Hello, and welcome to the IVA Weekly Brief for Wednesday, October 23.

There are no changes recommended for any of our Portfolios.

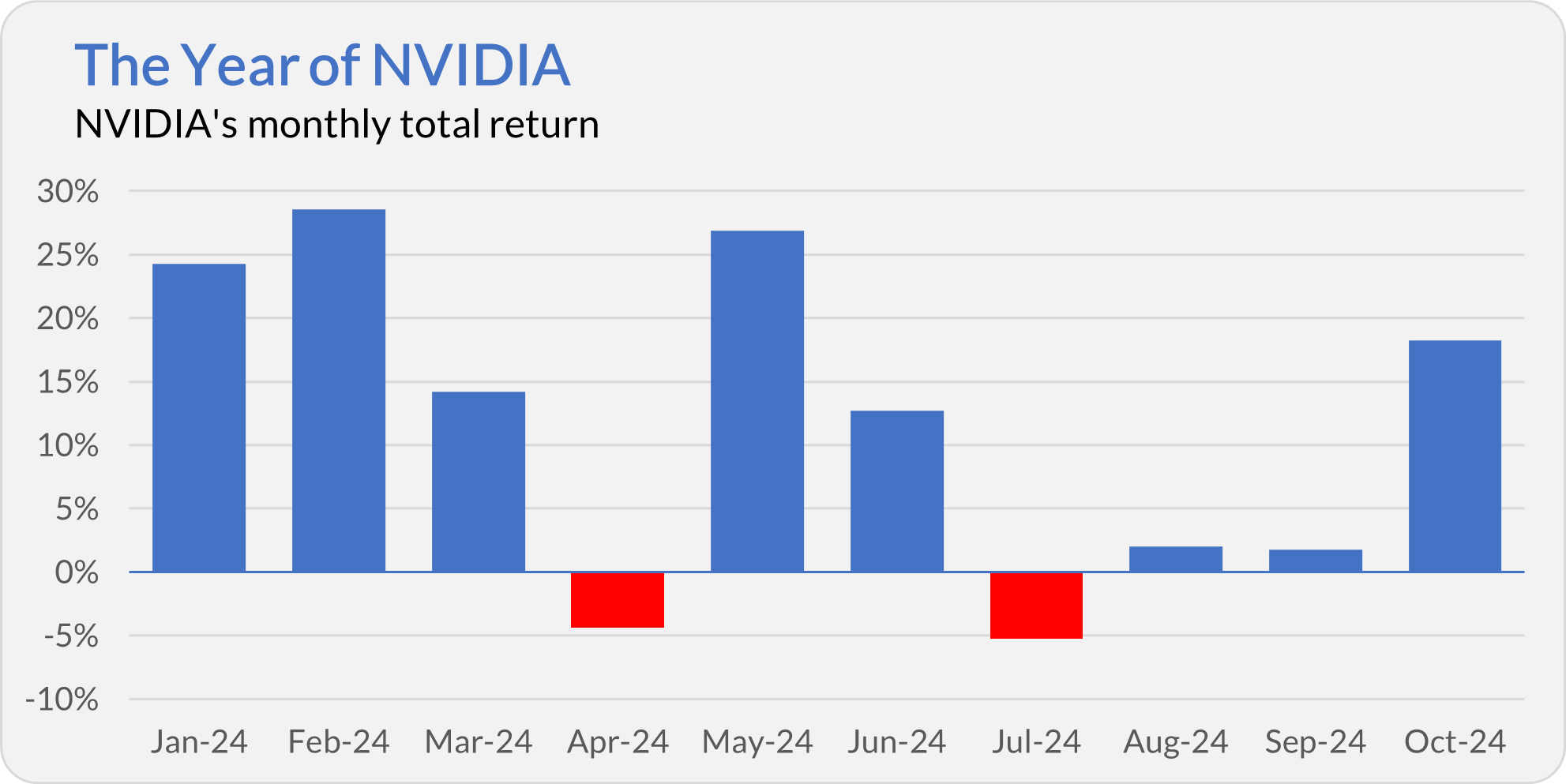

A few months ago, Steve Sosnick, Interactive Brokers’ chief strategist, said, “It’s NVIDIA’s market, and we’re all just trading in it.” I don’t want to be overly simplistic, but that description rings true in October.

