Hello, and welcome to the IVA Weekly Brief for Wednesday, December 18.

There are no changes recommended for any of our Portfolios.

Holiday Publishing Schedule

With the holidays upon us, I’m tweaking my publishing schedule. Here’s the plan for the next several weeks:

Next week (12/23–12/27), I’ll send the IVA Research article (on the Hot Hands strategy) to Premium Members on Monday, December 23. The (free) Weekly Brief will come out on Friday, December 27.

The following week (12/30–1/3), I’ll send the IVA Research article (my annual Outlook) to Premium Members on Tuesday, December 31. On Thursday, January 2, Premium Members can expect four articles from me—including a look back at the year that was and the Hot Hands Trade Alert. With five premium articles coming out that week (and Wednesday being a holiday), I will not publish a Weekly Brief.

I’ll return to the usual Tuesday–Wednesday schedule the week of January 6.

As always, if there is pressing Vanguard or market news, I’ll do my best to respond as quickly as possible.

If you are a free member and want in on more of the action, you can upgrade to a Premium Membership here:

Happy Holidays!

Investors focused on growth plays have plenty to cheer about this holiday season.

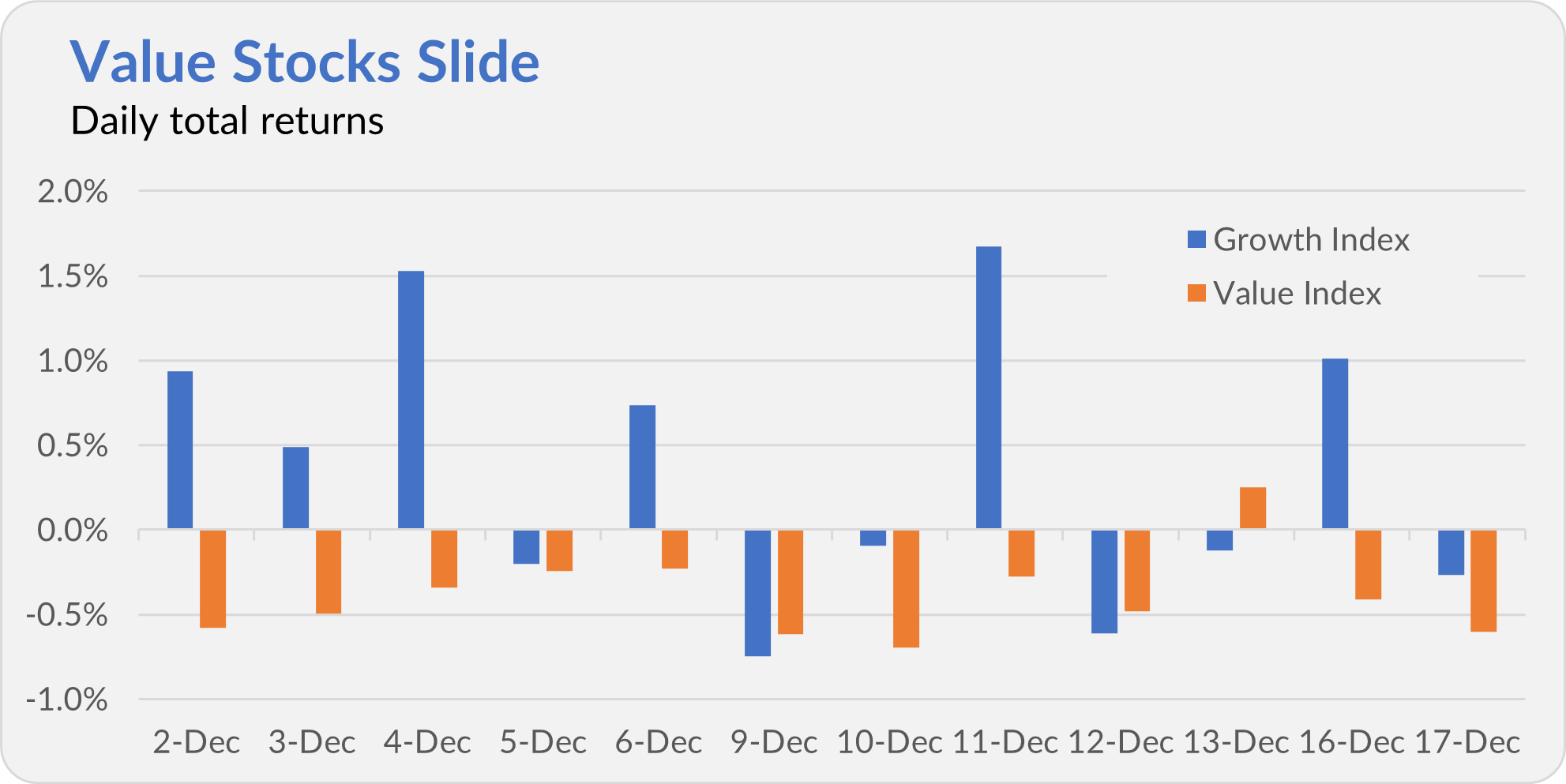

Growth Index (VIGAX) is up 4.4% in December (as of Tuesday’s close). The only three sector ETFs in positive territory this month are Consumer Discretionary ETF (VCR), which holds Amazon and Tesla at 35% of the portfolio, Information Technology ETF (VGT), with Apple, NVIDIA and Microsoft at 45% of the portfolio, and Communication Services ETF (VOX) which holds Facebook and Google (now called, Meta and Alphabet) at nearly 45% of the portfolio.

