Hello, and welcome to the IVA Weekly Brief for Wednesday, December 11.

There are no changes recommended for any of our Portfolios.

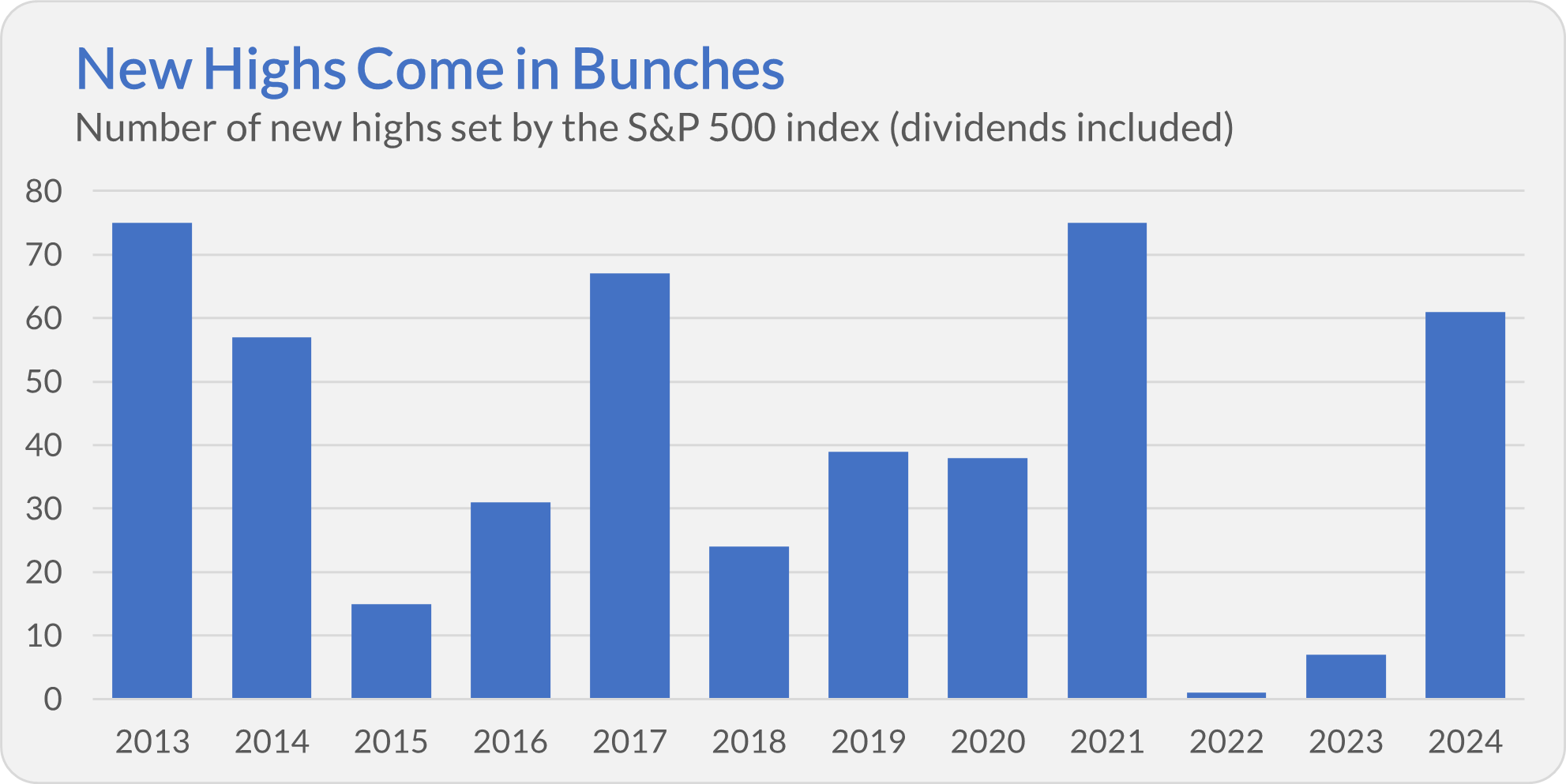

It’s been a record year in the market. The S&P 500 index has notched 57 new highs this year. That’s more than one record every week! If you count dividends (and you should), the index has set 61 record highs.

That sounds like a lot of milestones, right?