NVIDIA is up 18% in October—its sixth month of double-digit gains this year. Its “magnificent” siblings (Apple, Microsoft, Amazon, Meta (Facebook) and Alphabet (Google)) have returned between -1% and 2% so far this month. Oh, and Tesla is down 17%.

NVIDIA’s nearly 20% gain is the main driver behind growth stocks’ October resurgence. Growth Index's (VIGAX) 2.5% return is ahead of Value Index's (VVIAX) 0.7% advance, and Information Technology ETF (VGT) is Vanguard’s second-performing fund with a 3.4% gain.

Barring a dramatic turn in the final two months, 2024 will go down as the year of NVIDIA. The other market giants I mentioned above have delivered solid returns this year, ranging from 14% to 65%. (Though again, Tesla is an outlier, down 12%.) NVIDIA’s 190% return blows them all out of the water.

The chip maker’s stock has grown taller (and faster) than most thought possible, but trees don’t grow to the sky. At some point, its run will come to an end. Diversified (and patient) investors can find opportunities beyond today’s market darling.

3% or Better?

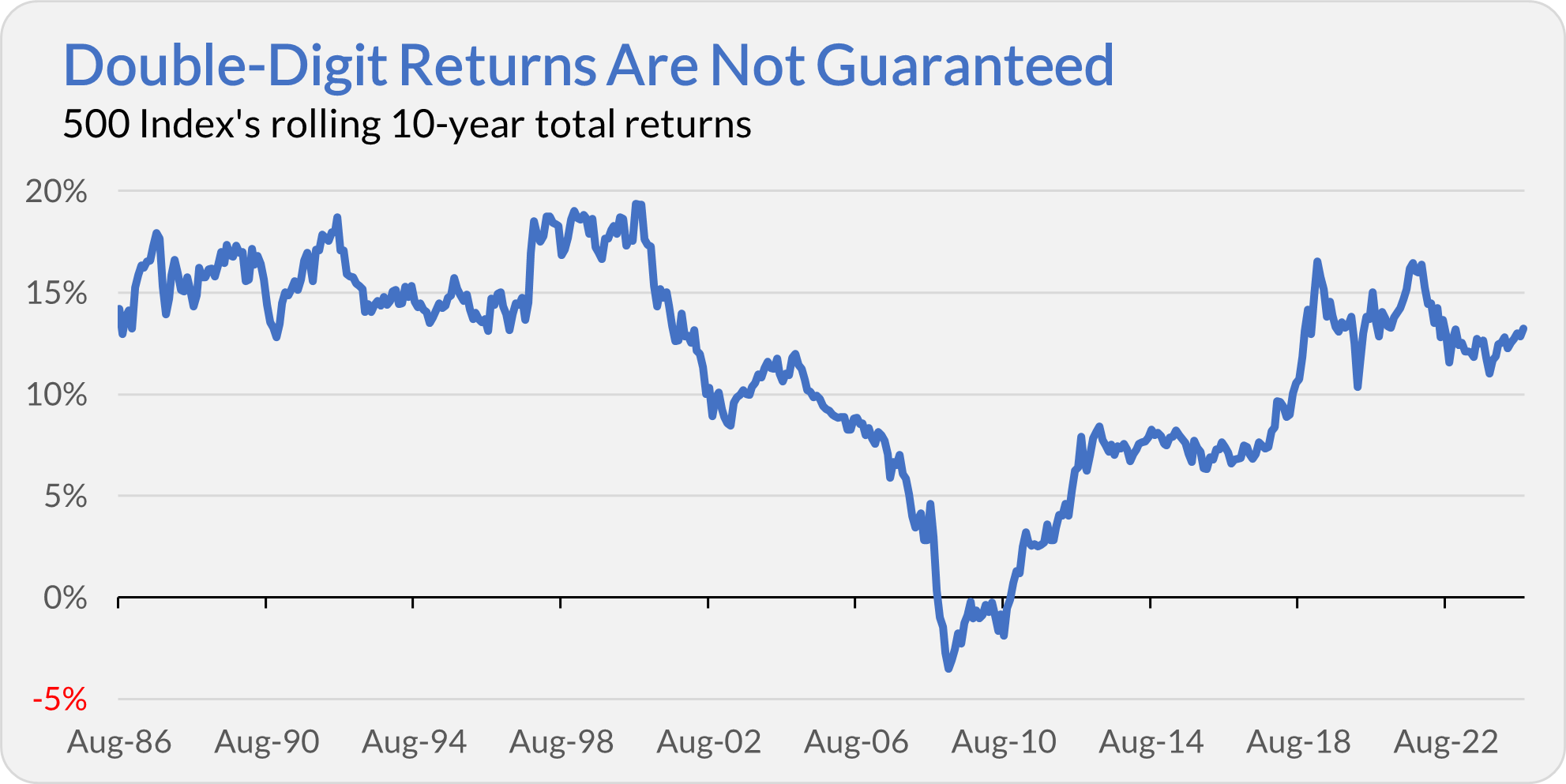

Goldman Sachs strategists are getting more than their fair share of media attention this week. Their forecast that the S&P 500 index will only return 3% per year over the next decade is turning heads, but it isn’t an outlier. Vanguard recently released its 10-year outlook, projecting U.S. stock returns between 3.2% and 5.2% per year.

But how much consideration should you give these forecasts and projections? Very little.

I don’t track Goldman Sach’s strategists too closely, but let’s look back at Vanguard’s 10-year outlook from the end of 2014. (I’ve included a copy below. See page 25.) Nearly 10 years ago, Vanguard predicted that a global stock portfolio would return 5% to 8% per year.

