Hello, and welcome to the IVA Weekly Brief for Wednesday, April 9.

There are no changes recommended for any of our Portfolios.

As you are well aware, President Trump’s tariff announcement upended the apple cart.

To recap, the U.S. started imposing a 10% blanket tariff on (virtually) all imports on April 5. That rate ratcheted up overnight for select countries, including Japan (24%), the E.U. (20%) and Vietnam (46%). Mexico and Canada were spared any additional tariffs—for now. But the 25% tariff on auto imports went ahead last week.

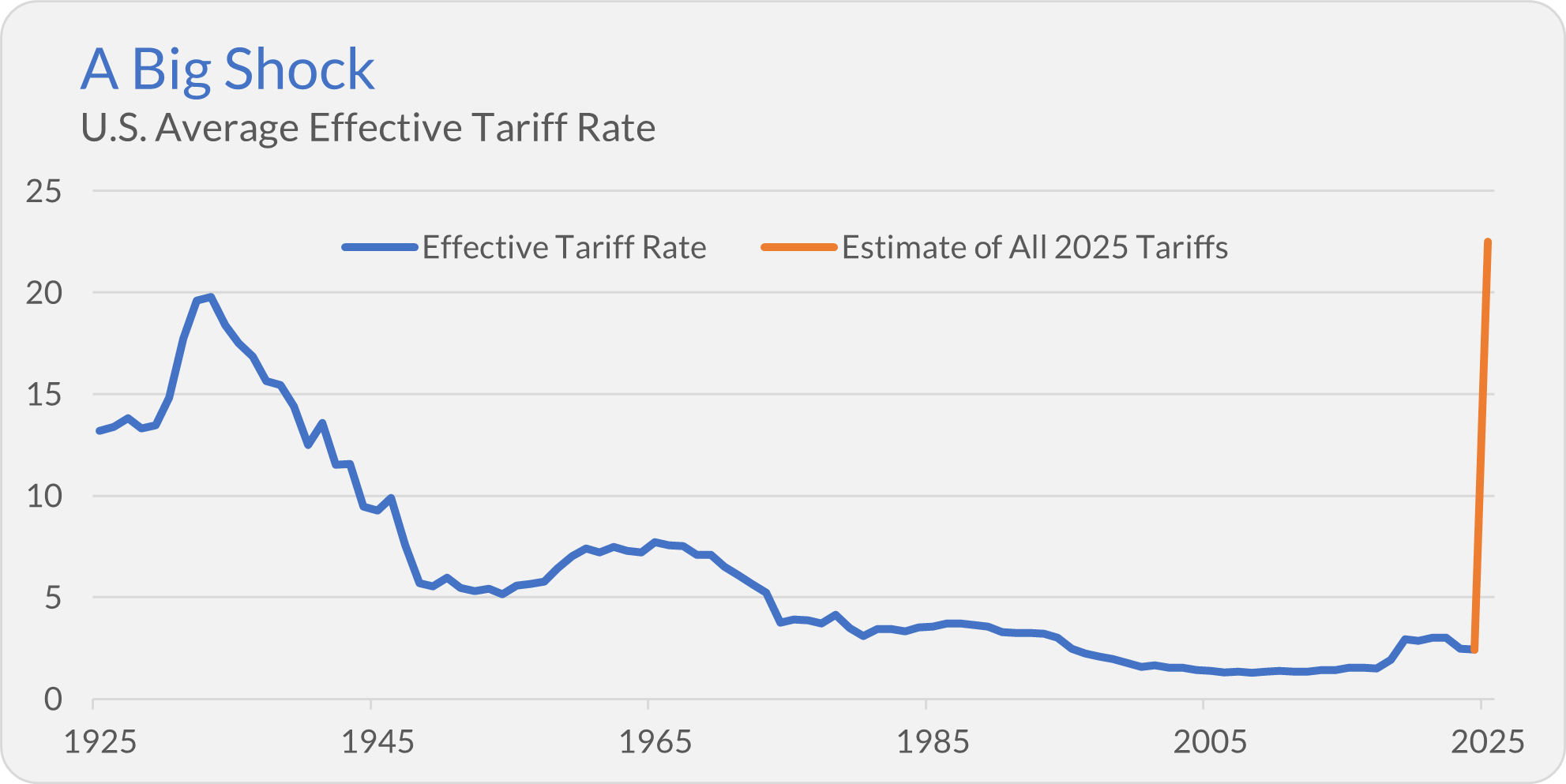

To put the size of the tariffs into context, the chart below tracks the effective U.S. tariff rate over the last 100 years. The Budget Lab at Yale projects that this year’s tariff actions will send the rate soaring from 2.4% in 2024 to 22.5%—the highest in over 100 years!

