Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, September 4.

There are no changes recommended for any of our Portfolios.

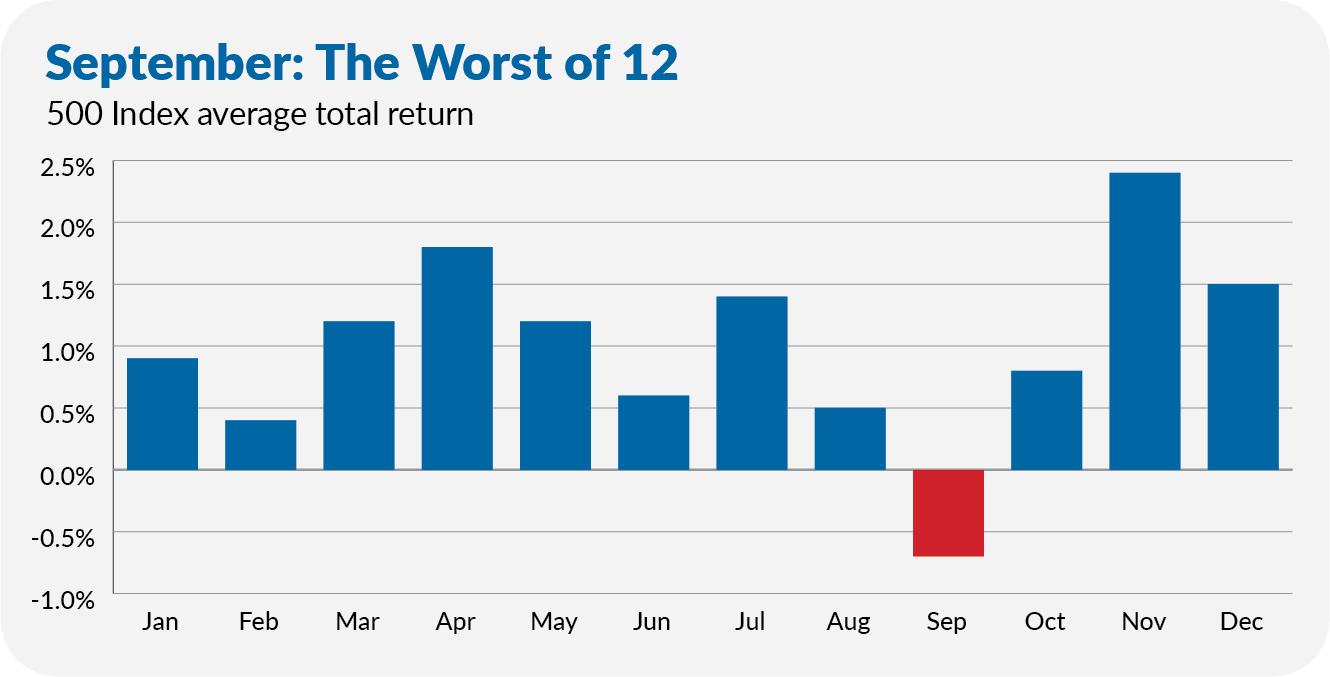

Yesterday, I showed Premium Members the evidence that September is historically the worst month for stocks. Here’s some of the data. The chart below plots 500 Index’s (VFIAX) average return in each calendar month since its 1976 inception. September is the only month when stocks have declined in value (on average).

As if on cue, on Tuesday, 500 Index fell 2.1%. That’s not a great start to an “ominous” month. And, after four months of consecutive gains that saw the flagship index fund gain 12.7%, a pause would be healthy. But, of course, one day does not make a month.

All this said, I’m not reaching for the Sell button. I’ve suggested (several times) that now may be an opportune time to rebalance your portfolio, but I’m not a short-term trader, so any trades I’d be making today would be with long-term objectives in mind. The path I’m following involves spending time in the market rather than timing the market.

