Hello, and welcome to the IVA Weekly Brief for Wednesday, November 13.

There are no changes recommended for any of our Portfolios.

The bull market is charging higher.

Since the November 5 election, the Dow Jones Industrial Average, the S&P 500 index, the S&P 400 index of mid-sized stocks, the S&P 600 index of small stocks, the tech-heavy Nasdaq and Bitcoin have all hit record highs. For the small stock index, it was the first record since November 2021.

Most of Vanguard’s diversified U.S. stock mutual funds hit new highs this week, too—the few exceptions weren’t far off the mark. The furthest, SmallCap Growth Index (VSGAX), only needs a gain of 3.2% to set a new record (as of Tuesday’s close).

Bitcoin, which is soaring on hopes that the Trump administration will replace the anti-bitcoin head of the SEC, Gary Gensler, and promote cryptocurrencies broadly, is currently trading around 90,000.

If everything is so bullish, where are the bears?

Well, it’s not (by definition) bearish, but on a relative basis, foreign markets have lagged since the election. While Total Stock Market Index (VTSAX) is up 3.9%, Total International Stock Index (VTIAX) is down 2.7%. The foreign stock index fund is now 6.4% below the high it reached on September 26.

The current bullishness has prompted some market watchers to make what appear to be big predictions. With the S&P 500 index closing over 6,000 for the first time on Monday, strategist Ed Yardeni gained some headlines with a prediction that the index would hit 10,000 by the end of 2029—just five years off.

While that sounds impressive—and, as I said, garnered lots of headlines—that’s merely a 10.8% annualized gain. For some perspective, 500 Index (VFINX) has compounded at an 11.8% pace on average over rolling five-year periods since its 1976 inception. I take all predictions like this with a massive grain of salt.

Will the market continue hitting new highs, or will the euphoria fade? I’d wager that the initial post-election bounce was a little overdone. Yesterday, stocks took a small step back, with the S&P 500 index slipping 0.3%.

However, I’m not saying the bull market is over. No one rings a bell at the top of the market. And the truth is that when the market hits a new high, it can only do one of two things the next day—it can set another new high or take a step back.

Don’t get caught up in record highs and near-term market calls; focus on tuning out the noise so you can spend time in the market.

