Hello, and welcome to the IVA Weekly Brief for Wednesday, March 5.

There are no changes recommended for any of our Portfolios.

The events surrounding the Ukraine War—negotiations between Presidents Trump and Zelensky breaking down in public on Friday and the U.S. pausing all military aid in response—will have far-reaching consequences. However, when it comes to the markets, tariffs are in the spotlight.

On Tuesday, the U.S. began levying a 25% tariff on imported goods from Canada and Mexico and added another 10% to the duties charged on Chinese imports. China and Canada have announced retaliatory tariffs. Mexico is expected to hit back within days.

The trade war’s start caused stock traders to hit the sell button. Here’s what the market fallout looks like through the eyes of a Vanguard investor:

Over the past two days, 500 Index (VFIAX) has fallen 2.9% and is now 5.9% below its February 19 high. Smaller stocks have fared worse, with SmallCap Index (VSMAX) down 3.8% over the past two days. Small stocks are now in correction territory—down more than 10% from their prior high.

Over the past two days, the worst-performing sectors were Financials ETF (VFH) and Energy ETF (VDE), down 4.4% and 4.5%, respectively. Utilities ETF (VPU) and Health Care ETF (VHT) were the best-performing sectors, dropping 1.4% and 0.8%, respectively. Real Estate Index (VGSLX) fell just 0.7%.

Dividend Growth (VDIGX) has delivered on its defensive promise—its 1.2% decline this week makes it the best-performing diversified U.S. stock fund in Vanguard’s stable.

Foreign stocks have also held up well in March. Total International Stock Index (VTIAX) is up 0.2% and European Index (VEUSX) is up 1.2%.

Bonds have also served balanced investors well. Total Bond Market Index (VBTLX) is down just 0.1% over the past two days, while Intermediate-Term Treasury (VFITX) gained 0.1%.

To put a slightly longer perspective on it; though markets initially rallied on President Trump’s Nov. 5 election victory, those gains have been erased in the past two weeks. 500 Index is now up only 0.4% since election day. SmallCap Index is off 4.8% from election day, while European Index is up 5.9%.

Of course, zoom out even more and over the last 10 years 500 Index has compounded at a 12.6% annual rate. That’s double European Index’s 5.8% growth rate over the last decade.

Looking at specific periods can provide insight into how markets and funds behave in different environments. But you have to use caution. As I often say, you can change the story by changing the start and end dates.

Also, keep in mind that the tariff situation is fluid. This morning (Wednesday), Commerce Secretary Lutnick suggested a compromise with our neighbors was in the works.

Still, with volatility and uncertainty rising, what’s a Vanguard investor to do?

Rule number 1: Don’t panic. Stocks go up and down—sometimes a lot—but over time, they rise as the economy grows and earnings grow. We’ve been through corrections and bear markets before. Uncertainty and volatility are the price long-term investors pay to participate in the wealth-compounding powers of the stock market.

If your investing worries are keeping you up at night, you should consider taking some risk off the table. Keep it simple and shift some dollars from stocks into a money market fund (or other cash option). Holding cash may not have the upside of something like the gold in Commodity Strategy (VCMDX), but it’s more reliable.

But, if, like me, you’re committed to spending time in the market, diversification is crucial. So, Rule number 2: Reread rule number 1.

Malvern News

Here is a rundown of this week’s Vanguard news:

Only kidding

Nearly two years ago, in July 2023, Vanguard told the SEC it was moving five stock index funds from one trust to another. Trusts are the legal entities under which each fund operates. As I told IVA readers at the time (here), this was a nothing-burger for investors. If done correctly, we wouldn’t notice a thing. This reorganization was all about Vanguard spreading the work around.

Well, Vanguard hasn’t completed the reorganization. The fund giant has regularly filed amendments with the SEC, delaying the action. And, on Monday, Vanguard scrapped the plan entirely. The five index funds—Total Stock Market Index, 500 Index, Extended Market Index, MidCap Index and SmallCap Index—are staying put.

Here’s what Vanguard had to say about reversing course:

A hallmark of Vanguard’s value proposition is disciplined product oversight and management. Vanguard continually reviews its product lineup and seeks to ensure our funds and ETFs are performing as expected, efficiently structured, and aligning with investor-desired outcomes. As outlined in our press release back in 2023, we sought to achieve administrative efficiencies with the moves. But after further evaluation, Vanguard has decided not to move forward at this time with the previously announced movement of five equity index funds among existing trusts.

I’m unsure what the “further evaluation” turned up, but I guess those administrative efficiencies are no longer worth pursuing.

No longer linking to Quicken

I can’t wait for the day when I get to write to you about Vanguard’s improved technology and service. Today is not that day … apparently Vanguard is but halfway through its modernization efforts to improve its technology and website. (I’m not holding my breath.)

The most recent tech issue I’m hearing about from IVA readers is that Vanguard accounts no longer update automatically in Quicken (possibly the oldest and most popular account tracking and tax software program available). The broken link is reportedly related to a new security login process. The problem has existed for over a week and doesn’t have an end in sight.

