Hello, and welcome to the IVA Weekly Brief for Wednesday, October 30.

There are no changes recommended for any of our Portfolios.

Keep Calm

This week and next are jam-packed.

Roughly half of the companies in the S&P 500 index are reporting earnings from the third quarter. And, as I like to remind investors, it’s earnings and interest rates that really drive stock prices—everything else is just noise.

This morning, the Bureau of Economic Analysis (BEA) released its estimate that the U.S. economy (measured by Gross Domestic Product, GDP) grew 0.7% in the third quarter. (More on this in a moment.)

With the presidential election less than a week away, it’s anyone’s guess who will win. It’s essentially a coin toss according to the polls.

Adding to the noise, immediately following the election, Federal Reserve (Fed) policymakers are holding their next two-day meeting.

Given all this “action,” I wasn’t surprised to be greeted Monday morning by headlines like The 10 Days That Could Make Or Break Markets.

Please. Take a deep breath.

I understand that emotions are running high and will continue to do so beyond election day. Whether “your” candidate wins or loses, let me warn you, once again, against mixing politics and your portfolio. Stocks have had good (and bad) runs under both Republican and Democratic Presidents.

Simply put, the next 10 days are not going to make or break your portfolio.

The Plane Has Landed

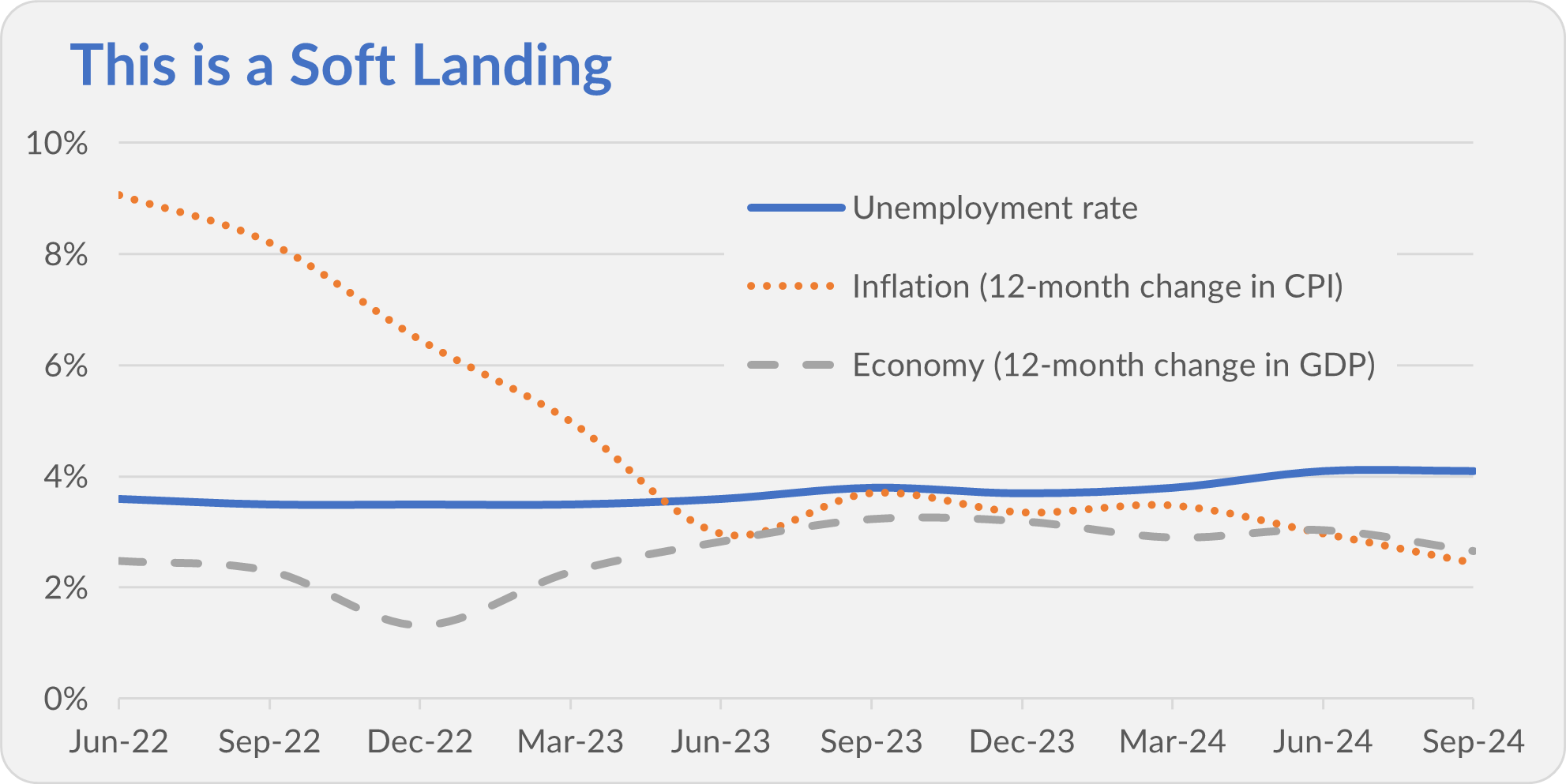

I’ve been saying for some time (see here, for example) that the U.S. economy has made a soft landing—inflation has come way down without a dramatic rise in unemployment.

Well, as I noted above, the first estimate from the Bureau of Economic Analysis is that GDP (gross domestic product) grew 0.7% (after adjusting for inflation) in the third quarter. (The 2.8% headline figure quoted in the press is an annualized number.) In dollars and cents, the economy grew by $162 billion to $23.4 trillion.

Putting it all together, over the 12 months ending September 2024, the economy grew 2.7% (after inflation), while inflation (measured by CPI) fell from 3.7% to 2.4%, and the unemployment rate rose from 3.8% to 4.1%. That’s a soft landing in my book.

The chart below shows how inflation, unemployment and the economy overall (measured by the 12-month change in GDP) have fared since inflation peaked in the middle of 2022. This is about as good as it gets.

Still, Fed policymakers aren’t sitting on their hands. Their hope is that they can provide a long, long runway for the soft landing so the economy just keeps on rolling. As it stands, traders expect policymakers to cut the fed funds target range from 4.75%–5.50% by 0.25% to 4.50%–4.75% when they meet next week.