Cash’s Falling Yield

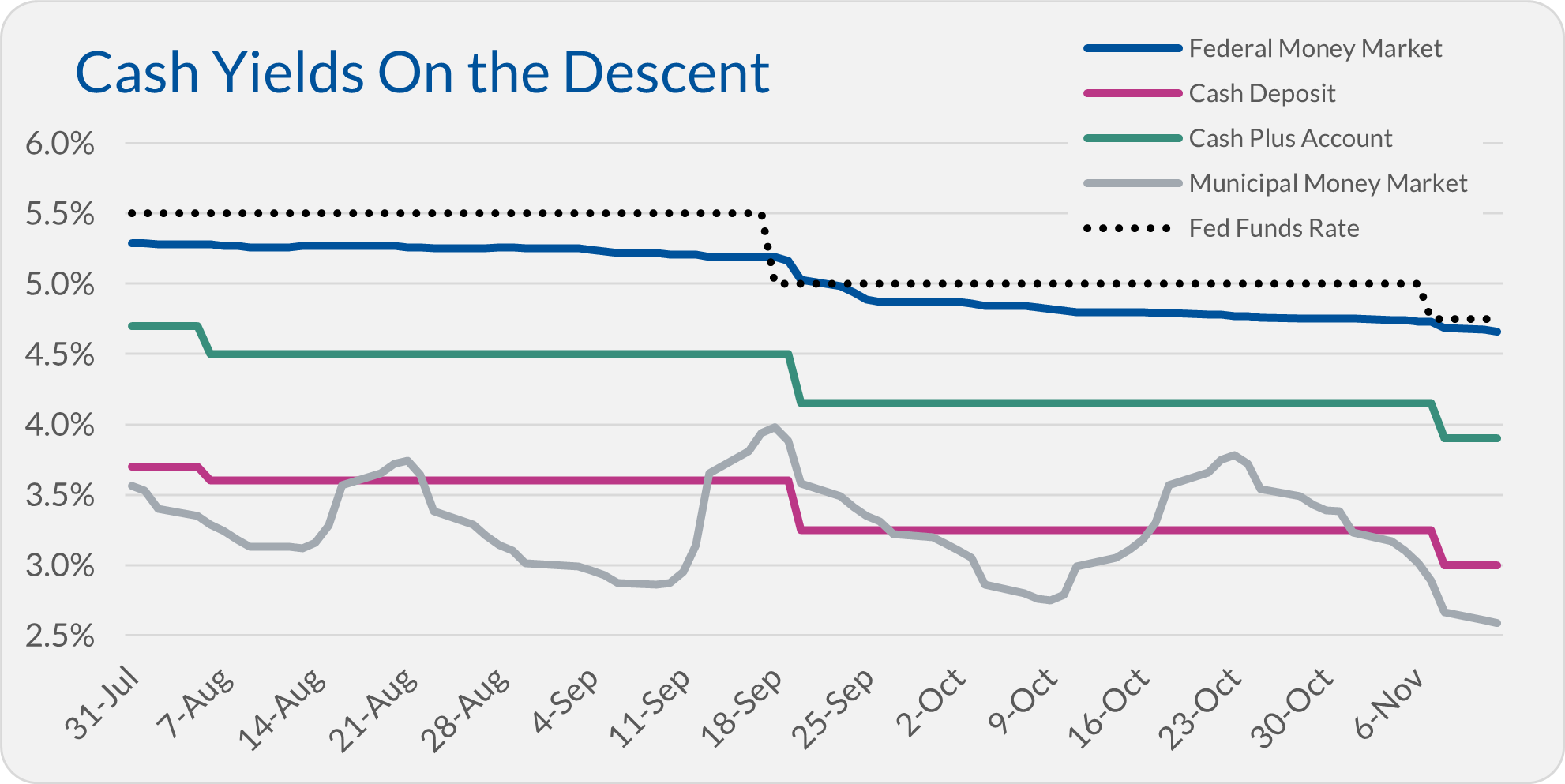

Cash isn’t trash by a long shot, but yields on Vanguard’s money market funds are falling. So are yields on Vanguard’s other “cash solutions.”

On Thursday last week, Federal Reserve policymakers lowered the fed funds target interest rate by 0.25% to a range of 4.50%–4.75%. Following suit, Vanguard lowered the yields on Cash Plus Account and Cash Deposit to 3.90% and 3.00%, respectively, the very next day.

The chart below shows that Vanguard’s two newer cash solutions—Cash Plus and Cash Deposit—yield less than Vanguard’s default settlement fund, Federal Money Market (VMFXX), which clocks in at 4.66%. As I've said, this is a good reminder that I don’t see a compelling reason to choose either "cash " account over Vanguard’s tried-and-true money market fund.

