Hello, and welcome to the IVA Weekly Brief for Wednesday, February 19.

There are no changes recommended for any of our Portfolios.

Records Set. Records Broken.

On Tuesday, the S&P 500 index gained 0.24% to close at a record high. But that wasn’t the only S&P 500-related record set yesterday.

Vanguard’s S&P 500 ETF (VOO) reportedly reached $632 billion in assets, surpassing State Street’s SPDR S&P 500 ETF (SPY) as the world's largest ETF. It’s a nice feather in Vanguard’s cap and speaks to their success in the ETF market.

But Vanguard passed the $630 billion mark in assets tracking the S&P 500 index long ago—you just have to count the firm’s mutual funds. Across all the different share classes (and counting some institutional versions), Vanguard managed $1.7 trillion in mutual funds and ETFs tracking the media’s favorite index at the end of January.

For the record, 500 Index isn’t Vanguard’s largest fund. Investors have over $1.8 trillion stashed in Total Stock Market Index’s (VTSAX) various share classes and institutional versions. The fund’s Institutional Plus shares class (VSMPX) holds over $740 billion (or $100 billion more than you’ll find in S&P 500 ETF).

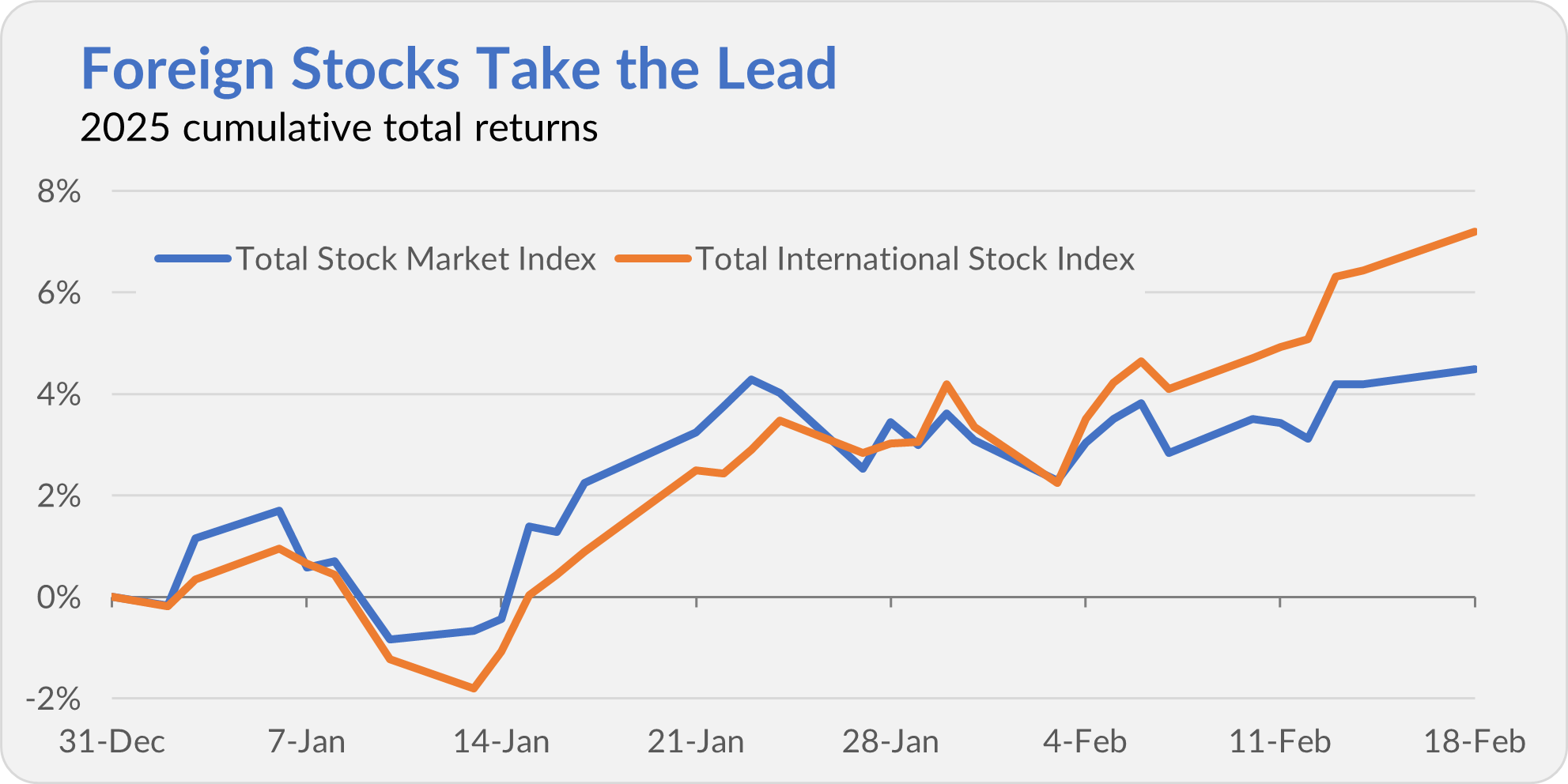

While those records are being set in the U.S. market, foreign stocks have caught my eye. Overseas stocks have started to outpace U.S. stocks. For example, Total International Stock Index (VTIAX) has gained 3.7% in February and is now up 7.2% on the year, while Total Stock Market Index (VTSAX) is up just 1.4% this month and up 4.5% gain for the year.

It's far too soon to say the cycle has turned definitively—foreign stocks have only led for the past 20 (or so) trading days. Nonetheless, should this emerging trend continue, diversified investors will repeat the rewards.

Management by Committee

A month ago, Vanguard’s fixed income team switched up the portfolio managers on a handful of funds—as it typically does every year. The firm’s stock index team wasn’t going to be outdone.

Yesterday, Vanguard added portfolio managers to 55 of its stock index mutual funds and ETFs. Among those impacted were 500 Index (VFIAX), Total Stock Market Index (VTSAX), Total International Stock Index (VTIAX) and Real Estate Index (VGSLX).

To be clear, no portfolio managers were taken off any funds; the manager ranks only increased on each fund.

Below, I’ve listed all the funds impacted, their existing managers and the new additions.

