Hello, and welcome to the IVA Weekly Brief for Wednesday, March 26.

There are no changes recommended for any of our Portfolios.

All Clear?

Investors—or really traders—must remember that no one rings a bell at the market’s top or bottom.

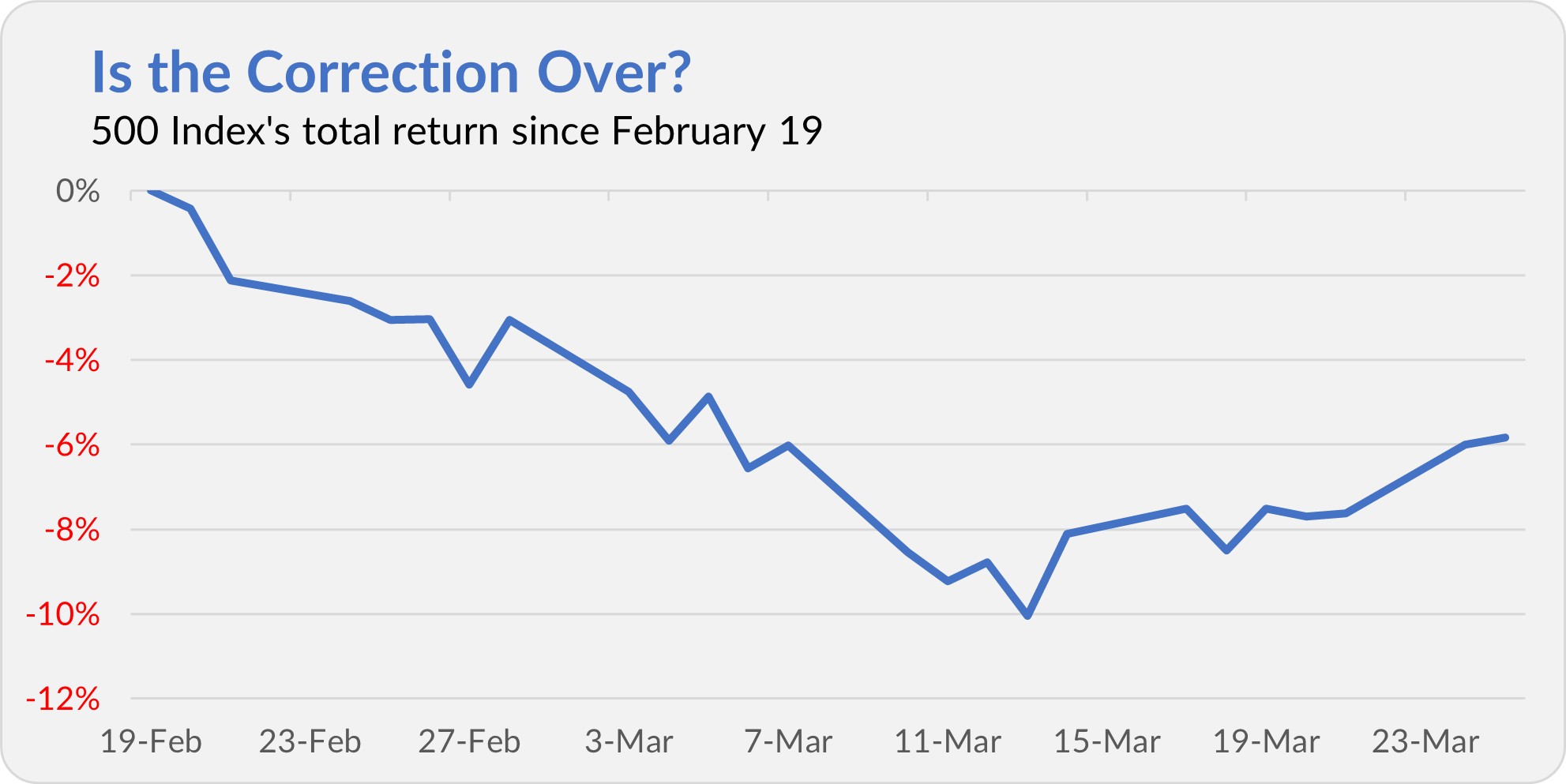

Between February 19 and March 13—a span of 16 trading days—500 Index (VFIAX) 10.05%, entering correction territory. The index fund has gained 4.7% over the past eight trading days.

Was March 13 “the” low? Are markets off to the races? Or is this just a brief reprieve before prices start falling again?

I haven’t met anyone who can reliably call market turning points in real time. No one rang a bell in March to signal a market low, just as no one was ringing one in February to call a high.

So to help Premium Members navigate these uncertain times, I analyzed the past four decades' worth of stock market corrections and bear markets—see here and here.

