Hello, and welcome to the IVA Weekly Brief for Wednesday, March 12.

🚨🚨On Friday, I recommended trades in four IVA Portfolios. Premium Members received a separate Trade Alert email explaining the trades and my reasoning behind them.

Are you interested in a Premium Membership? Start your free 30-day trial now.

Is anyone else feeling a little tariff whiplash?

Last week, the U.S. walked back blanket 25% tariffs on our neighbors—granting a one-month reprieve for autos as well as goods and services covered by the North American trade agreement (or USMCA). Canada responded with a surcharge on electricity on Monday. The U.S. hit back with a 50% tariff on Canadian steel and aluminum imports. By the end of Tuesday, a temporary truce (on electricity and metals) had been reached.

But, that’s not all. Overnight the U.S. imposed 25% tariffs on all steel and aluminum imports (as planned). Europe responded with 50% tariffs on various U.S. goods, like whiskey and motorcycles. The levies will go into effect on April 1, and Europe has planned another round of retaliatory tariffs for mid-April.

This is what a trade war looks like, and it is far from over. In addition to tit-for-tat responses, more tariffs are expected in April.

So far, traders have said that broad-based tariffs and a trade war are not good—to use a technical term. By my reckoning, the trade war started on February 1—when President Trump first announced 25% tariffs on Canada and Mexico. From the end of January through Tuesday’s close, 500 Index (VFIAX) is down 7.6%.

Most of those losses accrued in March as the trade war intensified. Vanguard’s flagship index fund has notched negative returns on five out of seven trading days on its way to a 6.4% decline in March.

Will this be a short-lived market correction, or are we in the early stages of a protracted bear market? The honest answer is that no one knows for sure.