Inflation Check-In

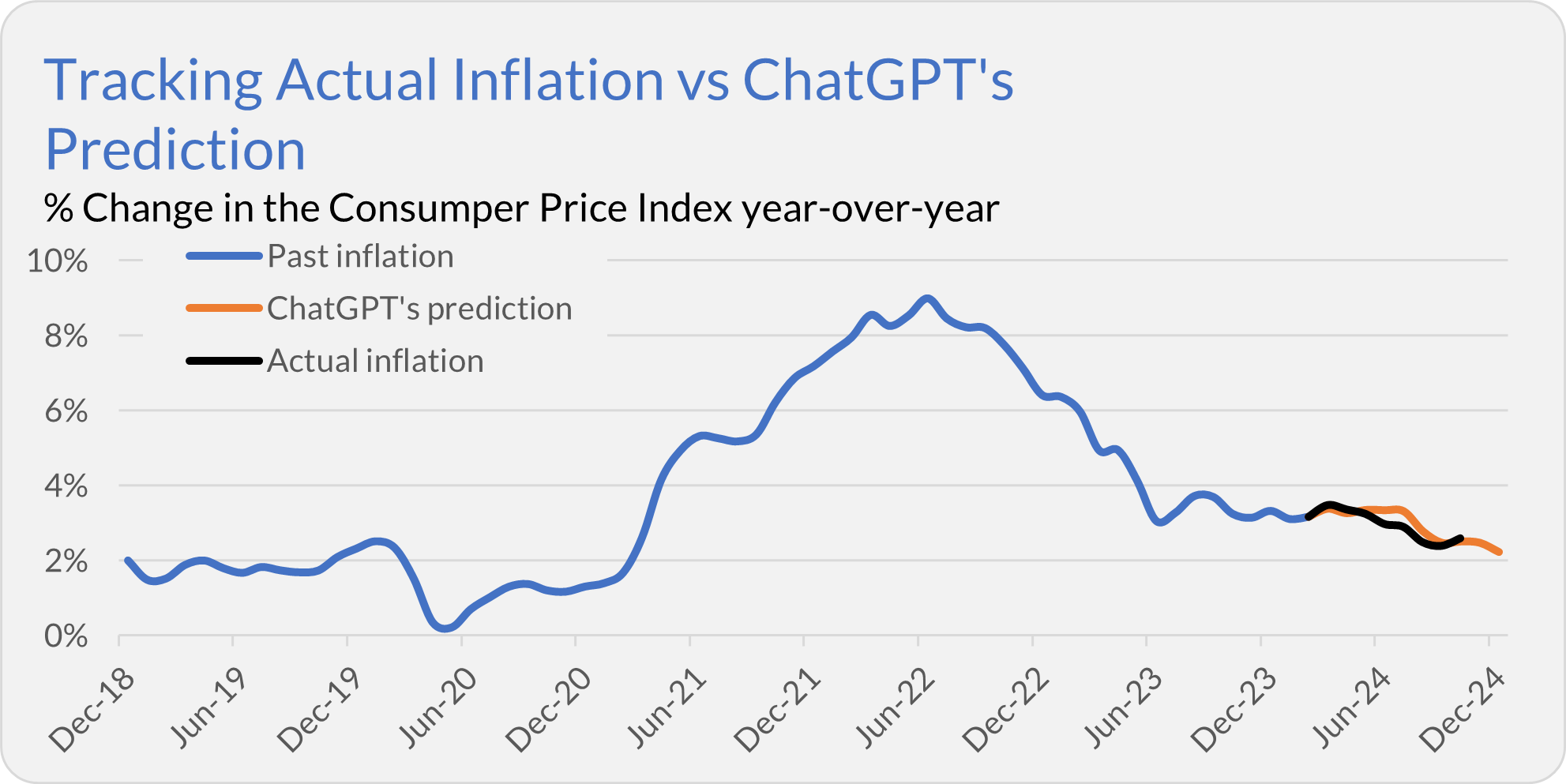

In my first test of artificial intelligence’s ability to see into the future this past April, I asked OpenAI's ChatGPT to predict inflation for the rest of the year. Today, the Bureau of Labor Statistics (BLS) reported that the Consumer Price Index (CPI) increased 0.2% in October and is up 2.6% over the past 12 months.

That’s pretty much spot on with ChatGPT’s 2.5% forecast.

As I said in April and have repeated several times, I was never looking to trade on ChatGPT’s inflation prediction. My goal was to have a little fun. But at this point, it’s fair to say that the computer’s forecast has proven quite accurate.

So, should we trust in the computer to make all our forecasts? No.

ChatGPT’s inflation prediction was generated using an “AutoRegressive Integrated Moving Average.” That’s a fancy way of saying that it predicted inflation would return to its average, which is what inflation did—so the computer looks smart. However, this model will miss those times when inflation deviates from the norm.

Frankly, most of the time, it’s reasonable to expect inflation (or the economy or unemployment) to be average. Economic booms and busts (recessions) happen, but those are the exceptions—most of the time, the mature U.S. economy grows at a normal rate.

Keep this in mind as you read the coming deluge of predictions about 2025.

A $40 Million Settlement

As I told you in September, Vanguard agreed to settle with a group of Target Retirement shareholders who sued the fund giant after getting hit with massive tax bills in 2021.

While still subject to court approval, Vanguard’s little “mistake” will cost it $40 million. At least they’ll finally be able to put this self-inflicted wound behind them.

While its motives—to provide more investors access to lower-cost funds—were “good,” Vanguard’s execution was sloppy. And Vanguard doesn’t have anyone but itself to blame since, according to the lawsuit, they knew their actions were going to hurt some shareholders.

