Hello, and welcome to the IVA Weekly Brief for Wednesday, April 16.

There are no changes recommended for any of our Portfolios.

Tariff Run Down

Having trouble keeping up with all of the tariff news? I don’t blame you.

As I said last week, "This whole tariff drama could end in an instant—with a tweet, a congressional move, or a court ruling." I didn’t know it was coming, but a few hours after hitting send, President Trump announced, via Truth Social, a 90-day pause on the elevated tariffs that had kicked in only 13 hours earlier.

Traders were undoubtedly pleased with the reprieve. The S&P 500 index gained 9.5% on Wednesday (April 9)—its third-best one-day return since its 1957 inception. (In a Thursday morning Quick Take, I shared a few reflections with Premium Members.)

Make no mistake, when it comes to tariffs, in the President’s own words, “Nothing is over yet.” So, here’s a quick recap of where country-level tariffs stand for the moment:

- China: 145% tariff, exempting electronic consumer goods (think iPhones).

- Canada and Mexico: 25% tariff with an exemption for products that meet USMCA standards and only a 10% levy on energy and potash from Canada.

- 10% minimum on all other countries. We are in a 90-day pause (until July 9) on elevated “reciprocal” tariffs.

Those country-level tariffs are separate from the 25% duty on steel, aluminum and automotive imports that remains in effect. More sector-specific levies—like pharmaceuticals and semiconductors (which may include those exempted electronic goods, it’s still unclear)—are in the works.

The situation is fluid. With the U.S. in a trade war with China and negotiating trade deals with multiple countries, where tariffs ultimately land is anyone’s guess. In the meantime, uncertainty is weighing on consumers, investors and businesses.