It’s actually normal during bull markets. The chart below tracks the number of new highs set by the index (including dividends) each calendar year over the past dozen years. It shows that when the index makes a new high, it often sets more records—they come in bunches.

A key takeaway is that just because the index set a bunch of new highs this year, that doesn’t mean it can’t go on to reach new heights next year.

Inflation Check-In

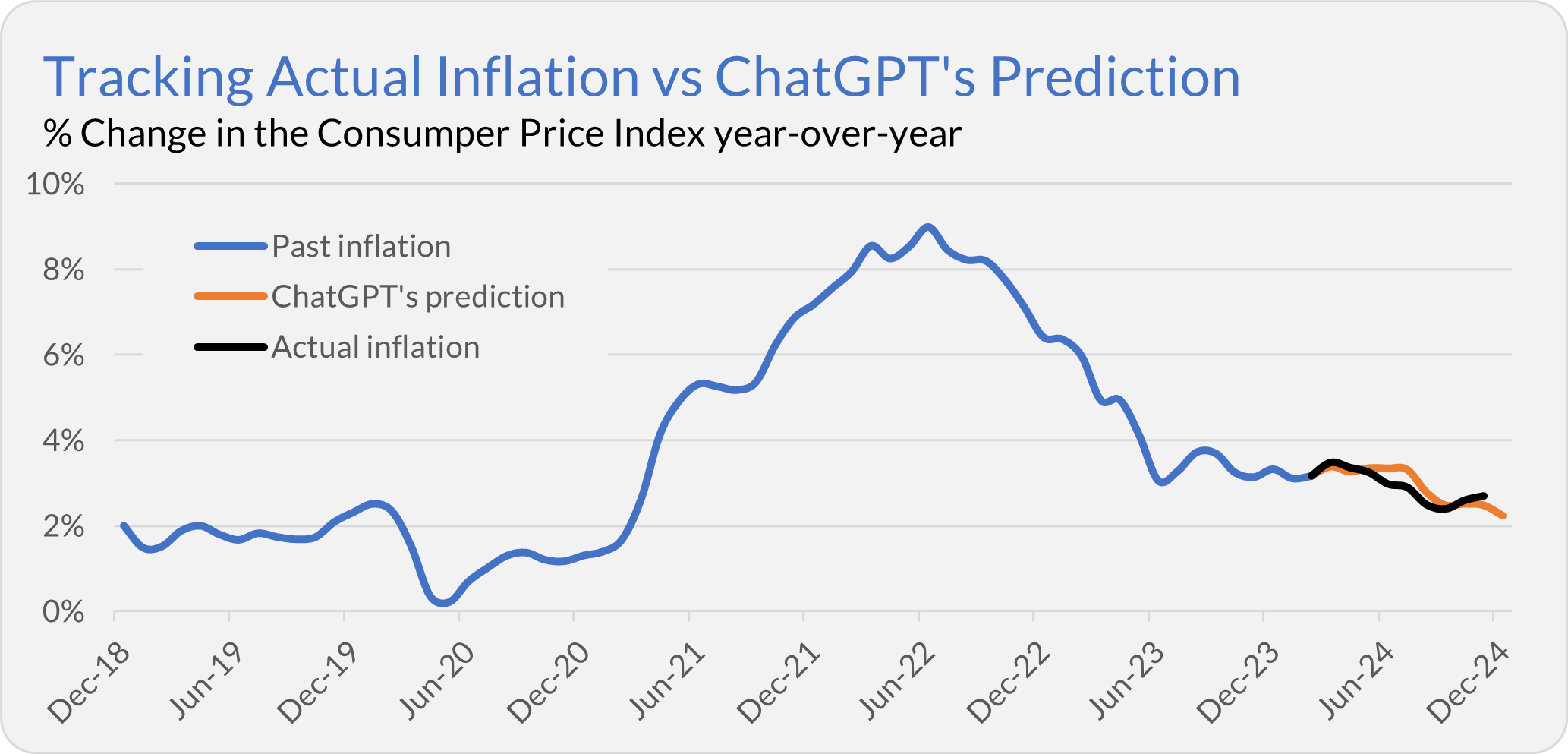

In my first test of artificial intelligence’s ability to see into the future this past April, I asked OpenAI's ChatGPT to predict inflation for the rest of the year. Today, the Bureau of Labor Statistics (BLS) reported that the Consumer Price Index (CPI) increased 0.3% in October and is up 2.7% over the past 12 months.