Our Portfolios

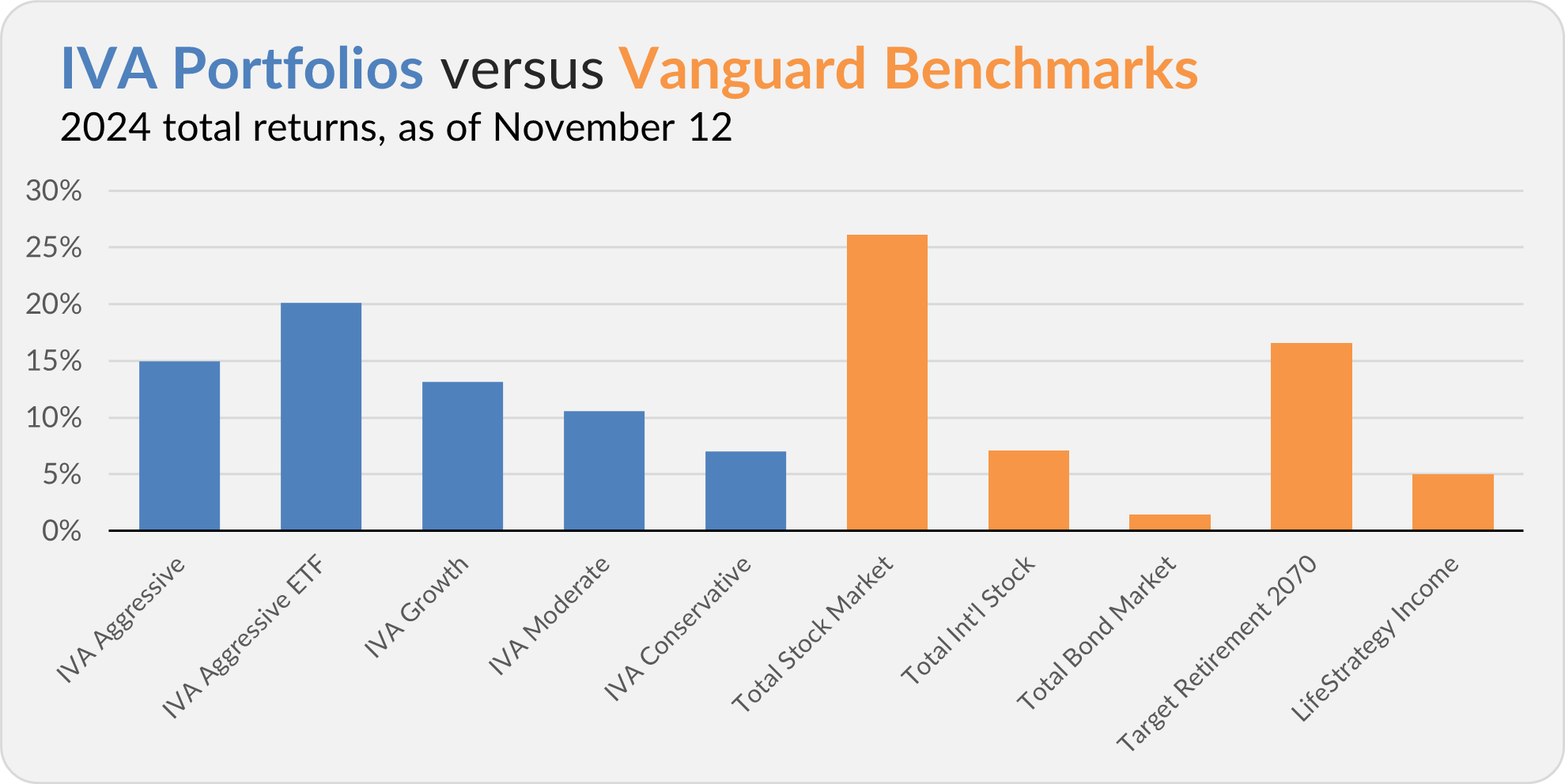

Our Portfolios are showing decent absolute returns for the year through Tuesday. The Aggressive Portfolio is up 15.0%, the Aggressive ETF Portfolio is up 20.2%, the Growth Portfolio is up 13.2%, the Moderate Portfolio is up 10.6% and the Conservative Portfolio is up 7.0%.

This compares to a 26.2% gain for Total Stock Market Index (VTSAX), a 7.1% return for Total International Stock Index (VTIAX), and a 1.5% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 16.5% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 5.0%.

IVA Research

Yesterday, I provided Premium Members with all the details they need to navigate year-end capital gain distribution season confidently.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.