Hello, and welcome to the IVA Weekly Brief for Wednesday, February 26.

There are no changes recommended for any of our Portfolios.

This morning, Vanguard held its shareholder meeting to elect the board of trustees. All 13 nominees were confirmed. The new trustees are John Murphy, Rebecca Patterson, Barabara Venneman and Vanguard CEO Salim Ramji. With the election completed, longtime board members Emerson Fullwood and Joseph Loughrey have retired.

You can read more about the board members and how much they have invested alongside us, the shareholders, here and here.

I, however, was unable to connect to the meeting online! I had a 16-digit control number, not the required 15-digit number. Calling the Computershare phone number at the bottom of the page was utterly useless. (I tried two times.) By the time a helpful Vanguard employee could track down a control number for me to try, the meeting was over.

I wonder how many other Vanguard shareholders struggled to join the meeting.

More Uncertain Than Usual

It’s a pet peeve of mine when commentators say the road ahead is uncertain. When is a future outcome ever assured?

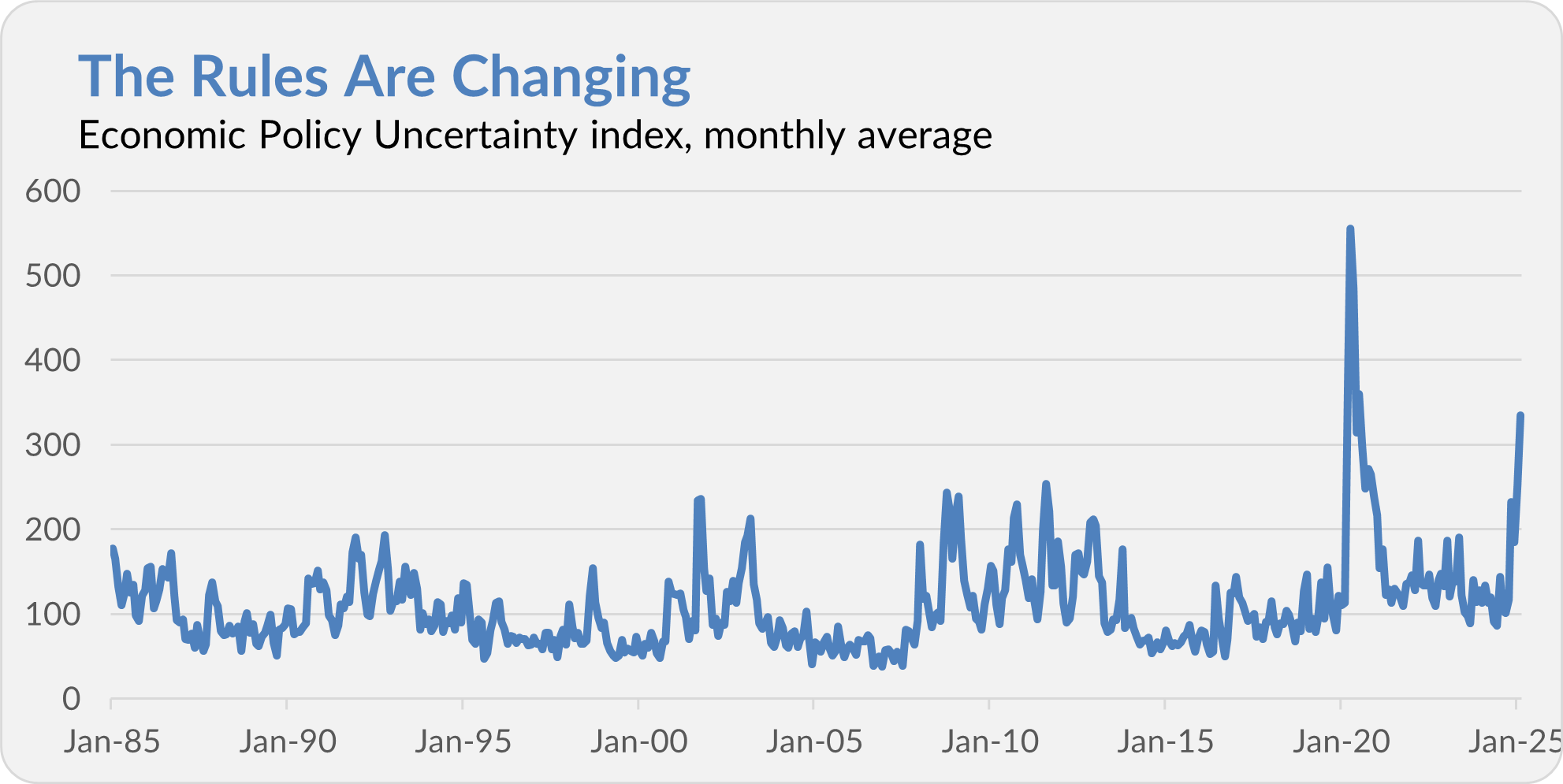

That said, by at least one measure—the Economic Policy Uncertainty Index—“uncertainty” is higher than it’s been in the last four decades (outside of the COVID-19 pandemic).

You can read about the index here. However, to summarize, the index counts newspaper articles containing terms like economy, uncertainty, congress, legislation, etc., to determine the level of ambiguity around policy. It also factors in changes to the tax code and whether forecasters are in agreement (or not).

In my opinion, this is the single best chart to describe the current environment.

However, given all the changes coming out of Washington, the spike in uncertainty isn’t surprising. What is a little more unexpected is how markets have taken the increased uncertainty largely in stride. For example, the S&P 500 index is only 3% below the record high set one week ago.

