Hello, and welcome to the IVA Weekly Brief for Wednesday, November 6.

There are no changes recommended for any of our Portfolios.

As you know by now, Donald Trump will be our 47th President. In last night’s voting, the Republican party also took control of the Senate. It will take a few days to see which party has a majority in the House, but it is likely the Republican party made a clean sweep.

I know emotions are running high and will continue to in the weeks ahead. Whether or not “your” candidate (and party) won, let me warn you, once again, against mixing politics and your portfolio. In fact, The Wall Street Journal recently looked into various “Trump trades” and came away less than convinced. Their conclusion: If you want to bet on politics, use betting markets, not stock markets.

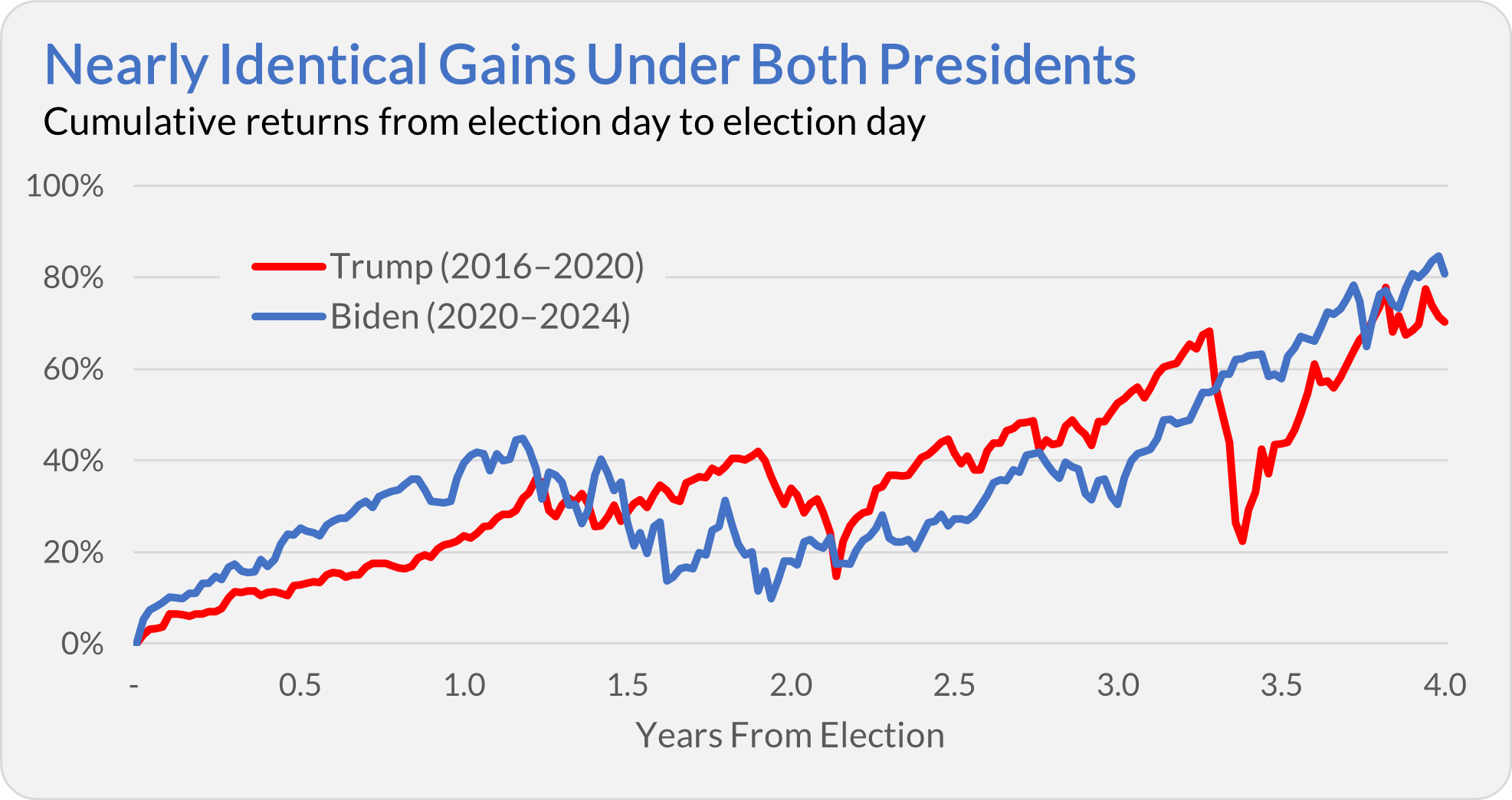

I referenced my article on politics and investing often as Election Day approached, but here’s one more look at how the S&P 500 index fared under both President Trump and President Biden. I’m measuring from election day to election day and counting dividends (total returns).

