Hello, and welcome to the IVA Weekly Brief for Wednesday, January 22.

There are no changes recommended for any of our Portfolios.

On Monday, Donald Trump was sworn in as our country’s 47th President and signed a raft of executive orders. Regular IVA readers know my standard advice is to leave politics out of your portfolio (see here and here). So, I’ll try to leave political commentary aside.

We are three days into Trump’s second term. It is too early to judge the impact of his actions on the economy and markets.

Arguably, the most market-relevant orders President Trump signed on Monday were related to energy and boosting oil and gas production. However, given that the U.S. is already producing more crude oil than ever before (here and here) and that crude oil currently trades around its 20-year average price, well, we’ll have to wait and see if his “order” has an impact. In my view, the biggest driver of oil production isn’t regulation but price—high prices lead to more production, while lower prices have the opposite effect.

The other big-ticket economic policies that Trump campaigned on—immigration, tariffs and taxes—are also a wait-and-see. Until we know what those will look like, any analysis is just speculation.

Over the next four years, investors across the political aisle should heed Charlie Munger’s advice to “…invest in the world we live in, and not the world we want.”

And the world we live in is a low(ish)-inflation, high-employment environment that has been very profitable for the companies we invest in. Only one out of ten S&P 500 companies have reported fourth-quarter earnings, but so far (or as of January 17), the blended earnings growth rate (which includes reported and estimated earnings) for the index is 12.5%. As earnings drive stock prices over time, this is a tailwind for the market.

A Large Bill

$152 million and counting.

That’s the total in fines and settlements that Vanguard is paying for sticking Target Retirement shareholders with outsized capital gain distributions in 2020.

In 2022, Vanguard paid $6.25 million in a deal with Massachusetts regulators. More recently, Vanguard agreed to a $40 million settlement with Target Retirement shareholders who sued the company (see here and here). And on Friday, the SEC announced that Vanguard is paying $106.41 million to settle charges related to the matter.

Technically, the SEC seemed concerned that Vanguard didn’t describe this situation—large capital gains from investors switching funds—as a risk.

Nonetheless, $106 million is in addition to that $40 settlement and will be distributed through a Fair Fund. I expect shareholders will need to submit a separate claim to get their piece of the Fair Fund settlement.

As I’ve said from the get-go, Vanguard was trying to do the right thing here—lowering fees. However, they went about it the wrong way. And instead of taking a $148 million hit to revenue, according to Beagen Wilcox at Ignites.com, they’re paying more than $152 million in settlements and taking a big hit to their reputation. This is one expensive self-inflicted wound.

Required Reading

A month ago, I shared a detailed analysis of PRIMECAP (VPMCX)—and, by extension, all the PRIMECAP Management-run funds—with Premium Members. If you want more commentary on the funds and management team, I’ve included the PRIMECAP Odyssey funds’ annual report below. It should be required reading for all shareholders.

The PRIMECAP team described recent results as “frustrating and disappointing.” They identified two reasons for lagging the S&P 500 index (their benchmark for all their funds). One, owning less NVIDIA stock than the index was a big headwind. Second, the firm’s “longstanding health care overweight” held the funds back.

In particular, I appreciated how the PRIMECAP team described the three phases in the market since 2008’s Global Financial Crisis: Recovery (2009–2013), Expansion (2014–2019) and To-be-determined (2020–2024). (Reasonably, they don’t want to attribute a one-word definition to the current phase without the benefit of hindsight and perspective.)

While the firm’s funds did well in the first two stages, they’ve struggled to keep up with the market in the most recent chapter. The expectation is that the funds are well-positioned for the next phase in the cycle. Here’s the managers’ conclusion:

Relative to the S&P 500® Index, we prefer our unconventional collection of stocks, portfolios that hardly resemble the Index. Despite some bright spots, the Funds have collectively been unable to keep pace of late. And this fiscal year’s underperformance, while disappointing, only deepens our conviction in the relative merit of our portfolios.

I agree. If you’re a shareholder and don’t agree, you may want to reconsider your position. But I’m holding onto my substantial stake in their funds.