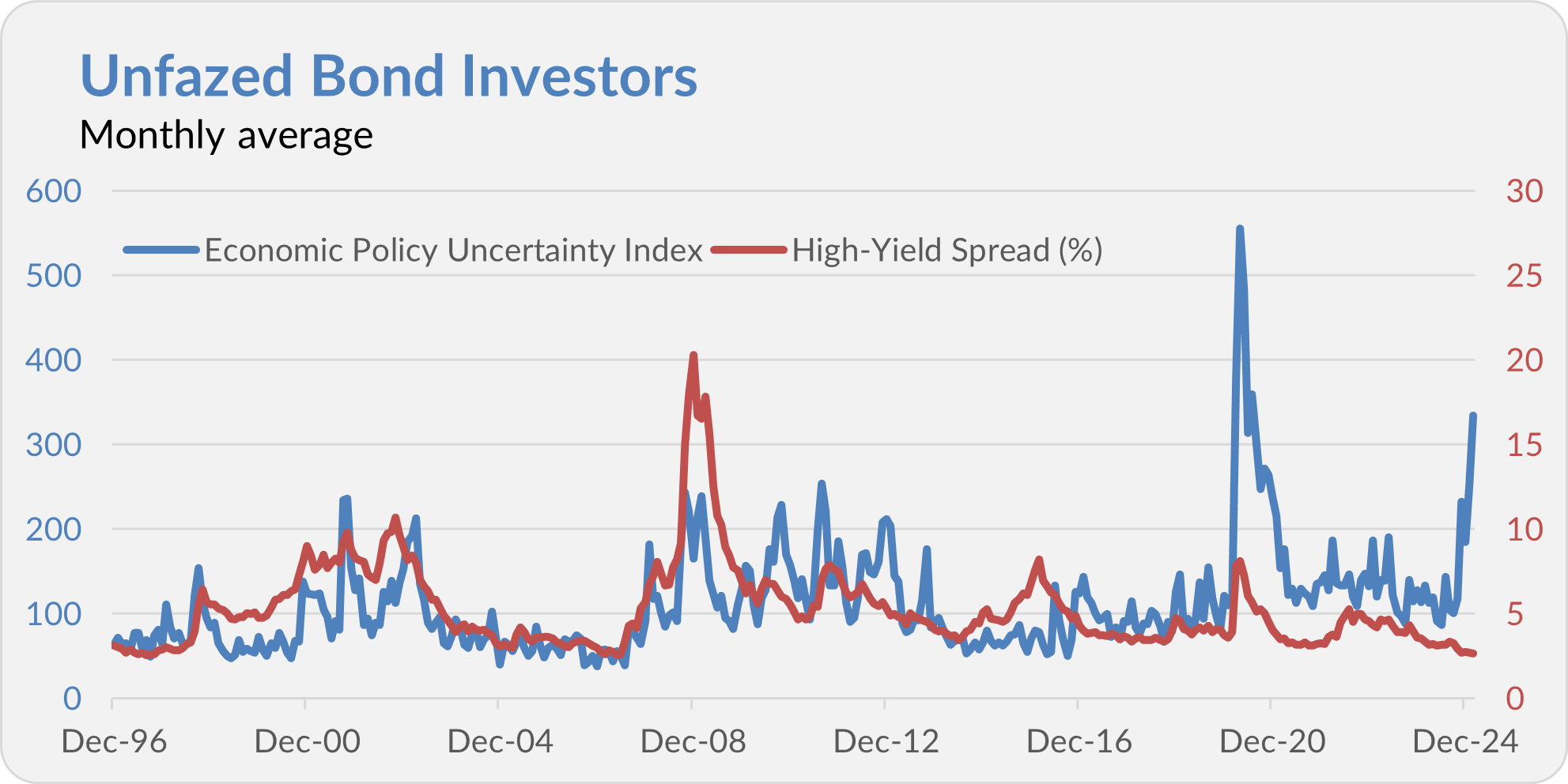

Or we can look at the bond market. When uncertainty is high, bond investors typically demand higher yields (a larger spread) when lending to less reliable borrowers with lower credit ratings. However, the junk bond market has no sign of stress (or distress). Investors still earn very little additional income with junk bonds compared to Treasury bonds.

Maybe the lesson is simply that every crisis is inherently uncertain, but uncertainty alone can't cause a crisis.

Still, I expect this disconnect will correct: Either we’ll get more clarity on policy, or the uncertainty will weigh on growth. Generally speaking, individuals and companies struggle to plan and invest for the future when they don’t know the rules. (Yes, I know Apple just announced some big spending plans, but the company has been moving in this direction for years.)

Let me give you a Vanguard example of how uncertainty and changing rules lead to (temporary) paralysis.

We Need to Reschedule

Vanguard has paused meetings with company management in response to a recent SEC notice (see here). The new guidance from the SEC means that Vanguard’s standard operating procedure when meeting with management might make it an “activist” investor.

As activist investors have stricter reporting requirements, Vanguard would very much like to maintain its status as a passive investor. So, Vanguard hit the pause button until it better understands the rules. It’s not just Vanguard; BlackRock canceled its meetings as well. (Though BlackRock has since resumed meeting with management teams.)

I suppose it’s a fair question to ask if Vanguard should ever meet with company management. After all, in most cases, Vanguard is an owner because the stock is in the index—and it’ll keep owning the stock as long as it is in the index. So, what’s there for Vanguard to discuss?

Putting aside the fact that Vanguard is also an active manager, consider that the fund giant oversees the investments and savings of millions of Americans. Meeting with company management seems like good practice.

Asked another way: If a decade ago Vanguard had voluntarily stopped meeting with management in any way, what would you have thought? I suspect most of us would’ve said they were dropping the ball.

Let’s be clear: Vanguard is not an activist in the traditional sense of the term—they aren’t acquiring companies to shake up the board or split companies apart. But, the definition of an activist investor (at least in the eyes of the SEC) may be changing.

As I’ve said, regulators should be asking questions about how they oversee Vanguard (and BlackRock). A firm with $10 trillion under management, large ownership stakes in most public companies and over 20% market share is different than a $1 trillion firm. But regulators must also remember that Vanguard and BlackRock have grown so big by delivering a clear good (nearly free exposure to the markets in a tax-friendly vehicle) to investors. Let’s not disrupt a tangible good to correct an undefined cost.