Well, Total World Stock Index (VTWAX) is up 9.7% per year from the end of 2014 through September 2024. In other words, Vanguard was expecting stocks to gain between 60% and 115% (or so) since the end of 2014 when, in fact, they’ve returned 146%.

Vanguard (in its 2014 outlook) went on to say that “the expected U.S. equity market return may undercut both its own historical average and the expected global ex-U.S. equity return.” In English, expect U.S. stocks to deliver below-average returns and foreign stocks to win the race.

Over the past (nearly) 10 years, Total Stock Market Index (VTSAX) has returned 12.5% per year. That’s better than average and double Total International Stock Index’s (VTIAX) 6.0% annual return. Vanguard’s forecast was wrong on both accounts!

So, before you overhaul your portfolio based on Goldman’s or Vanguard’s recent forecast, remember that strategists (including those at Vanguard) have been predicting below-average returns from U.S. stocks for at least a decade.

I’m not calling out Vanguard’s 2014 forecast in particular—I actually appreciate that Vanguard forecasts a range of returns rather than a precise number. But it serves as a reminder that all these forecasts must be taken with a grain of salt.

Yes, 500 Index (VFINX) could grow at a 3% rate over the next decade—it’s happened before. The chart below plots the flagship index fund’s 10-year total returns since its 1976 inception. Shareholders have compounded their wealth at double-digit rates more often than not, but a 3% annual return wouldn’t be unprecedented.

The bottom line is that the future is always unknowable. The logical answer is to hold a diversified portfolio that can do reasonably well in various market environments.

