy voting on all its funds but has rolled the option out to more and more over time. The latest additions to the program are High Dividend Yield Index (VHYAX or VYM), Tax-Managed Capital Appreciation (VTCLX) and Tax-Managed Small-Cap (VTMSX).

A Blank Page

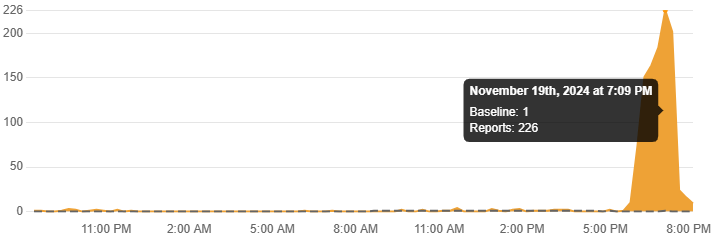

During dinner last night, I received an email from an IVA reader informing me, “I just tried logging into Vanguard, and my laptop went to a blank page … Not a good sign!!!”

When I checked Downdetector, it appeared he was not the only one having trouble accessing his Vanguard account.

It looks like there was only a temporary outage between 6 p.m. and 8 p.m. (or so). But temporary or not, it’s not a good sign.

In the past few weeks, IVA readers have reported a range of technology and service issues to me.

One of my correspondents has had trouble receiving a form to update the UTMAs he set up for his grandkids. Another sees different cost-basis methods for his holdings depending on which web page he is on. Several IVA readers have had issues with Vanguard’s portfolio watch tools handling non-Vanguard funds.

As if there was any doubt, Vanguard’s technology and service are not at the level we owners deserve. If you’re having trouble, please email me at support@independentvanguardadviser.com and, if possible, send me screenshots of what you’re seeing (or not seeing).

As you can tell, even during dinner, I’m online to make sure I’ve got you covered when it comes to keeping you up-to-date on all things Vanguard.

Our Portfolios

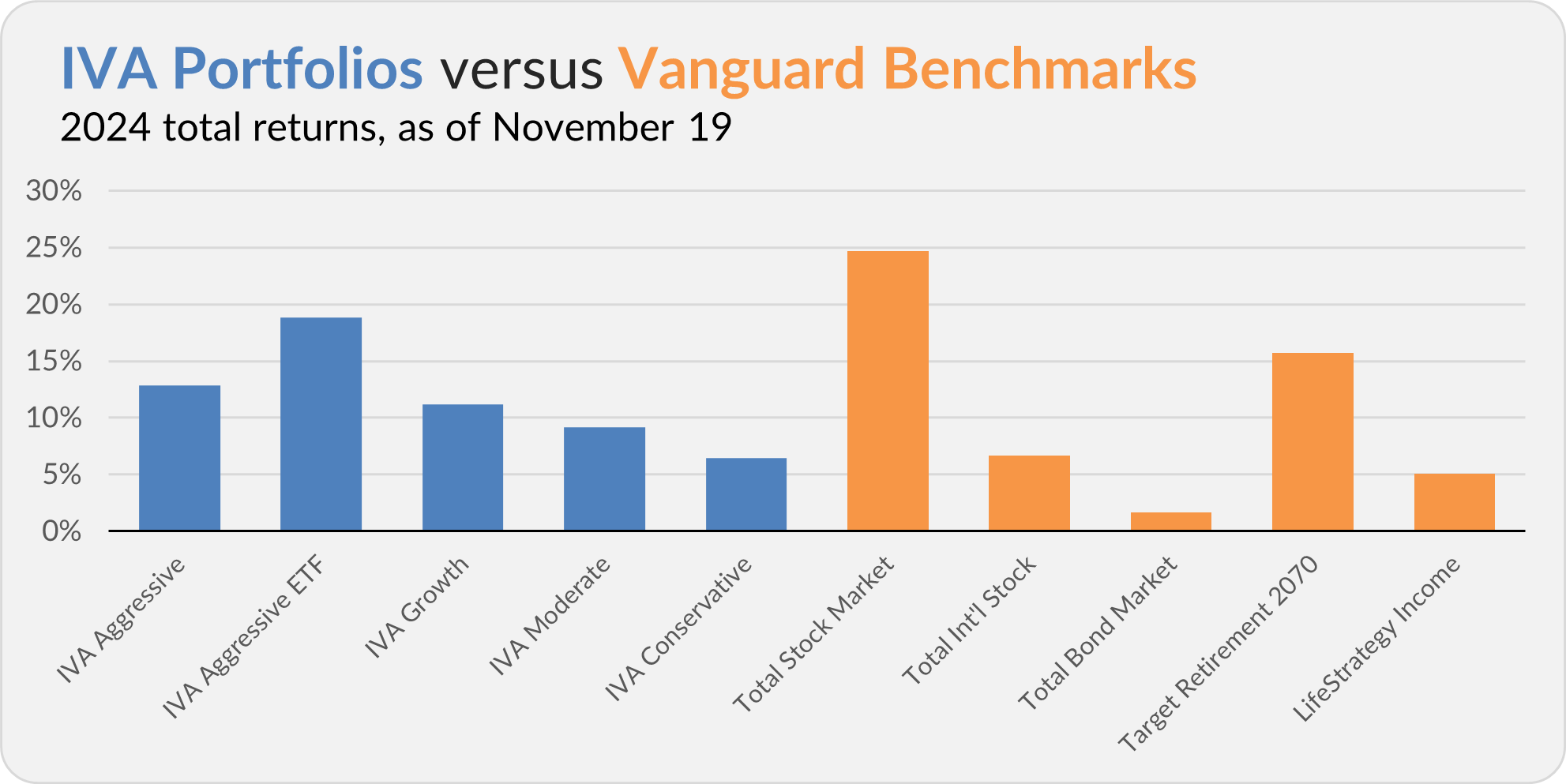

Our Portfolios are showing solid absolute returns for the year through Tuesday. The Aggressive Portfolio is up 12.8%, the Aggressive ETF Portfolio is up 18.8%, the Growth Portfolio is up 11.2%, the Moderate Portfolio is up 9.2% and the Conservative Portfolio is up 6.4%.

This compares to a 24.7% gain for Total Stock Market Index (VTSAX), a 6.7% return for Total International Stock Index (VTIAX), and a 1.7% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 15.7% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 5.0%.

IVA Research

Yesterday, in Politics, Policies and Portfolio Decisions, I risked stepping on the “third rail” of investment advice, namely mixing politics (or religion) into my commentary. Why? Because my inbox was full of questions about how the election might impact the stock and bond markets. Premium Members can read my take here.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.