Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, September 11.

There are no changes recommended for any of our Portfolios.

It’s been 23 years since the September 11 terrorist attacks. As somber an anniversary as this is, there is a lesson here for investors.

Say you bought 500 Index (VFIAX) on Monday, September 10, 2001—the day before the attack. You may not remember, but the stock market didn’t open on September 11, nor did it open for the rest of the week. Your decision to buy looked particularly poorly-timed. But, if you held on (and reinvested your income and capital gains distributions), you’d have seen your money compound at a 9.2% annual pace (as of Tuesday’s close). That’s a total return of 666%.

This is as clear an example of the wisdom of spending time in the market as you’ll find. An investor in the flagship index fund compounded at a nearly double-digit rate despite buying right before disaster struck and investing through the Global Financial Crisis (2008-2009) and a global pandemic—three monstrously uncertain and worrisome periods in modern U.S. history.

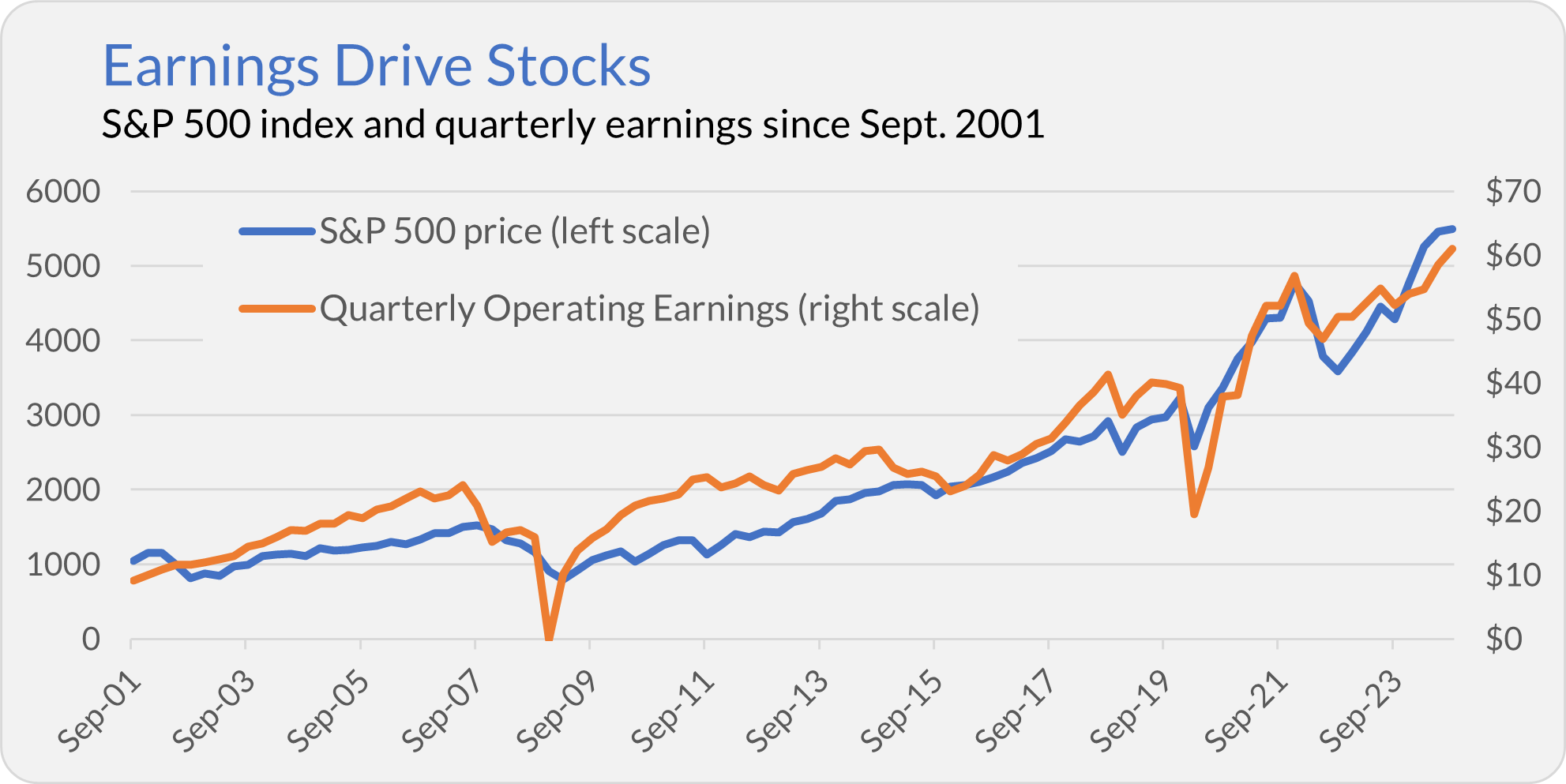

How is this possible? The short answer is that earnings drive stock prices, and for all of the “bad things” that have happened over the last quarter of a century, the economy has expanded, and companies are earning more than ever.

Pessimists can be persuasive and will occasionally be proven right, but optimists triumph in the market over time.

Oh, and if you were curious, Vanguard’s best-performing fund over this stretch (since September 10, 2001) has been Capital Opportunity (VHCOX), with a 1,005% gain (or 11.0% per year).