Vanguard Manager Additions

| Fund | Existing Managers | New Managers Added on 2/18 |

|---|---|---|

| 500 Index | Aaron Choi; Nick Birkett; Michelle Louie | Aurelie Denis |

| Communication Services Index | Walter Nejman; Nick Birkett | Aaron Choi; Chris Nieves |

| Consumer Distrectionary Index | Nick Birkett | Aaron Choi; Chris Nieves |

| Consumer Staples Index | Nick Birkett | Aaron Choi; Chris Nieves |

| Developed Markets Index | Christine D. Franquin; Michael Perre | Nicole Brubaker |

| Dividend Appreciation | Gerard C. O'Reilly; Walter Nejman | Kenny Narzikul; Jena Stenger |

| Emerging Markets Stock Index | Michael Perre; Jeffrey D. Miller | John Kraynak |

| Energy Index | Nick Birkett | Aaron Choi; Chris Nieves |

| European Index | Christine D. Franquin; Scott E. Geiger | John Kraynak |

| ESG U.S. Stock ETF | Nick Birkett; Gerard C. O'Reilly | Aaron Choi; Chris Nieves |

| Extended Market Index | Michelle Louie; Nick Birkett | Walter Nejman |

| Financials Index | Kenny Narzikul; Michelle Louie | Jena Stenger |

| Global ex-U.S. Real Estate Index | Michael Perre; Scott E. Geiger | John Kraynak |

| Growth Index | Gerard C. O'Reilly; Walter Nejman | Aaron Choi; Jena Stenger |

| Health Care Index | Michelle Louie; Walter Nejman | Aaron Choi; Kenny Narzikul |

| High Dividend Yield Index | Gerard C. O'Reilly; Nick Birkett | Chris Nieves; Jena Stenger |

| Industrials Index | Michelle Louie; Walter Nejman | Aaron Choi; Kenny Narzikul |

| Information Technology Index | Nick Birkett; Walter Nejman | Kenny Narzikul; Jena Stenger |

| International High Dividend Yield Index | Michael Perre; Aaron Choi | Scott E. Geiger |

| LargeCap Index | Michelle Louie; Walter Nejman | Chris Nieves; Jena Stengerr |

| Materials Index | Kenny Narzikul; Michelle Louie | Jena Stenger |

| MegaCap 300 ETF | Gerard C. O'Reilly; Michelle Louie | Chris Nieves; Jena Stenger |

| MegaCap 300 Growth ETF | Gerard C. O'Reilly; Michelle Louie | Chris Nieves; Jena Stenger |

| MegaCap 300 Value ETF | Gerard C. O'Reilly; Michelle Louie | Chris Nieves; Jena Stenger |

| MidCap Index | Aaron Choi; Aurelie Denis | Kenny Narzikul |

| MidCap Growth Index | Aaron Choi; Aurelie Denis | Kenny Narzikul |

| MidCap Value Index | Aaron Choi; Aurelie Denis | Kenny Narzikul |

| Pacific Index | Jeffrey D. Miller; Michael Perre | Nicole Brubaker |

| Real Estate Index | Gerard C. O'Reilly; Walter Nejman | Chris Nieves; Jena Stenger |