ChatGPT’s 2.5% forecast isn’t far off the mark. However, inflation has been marginally higher than the computer predicted in the past two months.

As I've said all along, I was never looking to trade on ChatGPT’s inflation prediction. My goal was to have a little fun.

What does the latest inflation report mean for our investments?

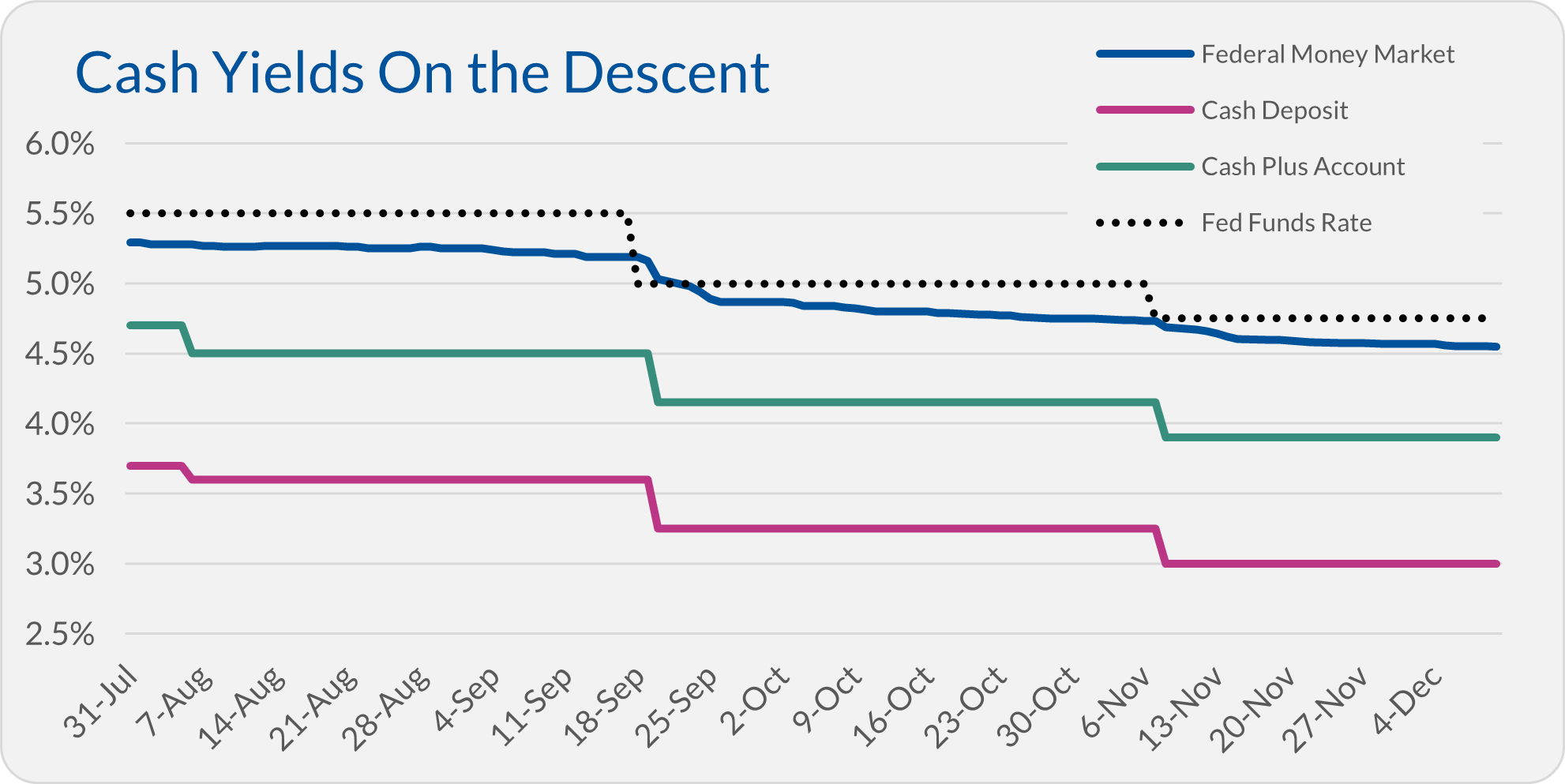

Even though inflation is still running above policymakers’ 2% target, it seems certain that Fed Chair Jerome Powell and his colleagues will lower the fed funds target range to 4.25%–4.50% when they meet next week.

