Hello, and welcome to the IVA Weekly Brief for Wednesday, February 12.

There are no changes recommended for any of our Portfolios.

As I said last week, the tariff story is far from over.

In its latest chapter, President Trump announced 25% tariffs on steel and aluminum imports on Monday. These new duties apply to all countries without exception—including Mexico and Canada.

And there’s more to come. The European Union has promised to respond with retaliatory tariffs of their own. On top of that, Trump plans to impose “reciprocal” tariffs (meaning the U.S. would match the duties other countries charge) while levies on cars and semiconductors are in the works. Also, the blanket 25% tariffs on Mexican and Canadian goods were only put on hold until March 4.

In contrast to a week ago, when traders slammed the sell button in response to tariff news, the latest round of levies was a non-event in the market. The S&P 500 index was down only 0.2% on Tuesday morning and ended the day up 0.03%. As I said, a nothing burger!

Traders were arguably more focused on Federal Reserve Chair Jerome Powell’s Congressional testimony (he said that policymakers would stand pat until they got more information on the direction of the economy) than tariffs. Heck, stocks are selling off harder this morning (Wednesday) in response to inflation (measured by the Consumer Price Index, CPI) clocking in at 3.0% over the past year.

The lesson is that, according to traders, targeted (good-specific) tariffs are acceptable, but across-the-board levies are problematic. (Or maybe the lesson is that traders "know" how to respond to things like inflation and earnings reports but are still "learning" how to react to tariff news.)

Either way, the book isn’t written on tariffs—we still don’t know what tariffs will be implemented, on whom and for how long. I doubt policymakers even know what tariffs we'll be collecting (and paying) 12 months from now. Even if you knew, you still couldn't know how markets (traders) will respond.

As long as the future is uncertain, I’ll continue advocating for a diversified portfolio.

New Cash-Like ETFs Arrive

That said, if you’re looking for a place to hide, Vanguard’s two newest ETFs may be of interest. On Tuesday, Vanguard launched 0-3 Month Treasury Bill ETF (VBIL) and Ultra-Short Treasury ETF (VGUS).

Here’s the short story:

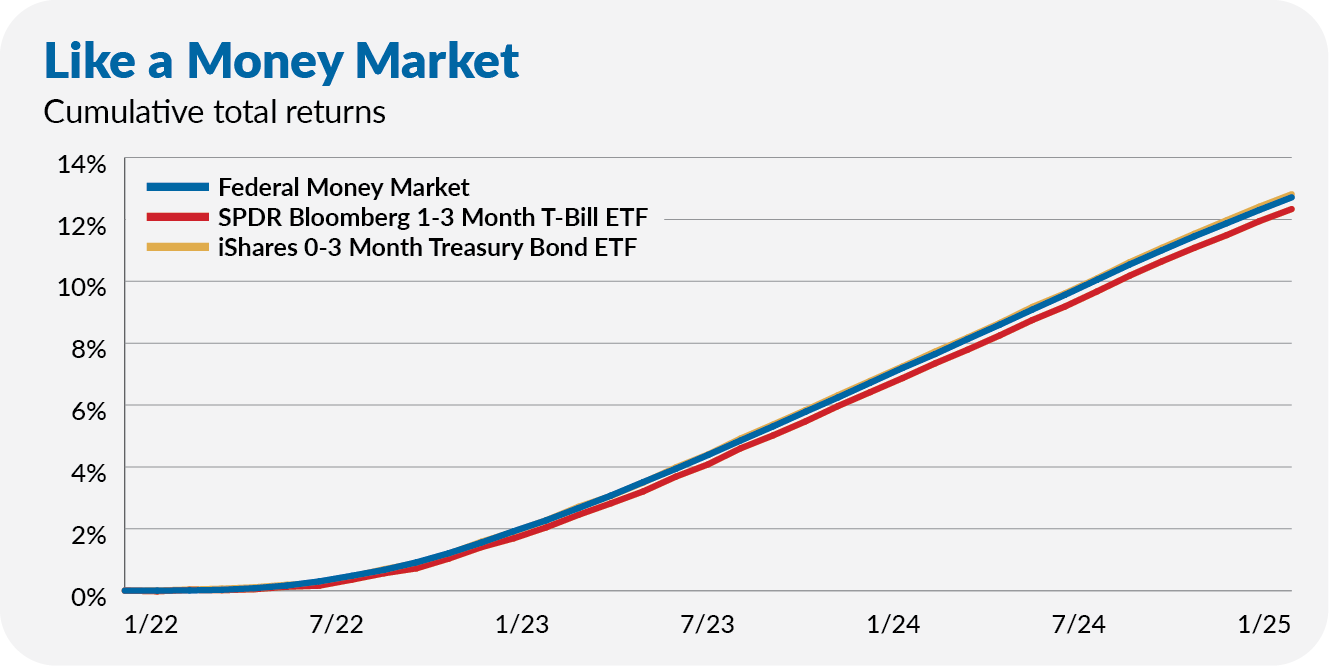

Think of 0-3 Month Treasury Bill ETF, which holds only the shortest T-Bills (as the name describes), as a cash alternative. To be clear, the new ETF isn't a money market fund—its price will fluctuate—but it should deliver similar returns to Federal Money Market (VMFXX) over time.

You can see this in the chart below tracking Federal Money Market’s performance over the past three years alongside T-Bill ETFs from iShares and StateStreet (SPDR).

