Hello, and welcome to the IVA Weekly Brief for Wednesday, March 19.

There are no changes recommended for any of our Portfolios.

Soft vs. Hard Data

The shift in sentiment is palpable.

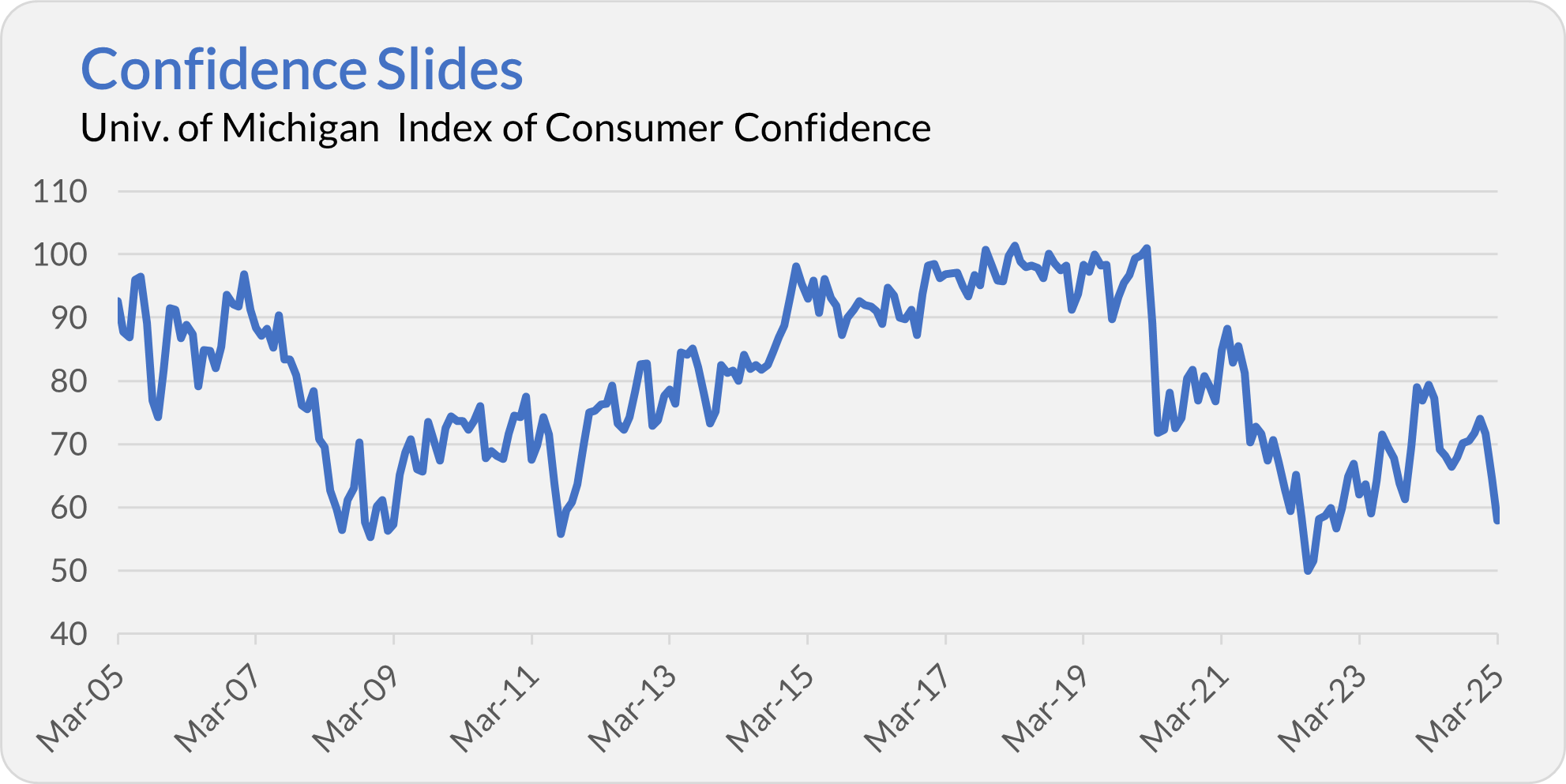

According to the University of Michigan, consumers are much less confident than they were two months ago. They are now about as concerned as they were during the depths of the great financial crisis (2008–2009). Higher inflation and holding onto their jobs are big worries.

Of course, how someone answers a survey doesn’t necessarily reflect their actions. As a former colleague liked to say about this kind of “soft data”, “Watch what people do, not what they say.”

The trouble is that, for the moment, we don’t know what people are doing—the “hard data” isn’t in yet. The survey responses suggest that the economic data will be weak in the months ahead. I’ll be on the lookout to see if people’s actions match their words.

A Buying Opportunity?

Investors are worried, too.