Too Good to Be True

For the past two weeks—see here and here—I have investigated the implications for our portfolios of Federal Reserve policymakers lowering interest rates. The Wall Street Journal’s Jason Zweig had an additional take on what falling interest rates will bring—hucksters promising high yields with no risk.

You can read the entire piece here. But the punchline is that you need to be wary of the current crop of snake oil salesmen selling guaranteed, no-risk yields. When unquestionably safe Treasury bonds yield 4%, and the risky (but familiar) junk bonds in High-Yield Corporate (VWEHX) yield 6%, be highly skeptical of anyone promising you fully guaranteed double-digit returns. As Zweig says, “If it sounds too good to be true, it definitely is.”

A Small Win for Small Investors…

Today, Vanguard lowered the minimum investment requirement for its Digital Advisor program from $3,000 to $100.

A hundred bucks is very low, particularly considering that one share of Total Stock Market ETF (VTI) costs around $270. In the past, you could only trade Vanguard ETFs in whole shares. So, if you only had $100 to invest, well, you couldn’t buy Total Stock Market ETF—full stop.

Even if you had $3,000, your ability to reach your desired asset allocation while being fully invested was hindered. For example, with your $3,000, you could purchase ten shares of Total Stock Market ETF. But you’d be left with roughly $300 in cash.

So, how can Vanguard invest $100 in a diversified portfolio of ETFs?

The firm recently added the ability to trade “fractional shares” of ETFs to its Advice programs. An investor in Vanguard’s advice program can now use $100 to purchase around 0.37 shares of Total Stock Market ETF.

Trading in fractional shares is standard operating procedure for old-school mutual funds. Most mutual fund investors simply enter orders to purchase (or sell) a fund using whole dollar amounts without a care for the number of shares involved.

Trading ETFs has always been more complicated, but that’s starting to change. In addition to the lowered hurdle at Digital Advisor, fractional share trading has allowed Vanguard to beta-test automatic, recurring ETF investments. In other words, Vanguard is working to make ETFs function (or at least trade) more like mutual funds.

The lower minimum and ability to purchase fractional shares are wins for small investors using Vanguard's Digital Advice program, as they can be more fully invested in a diversified portfolio. Granted, Vanguard could’ve achieved this outcome by waiving the minimums on its index mutual funds … but a win is a win.

.. But There’s Still Work to Do

That doesn’t mean everything is right with Vanguard’s tech.

A year ago, Vanguard announced it would start charging customers with under $5 million in “qualifying” assets who wanted to receive printed statements $25 per brokerage account. The easiest way to avoid that “annual service” fee is to accept e-delivery of statements, confirmations, reports, prospectuses, proxy materials, etc. (That’s what I do.)

I’ve heard from several readers that Vanguard recently collected this fee—no surprise there. I was surprised to hear from one IVA reader who was hit with this $25 despite switching to e-delivery last year!

This apparently was not a complete one-off, either. The IVA reader was told that a glitch had caused a number of accounts to be charged the fee in error. As of Tuesday, the subscriber was still waiting for the money to be returned to their account.

Vanguard has a lot of work to do to fulfill CEO Salim Ramji’s promise to have the “most modern technology infrastructure in the industry.” In the meantime, you may want to double-check that you weren’t erroneously charged that $25 annual service fee.