Inflation Check In

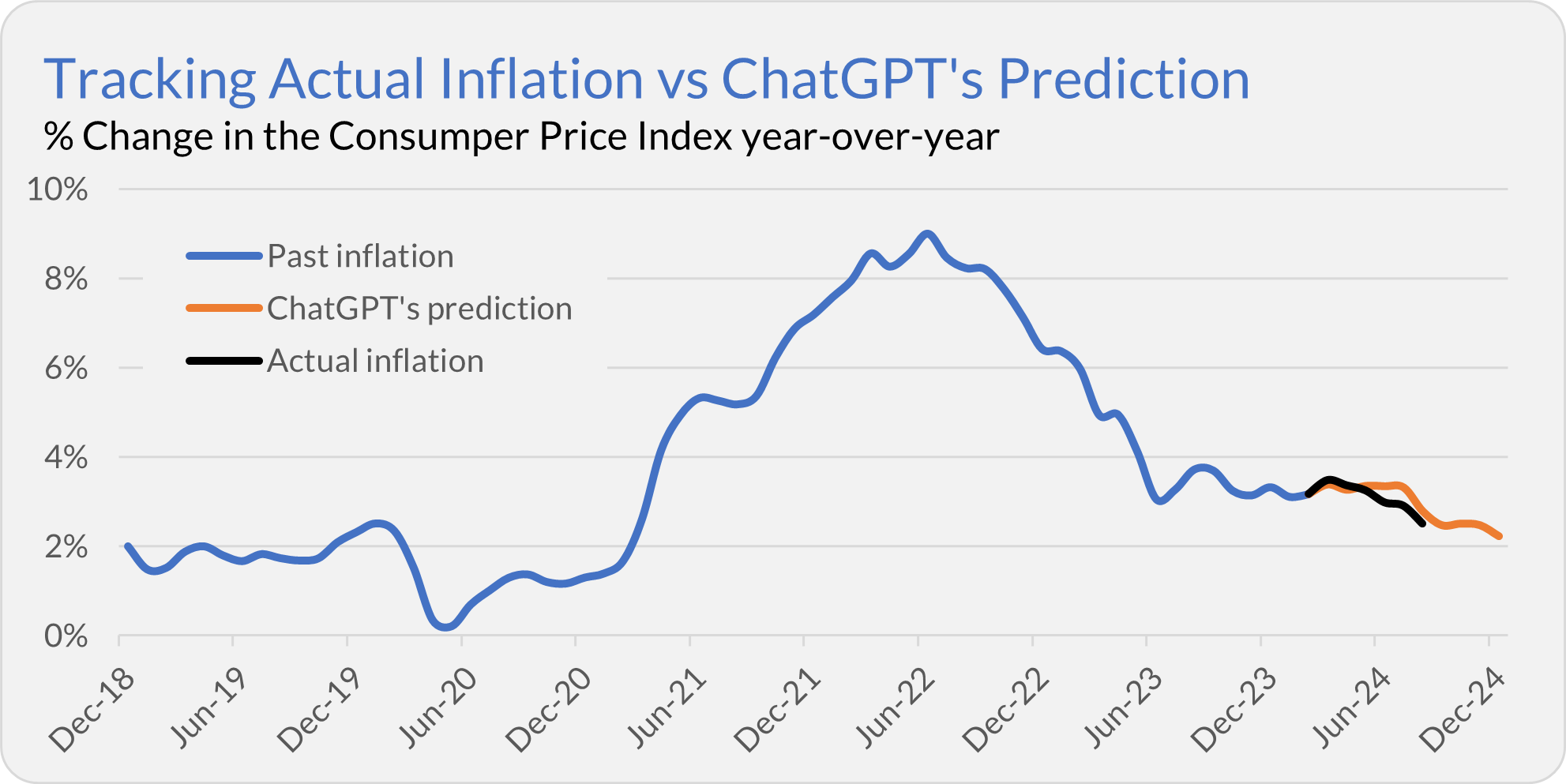

In April, I asked OpenAI's ChatGPT to predict inflation for the rest of the year. Today, the Bureau of Labor Statistics (BLS) reported that the Consumer Price Index (CPI) was up 0.2% in August and is up 2.5% over the past 12 months.

That’s a little lower than ChatGPT’s expectation of 2.8%.

The computer’s forecast has been pretty darn good, but, as I’ve said, I’m not looking to trade on ChatGPT’s inflation prediction—I’m having a little fun here.

It’s all but certain that Federal Reserve (Fed) policymakers will cut the fed funds rate in September. The only question on traders’ minds is whether the Fed will cut the fed funds rate by 0.25% or 0.50%. For what it's worth, traders are putting the odds of a 0.25% move at around 85%, according to the CME’s FedWatch Tool (which calculates the probability of changes in the fed funds rate based on futures prices).

The immediate impact of policymakers targeting a lower fed funds rate is that investors will earn less income on their money market (and other cash) holdings. Beyond that, it’s hard to say with certainty how markets will react.

Over the past few weeks, traders have been a little, well, inconsistent on whether a Fed interest rate cut is good for stocks (or not). To a degree, that makes sense. All things equal, lower interest rates should boost stock prices. However, lower interest rates also tend to go hand in hand with economic weakness, which is a headwind for company earnings and stock prices.

I recently examined the data unemotionally to see how stocks and bonds reacted when the Fed lowered interest rates—see here and here. The punchline is that you shouldn’t overhaul your portfolio based entirely on the central bank’s next action.

Speaking of predicting interest rates and policy, it was only a bit more than a month ago that Vanguard’s chief economist for the Americas and global head of portfolio construction, Roger Aliaga-Díaz, told Barron’s that there’d be no Fed interest rate cuts until December, and possibly none at all in 2024.

I don’t intend to bash Aliaga-Díaz or Vanguard, but why are they in the prediction business at all? Under Jack Bogle, Vanguard’s message was similar to what I wrote above: invest for the long haul and ignore the noise. Well, instead, Vanguard simply added to the noise, and they were wrong to boot. (Assuming, of course, that the Fed follows through and does cut interest rates this month.)