Here’s what Vanguard had to say:

The Direct Connect service, which connects Vanguard data with third-party software such as Quicken, is temporarily disabled, and an exact ETA is not currently available. We understand the value this service provides to our clients, and we are working diligently to restore the functionality.

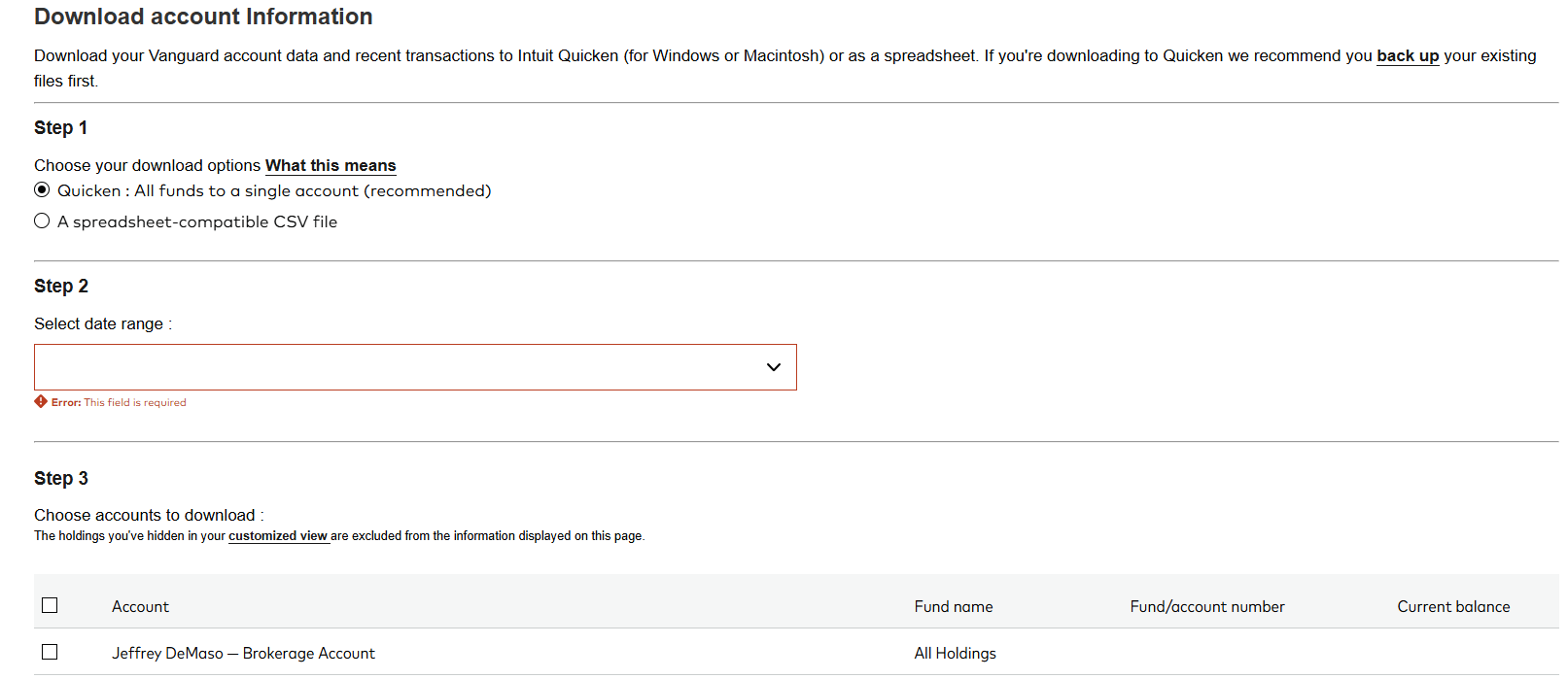

If you’re looking for a workaround, you can manually download your account information from Vanguard and upload it to Quicken. The “Download Center” is on the “Activity” tab. (See the screenshot below.)

You can then choose your timeframe, account and a Quicken-friendly export.

I hope that helps!

Meetings are back on

I told you last week that Vanguard had paused meetings with corporate management in response to an SEC notice. The new guidance from the SEC meant that Vanguard’s standard operating procedure when meeting with management might make it an “activist” investor.

I also told you the pause would be temporary. Well, meetings are reportedly back on. Only now, Vanguard will start each meeting with a reminder that they are passive investors.

Proxy program takes flight (again)

Vanguard’s third proxy voting pilot program, which I wrote about in November, has begun. (Though why it’s still in “pilot” mode after three years is beyond me.)

This year, the program will run through “late 2025” and includes eight funds: S&P 500 Growth ETF (VOOG), ESG U.S. Stock ETF (ESGV), Russell 1000 ETF (VONE), MegaCap ETF (MGC), Dividend Appreciation ETF (VIG), High-Dividend Yield Index (VHYAX or VYM), Tax-Managed Capital Appreciation (VTCLX) and Tax-Managed SmallCap (VTMSX). The last three funds in the list are new additions.

