Hello, and welcome to the IVA Weekly Brief for Friday, December 27, my last of the year.

There are no changes recommended for any of our Portfolios.

Holiday Publishing Schedule

As a reminder, there will be no Weekly Brief next week. That doesn’t mean I’m taking the time off. Premium Members can expect to receive several missives from me over the coming days.

On Tuesday, December 31, I’ll publish my 2025 Outlook. Thursday, January 2, Premium Members can expect four articles from me—including a look back at the year that was and the Hot Hands Trade Alert. (If the data gods will it, I’ll get the Hot Hands notice out sooner.)

Free members who want in on more of the action can upgrade to a Premium Membership here:

Happy Holidays!

Common sense and historically logical investment advice have been severely tested during this latest market cycle. Holding a diversified portfolio has looked pretty darned foolish compared to a “going for broke” portfolio strategy. Let me give you two examples.

On Wednesday, December 18, as expected, Fed policymakers lowered the fed funds target range one step to 4.25%–4.50%. However, traders were not pleased to learn that policymakers are considering just two interest rate cuts next year.

One might have expected bonds would react negatively, but stocks and other kinds of investments, well, pretty much everything sold off on the day. 500 Index (VFIAX) dropped 2.9%, SmallCap Index (VSMAX) fell 4.1%, Total International Stock Index (VTIAX) slid 2.0%, Commodity Strategy (VCMDX) dropped 2.7%, Real Estate Index (VGSLX) fell 4.1%, Total Bond Market Index (VBTLX) slid 0.7%. I could go on.

That’s just one day, of course. December (and even the year) has been challenging for diversified investors.

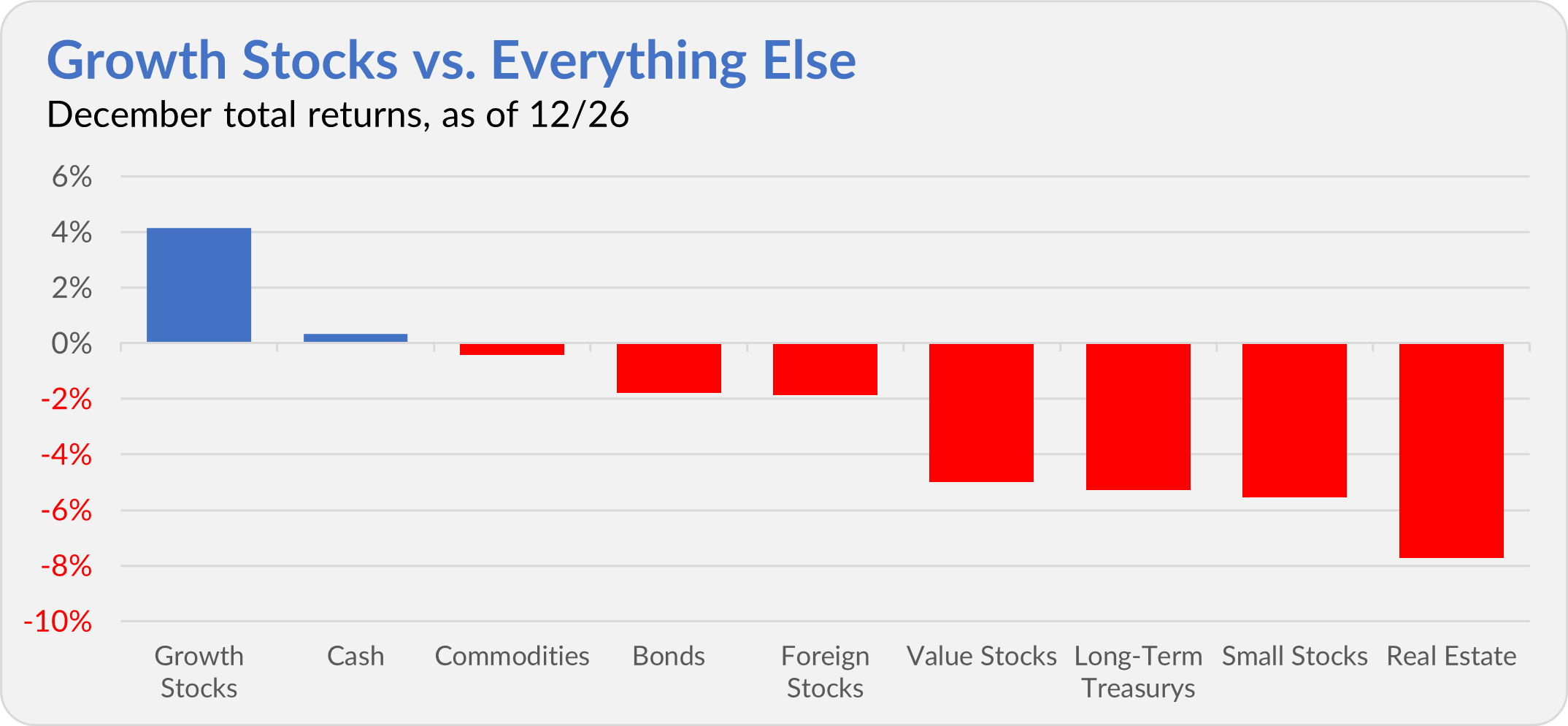

While large growth stocks have gained ground in December—for instance Growth Index (VIGAX) is up 4.1% as of Thursday’s close—everything else (except cash) is in the red. Value stocks, smaller stocks and foreign stocks are all down. Diversifying assets like bonds, commodities and real estate have also declined this month.

Of course, large growth stocks (like the giant tech companies that dominate the major stock indexes) could continue to lead the market in the months and year ahead, but diversification will pay off over time. I can’t tell you exactly when that will be, but I know that leaders eventually have their comeuppance!

