Hello, and welcome to the IVA Weekly Brief for Wednesday, December 4.

There are no changes recommended for any of our Portfolios.

It’s only been two and a half trading days since my last Weekly Brief, and whether stocks and bonds have been up or down since then is irrelevant. So, let’s not get caught up in market minutia. Instead, let me offer a slightly broader perspective as we enter the final month of a tumultuous but ultimately profitable year.

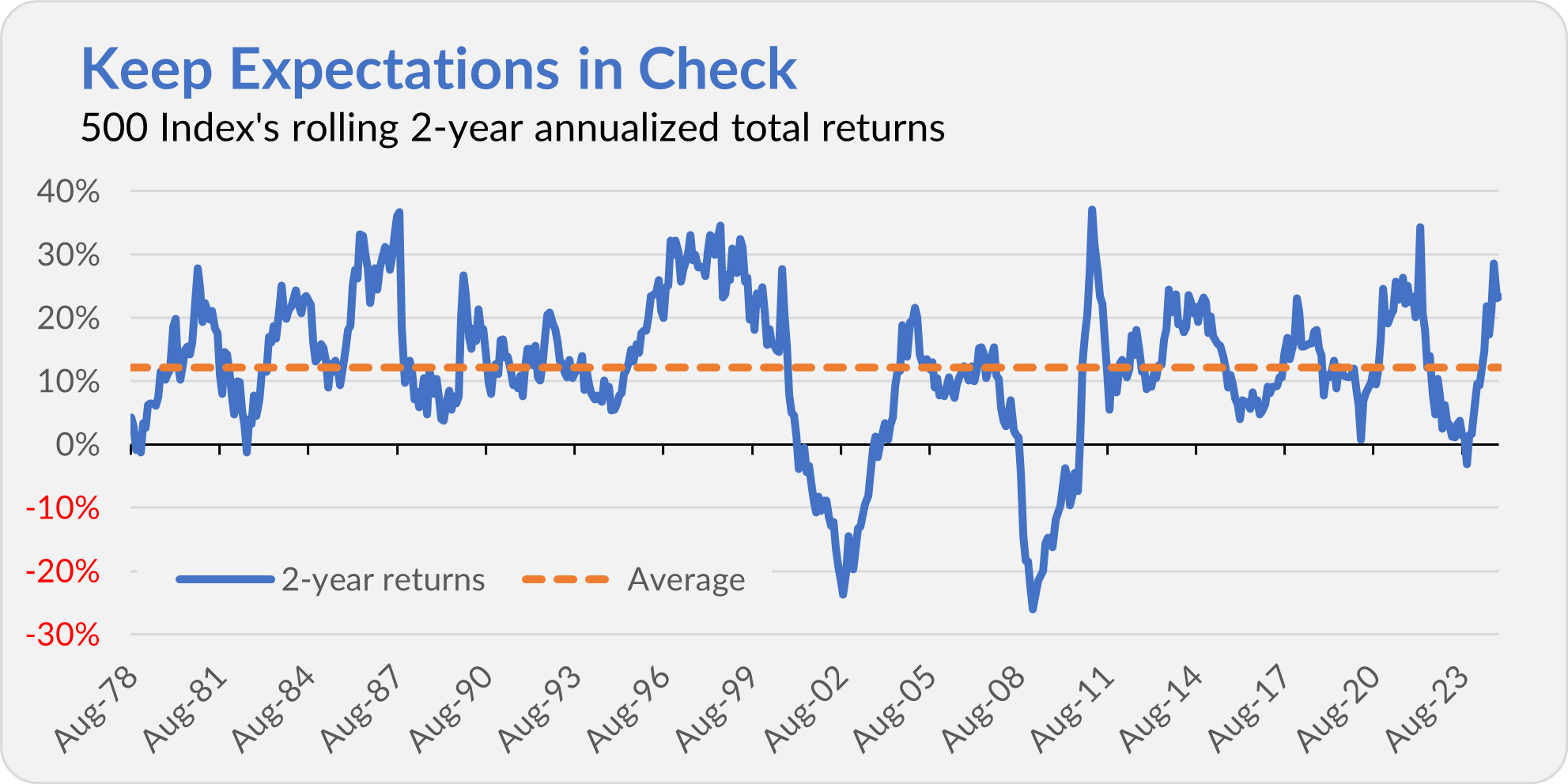

First, U.S. stocks have had a very solid run over the past two years or so—since September 2022. How good has it been?