U.S. stocks delivered similar total returns under both presidents—70% during Trump’s first stint in office and 81% since Biden’s election—despite taking very different paths to get there.

From an economic standpoint, the differences aren’t as stark as you might think.

The table below looks at three critical economic metrics—unemployment, inflation and GDP growth—when Trump was elected (Oct. 2016), before COVID-19 (Oct. 2019), when Biden was elected (Oct. 2020) and where they stand today.

The economy Trump inherited (from Obama) had grown 1.8% in the prior 12 months and was sporting an unemployment rate of 4.8% and an inflation rate of 1.6%. Three years into Trump’s presidency, those numbers hadn’t changed too much—though unemployment had shrunk and the economy had picked up a little steam. Of course, COVID-19 struck in the fourth year, throwing off the numbers—unemployment spiked and the economy shrank.

If you’re going to give Trump a pass on those final (2020) numbers, you should give Biden a pass on the resulting high inflation rate in 2022. Nonetheless, the most recent economic data—unemployment of 4.1%, inflation at 2.4% and GDP at 2.7%—is pretty darned close to where it stood before the pandemic.

| Unemployment rate | Inflation (12-month change in CPI) | Economy (12-month GDP growth) | |

| When Trump Was Elected (Oct. 2016) | 4.8% | 1.6% | 1.8% |

| Before COVID-19 (Oct. 2019) | 3.6% | 1.8% | 2.8% |

| When Biden Was Elected (Oct. 2020) | 6.9% | 1.2% | -1.4% |

| Most Recent Data | 4.1% | 2.4% | 2.7% |

| Source:The IVA | |||

My point is that the market and economy are bigger than the President. Don’t overhaul your portfolio based on who resides at 1600 Pennsylvania Ave.

Bad Request

Last week, I told you that Vanguard was encouraging customers to use margin in their brokerage accounts. Well, my mentor recently chronicled his attempt to go on margin at Vanguard—see here and here.

The short story is that he repeatedly ran into a “Bad Request” message when signing up online. Vanguard’s solution was to suggest he fill out paper forms and fax them in. Yikes!

Dan also shared with me that he changed a trusted contact on an account in mid-October. It took Vanguard two weeks to send him an email confirmation. Needless to say, the confirmation, coming weeks after the fact, caught him by surprise.

If this is the new, improved Vanguard tech stack, well, let’s say there’s still plenty of room for improvement.

IVA Website Accessibility Update – Part II

Over the weekend, my team and I made two minor updates to the IVA website, which should make it more user-friendly.

First, we added the ability to listen to our articles on our website. You'll find a button at the top of every new article (including this one) that says “Listen.” (If you don’t see it, try refreshing the page.)

If you click on the button, the player will open. Here, you can start and stop the audio and change the listening speed—you can play it faster or slower.

Here are a few other tips:

The left and right arrows will advance (or rewind) one paragraph at a time. Similarly, if you click on a paragraph, the audio will start from that point. (You can also stop the audio by clicking on a paragraph.) And, if you scroll down the page while listening to the audio, the player will move to the bottom of your screen.

And a few caveats.

First, this feature is only available on our website. The audio option is not included in the email version of the letter.

Second, while you’ll have the option to listen to each new article from now on, it will take a little time to add this feature to the 300 or so articles I’ve published over the past two years.

Third, to listen to premium content, you must be logged into your account; otherwise, the player won’t be available.

Finally, please be aware that I’m using artificial intelligence to power this text-to-speech feature. (If you’re curious, I’m using BeyondWords.) No, I did not clone my voice for this feature. So, I ask that you pardon any mistakes and the inevitable mispronunciations.

I hope this feature is helpful and will improve over time. If you have any suggestions or notice places where the audio is consistently “wrong,” please let me know.

The second website update is a new “Share” button. You can find it at the top of each page next to the “Listen” and “Text Size” buttons. This should make it easier to, well, share our content via email or social media (X, Facebook or LinkedIn). Please feel free to spread the word!