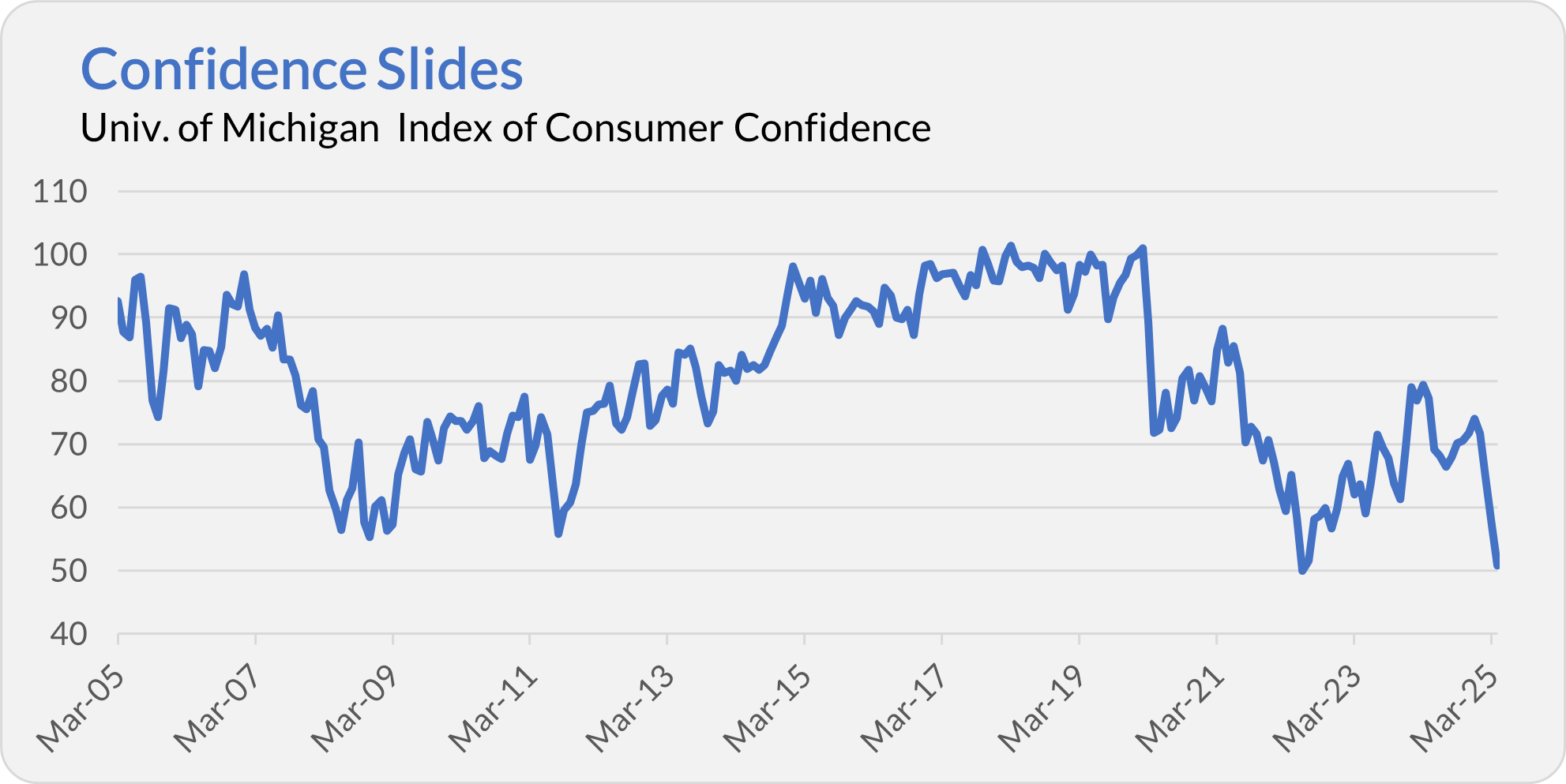

For example, consumer sentiment is in the doldrums. According to the University of Michigan’s survey, consumer confidence is lower today than in the last two decades, bar one month in 2022.

Cracks in Confidence

Uncertainty has crept into the bond market as well.