If that’s the case, we can expect the yields on Vanguard’s money market funds and other cash products to drop. I anticipate Federal Money Market’s (VMFXX) yield will fall from 4.55% (today) toward 4.25%—though it will take a month or so to get there.

The yields on Vanguard’s cash solutions—Cash Plus Account and Cash Deposit—should react immediately. My best guess is that Cash Plus Account’s yield will drop from 3.90% to 3.65% and Cash Deposit’s yield will fall from 3.00% to 2.75%.

Those are just guesses. I’ll let you know if I was right or wrong, so stay tuned.

While the connection between Fed actions and money market yields is strong, it’s harder to draw conclusions for the stock and bond markets. Do traders focus more on the near-term benefit of lower interest rates or the longer-term implication of inflation still exceeding the Fed’s target?

I’m not a trader—I’m an investor. So, I’m focused on spending time in the market and not letting noise (like monthly inflation reports or whether the Fed tweaks interest rates) knock me off course.

Ramji’s First Shake Up

It’s been a busy week at Vanguard HQ, with the firm announcing a high-profile departure, hiring an ex-Fidelity executive and carving out a “new” division.

Last Thursday, Vanguard announced that Karin Risi, managing director and head of Strategy, Product, Marketing, and Communications, will “retire” at the end of the year. I put “retire” in quotes because Risi is only 52 years old; I doubt this is the last we’ll see of her.

A 27-year Vanguard veteran, Risi is well-respected across the industry. Her most significant contribution was leading the launch of Vanguard’s Personal Advisor program in 2015. Some insiders saw her on the shortlist of CEO candidates.

On the heels of Risi’s news, Vanguard announced that ex-Fidelity executive Joanna Rotenberg will join the fold in January to lead a “new” Advice and Wealth Management division.

I see two sides to this story.

First, notably, this year, we’ve seen two high-profile Vanguard “lifers” far from typical retirement age—Risi and former CEO Tim Buckley—leave the firm. They’ve been replaced by BlackRock (current CEO Salim Ramji) and Fidelity (Rotenberg) alumni—not homegrown talent. Ramji has said all the right things since joining the firm, but we’ll see how this willingness to hire outsiders plays out.

Second, what should we make of this new Advice and Wealth Management division?

Given their size and growth, making a separate division for the Advice offerings—Digital Advisor, Personal Advisor, Select and Wealth Management—is logical. It essentially splits the do-it-yourself clients from those that want advice.

In the press release, both Ramji and Rotenberg say the goal is to “enhance” or “expand” Vanguard’s offerings.

I would be surprised if we saw much change at the lower minimum solutions—Digital Advisor and Personal Advisor. Raising fees would be hard—it's a competitive space with Betterment, Wealthfront and Schwab all running hard.

However, Vanguard might have more wiggle room at the "top" end—Wealth Management, which is for clients with at least $5 million. As I said, raising fees is hard, but Vanguard may be able to introduce "other" services or offerings (e.g., private funds) on which it can earn some fees.

In a staff email (via the Financial Times), Ramji pointed to another potential benefit of the realignment; “With a focused direct offer, we can create a better experience for our current clients and make it even easier for more investors to be served by Vanguard.”

In other words, Vanguard hopes that separating the Advice channel will lead to better technology and service for the rest of us. I hope so, too!

STAR’s Latest Shake Up

As I told Premium Members last week, Vanguard is transitioning nearly half of STAR’s (VGSTX) portfolio in the first quarter of 2025. Premium Members can read my Quick Take here.

A few IVA readers have asked about the tax impact of this transition on STAR and the underlying funds being traded. Premium Members can expect a follow-up article from me soon. Stay tuned.

Dividend Reminder

Vanguard’s funds will start paying out capital gains next week. Premium Members can find all the information they need to navigate distribution season here.