Our Portfolios

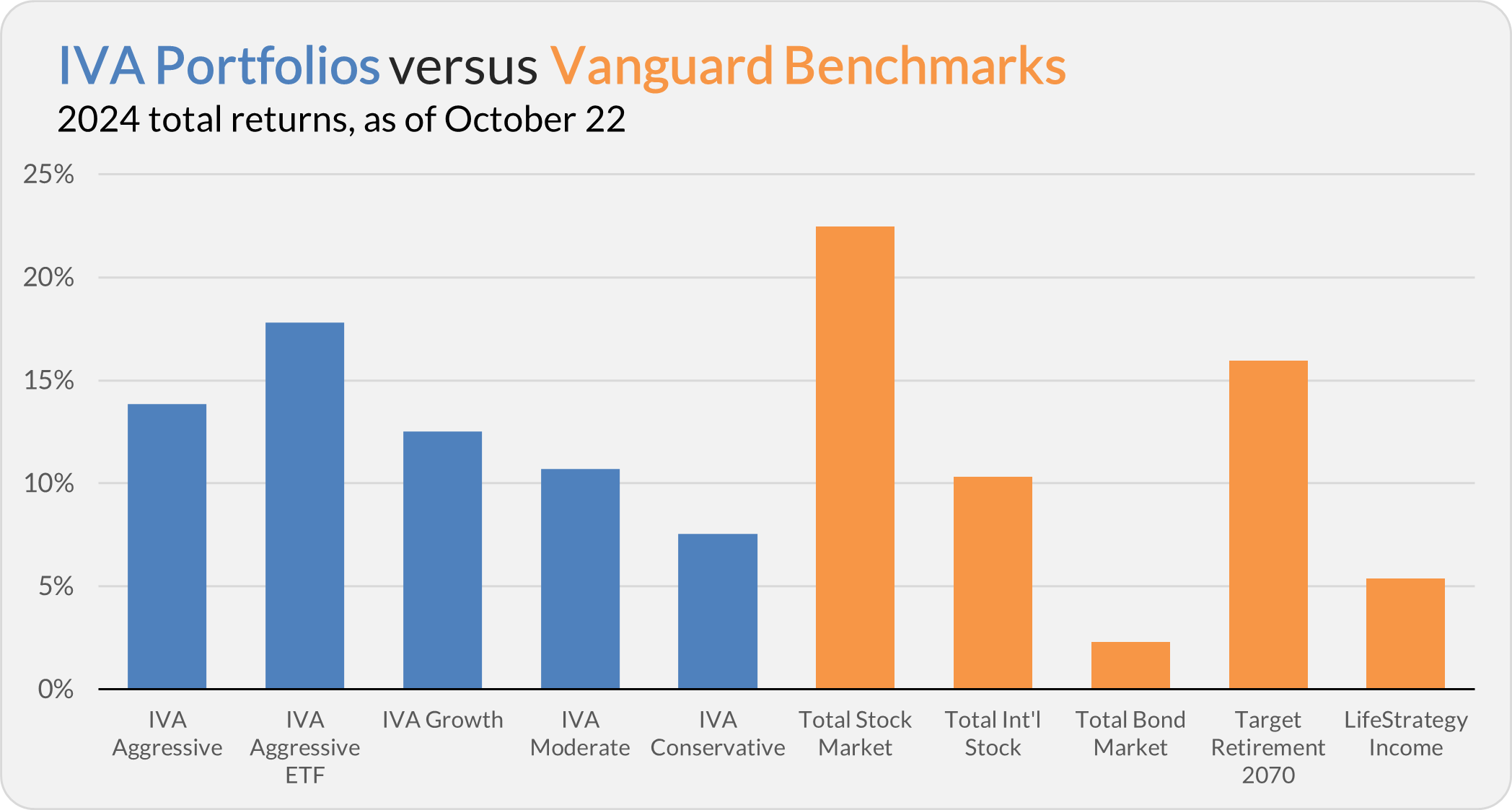

Our Portfolios are showing decent absolute but lagging relative returns for the year through Tuesday. The Aggressive Portfolio is up 13.9%, the Aggressive ETF Portfolio is up 17.8%, the Growth Portfolio is up 12.5%, the Moderate Portfolio is up 10.7% and the Conservative Portfolio is up 7.6%.

This compares to a 22.5% gain for Total Stock Market Index (VTSAX), a 10.3% return for Total International Stock Index (VTIAX), and a 2.3% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 15.9% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 5.4%.

IVA Research

Yesterday, in preparation for year-end capital gains distribution season, I shared two articles with Premium Members. In Capital Gains 101, I covered the basics of mutual fund and ETF distributions. In Capital Gains 102, I discussed two tax-reduction strategies.

Next week, I’ll give Premium Members a sneak peek at what they can expect to receive in capital gains in December—before Vanguard releases its official estimates.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.