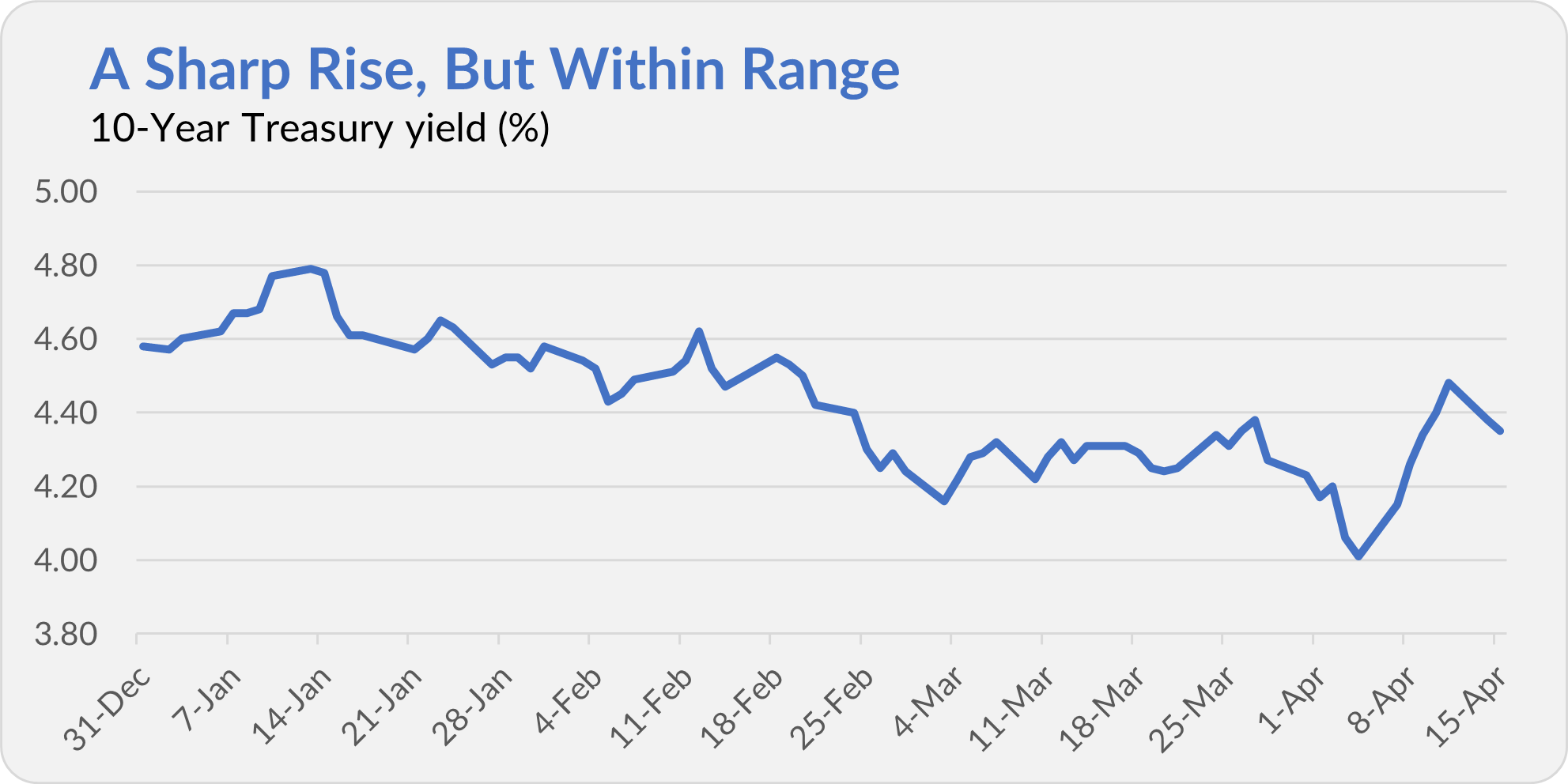

The first two trading days after the president’s April 2 tariff announcement, the yield on the 10-year Treasury fell from 4.20% to 4.01%. Remember, bond yields fall as bond prices rise. So, this is what you’d expect—as stocks fell 10% in two days, investors turned to Treasury bonds as a haven.

However, last week, the yield on the 10-year Treasury rose from 4.01% to 4.48% despite continued market volatility and investor angst. That significant five-day rise has grabbed a lot of attention.

The simplest explanation for the unexpected increase in Treasury yields (and decline in price) is that investors didn’t want to own Treasurys. The administration's willingness to break with precedent and shake up the global trading order has raised a new question: What else might they do?

But let’s keep things in perspective.

The 10-year Treasury’s 4.48% yield on Friday was lower than where it started the year (4.58%). Also, as of Friday, Intermediate-Term Treasury (VFITX) was Vanguard’s third-best performing bond fund on the year, up 2.1%.

Plus, as you can see in the chart above, the yield on the 10-year Treasury has fallen to 4.35% over the past two days. Intermediate-Term Treasury is Vanguard’s second-best performing bond fund—now with a 2.9% gain this year.

Rising Treasury yields might signal some early cracks in confidence in the U.S. as a borrower—but let’s not overreact.