It doesn’t feel like we're out of the woods, as many questions remain unanswered. Take tariffs, for example.

We still don't know what tariffs will be implemented on April 2. The latest indication is that the U.S. will impose reciprocal tariffs with some exemptions and reductions. Import duties on the lumber, semiconductor and pharmaceutical industries have been kicked down the road, but the auto industry's time is nearly up—or at least, that's how it stands now. Things could, and probably will, change in the next week.

If you ask Federal Reserve policymakers, they are worried about stagflation—higher inflation coupled with higher unemployment and slower overall economic growth. However, at the end of last week's two-day meeting, policymakers sat on their hands, holding the fed funds target range steady at 4.25%–4.50%.

Investors may want to follow Federal Reserve policymakers' lead—sitting on your hands is often the wisest investment decision you can make. You have a long-term investment plan for a reason—you shouldn't deviate from it lightly.

Remember, the one thing all the corrections and bear markets of the past 40 years had in common is that they ended, and were followed by bull markets.

Malvern News

Here is a rundown of this week’s Vanguard news:

A new ETF is almost here …

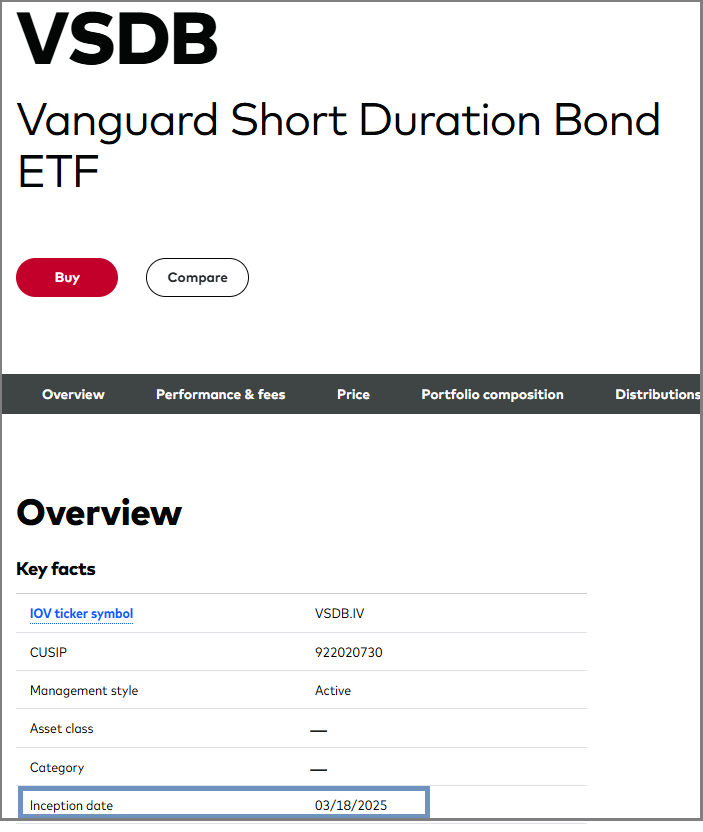

In January, Vanguard filed with the SEC to introduce a new actively managed bond ETF—Short Duration Bond ETF (VSDB). I first wrote about it here.

Well, it looks like Vanguard is ramping up for the fund’s April launch. Vanguard filed an updated prospectus with the SEC today and already has a page for the fund on its website—see here.

Yes, the website says the fund’s inception date was March 18, but Vanguard confirmed that “it is not yet fully launched … We remain on track for early April.”

So, stay tuned.

… And another is in the works

On Monday, Vanguard filed with the SEC to launch an ETF version of Multi-Sector Income. Technically a separate fund (a distinct legal entity from the mutual fund), the ETF is set to debut in June under the ticker VGMS. It will carry a 0.30% expense ratio—matching the cost of the mutual fund’s Admiral shares and coming in 0.15% cheaper than the Investor shares.

Premium Members can read more about the new fund and what it means for future Vanguard ETFs here.

Congrats ... but

According to J.D. Power, Vanguard earned the top ranking from do-it-yourself investors (see here). The fund giant scored highly on brand trust, value for fees paid and meeting investors’ needs.

Vanguard’s performance deserves recognition, but it’s also important to consider ongoing challenges.

For example, while the link between Quicken and Vanguard has been repaired, IVA readers recently reported connection issues with Schwab, Northern Trust, Boldin and Empower.

Another example: Two IVA readers have reported receiving trade confirmation emails from Vanguard for stock purchases they never made. Vanguard told one reader that the firm’s AI software generated the email, and it was not a legitimate purchase. So, no “harm” was done to anyone’s account, but it remains unclear whether this was an isolated glitch or a broader system issue.

So, no, I'm not ready to say that Vanguard’s technology is fully fixed.

