Hello, and welcome to the IVA Weekly Brief for Wednesday, October 9.

There are no changes recommended for any of our Portfolios.

Despite a bang-up employment report (more on that in a moment) and a quick resolution to the dockworkers' strike, markets have gotten off on the wrong foot this month. As of Tuesday night, roughly 9 out of 10 Vanguard funds were in the red for October.

The primary portfolio building blocks are down: U.S. stocks (Total Stock Market Index, VTSAX) are down 0.2%, foreign stocks (Total International Stock Index, VTIAX) are off 1.3%, and bonds (Total Bond Market Index, VBTLX) are down 1.1%. As you’d expect, cash has held steady—Federal Money Market (VMFXX) is up 0.1% so far.

However, there have been some pockets of positive returns within the markets. For example, Growth Index (VIGAX) is in the green, up 0.3%, and Emerging Markets Stock Index (VEMAX) is up 0.6%.

Emerging markets may not hold to those gains for long, though. Chinese stocks play an outsized role in the index fund—comprising a quarter of its portfolio. Using iShares MSCI China ETF (MCHI) as my proxy (since Vanguard doesn’t have a dedicated China fund), Chinese stocks gained 17% in the first week of October on the news of significant government stimulus. However, those gains were wiped out in the last two trading days. (Or at least, that’s the case as of Wednesday morning while I’m writing this.)

That’s quite the swing and another example of how hard it is to time the market.

Soft Landing

Is it the economic equivalent of beating a dead horse? When will the pundits stop asking whether Federal Reserve (Fed) policymakers have achieved a soft landing—lower inflation without a hit to employment? I thought I had answered that question long ago in my 2024 Outlook:

Based purely on 2023’s outcome, I’ll say it right here: the Fed has achieved the elusive soft landing. Inflation has fallen without a dramatic rise in unemployment or a slowdown in economic activity.

And, with Friday’s better-than-expected jobs report—we added 254,000 jobs, and the unemployment rate fell to 4.1%—you’d think the debate would be over. But no, everyone is arguing about whether the U.S. has or has not achieved a soft landing (again).