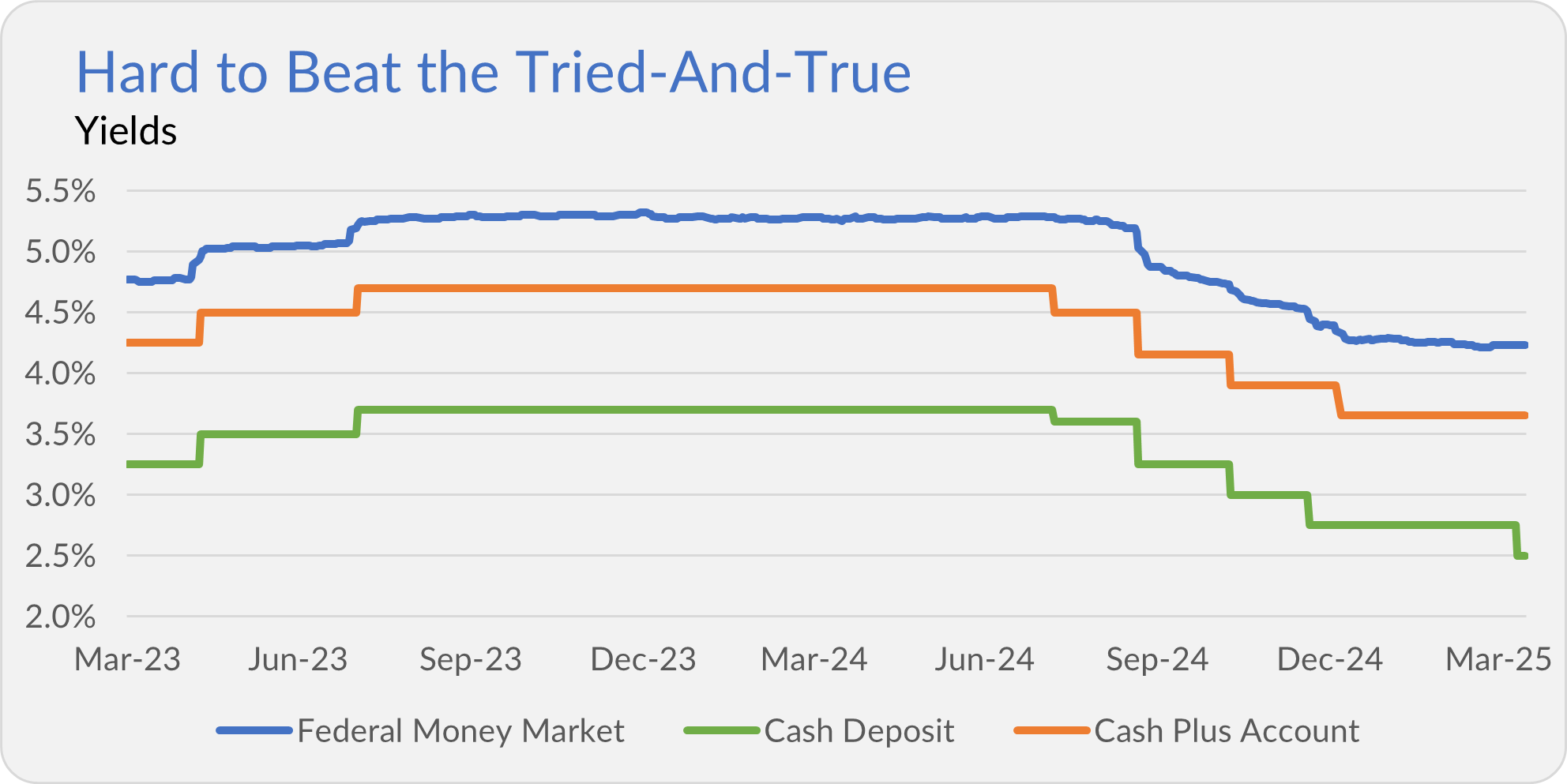

Cash Yield Slips

Speaking of yields, with zero fanfare, Vanguard lowered the yield on Cash Deposit—its settlement fund alternative to Federal Money Market (VMFXX)—from 2.75% to 2.50%. So far, the yield on Vanguard’s other cash account—Cash Plus Account—has held steady at 3.65%.

Premium Members will receive my full breakdown of Vanguard’s cash offerings next week, but spoiler alert—I’m not budging from the firm’s dependable money market funds.

A Trio of Giants

Vanguard is teaming up with Wellington Management and Blackstone (a heavyweight in private markets) to develop investment products that blend public and private assets.

Based on what’s been shared, the initial offerings will be sold through financial advisers, which I take to mean they’ll be limited to clients of Vanguard’s advice channel. That said, details are scarce—we’ll learn more in the months ahead.

The likely long-term goal is to stuff private investments into the Target Retirement funds. I’ll have a lot more to say about private markets down the road. For now, I’ll just say this: I’m skeptical—I hope Vanguard moves slowly on this.