The chart below plots 500 Index’s (VFINX) rolling two-year annualized returns since its 1976 inception. The flagship index fund has risen at a 23.4% pace over the last two years (through the end of November)—putting the period in the top 15% of all two-year runs for the fund.

And 500 Index’s two-year return (28.6%) at the end of September was even more extreme—nearly in the top 5% of all intervals. As good as that is, we’ve seen better, such as the period right after the 2008 financial crisis.

But, that said, it’s unlikely that 500 Index will continue to grow at a 20% (let alone a 30%) annual pace between now and November 2026. Keep your expectations in check.

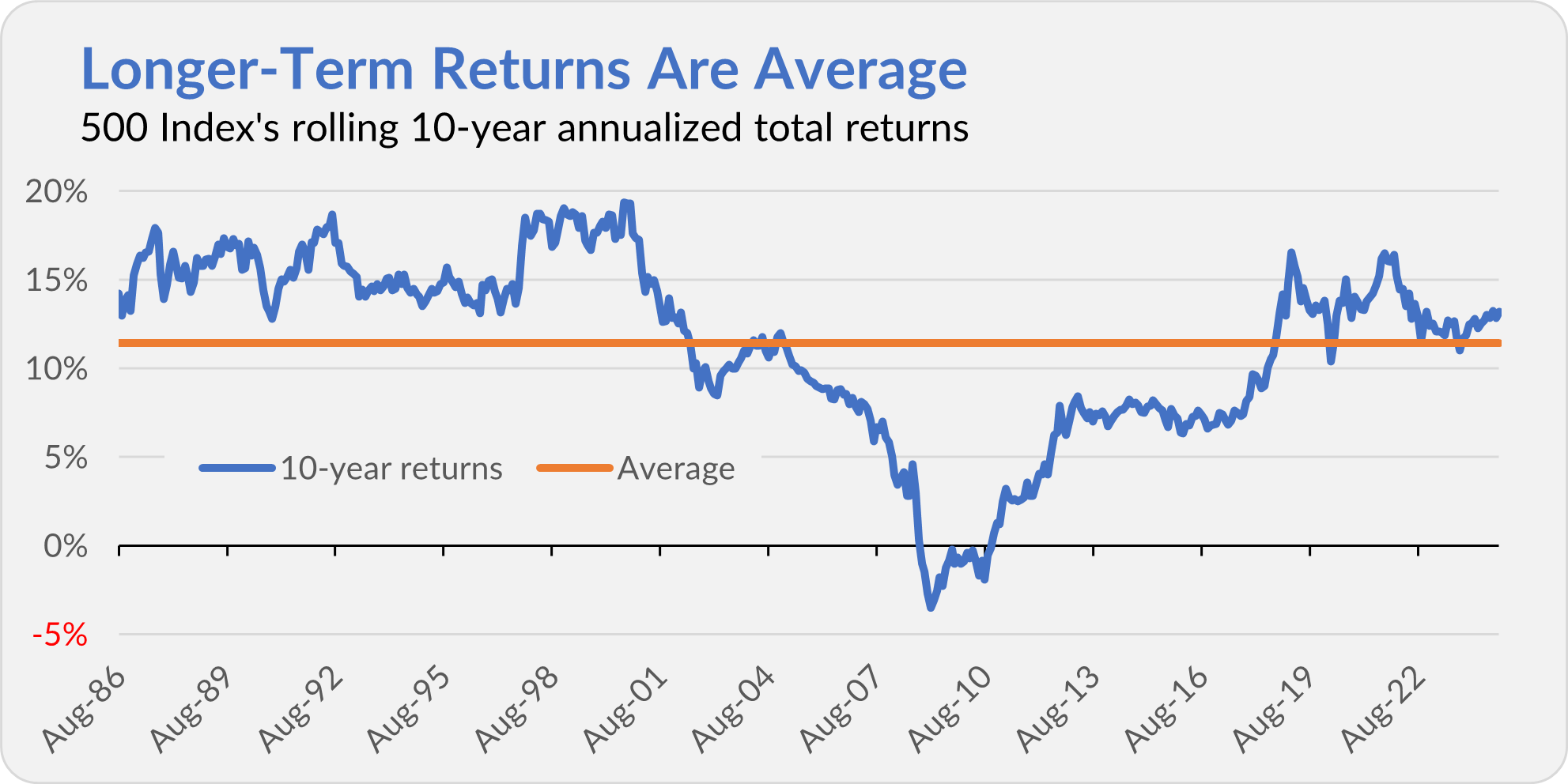

While rolling two-year returns make the market look slightly overcooked, everything appears normal when viewed through the lens of 10-year returns.