| Russell 1000 ETF | Nick Birkett; Aurelie Denis | Chris Nieves; Jena Stenger |

| Russell 1000 Growth ETF | Nick Birkett; Aurelie Denis | Chris Nieves; Jena Stenger |

| Russell 1000 Value ETF | Nick Birkett; Aurelie Denis | Chris Nieves; Jena Stenger |

| Russell 2000 ETF | Nick Birkett; Kenny Narzikul | Aaron Choi |

| Russell 2000 Growth ETF | Nick Birkett; Kenny Narzikul | Aaron Choi |

| Russell 2000 Value ETF | Nick Birkett; Kenny Narzikul | Aaron Choi |

| Russell 3000 ETF | Nick Birkett; Walter Nejman | Aaron Choi; Kenny Narzikul |

| S&P 500 Growth ETF | Michelle Louie; Kenny Narzikul | Chris Nieves |

| S&P 500 Value ETF | Michelle Louie; Kenny Narzikul | Chris Nieves |

| S&P MidCap 400 ETF | Kenny Narzikul | Chris Nieves |

| S&P MidCap 400 Growth ETF | Kenny Narzikul | Chris Nieves |

| S&P MidCap 400 Value ETF | Kenny Narzikul | Chris Nieves |

| S&P SmallCap 600 ETF | Kenny Narzikul; Nick Birkett | Jena Stenger |

| S&P SmallCap 600 Growth ETF | Kenny Narzikul; Nick Birkett | Jena Stenger |

| S&P SmallCap 600 Value ETF | Kenny Narzikul; Nick Birkett | Jena Stenger |

| SmallCap Index | Gerard C. O'Reilly; Kenny Narzikul | Aaron Choi |

| SmallCap Growth Index | Gerard C. O'Reilly; Nick Birkett | Aaron Choi; Kenny Narzikul |

| SmallCap Value Index | Gerard C. O'Reilly; Nick Birkett | Aaron Choi; Kenny Narzikul |

| Social Index | Gerard C. O'Reilly; Nick Birkett | Aaron Choi; Chris Nieves |

| Tax-Managed Capital Appreciation | Walter Nejman | Chris Nieves; Jena Stenger |

| Tax-Managed Small Cap | Walter Nejman; Kenny Narzikul | Chris Nieves |

| Total International Stock Index | Christine D. Franquin; Michael Perre | Jeffrey D. Miller |

| Total Stock Market Index | Gerard C. O'Reilly; Walter Nejman; Michelle Louie | Nick Birkett |

| Utilities Index | Walter Nejman | Chris Nieves; Jena Stenger |

| Value Index | Gerard C. O'Reilly; Walter Nejman | Aaron Choi; Jena Stenger |

| World ex-US SmallCap Index | Jeffrey D. Miller; Michael Perre | Nicole Brubaker |

While 11 managers picked up new charges yesterday, four saw their responsibilities increase significantly. Kenny Narzikul, who already has a hand in managing 15 funds, was added to 10 more. Aaron Choi picked up 17 funds to go with the five he already manages. First-time Vanguard managers Jena Stenger and Chris Nieves were named co-managers on 20 and 23 funds, respectively.

Vanguard’s indexers seem to be taking a “management by committee” approach. Granted, it’s an index fund, so they aren’t picking and choosing stocks. Their responsibility is to track the indexes as closely as possible while keeping taxes as low as possible. So, having more managers creates redundancy and resilience while developing the next generation of managers—or so the thinking goes.

Disappointingly—though frankly, not surprisingly—the new managers are not invested alongside shareholders. Of the 81 new manager appointments, only four have any money in the funds they now oversee.

- John Kraynak has invested $1–$10,000 in Emerging Markets Stock Index (VEMAX).

- Kenny Narzikul has invested $1–$10,000 in SmallCap Value Index (VSIAX) and Dividend Appreciation Index (VDADX).

- Jeffrey Miller has invested $1–$10,000 in Total International Stock Index.

Those stats are as of the end of 2024, so, sure, maybe something has changed in the past 45 days. But, simply put, this is not a good showing. Even the managers with some skin in the game have put less than $10,000 into play. Nieves and Stenger now manage over 20 funds each and don’t have a penny invested in any of them. It makes you wonder where they invest their money!

One Other Manager Update

Last week, D.E. Shaw Investment Management’s CIO, Ruvim Breydo, departed the firm after nearly three decades. Why is that relevant for Vanguard investors? D.E. Shaw has managed a third of Growth & Income’s (VQNPX) portfolio since 2011, and Breydo was their named portfolio for the last few years.

Max Stone (a managing director of the firm) and Konstantin Turitsyn (a former professor turned hedge fund analyst) have replaced Breydo as co-managers of D.E. Shaw’s sleeve of the fund. Neither of the new managers is invested in the fund.