The answer is probably to find a middle ground where Vanguard isn’t considered a passive or activist investor but is regulated as an “influential” shareholder.

The Remedy

Ok. What does this uncertainty mean for investors?

My favorite defense against uncertainty is to own a well-diversified portfolio. Ultimately, it won’t be the “right” portfolio to own in the years ahead, but it also won’t be the “wrong” portfolio to own. The goal is to spend time in the market while doing reasonably and relatively well in many different scenarios.

If you’re losing sleep over your portfolio, keep it simple: Sell some stocks and move to cash. I can’t tell you how much to sell but try to keep a foot in the market. That will make it easier to get back into the market while ensuring you participate (to a degree) in gains should things work out better than you expect.

And if you’re gung-ho about everything happening in Washington, try to resist the temptation to load up on risk beyond your comfort zone. That’s a recipe for buying high and selling low if (when) markets hit a pothole.

As for Vanguard refraining from meeting with company management, I expect that to be temporary.

IVA on AIR

Over the weekend, my recent appearance on Orion's The Weighing Machine podcast aired. You can find the episode wherever you listen to podcasts, but I've provided Spotify and Apple Podcasts links below.

I think you'll enjoy my 35-minute conversation with co-hosts Rusty Vanneman and Robyn Murray as we covered a lot of ground. We discussed what Vanguard does well, where it needs to improve and where Vanguard is headed over the next five to ten years. We also talked about my outlook on the market, the merits of owning foreign stocks, some of my favorite funds ... and more.

Enjoy!

Spotify

Apple

Fees Can Go Up, Too

Vanguard made big headlines in early February with its largest fee cut ever. I wrote about it here and here. As I said then, the savings are significant in the aggregate. However, at the individual level, the savings are a rounding error—in most cases, expense ratios fell by just a single basis point (or 0.01%).

Well, I hate to break it to you, but fees don’t only go down at Vanguard. They can also go up!

An IVA reader shared a notice he received from Vanguard that on April 1, 2025, the per-participant recordkeeping fee on his 403(b) account is increasing by $20—from $60 per year to $80.

I’ve tried to provide some perspective in the table below by translating that $20 fee increase into percentage terms for various account sizes. I also calculated how much 0.01% (or the reduction in expense ratios everyone was cheering three weeks ago) of each portfolio is in dollars.

Fees In Context

| Account size | $20 as percentage of portfolio | 0.01% in dollars |

|---|---|---|

| $10,000 | 0.20% | $1.00 |

| $25,000 | 0.08% | $2.50 |

| $50,000 | 0.04% | $5.00 |

| $100,000 | 0.02% | $10.00 |

| $200,000 | 0.01% | $20.00 |

| $500,000 | 0.004% | $50.00 |

| $1,000,000 | 0.002% | $100.00 |

Clearly, the flat $20 fee increase impacts smaller investors more. So, if you’re starting out or struggling to save, this fee is significant. The breakeven point between a $20 recordkeeping fee increase and a 0.01% expense ratio reduction is $200,000.

So much for looking out for the little guy!