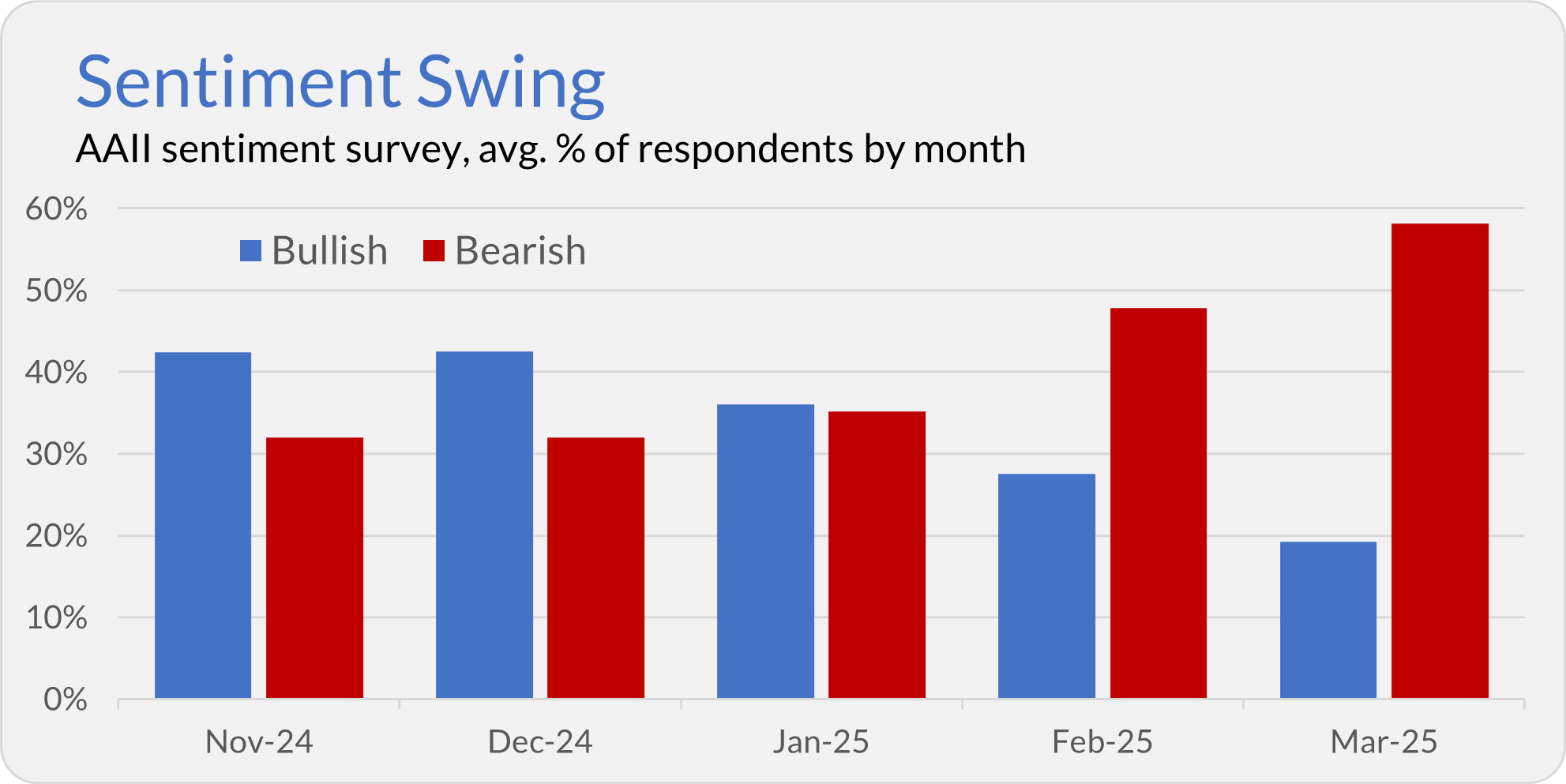

Every week, the American Association of Individual Investors (AAII) asks its thousands of members whether they think the stock market will be higher or lower six months from now (here). In November and December, bullish respondents outnumbered bearish respondents. In January, they were evenly split. In February, there were more bearish investors than bullish investors. And, so far, in March, bears are outnumbering bulls three-to-one.

Despite rising bearish sentiment in February, Vanguard investors bucked the tide; they were net buyers of the firm’s U.S. stock, foreign stock, taxable bond and municipal bond funds.

Investor sentiment is often a contrary indicator—meaning you want to buy when everyone is bearish and sell when everyone is bullish. The March numbers—58% bearish respondents and only 19% bullish on average—are extreme.

Did investors do what they said? The fund flow data won’t be available until the first week of April. As I said, there’s a time and data lag between what investors say and what they do.