Our Portfolios

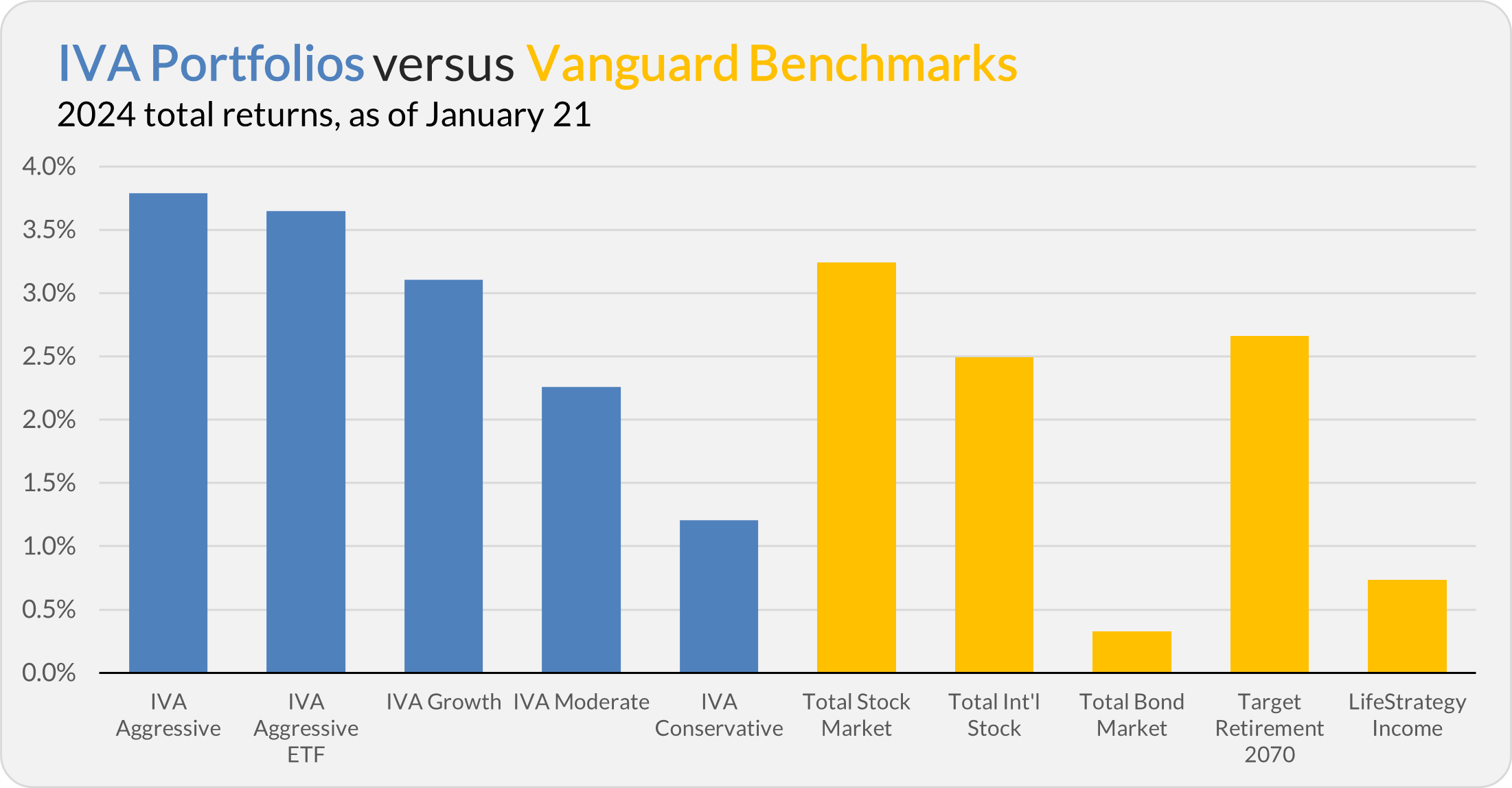

Our Portfolios are showing decent returns for the year through Tuesday. The Aggressive Portfolio is up 3.8%, the Aggressive ETF Portfolio is up 3.6%, the Growth Portfolio is up 3.1%, the Moderate Portfolio is up 2.3% and the Conservative Portfolio is up 1.2%.

This compares to a 3.2% gain for Total Stock Market Index (VTSAX), a 2.5% return for Total International Stock Index (VTIAX), and a 0.3% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 2.7% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 0.7%.

IVA Research

Yesterday, I shared an update on the new limits on how much you can sock away in retirement accounts (and a detailed cheat sheet) with Premium Members.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.