Breydo’s departure doesn’t change my opinion of Growth & Income—it's still basically an index fund charging active management fees.

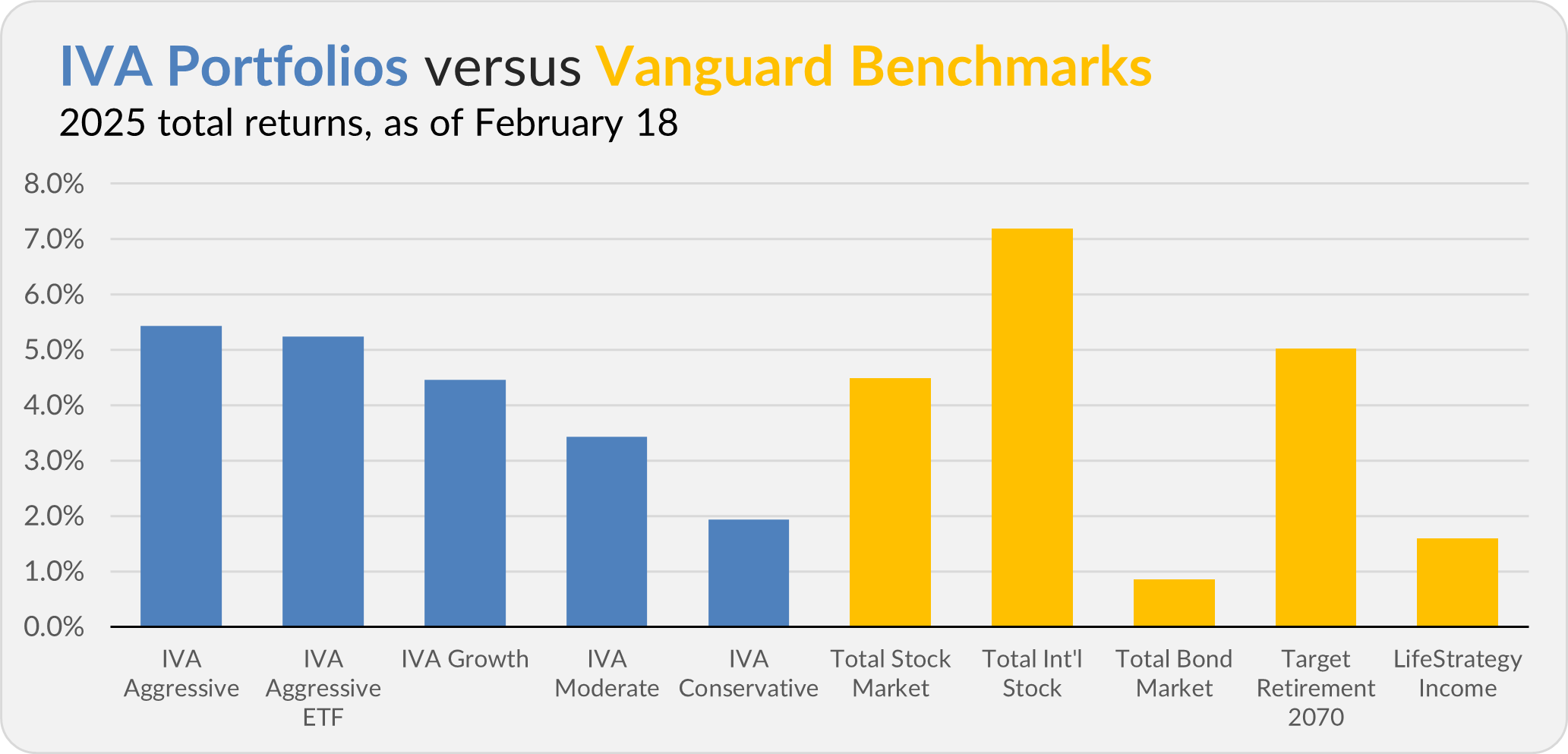

Our Portfolios

Our Portfolios are showing solid returns for the year through Tuesday. The Aggressive Portfolio is up 5.4%, the Aggressive ETF Portfolio is up 5.2%, the Growth Portfolio is up 4.5%, the Moderate Portfolio is up 3.4% and the Conservative Portfolio is up 1.9%.

This compares to a 4.5% gain for Total Stock Market Index (VTSAX), a 7.2% return for Total International Stock Index (VTIAX), and a 0.9% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 5.0% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 1.6%.

IVA Research

Yesterday, in Bonds Beyond the Benchmark: Navigating Vanguard’s Specialty Bond Funds, I shared my analysis of Vanguard’s specialty bond funds with Premium Members.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.