Hello, and welcome to the IVA Weekly Brief for Wednesday, February 5.

There are no changes recommended for any of our Portfolios.

On again, off again.

Unless you’ve been purposely avoiding the news you already know by now, but on Saturday, President Trump announced the U.S. would impose 25% tariffs on nearly all imports from Canada and Mexico, a 10% levy on energy items (think crude oil) from Canada, and an extra 10% duty on China.

On Monday, stocks opened down around 2% but recouped some ground (with the S&P 500 index dropping only 0.8%) as a trade war with our neighbors was averted—or at least delayed. After agreements around border security were made, the sweeping 25% tariffs were put on hold for a month.

However, the additional 10% tariff on Chinese goods went into effect on Tuesday. China hit back with levies on certain goods (like coal, natural gas and pick-up trucks), an antitrust probe into Google and limiting exports of certain minerals.

While traders breathed a sigh of relief on Monday, the tariff story is far from over. The levies on Mexico and Canada were only delayed. China and the U.S. could reach a deal or escalate matters from here. And President Trump also has Europe in his sights.

What are we long-term investors to do?

It probably won’t surprise you, but my response is to stay diversified. As I told Premium Members on Monday (here), the range of outcomes is very wide, with many variables in play. So, let’s not jump to conclusions.

For what it’s worth, here’s what “worked” in the markets on Monday. Commodity Strategies (VCMDX) was Vanguard’s best-performing fund, up 1.2%. Long-maturity Treasurys also gained around 1%. Utilities ETF (VPU) and Consumer Staples (VDC) were the best-performing sector funds up 0.6% and 0.5%, respectively. Dividend Growth (VDIGX) dropped 0.4% on the day, about half as much as the S&P 500 index (down 0.8%).

On the flip side, Global Environmental Opportunities Stock (VEIOX) was Vanguard’s worst-performing fund, dropping 2.1%. That’s a fairly niche fund, though. More generally, smaller stocks trailed large stocks. The worst-performing sectors were Consumer Discretionary ETF (VCR) and Information Technology ETF (VGT), down 1.6% and 1.4%, respectively.

Is that a playbook for future tariff troubles? Possibly.

Monday showed that traditional “safe” assets—like Treasury bonds and dividend growers—are still where traders turn when storm clouds appear on the horizon.

Consumer Discretionary ETF was hit harder by this round of (potential) tariffs because autos and homebuilders comprise a quarter of its portfolio—those sectors are highly integrated across the North American continent. Future tariffs may (or may not) hit these stocks as hard.

Notably, tech stocks led the way down. I think this reflects their lofty valuations and higher ownership more than their being particularly threatened by tariffs. If people are selling, well, they sell what they own—which are the tech giants.

Again, trying to predict precisely how tariffs will play out in the economy and (particularly) the markets is fraught. Rather than bet big on one uncertain outcome, aim to own a portfolio that can do reasonably well in different outcomes.

Lower Fees

As I told Premium Members on Monday (here), Vanguard announced its most significant fee cut in history.

This move should put any concerns about Salim Ramji’s (Vanguard’s new CEO) commitment to continuing Vanguard’s mission to rest. This is also clearly a win for investors as it means they keep more of their fund returns.

However, let’s keep things in perspective. In most instances, with Vanguard fees already near rock bottom, expense ratios fell by just a single basis point (or 0.01%). To put that in dollars and cents, one basis point on a $100,000 investment is just $10, and it’s only $100 on a million-dollar position. So, yes, at Vanguard’s level, the savings are big ($350 million this year, according to their math), but for an individual investor, it’s a rounding error.

I suspect that many Vanguard investors would be happy for Vanguard to keep that basis point if it led to better technology and service.