Our Portfolios

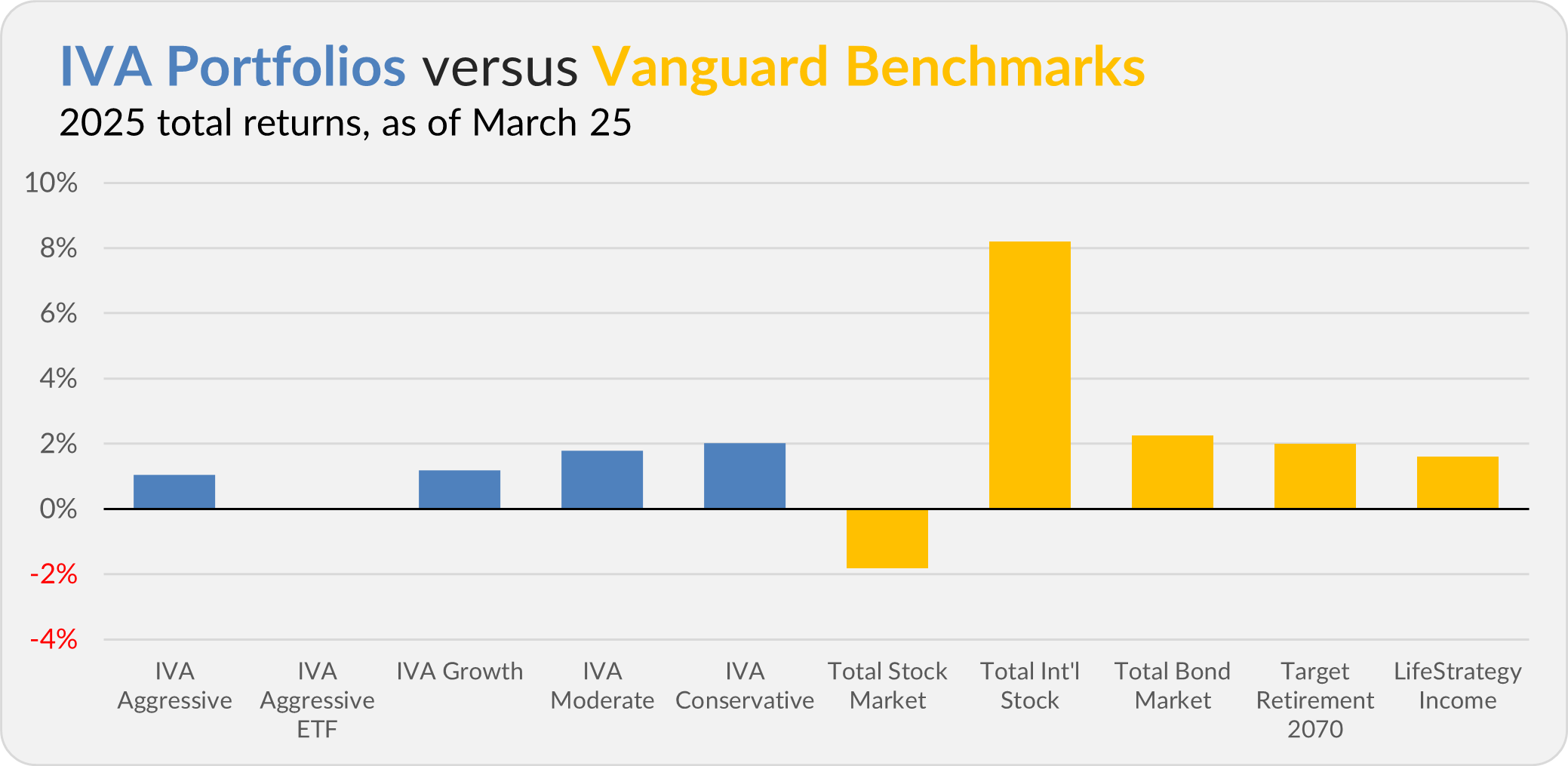

Our Portfolios are showing relatively good returns for the year through Tuesday. The Aggressive Portfolio is up 1.0%, the Aggressive ETF Portfolio is down fractionally (less than 0.1%), the Growth Portfolio is up 1.2%, the Moderate Portfolio is up 1.8% and the Conservative Portfolio is up 2.0%.

This compares to a 1.8% decline for Total Stock Market Index (VTSAX), an 8.2% gain for Total International Stock Index (VTIAX), and a 2.3% return for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 2.0% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 1.6%.

IVA Research

When stocks entered correction territory on March 13, I shared a Quick Take, Investing Through Market Corrections, with Premium Members. Yesterday, in Bear Markets & Corrections, I responded to reader feedback and dug deeper into past stock market declines.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.