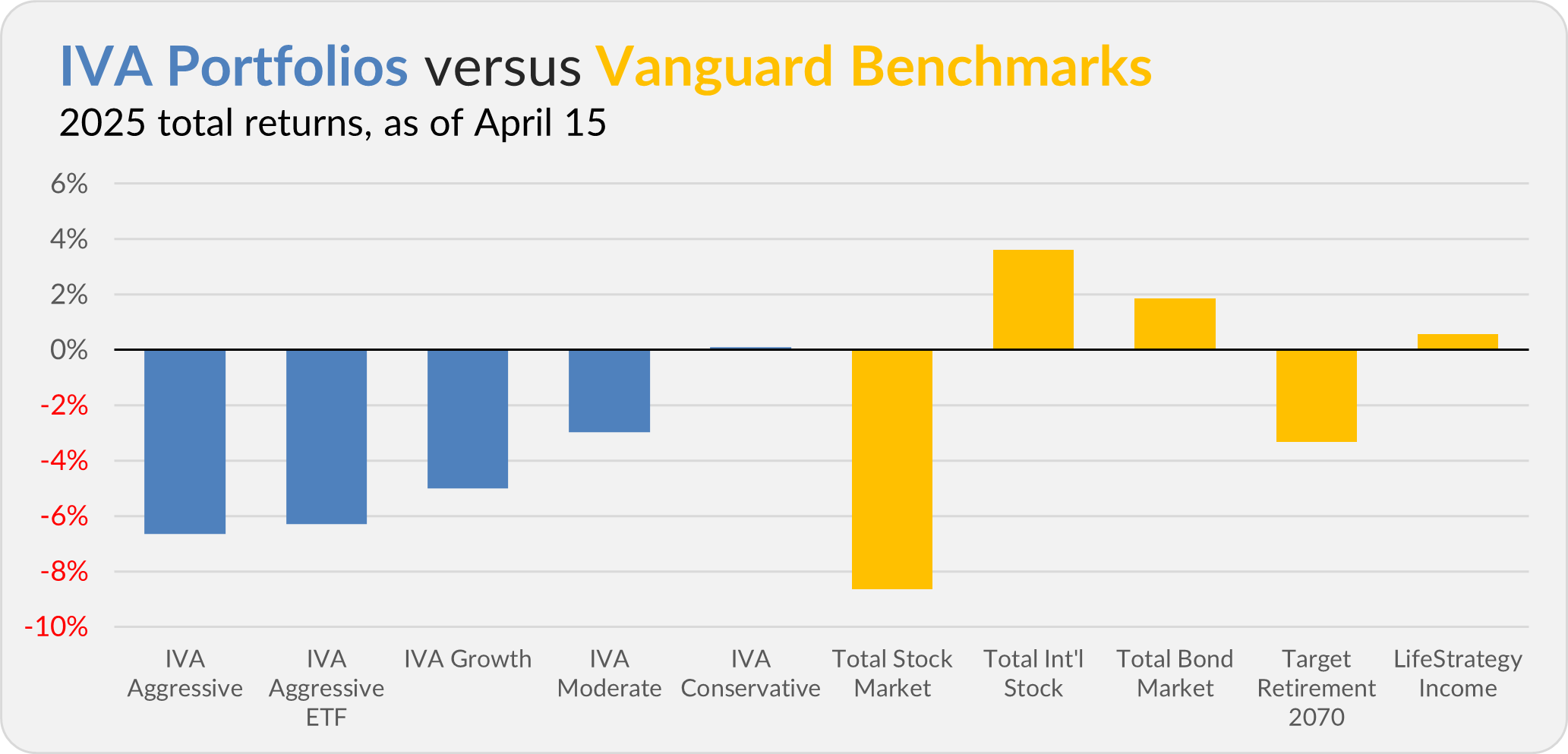

Our Portfolios

Our Portfolios are showing mixed returns for the year through Tuesday. The Aggressive Portfolio is down 6.6%, the Aggressive ETF Portfolio is off 6.3%, the Growth Portfolio is down 5.0%, the Moderate Portfolio is off 3.0% and the Conservative Portfolio is up 0.1%.

This compares to an 8.7% decline for Total Stock Market Index (VTSAX), a 3.6% gain for Total International Stock Index (VTIAX), and a 1.9% return for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is down 3.3% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 0.6%.

IVA Research

On Thursday, I walked Premium Members through how big market swings—up and down—tend to come in bunches. Yesterday, I extended that thread by digging deeper into the well-known “miss the 10 best days” chart.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.