The chart below shows 500 Index’s rolling 10-year returns. (As a reminder, this is every 10-year period, calculated monthly, since 1986, when 500 Index finished its first 10-year run.) Over the past decade, the index fund has compounded at a 13.2% annual pace. That’s slightly above the long-term average of 11.4%.

Of course, earning that (roughly) average return over the last decade wasn’t “easy.” You had to hold through a near-bear market in 2018, the COVID-19 bear market in 2020 and 2022’s reflation bear market. It’s some snappy rebounds from those bearish periods that have pushed market returns higher.

The final point I’d like to make is that you need to be cautious when reading investment and market commentary.

As the two charts above demonstrate, changing the time period can change the story. Is the market running too hot or just right? (I doubt anyone is saying it’s too cold.) It depends on how you look at it.

If you read an analysis that only shows you one of the two charts I’ve just put together, the author may be trying to convince you of one narrative or the other rather than providing a fuller picture.

No Longer Diversified?

Yesterday, I received an email from Vanguard with links to “important materials” for several Vanguard funds—including Total Stock Market Index (VTSAX), Emerging Markets Stock Index (VEMAX) and Total International Bond Index (VTABX)—notifying me that the funds may no longer be diversified.

Let’s use Total Stock Market Index as our case study. Here is a link to the recent update.

Let’s put aside the fact that the supplement is dated October 25 and I’m only getting the email now, more than a month later, and focus on the fact that it may be a little off-putting to learn that your fund may “become nondiversified.”

Rest easy: This description does not reflect a change in the fund or its strategy—it will still try to track the market by owning all U.S. stocks. The new language is required because of how U.S. regulators define diversification.

According to the Investment Company Act of 1940, which defines the rules for mutual funds (and ETFs), a 5% position is a large holding. If 25% of a mutual fund's assets are invested in those large holdings, it is no longer diversified.

Given the market's concentration, Vanguard must update its prospectus to state that its index funds could violate the diversification test.

Again, Vanguard isn’t changing how Total Stock Market Index (or any other funds) operates; this is about complying with the regulators while tracking the indexes.

Vanguard Voting Update

When I wrote to you last week about Vanguard’s first shareholder vote in roughly seven years—the last one was held in 2017—I had a few outstanding questions for Vanguard.

Below is their response:

Vanguard will periodically hold a proxy to vote on the members of the Vanguard Funds’ Board of Trustees … Emerson Fullwood and Joseph Loughrey are not on the ballot because they will be retiring from the Board next year, and Greg Davis is not on the ballot because Salim [Ramji] will be the only interested director at this time.

I was hoping for more clarity on why we are voting now, but I found the answer buried in one of Vanguard’s recent SEC filings related to the proxy vote.

Electing the trustees enables the funds to avoid costly proxy solicitations and shareholder meetings for each new trustee appointment. Federal law permits fund boards to appoint new trustees as needed, provided at least two-thirds of the board members are elected by shareholders. [emphasis added]

Well, only five nominees—Mark Loughridge, Scott Malpass, Andrè Perold, Sarah Raskin and Peter Volanakis—have been previously elected by shareholders. The rest were appointed by the board over the years or are new to the fold.

So, we are voting now because we haven’t voted on most of our trustees.

As for how to cast your vote, well, I’m still waiting for an email from Vanguard with instructions. (I’ve been working off SEC filings so far.) However, I found a page dedicated to the proxy vote on Vanguard’s website—here. The page includes a Vote now link, but you won't get very far unless you’ve received your proxy materials.

If you prefer to vote over the phone, the toll-free number (888-218-4371) on the proxy card (which looks like this) will take you to an automated system. But, again, you’ll need your proxy materials to vote on that line.

However, even if you haven’t received your materials, you can still vote by phone. Calling Vanguard (877-662-7447) and following the prompts led me to a Computershare Fund Services representative who was happy to take my vote over the phone. (I haven’t voted yet.) You can also reach Computershare directly at 866-643-5201.

If you’re trying to decide whether to vote for or against any of the candidates, well, one question you may have is how much the nominees have invested in the Vanguard mutual funds (and ETFs) they will be tasked with overseeing on our behalf. I report on this topic every year (see here), but I’ll have an update covering all the trustees (including the new ones) for Premium Members next week—stay tuned.