If you don’t own these then your advent calendar isn’t opening to particularly bullish pictures.

While Growth Index is up 4.4%, Value Index (VVIAX) has dropped 4.6% in December. The value stock index fund has declined on 11 out of 12 trading days this month!

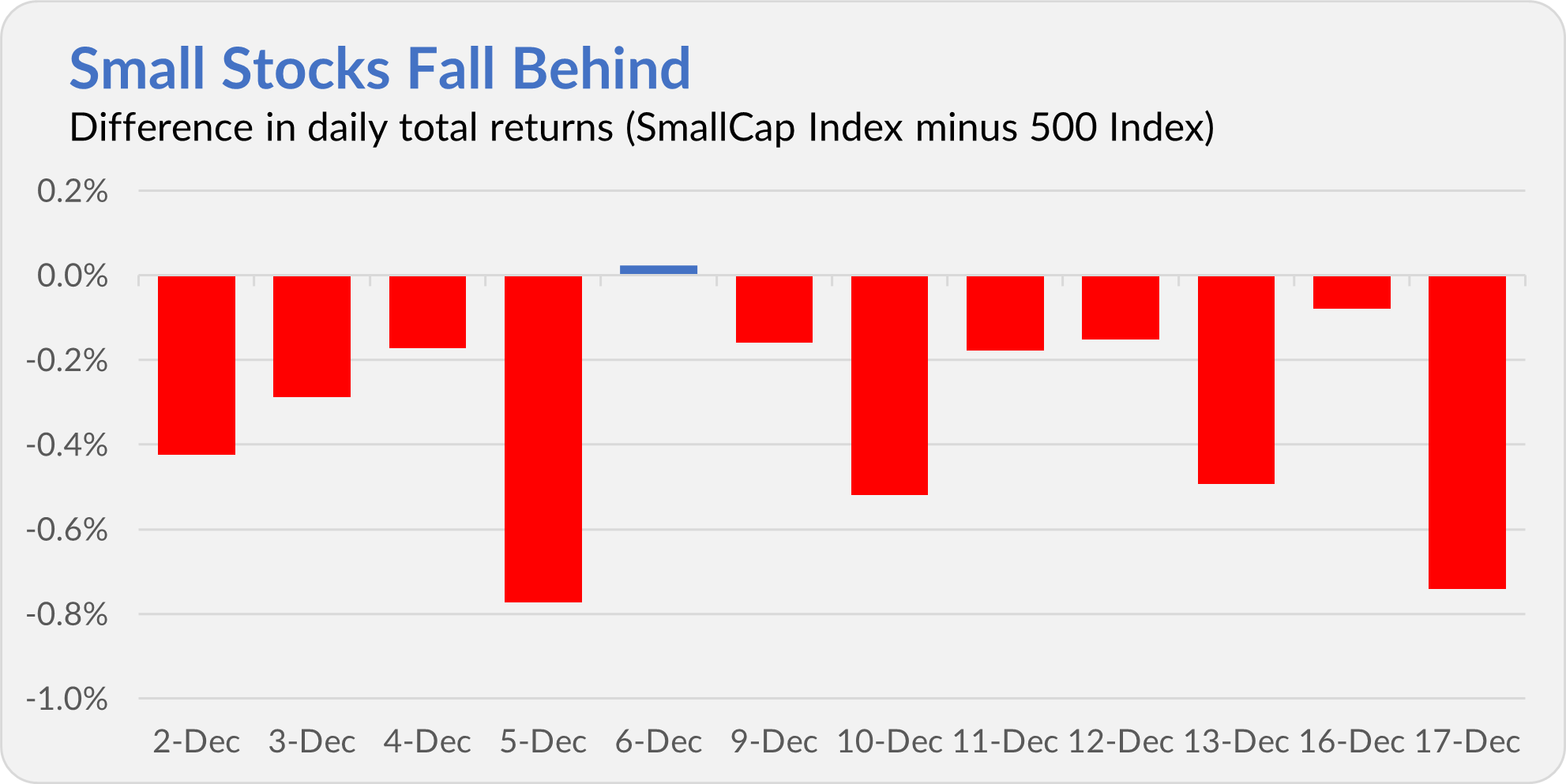

Small stocks haven’t had it quite as bad as value stocks—SmallCap Index (VSMAX) is off “only” 3.5% this month. However, smaller stocks have trailed larger stocks (measured by 500 Index (VFIAX)) on 11 out of 12 trading days in December.