Our Portfolios

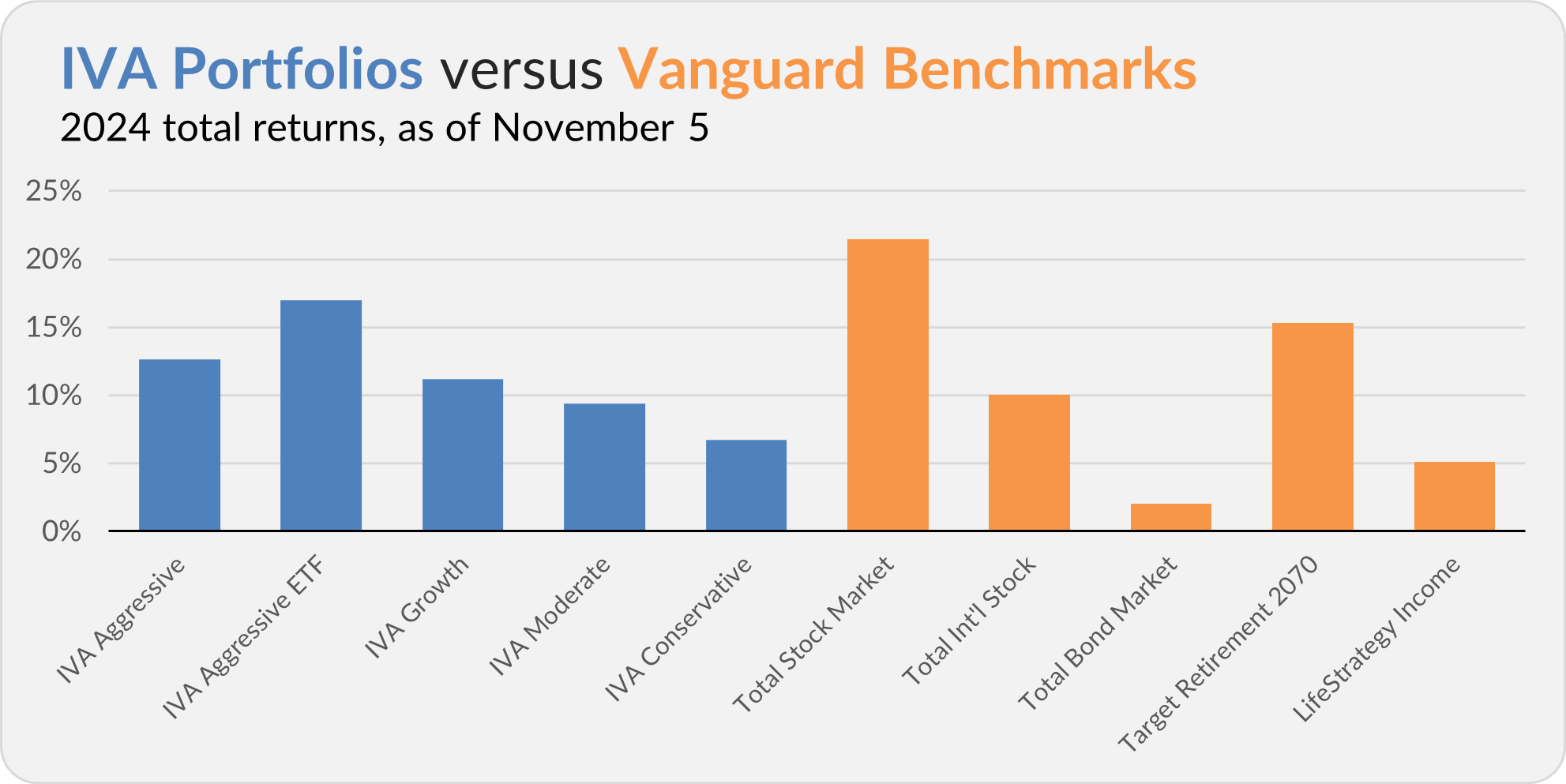

Our Portfolios are showing decent absolute returns for the year through Tuesday. The Aggressive Portfolio is up 12.7%, the Aggressive ETF Portfolio is up 17.0%, the Growth Portfolio is up 11.2%, the Moderate Portfolio is up 9.4% and the Conservative Portfolio is up 6.7%.

This compares to a 21.4% return for Total Stock Market Index (VTSAX), a 10.0% gain for Total International Stock Index (VTIAX), and a 2.0% return for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 15.3% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 5.1%.

IVA Research

Yesterday, in Dividends Deserve Patience, I analyzed the merits of Dividend Growth (VDIGX) and Dividend Appreciation ETF (VIG) for Premium Members.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.