Our Portfolios

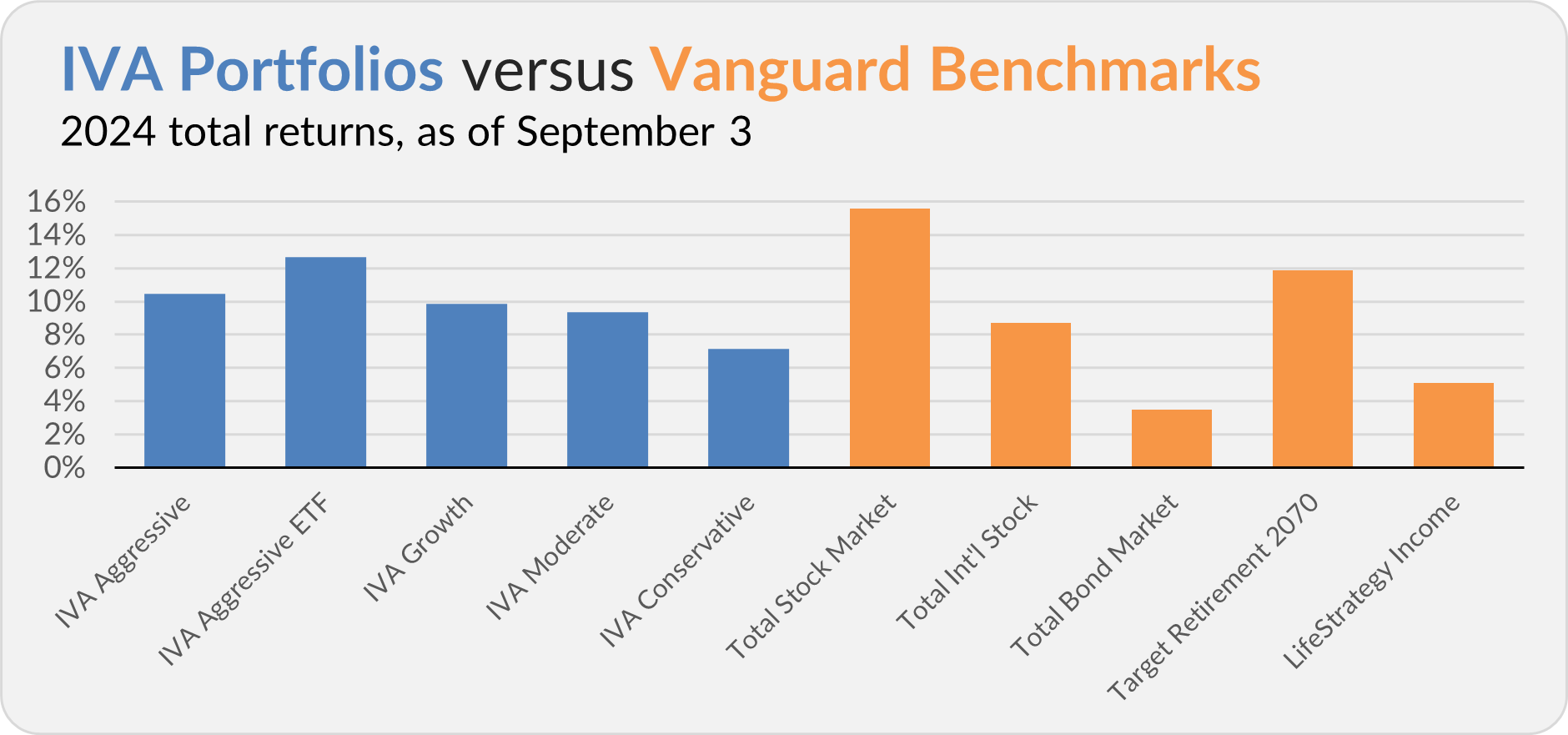

Our Portfolios are showing decent absolute but lagging relative returns for the year through Tuesday. The Aggressive Portfolio is up 10.5%, the Aggressive ETF Portfolio is up 12.7%, the Growth Portfolio is up 9.9%, the Moderate Portfolio is up 9.4% and the Conservative Portfolio is up 7.2%.

This compares to a 15.6% gain for Total Stock Market Index (VTSAX), an 8.7% return for Total International Stock Index (VTIAX), and a 3.5% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 11.9% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 5.1%.

IVA Research

Last week, I put the Wall Street adage “Don’t fight the Fed” to the test from the standpoint of a bond investor. Yesterday, I took the perspective of a stock investor.

Next week, Premium Members can look forward to my exclusive interview with Baillie Gifford’s Thomas Coutts—portfolio manager of International Growth (VWIGX). Stay tuned.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.