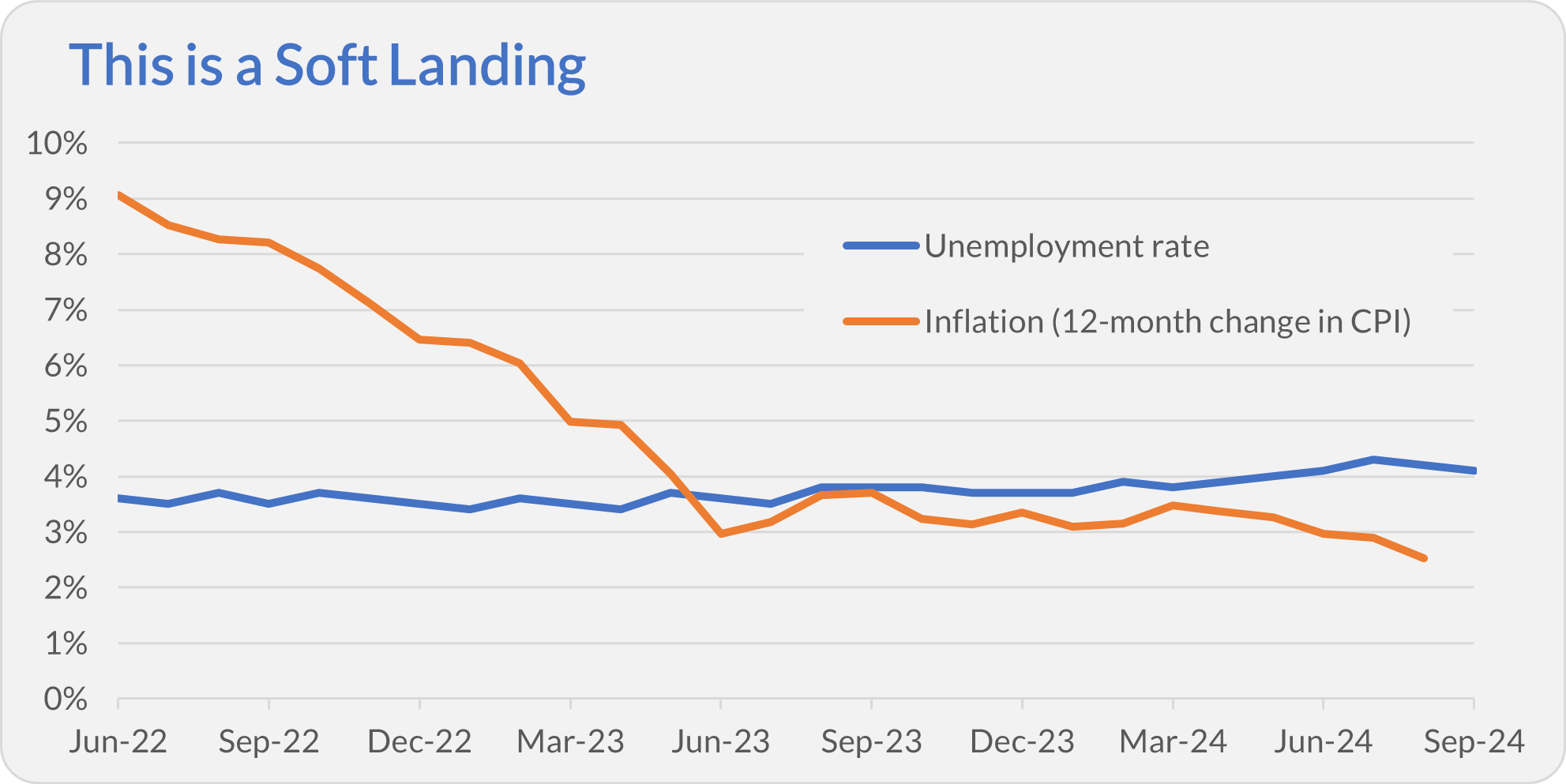

Inflation (measured by the 12-month change in the Consumer Price Index) has cooled substantially from a 9.1% peak in June 2022 to 2.5% in August 2024. The unemployment rate has risen from 3.6% to 4.1% since the middle of 2022.

That’s more than two years of falling inflation without a meaningful uptick in unemployment. Plus, the economy (measured by GDP, gross domestic product) has expanded by more than 6% (after inflation) over that period.

Even if the economy slips into a recession, we’ve already achieved a soft landing in my book!

Of course, the economic data only tells us what has happened; it doesn’t tell us anything about what will happen.

Though many intelligent and hard-working people try to forecast what’s next for the economy, I’ve yet to find anyone who can reliably (and profitably) do it.

This cycle has confounded many forecasters as multiple recession warning signals have been flashing yellow for two years. Reacting to past recession calls—dumping stocks in favor of cash or bonds—meant missing an opportunity to grow your wealth. 500 Index (VFIAX), for example, is up 57% since the end of June 2022.

Keep this in mind as we approach the new year, and everyone rushes to release their annual outlooks and forecasts.

Checking Vanguard’s ETF Work

As I mentioned two weeks ago, I was invited to test out Vanguard’s new automated ETF purchasing program.

Here’s the schedule I established: At the end of each month, draw $25 from my checking account into my brokerage account. On the 7th of each month, purchase $25 worth of S&P 500 ETF (VOO).

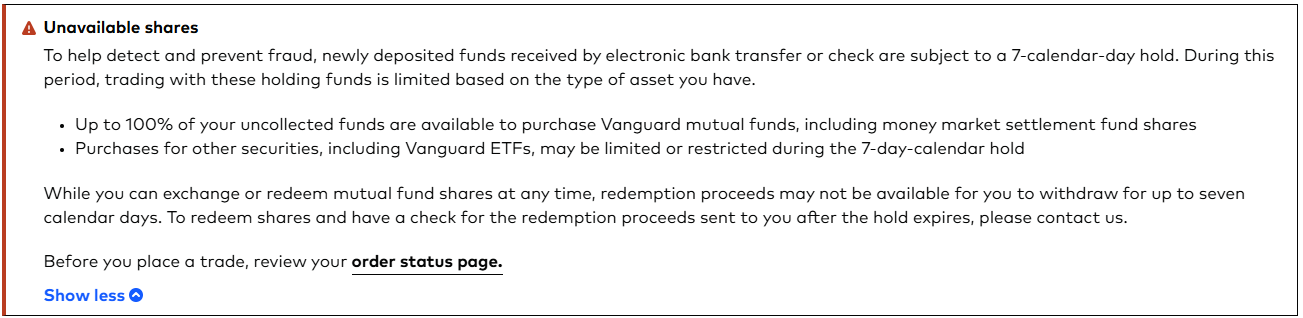

The $25 transfer at the end of the month went smoothly. However, until Monday, my account page showed the ominous message below, telling me the funds were subject to a 7-calendar-day hold. It goes on to warn that purchases of Vanguard ETFs “may be limited or restricted” while that hold is in effect.

I’m all for security and protecting against fraud, but this is becoming increasingly inefficient. First, I cannot set up a recurring transfer from my Cash Plus Account to my brokerage account. Now, I need to plan my transfer seven days in advance?! (The fact that I did this already was just a coincidence.)

In this day of instant transfers, a seven-day delay to get invested feels like an eon. If I kept the money at Schwab (where my checking account is; see here for more on that), I could be invested in a day (or two). So, strike one.