Our Portfolios

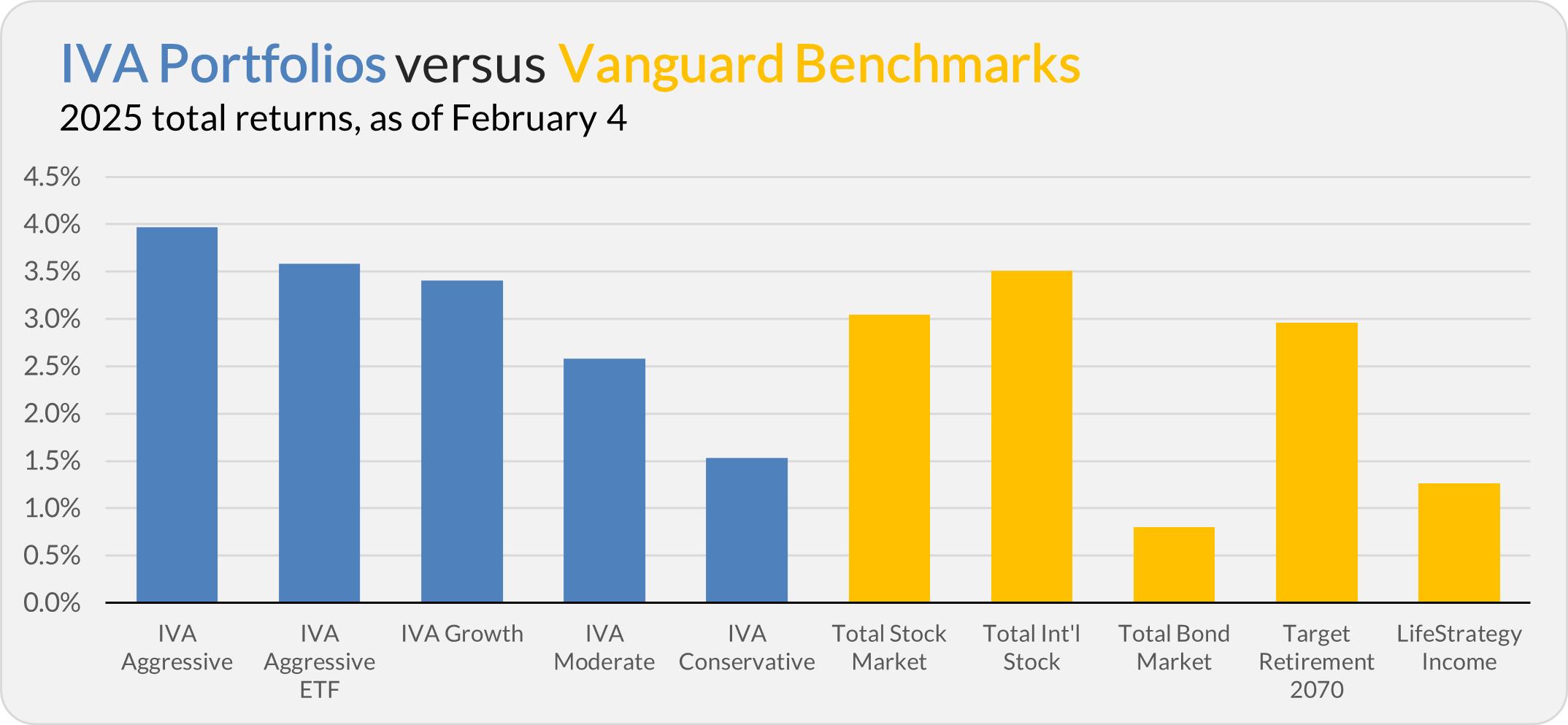

Our Portfolios are showing decent returns for the year through Tuesday. The Aggressive Portfolio is up 4.0%, the Aggressive ETF Portfolio is up 3.6%, the Growth Portfolio is up 3.4%, the Moderate Portfolio is up 2.6% and the Conservative Portfolio is up 1.5%.

This compares to a 3.0% return for Total Stock Market Index (VTSAX), a 3.5% gain for Total International Stock Index (VTIAX), and a 0.8% advance for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 3.0% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 1.3%.

IVA Research

Yesterday, in Safety Over Yield, I explained why I’m taking a safety-first approach to the bond market.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.