Our Portfolios

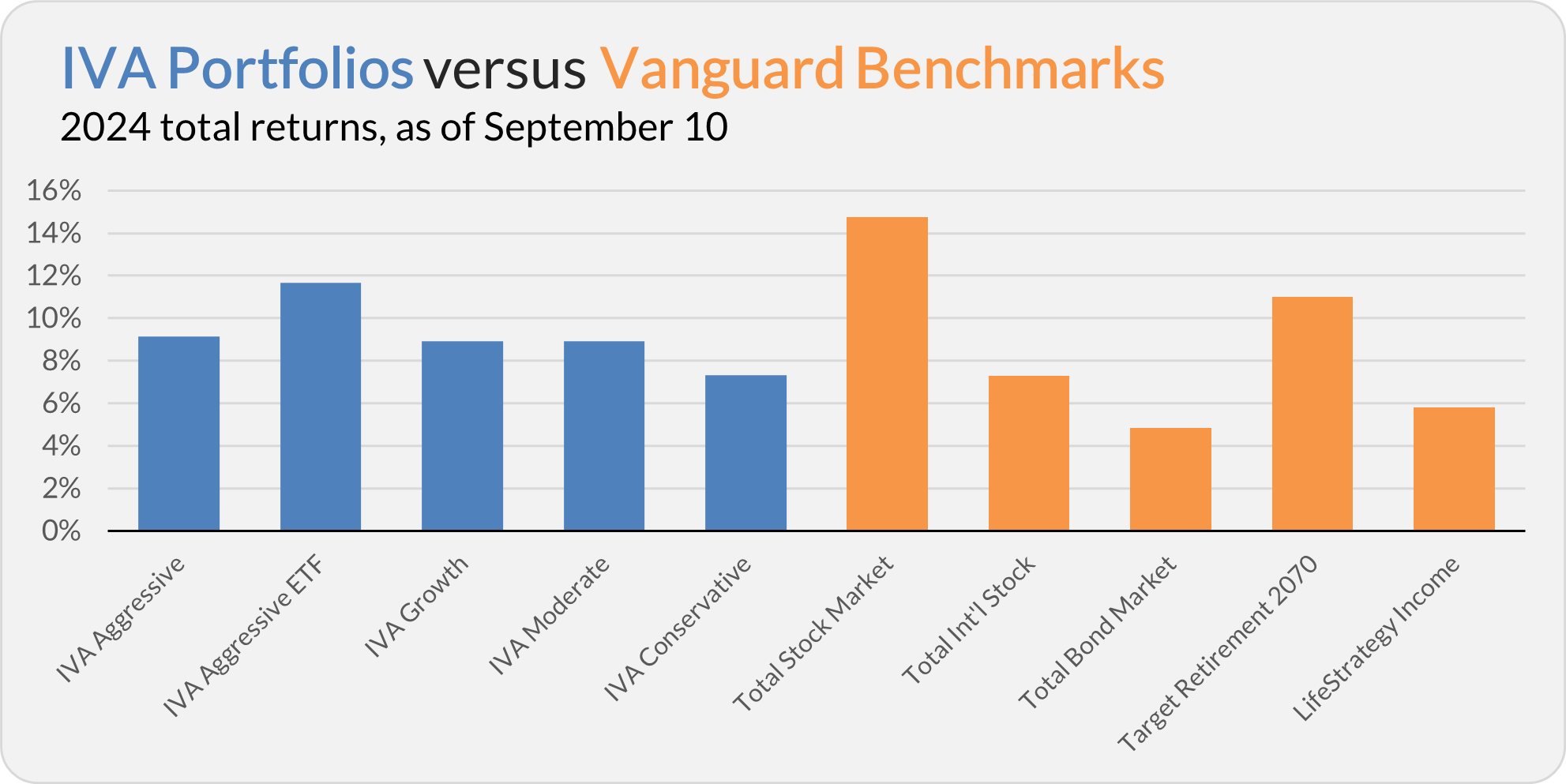

Our Portfolios are showing decent absolute returns but are lagging behind the U.S. stock market for the year through Tuesday. The Aggressive Portfolio is up 9.2%, the Aggressive ETF Portfolio is up 11.7%, the Growth and Moderate Portfolios are up 8.9%, and the Conservative Portfolio is up 7.3%.

This compares to a 14.7% gain for Total Stock Market Index (VTSAX), a 7.3% return for Total International Stock Index (VTIAX), and a 4.8% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 11.0% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 5.8%.

IVA Research

Yesterday, Premium Members received my exclusive interview with Baillie Gifford’s Thomas Coutts—portfolio manager of International Growth (VWIGX).

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.