So, with 500 Index (VFIAX) 8.5% below its February 19 high and sentiment in the dumps, is today a buying opportunity? If you’re a long-term investor, the answer is yes. Of course, that doesn’t mean stock prices won’t fall further from here.

As I told Premium Members last week, market corrections are a normal part of spending time in the market. While some past market corrections have been buying opportunities, others were a precursor to further losses. I’ve yet to meet anyone who could tell you ahead of time which corrections would lead to bear markets and which would peter out.

Here are two additional bits of context to consider:

First, while the market is in a correction from its February 19 high, most people aren’t comparing their portfolios to that date. If you step back and look year-to-date, Total Stock Market Index (VTSAX) is down less than 5%. (4.7%, to be specific.) That’s not so bad.

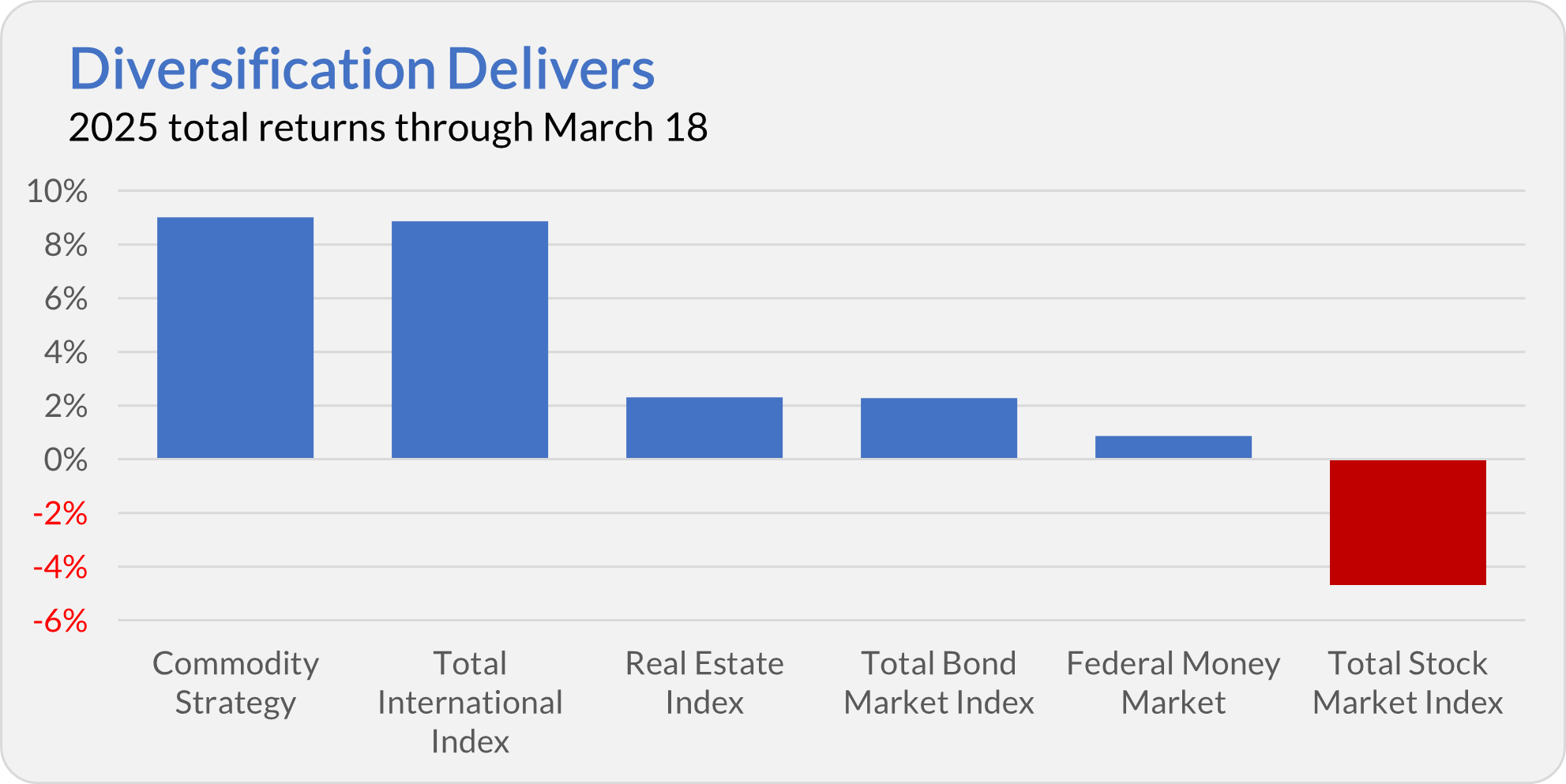

Additionally, if we broaden the scope to look beyond U.S. stocks, diversification is working this year. The chart below shows that foreign stocks, bonds, cash, commodities and real estate are all up on the year.