Our Portfolios

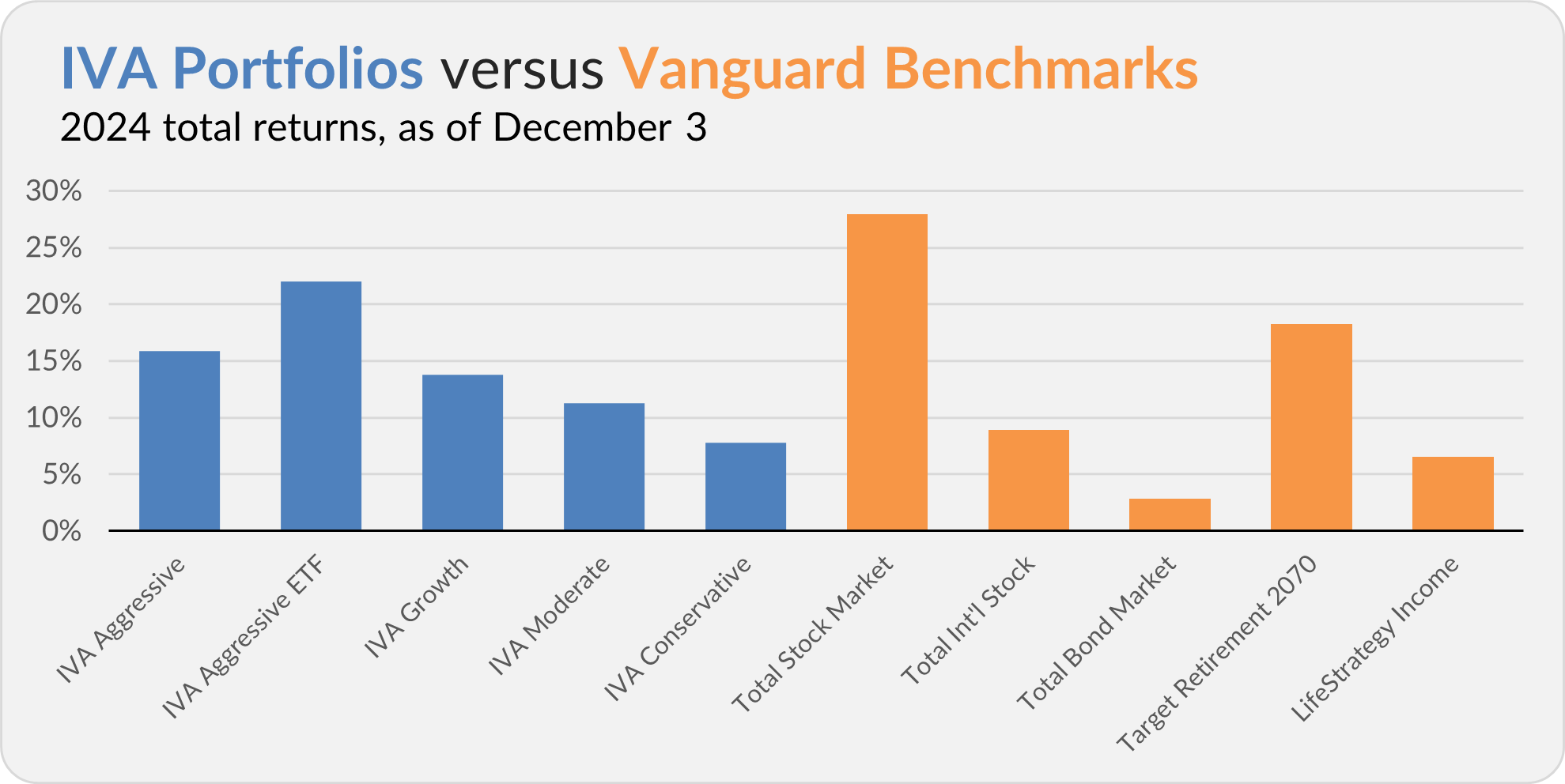

Our Portfolios are showing solid absolute returns for the year through Tuesday. The Aggressive Portfolio is up 15.8%, the Aggressive ETF Portfolio is up 22.0%, the Growth Portfolio is up 13.8%, the Moderate Portfolio is up 11.2% and the Conservative Portfolio is up 7.8%.

This compares to a 27.9% gain for Total Stock Market Index (VTSAX), an 8.9% return for Total International Stock Index (VTIAX), and a 2.9% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 18.3% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 6.5%.

IVA Research

Yesterday, I celebrated 40 years at PRIMECAP (VPMCX). But I wasn’t just popping champagne—I also gave Premium Members my answer to the question on shareholders’ minds: Is PRIMECAP still a buy?

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.