This is a major shock to the global economic system—and it doesn’t even factor in the escalating trade war with China. As of this morning, the U.S. is imposing a 104% tariff on Chinese goods, while China has responded with an 84% duty on U.S. imports.

And the tariff wave isn’t over. The administration has hinted at sector-specific levies targeting semiconductors and pharmaceuticals. Meanwhile, higher port fees—though not technically tariffs—are also on the horizon.

This shock to the system explains the sharp market reaction: Total Stock Market Index (VTSAX) has fallen 12.4% since the April 2 tariff announcement.

Cards on the table: I do not like this sweeping tariff plan. It’s not just a massive tax hike—it also injects uncertainty into the decisions of U.S. business owners and global trading partners.

Despite the White House's rhetoric, these are in no way “reciprocal” tariffs—they do not match the duties other countries impose on us. Instead, they have been calculated to reflect, in some manner, the size of our trade deficit with each nation.

Trade deficits are not inherently bad. For example, I run a trade deficit with my barber—I buy haircuts from her, but she doesn’t buy anything from me. We’re both happy with this arrangement. (Same goes for my plumber, electrician and grocery store!)

The same concept applies at the country level too. When one country produces a good that we don’t (like coffee, which we can’t grow outside of Hawaii), it’s only natural that a deficit in trade in that one product will exist.

To be clear, I’m not suggesting all tariffs are harmful or that every trade deficit is beneficial. However, a blanket tariff policy and the push to eliminate all trade deficits miss the mark.

In the short run, the new tariffs will raise prices, slow growth and damage our reputation as a trading partner. Any benefits from bringing back manufacturing will take years to materialize, if they come back at all.

I’m skeptical because business owners won’t rush to break ground on new factories when the tariff landscape is uncertain. If the rules change or the tariffs are repealed, the economics favoring domestic production could vanish in a flash. And any new plants won’t be hiring like it’s the 1950s—robots and automation will be doing most of the heavy lifting.

This whole tariff drama could end in an instant—with a tweet, a congressional move, or a court ruling. And while I expect the administration to cut deals to ease tariffs on select countries, the reality is that, for now, higher tariffs look like they’re here to stay.

Investing in the World We’ve Got

All of this said, you and I must invest in the world as it is, not necessarily as we want it to be. With that in mind, what’s an investor to do?

First—not to be patronizing—take a deep breath and try to keep things in perspective.

500 Index (VFIAX), a benchmark for the market, is “only” 18.8% below its February 19 high. That’s close, but not a bear market. And even if it was, as I explained here, long-term investors will inevitably encounter corrections and bear markets. It’s the natural consequence of investing long-term.

If you own a balanced portfolio (a mix of stocks and bonds), you’re holding up better than the headline all-stock indexes.

Second, if you've spent the past few days losing sleep worrying about your portfolio, then you’re probably positioned too aggressively for your comfort level. Consider taking some risk off the table. Keep it simple and sell stocks to buy bonds or cash.

If you wanted to reduce risk but stay in the stock market, a handful of defensive stock funds came through last week. Two examples: Dividend Growth (VDIGX) and U.S. Minimum Volatility Factor ETF (VFMV) are both down 9.6% since the tariff announcement, while 500 Index is off 12.1%.

Funds like these invest in stocks, so they won’t be immune when the market declines—but they have a track record of holding up relatively well in challenging environments.

Of course, dialing down risk two months ago would've been better—but there’s no rewinding the clock. The bottom line: It’s never a bad time to move to a portfolio that fits your comfort level better.

Third, if you’re looking to “take some action” without upending your long-term plan, consider tax-loss harvesting. I shared a guide on tax-loss harvesting in the IVA Portfolios with Premium Members yesterday. Just remember to invest any tax savings.

Fourth, consider converting some—or even all—of your traditional IRA to a Roth IRA. Bear markets can be a smart time to shift tax-deferred savings into a tax-free account. Just be sure to consult a tax professional, as this move has tax implications.

Finally, as I’ve said all year, diversification is your friend when uncertainty reigns.