Ultra-Short Treasury ETF holds Treasuries with maturities of less than 12 months. It bridges the (small) gap between Federal Money Market and Ultra-Short-Term Bond (VUBFX or VUSB). The new ETF is a good spot to park cash you don’t need immediately but want to keep safe, but I suspect it’ll be less popular than its 0–3-month sibling.

Fixing Vanguard’s Tech at Home

“Try a different browser” is fast becoming the new “Did you restart the computer?” at Vanguard.

If you’re like me, you learned pretty quickly to try restarting your computer before calling tech support. Hitting that reboot button has fixed many of my computer problems over the years.

While I can’t hit restart on Vanguard’s computers, I can try accessing their website on a different browser. For example, if something isn’t working when I’m using Microsoft’s Edge browser, I try the same thing on Google Chrome. And, presto, (sometimes) it works!

And it’s not just me. One IVA reader recently told me he kept running into a blank page while trying to set up his required minimum distribution (RMD). When he switched browsers (from Edge to Firefox), it worked fine.

We Vanguard shareholders deserve better—the website functioning on all major browsers is a low hurdle to clear. Nonetheless, if you run into an issue on Vanguard’s website, try using a different browser. It just might solve the problem!

Our Portfolios

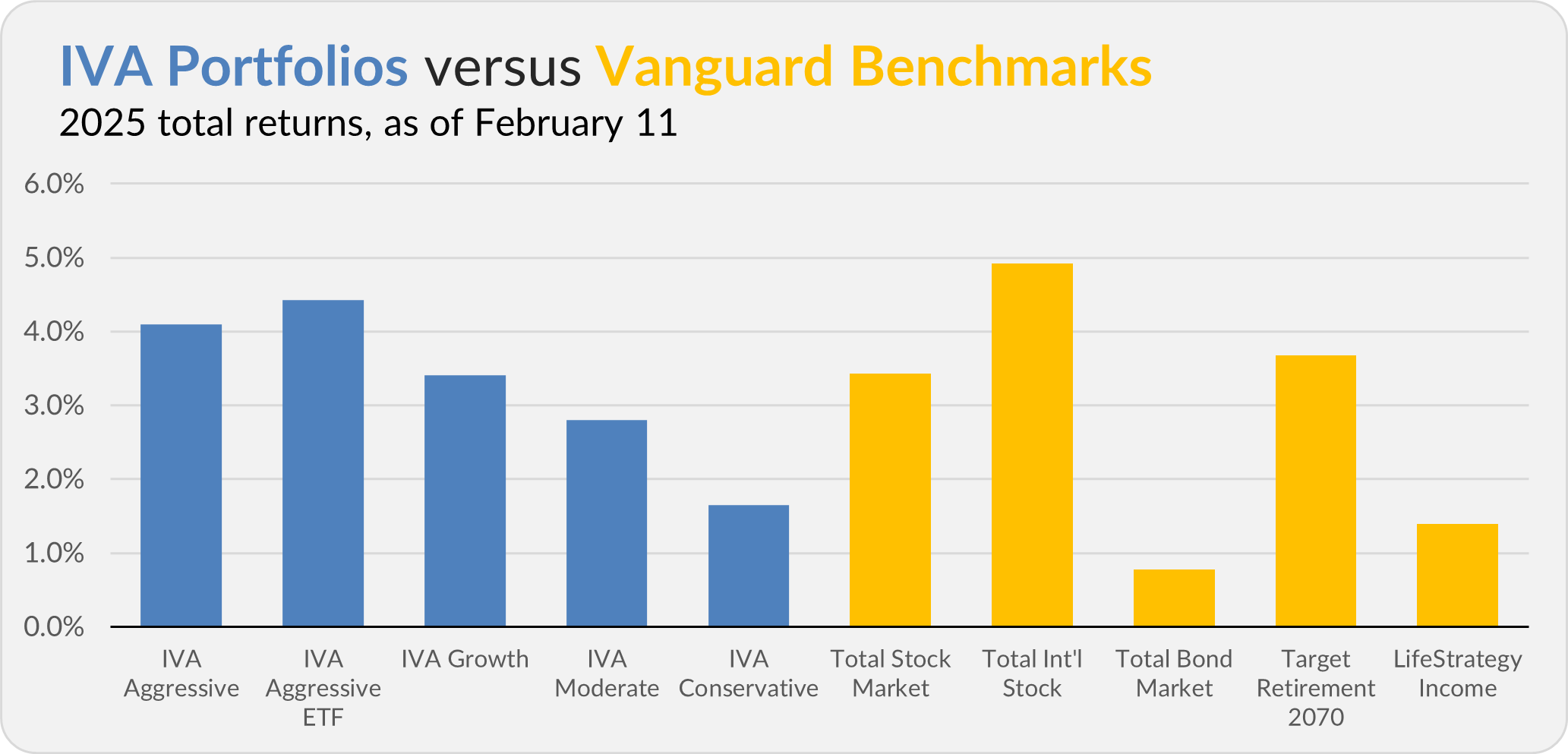

Our Portfolios are showing decent returns for the year through Tuesday. The Aggressive Portfolio is up 4.1%, the Aggressive ETF Portfolio is up 4.4%, the Growth Portfolio is up 3.4%, the Moderate Portfolio is up 2.8% and the Conservative Portfolio is up 1.6%.

This compares to a 3.4% gain for Total Stock Market Index (VTSAX), a 4.9% return for Total International Stock Index (VTIAX), and a 0.8% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 3.7% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 1.4%.

IVA Research

Yesterday, in Finding Balance with Core Bonds, I shared my analysis of Vanguard’s core taxable bond funds with Premium Members.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.