Cash Yields To Fall

Last week, I made the following predictions about how the yields on Vanguard’s cash solutions would react to Fed policymakers lowering fed funds target range to 4.25%–4.50%.

- I anticipate Federal Money Market’s (VMFXX) yield will fall from 4.53% (today) to 4.25%.

- Cash Plus Account’s yield will likely drop from 3.90% to 3.65%.

- Cash Deposit’s yield will probably fall from 3.00% to 2.75%.

I said that the money market fund’s yield would drop slowly over the next month but that the yields on the two newer cash solutions would drop immediately.

Well, the changes are coming to pass. As I expected, Cash Deposit’s yield dropped from 3.00% to 2.75% on Friday (12/20). However, Cash Plus Account’s yield has, so far, held steady at 3.90%.

This is the first time (since I began tracking them in mid-2023) that their yields have not moved in the same direction on the same day. It’s only a matter of time until Cash Plus Account’s yield drops to 3.65%.

As for Federal Money Market, its yield has dropped from 4.53% the day before policymakers met to 4.38% (on Thursday), as I said it would.

Gift Idea

Forgot someone on your holiday gift list? How about giving a subscription to The IVA?

Our Portfolios

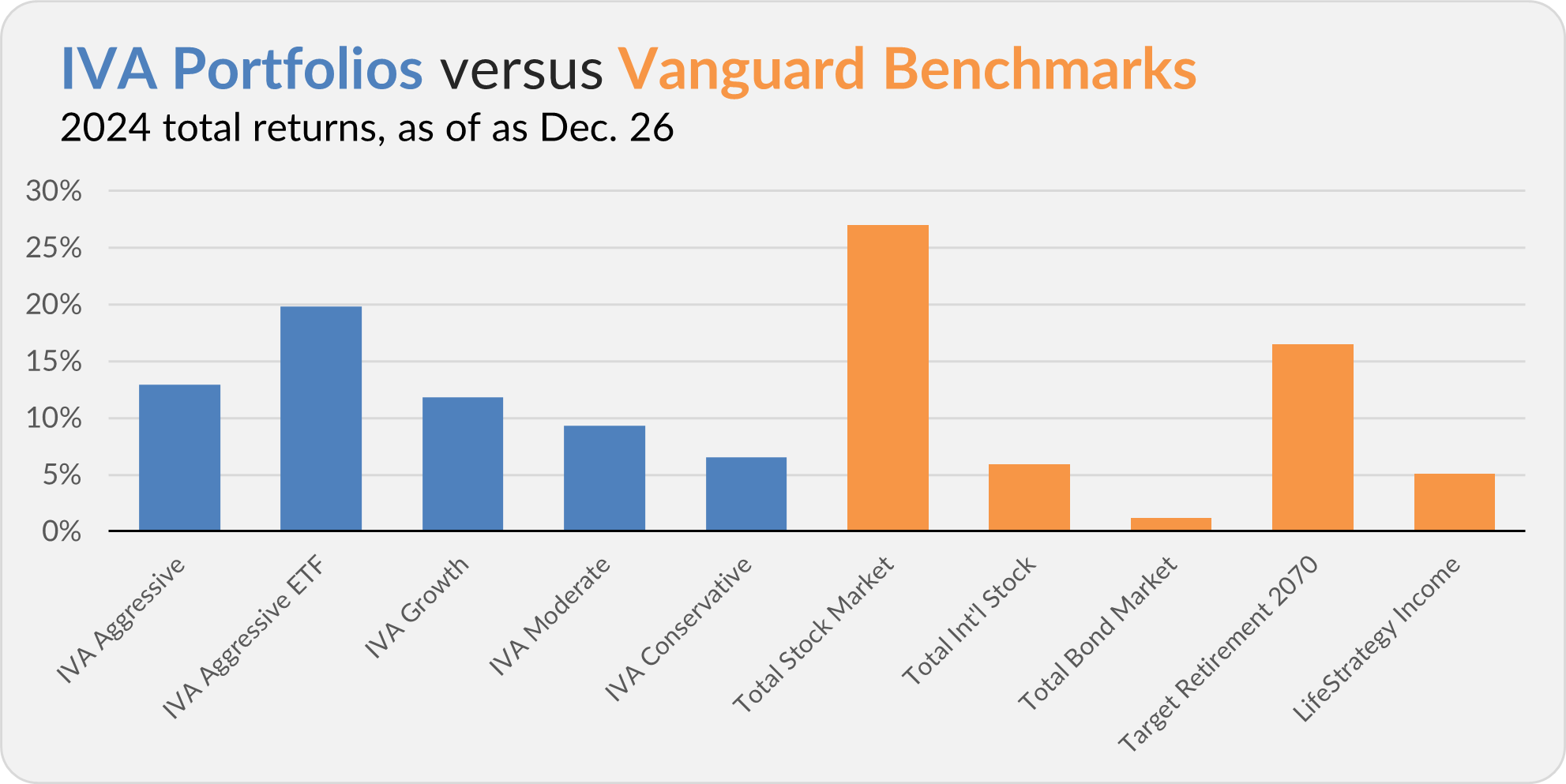

Our Portfolios are showing decent absolute returns for the year through Tuesday. The Aggressive Portfolio is up 12.9%, the Aggressive ETF Portfolio is up 19.8%, the Growth Portfolio is up 11.8%, the Moderate Portfolio is up 9.3% and the Conservative Portfolio is up 6.5%.

This compares to a 27.0% gain for Total Stock Market Index (VTSAX), a 5.9% return for Total International Stock Index (VTIAX), and a 1.2% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 16.5% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 5.1%.

IVA Research

On Monday, in Heating Up?, I analyzed the track record of our long-running Hot Hands trading strategy Premium Members.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future and a very happy New Year.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.