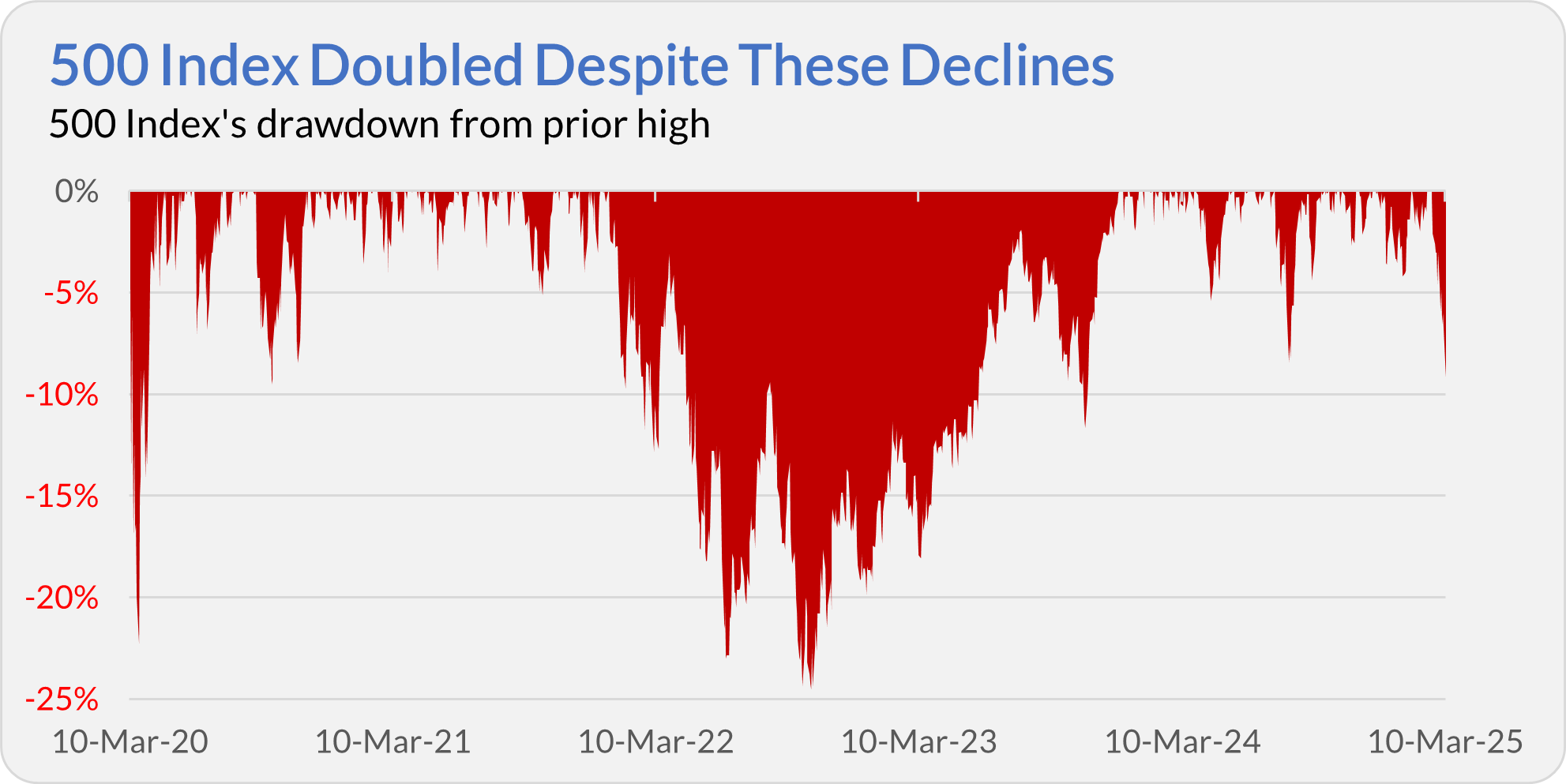

To offer a little perspective, five years ago (on March 11, 2020), the World Health Organization declared COVID-19 a pandemic. Had you bought 500 Index the day before the declaration (March 10), your position would have fallen 22.3% over the next two weeks. Ouch.

However, if you held on, you’d have doubled your money since your initial ill-timed purchase. 500 Index has gained 109% between March 10, 2020 and March 11, 2025—that includes the initial drop, the reflation bear market of 2022 and the recent market dip!

If I had an edge in trading the market’s ups and downs, well, I would time the market—the rewards could be significant. However, I don’t have that edge and haven’t met anyone who does. So, the next-best approach is to spend time in the market, even when it’s uncomfortable.

Malvern News

Here is a rundown of this week’s Vanguard news:

New ETFs on the way

Last week, Vanguard filed to launch two new municipal bond ETFs: Long-Term Tax-Exempt Bond ETF (VTEL) and New York Tax-Exempt Bond ETF (MUNY). The new funds won’t turn heads but are practical offerings that plug two holes in the lineup.

Premium members can read more about the new funds here.

Quicken follow-up

Last week, I told you that Vanguard accounts were no longer updating automatically with Quicken. Well, according to Quicken, it’s a Vanguard issue. Below is a screenshot of the error message my mentor received when trying to link his account.

Unfortunately, for Quicken users, this being a Vanguard problem explains why it has persisted. Until it is resolved (and I'm not holding my breath), you'll need to download your transaction data and positions from Vanguard manually.

Under fire

Vanguard has been sued over the $100 fee it now charges to close accounts with less than $5 million in assets. While researching the lawsuit, I found a similar suit had been filed earlier this year (here). If you ask me, the $100 exit fee is a “junk fee,” but, well, I’m not a lawyer or legal expert. Vanguard isn’t the only financial platform to charge fees when closing accounts, so we’ll see how this plays out.

Supplemental distributions ahead

A handful of Vanguard’s mutual funds are paying out supplemental capital gains toward the end of March. I shared all the relevant details with Premium Members yesterday—here.