To be clear, I’m not looking to overhaul my investment setup. I’m only purchasing $25 each month to test out Vanguard’s system. Additionally, automated ETF purchases are more of a game-changer for smaller investors who can’t meet the minimums required to make pre-programmed mutual fund purchases. So, using a small dollar amount is a reasonable test, in my view.

Looking past the purported time delay, how did the first trade go?

Thankfully, my automated purchase went through. Vanguard purchased 0.0476 shares of S&P 500 ETF at a share price of $524.68. So, that’s $24.97—not quite the full $25 I was looking for.

How does that $524.68 purchase price stand up? Well, on Monday, the ETF traded between $520.81 and $525.72. The chart below shows how the ETF traded throughout the day.

So, the trade was (likely) executed in the early afternoon before the ETF’s price meaningfully dropped.

No, I don’t expect Vanguard to reliably time its purchases at the lowest price of the day—that’s just unreasonable. However, it is interesting to note that I would’ve received a better (lower) price if I had been auto-investing into the mutual fund. Of course, that won’t always be the case.

The first test is complete. While there is room for improvement, I’ll give Vanguard a passing grade—it pulled off the automated transfer and ETF purchase successfully.

I’ll keep you updated on this program in the months ahead.

Changes to Your Statements

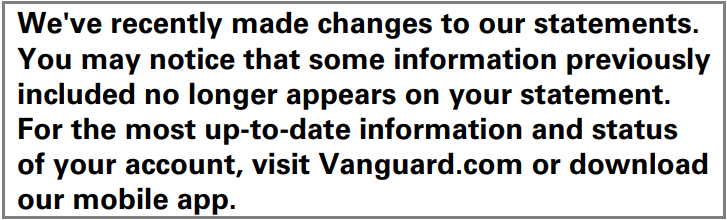

When I opened my September account statement, I was greeted by the following message:

Great! (Sarcasm)

Despite the legalese-like warning, Vanguard did not describe precisely what information was removed, so the hunt began. Here’s what I noticed when I put my August and September statements side-by-side.

First, Vanguard dropped some of the cost basis-related information. For example, Vanguard dropped the “total cost” column for ETF holdings. For mutual fund holdings, Vanguard no longer reports the average price per share or the total cost.

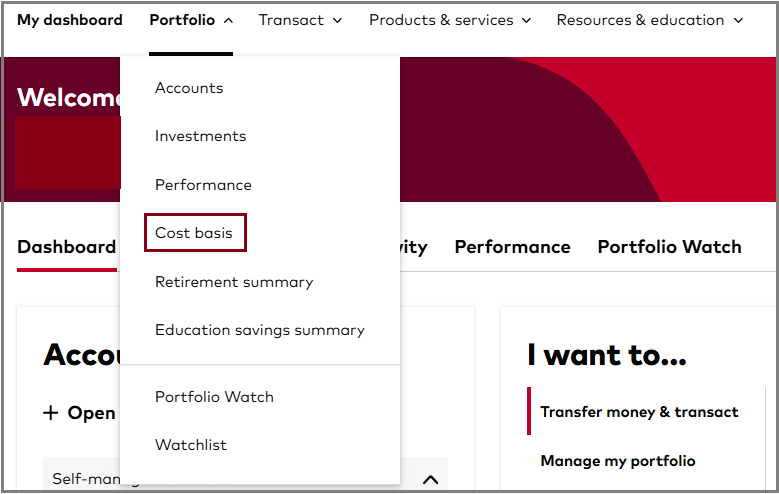

If you’re looking for cost basis information, you can find it on Vanguard’s website under the “Portfolio” tab at the top of the page. (See the screenshot below.) You can view either realized or unrealized gains (and losses) across your different accounts.

The other significant change is that Vanguard no longer reports an “estimated annual income” or “estimated yield” for each holding and the account overall. Unfortunately, I don’t believe this information is available on Vanguard’s website. So, if you found it helpful, Vanguard’s left you hanging.

If you’re trying to estimate how much income your portfolio will generate this year, I have a few suggestions:

- First, if you haven’t traded much, the income your portfolio generated last year (in 2023) is a decent starting point.

- Second, Vanguard still reports the income you have earned so far this year on your statement. So, if you haven’t traded much, you can annualize that figure. (Take the September year-to-date number and multiply by 1.33.)

- Finally, in the weeks ahead, I’ll provide Premium Members with all the details about year-end capital gains season. That information will help you determine a more accurate “income” picture.

Vanguard also updated the disclosures. Not surprisingly, they dropped the paragraphs around cost basis and the estimated income figures. Vanguard also updated the section under “Advice” to include the “point-in-time recommendation” language I discussed last week.

Why did Vanguard make these changes? I suspect the fine Vanguard paid in 2023 for having stale yield data on its statements contributed to this decision.