Our Portfolios

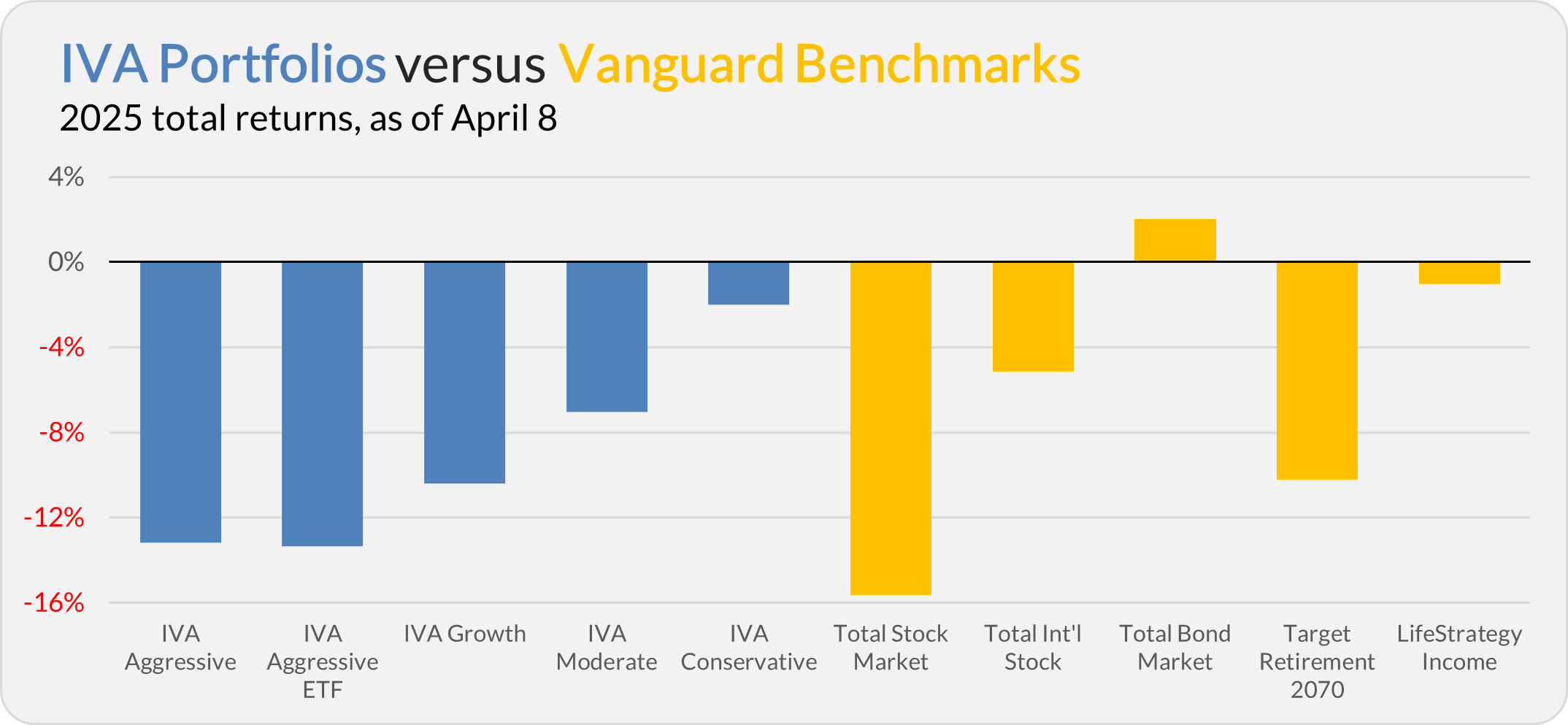

Our Portfolios are down but showing relatively good returns for the year through Tuesday. The Aggressive Portfolio is off 13.2%, the Aggressive ETF Portfolio is down 13.4%, the Growth Portfolio is off 10.4%, the Moderate Portfolio is down 7.0% and the Conservative Portfolio is down 2.0%.

This compares to a 15.6% decline for Total Stock Market Index (VTSAX), a 5.2% drop for Total International Stock Index (VTIAX), and a 2.0% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is down 10.2% for the year, and its most conservative, LifeStrategy Income (VASIX), is off 1.0%.

IVA Research

I don’t react to every market twist and turn, but with stocks selling off sharply last week, I shared two Quick Takes with Premium Members—one on Thursday and another on Saturday.

Yesterday, I shared a how-to guide for harvesting losses in the IVA Portfolios with Premium Members.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.