Our Portfolios

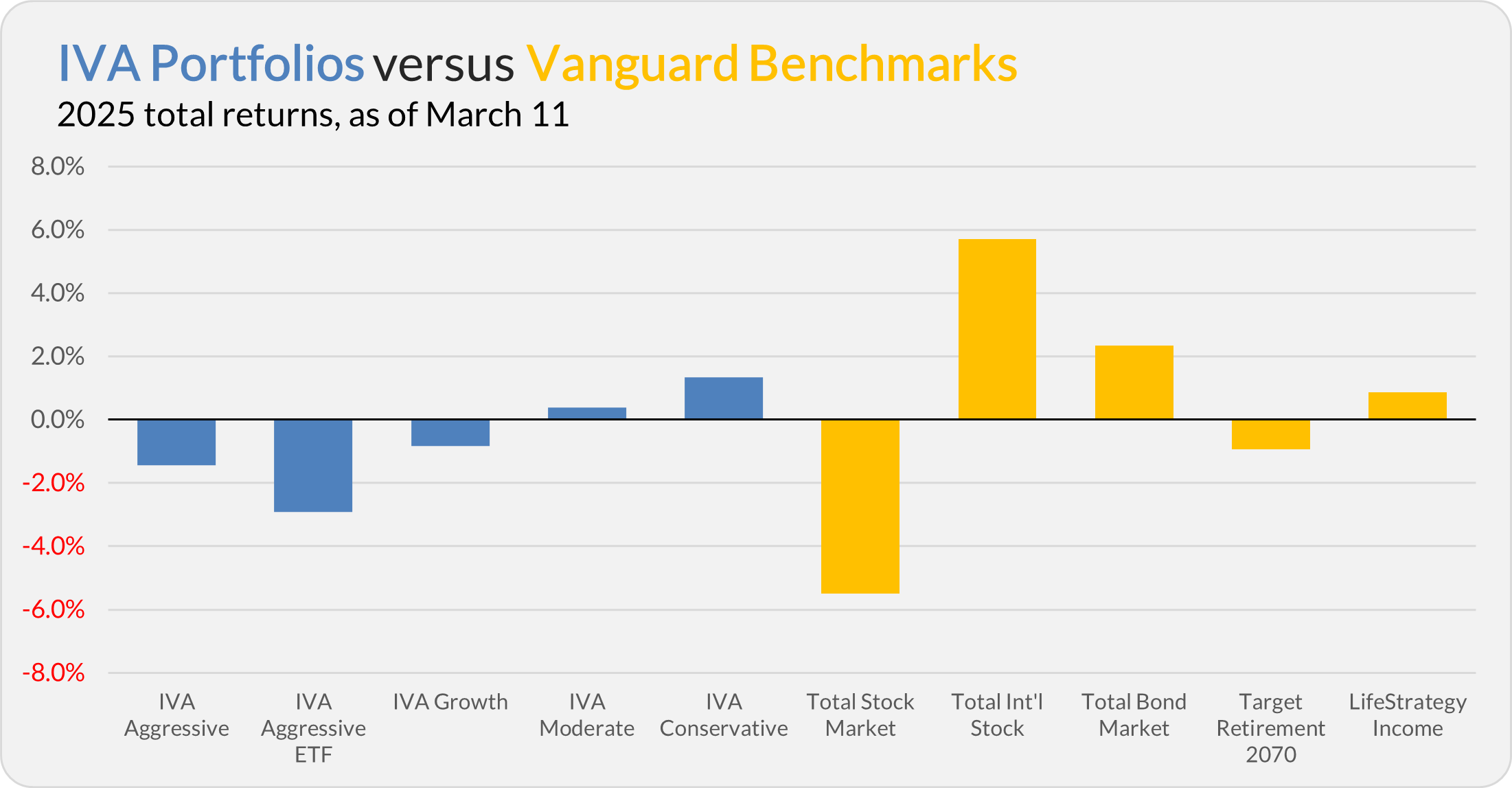

Our Portfolios are holding up relatively well for the year through Tuesday. The Aggressive Portfolio is down 1.4%, the Aggressive ETF Portfolio is off 2.9%, the Growth Portfolio is down 0.8%, the Moderate Portfolio is up 0.4% and the Conservative Portfolio is up 1.3%.

This compares to a 5.5% decline for Total Stock Market Index (VTSAX), a 5.7% gain for Total International Stock Index (VTIAX), and a 2.3% return for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is down 0.9% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 0.9%.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.