So, if you own a diversified portfolio, your account balance is likely holding up better than the headlines suggest.

Our Portfolios

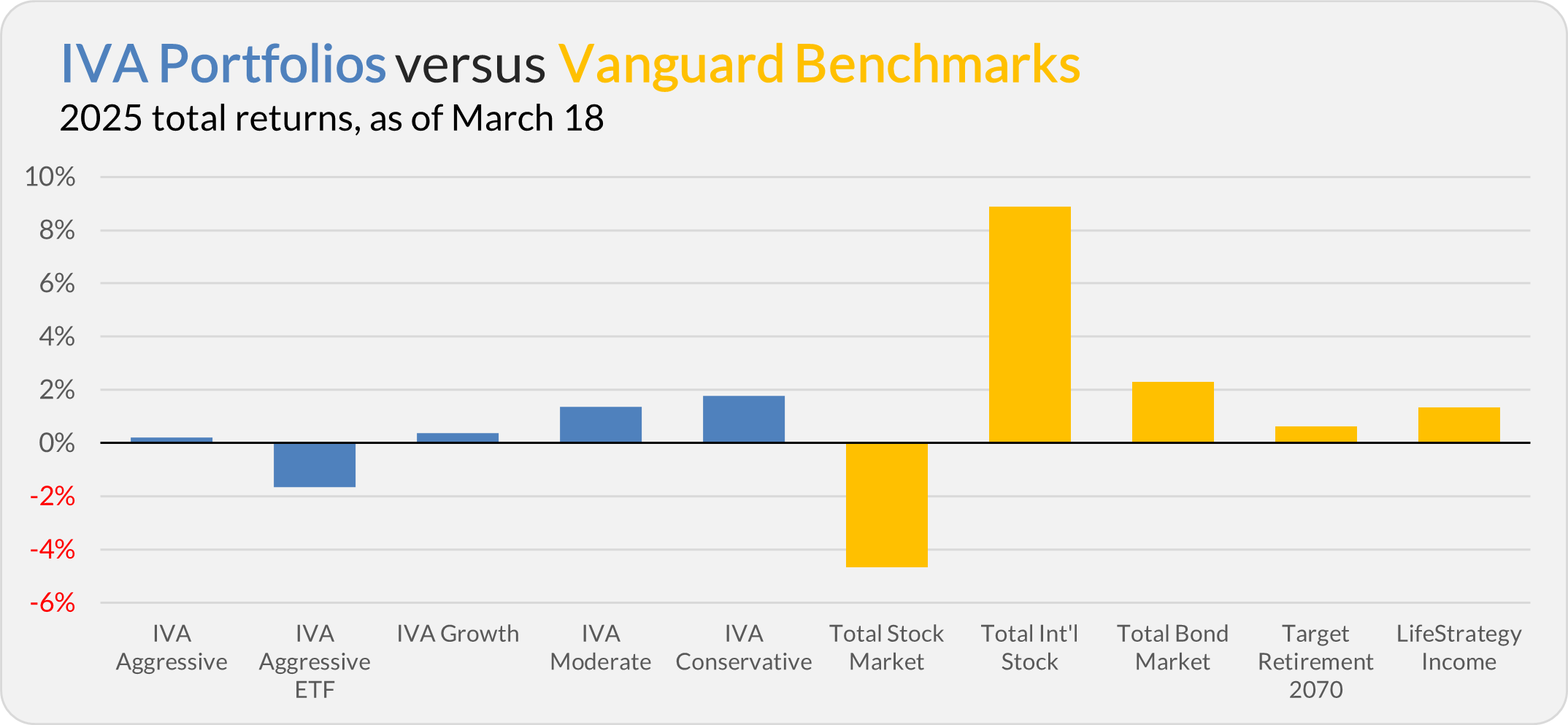

Speaking of which, four of our Portfolios are positive for the year through Tuesday. The Aggressive Portfolio is up 0.1%, the Growth Portfolio is up 0.4%, the Moderate Portfolio is up 1.4% and the Conservative Portfolio is up 1.8%. Only the Aggressive ETF Portfolio is in the red, down 1.6%.

This compares to a 4.7% decline for Total Stock Market Index (VTSAX), an 8.9% gain for Total International Stock Index (VTIAX), and a 2.3% return for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 0.6% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 1.3%.

IVA Research

Premium members have heard from me three times since last week’s Weekly Brief.

On Friday, I tried to put the current market correction into perspective.

On Monday, I discussed Vanguard firing Baillie Gifford from International Explorer’s (VINEX) portfolio.

And finally, yesterday, I shared my personal long-term investment portfolio with Premium Members.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.