What does this all mean for investors?

As long as the economy and earnings are growing, stocks can continue to rise in price. For example, despite all the political noise, 500 Index (VFIAX) and SmallCap Index (VSMAX) are up 1.4% and 0.7%, respectively, in October.

The Fed cutting the fed funds rate only has one reliable outcome—yields on money market funds (and other cash options) will fall. Since the end of September, Federal Money Market’s (VMFXX) yield has fallen from 4.87% to 4.75%.

But not all bond yields have followed suit. For example, Total Bond Market Index’s (VBTLX) yield has risen from 3.99% at the end of September to 4.23%. Given that bond prices fall as yields rise, the broad bond index fund has declined 2.3% in October.

To add a little perspective to Federal Money Market’s 4.75 %yield. Yes, it’s quite a bit lower than the nearly 5.30% yield we were earning several months ago. But it is still beating inflation by 2% or so. It’s also better than Cash Plus Account’s 4.15% yield—which Vanguard has been touting recently via an email promotional campaign.

Our Leverage, Not Their Leverage

Speaking of Vanguard promoting its “products,” my mentor received not one but two emails this week encouraging him to use margin in his brokerage account. Vanguard blocks trading in leveraged ETFs but is happy for you to leverage your brokerage account. That doesn’t quite add up.

I totally understand that a margin loan can be useful in very specific situations (like covering a short-term expense that will be repaid quickly), but Jack Bogle (Vanguard’s founder) must be rolling in his grave over these marketing emails.

The End of Legacy Mutual Fund Accounts

As I told Premium Members last week, Vanguard is finally pulling the plug on its legacy mutual fund account platform.

Vanguard has been pushing customers to transition from the old mutual fund account setup to its brokerage platform for years, but the game is coming to an end. Like it or not, the platform is being discontinued at the end of 2025.

One thing you can do with a brokerage account that you couldn’t do with the legacy accounts is, as noted above, go on “margin,” leveraging your holdings to raise some cash. I would recommend you not take on this kind of risk.

If you still have a legacy mutual fund account, expect to hear from Vanguard next year about being transitioned automatically to the brokerage platform. Premium Members can read more about the transition and why Vanguard is doing it here.