In a nutshell, the program lets you choose among five policies that determine how your votes will be cast at the annual shareholder meetings for the companies in each fund. Premium Members can read more about the program here. (You can find Vanguard’s recent announcement about the program here.)

If you own one (or more) of those eight funds, watch for an email from Vanguard about participating in the pilot program. Alternatively, this link should take you to a page where you can make your selections.

If you previously participated in the pilot program, your choice will be retained. It’ll also be automatically applied to any funds added to the program.

Our Portfolios

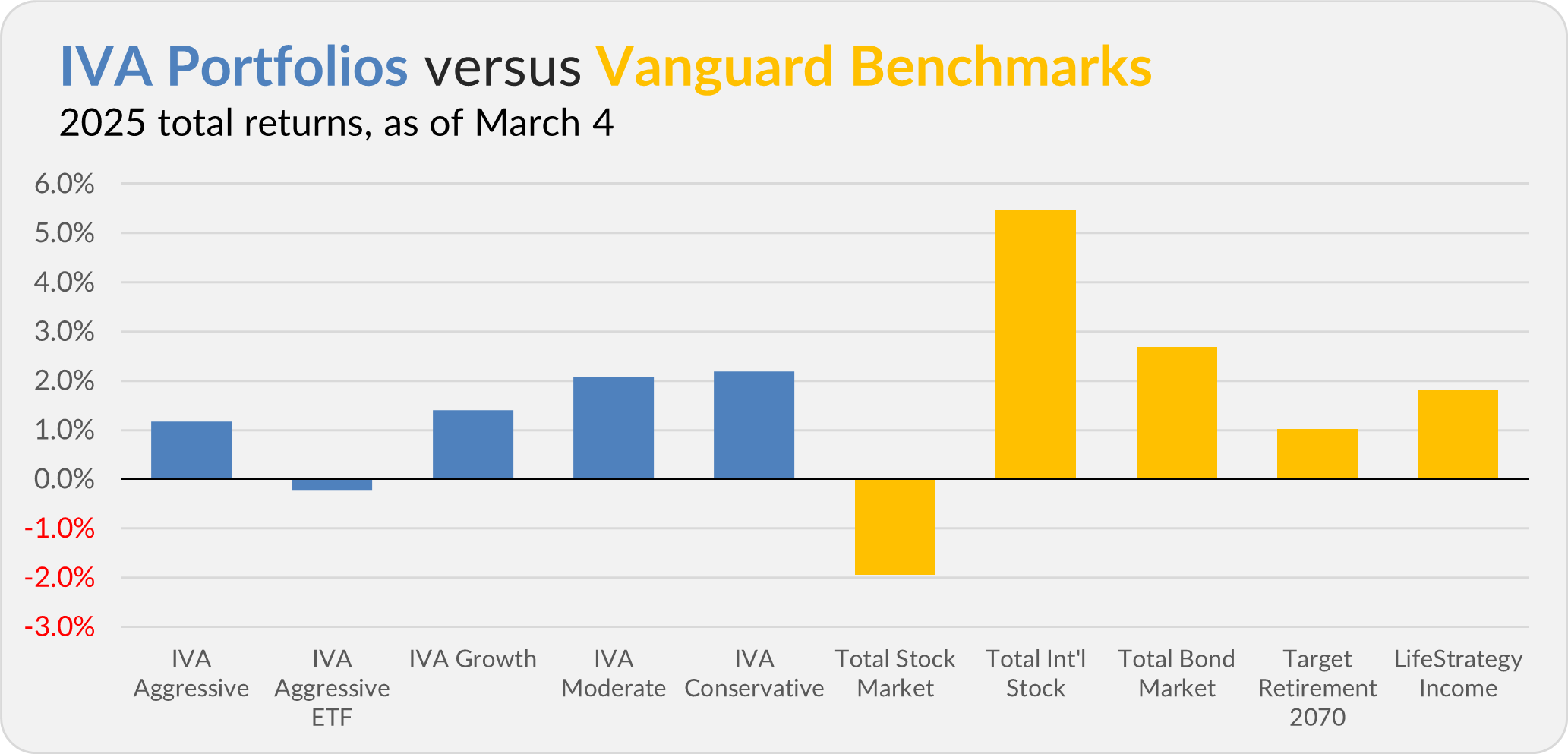

Our Portfolios are showing decent returns for the year through Tuesday. The Aggressive Portfolio is up 1.2%, the Aggressive ETF Portfolio is down 0.2%, the Growth Portfolio is up 1.4%, the Moderate Portfolio is up 2.1% and the Conservative Portfolio is up 2.2%.

This compares to a 1.9% decline for Total Stock Market Index (VTSAX), a 5.5% gain for Total International Stock Index (VTIAX), and a 2.7% return for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 1.0% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 1.8%.

IVA Research

On Monday, I shared a monthly review article with Premium Members. Yesterday, I answered February’s most common IVA reader question: Are Treasurys still safe?

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.