Our Portfolios

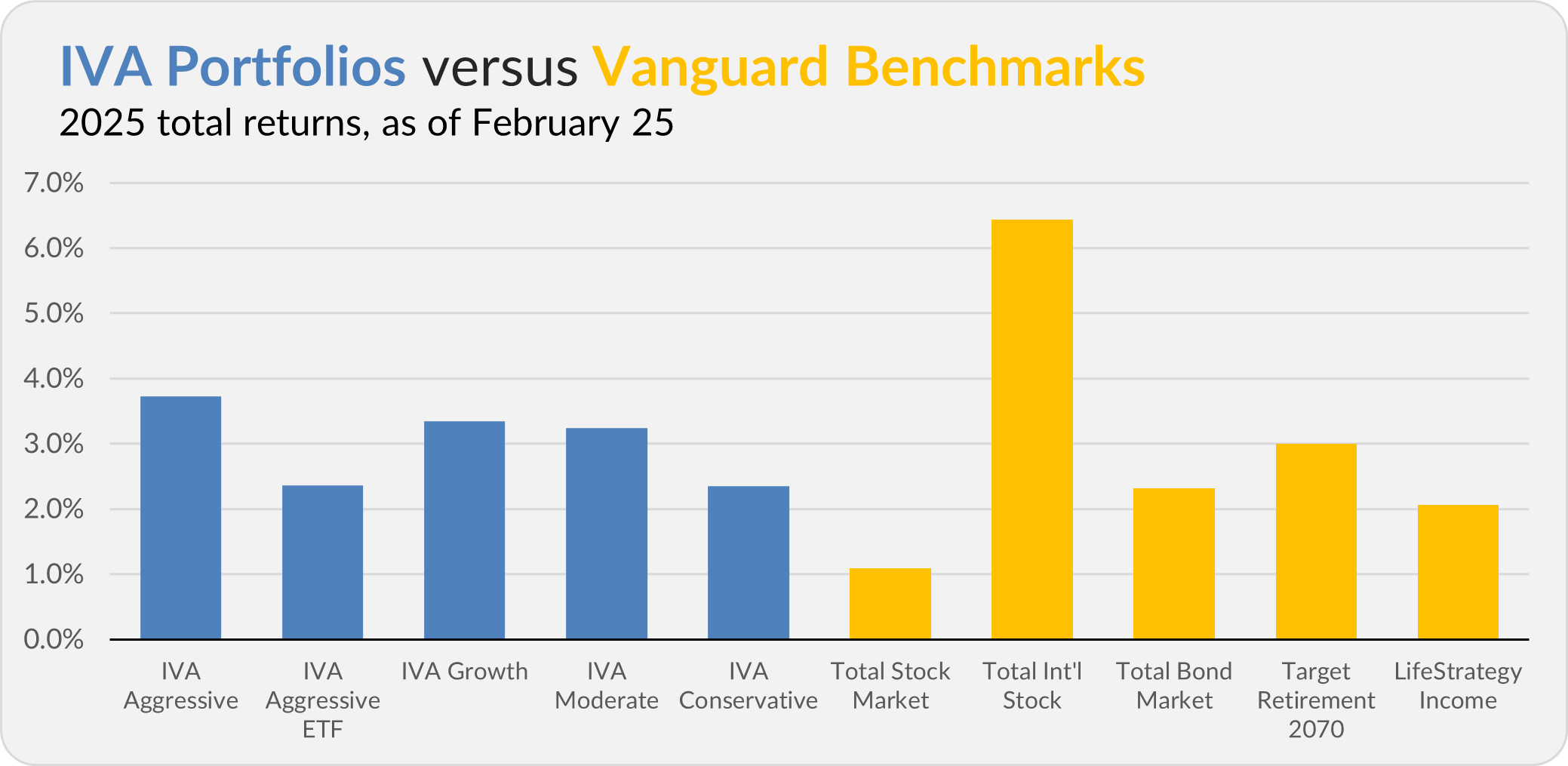

Our Portfolios are showing decent returns for the year through Tuesday. The Aggressive Portfolio is up 3.7%, the Aggressive ETF Portfolio is up 2.4%, the Growth Portfolio is up 3.3%, the Moderate Portfolio is up 3.2% and the Conservative Portfolio is up 2.3%.

This compares to a 1.1% gain for Total Stock Market Index (VTSAX), a 6.4% return for Total International Stock Index (VTIAX), and a 2.3% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 3.0% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 2.1%.

IVA Research

Yesterday, in A Guide to Vanguard’s Muni Bond Funds, I shared my analysis of Vanguard’s tax-free bond funds with Premium Members.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.