Our Portfolios

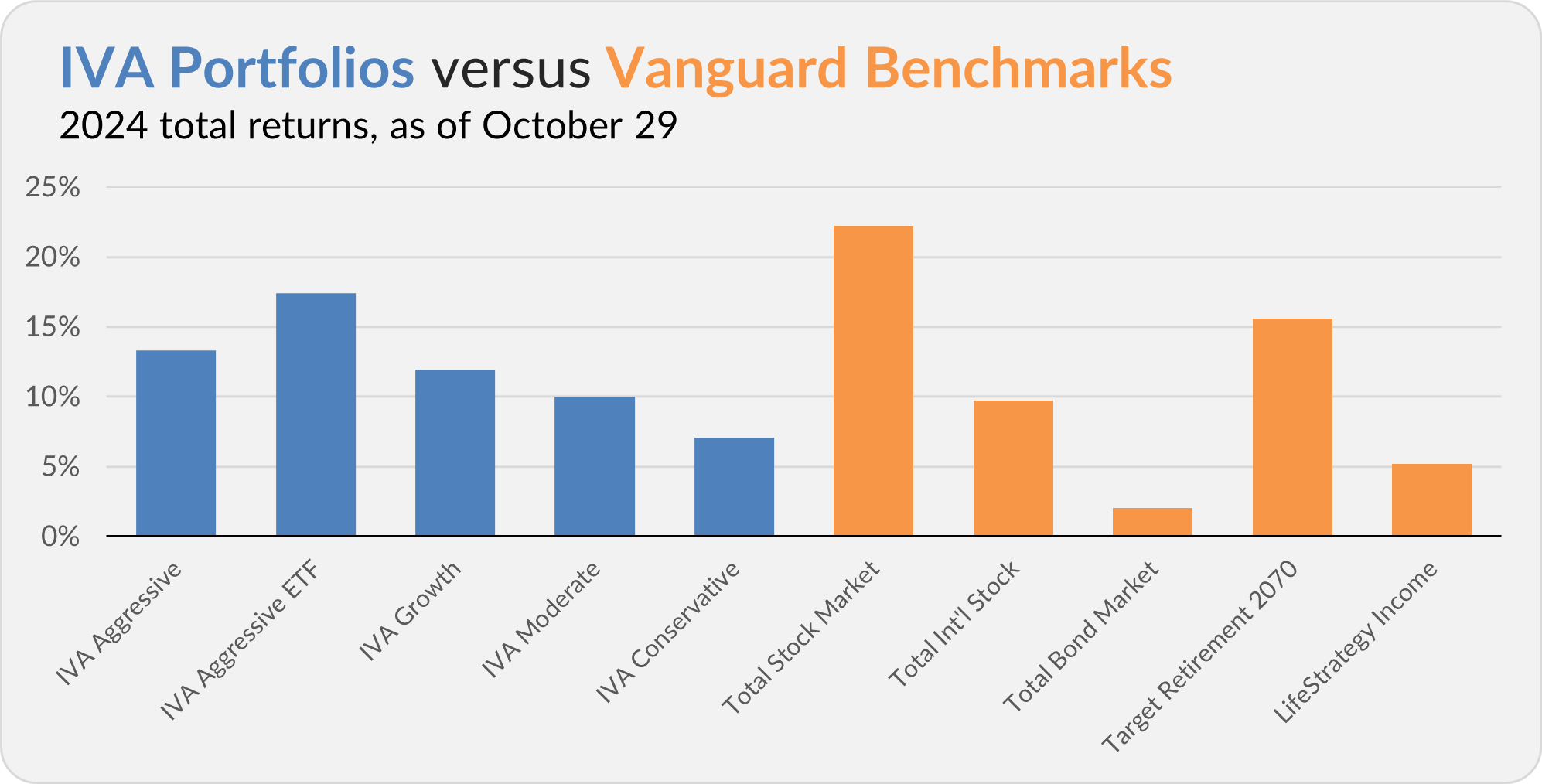

Our Portfolios are showing decent absolute but lagging relative returns for the year through Tuesday. The Aggressive Portfolio is up 13.3%, the Aggressive ETF Portfolio is up 17.4%, the Growth Portfolio is up 12.0%, the Moderate Portfolio is up 10.0% and the Conservative Portfolio is up 7.1%.

This compares to a 22.2% gain for Total Stock Market Index (VTSAX), a 9.7% return for Total International Stock Index (VTIAX), and a 2.1% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 15.6% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 5.2%.

IVA Research

Yesterday, in Capital Gains Sneak Peek: 2024, I provided Premium Members with an early look at what they can expect to receive in capital gains in December. And, if you need a refresher on capital gains, see my recently published Capital Gains 101 and 102 articles.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.