Our Portfolios

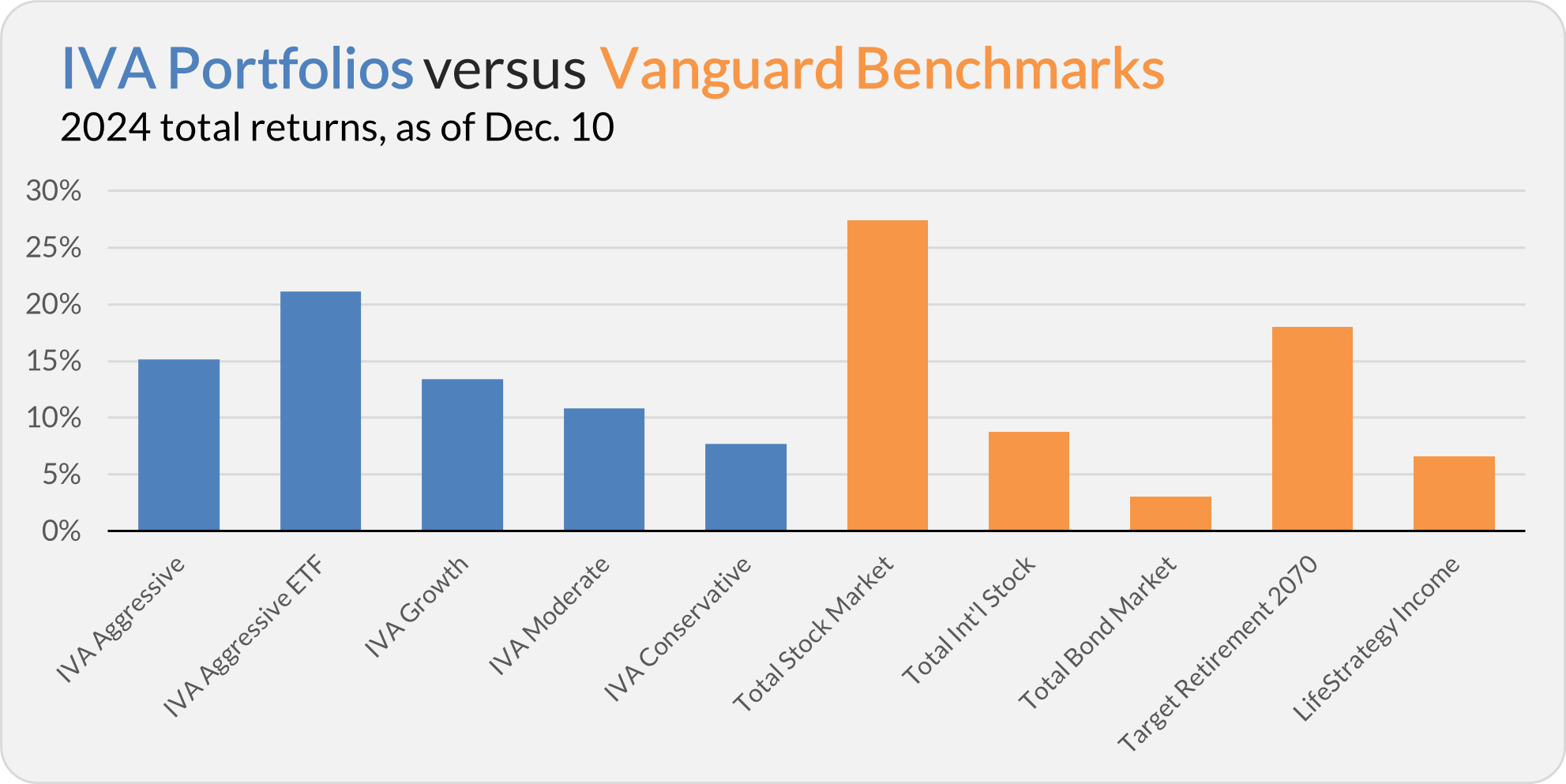

Our Portfolios are showing decent absolute returns for the year through Tuesday. The Aggressive Portfolio is up 15.1%, the Aggressive ETF Portfolio is up 21.1%, the Growth Portfolio is up 13.4%, the Moderate Portfolio is up 10.8% and the Conservative Portfolio is up 7.7%.

This compares to a 27.4% gain for Total Stock Market Index (VTSAX), an 8.7% return for Total International Stock Index (VTIAX), and a 3.0% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 18.0% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 6.6%.

IVA Research

Vanguard is holding a proxy vote to elect trustees who oversee the funds on our behalf. Yesterday, in Boardroom Stakes, I told Premium Members how much each nominee had invested in the Vanguard funds they’ll be watching over.

I believe it’s important for trustees to invest alongside the shareholders they represent. That is why I report on the topic every year and post all the details here.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.