It also seems that “less is more” has become Vanguard's overriding communication philosophy. I’m afraid I have to disagree.

Our Portfolios

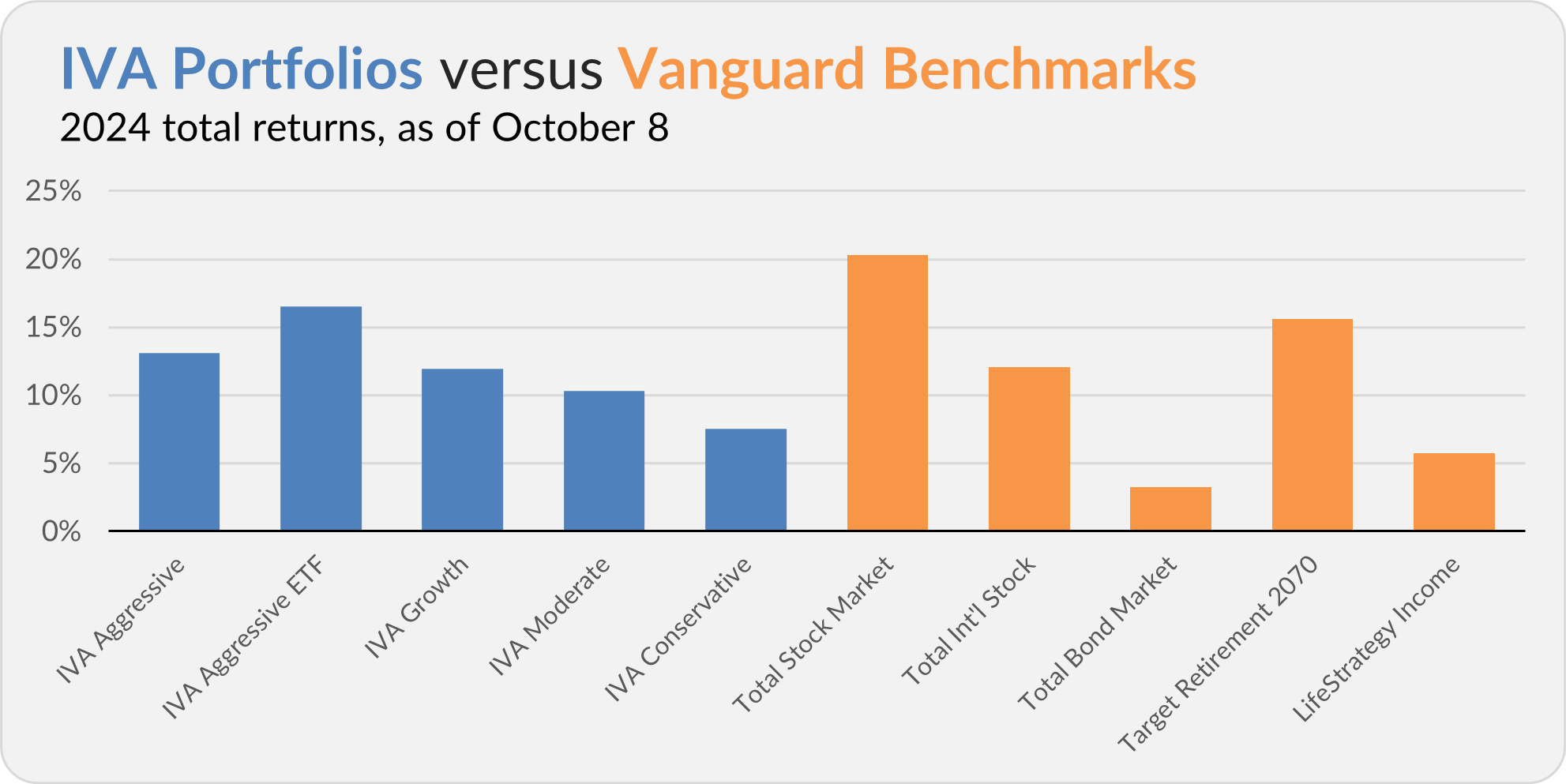

Our Portfolios are showing decent absolute but lagging returns for the year through Tuesday. The Aggressive Portfolio is up 13.1%, the Aggressive ETF Portfolio is up 16.5%, the Growth Portfolio is up 11.9%, the Moderate Portfolio is up 10.3% and the Conservative Portfolio is up 7.5%.

This compares to a 20.3% gain for Total Stock Market Index (VTSAX), a 12.1% return for Total International Stock Index (VTIAX), and a 3.2% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 15.6% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 5.8%.

IVA Research

Yesterday, in One Income Fund to Rule Them All, I analyzed Vanguard’s fund lineup in search of the firm’s best income fund.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.