This hasn’t been a fun month (or year) for diversified investors, as growth stocks have led the charge consistently. Still, I believe patience and discipline will eventually reward diversified investors. Stay the course.

Lower Cash Yields Ahead

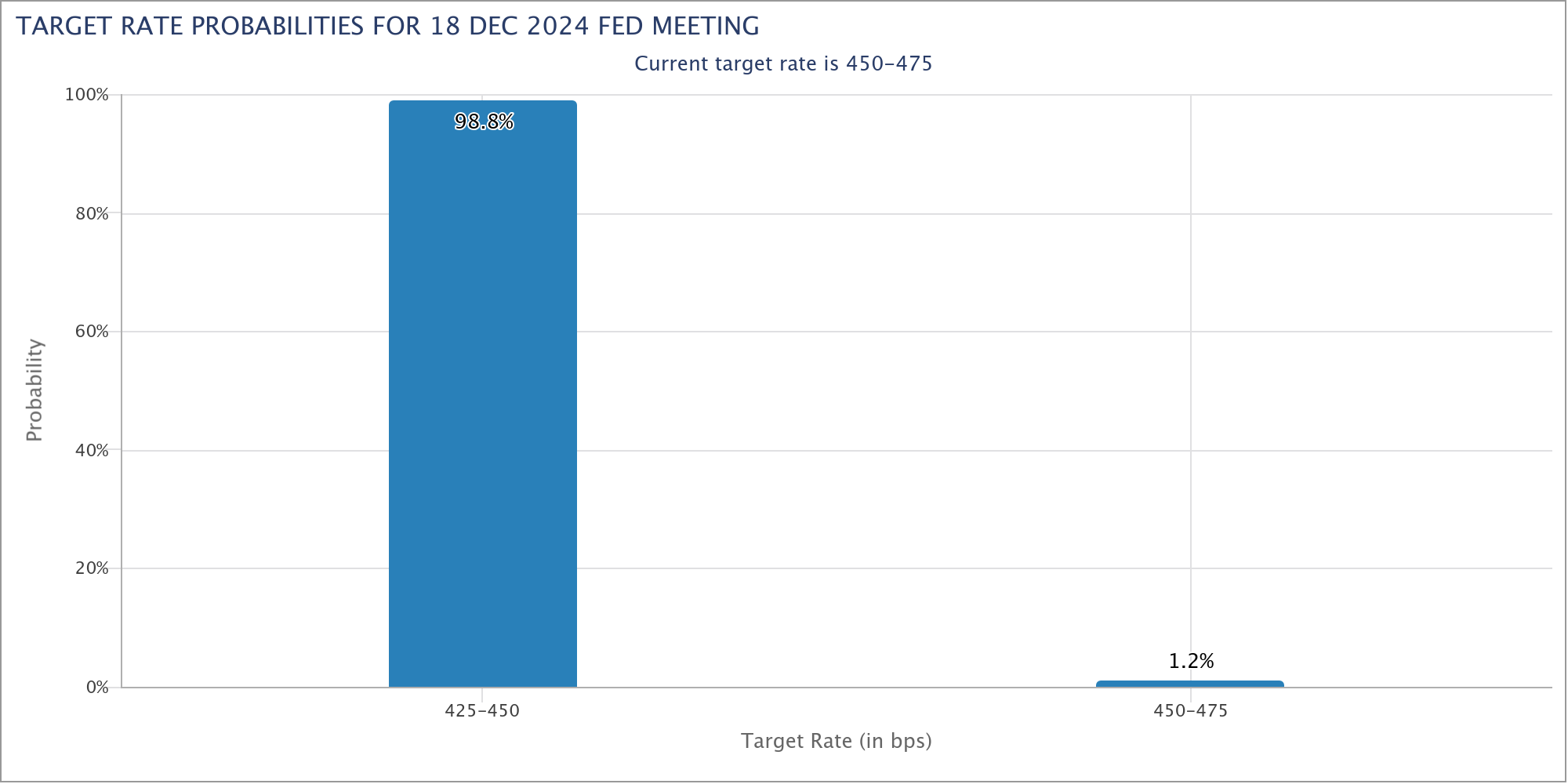

I’m traveling today, which is why this article landed in your inbox before the Fed’s announcement as to whether they’ll be cutting interest rates again or not. Judging by the CME Group’s FedWatch (which tracks the probabilities of changes to Fed policy based on futures prices), traders are certain that policymakers will lower the fed funds target range to 4.25%–4.50%.

So, let’s assume that the Fed doesn’t surprise (nearly) everyone and lowers the fed funds rate this afternoon. What does this mean for our portfolios?

Well, as I’ve said, the link between Fed actions and stock prices is weak. However, cash yields typically follow the Fed closely. So, I’m reasonably confident in predicting that the yields on Vanguard’s cash products will fall. To be specific …

- I anticipate Federal Money Market’s (VMFXX) yield will fall from 4.53% (today) to 4.25%.

- Cash Plus Account’s yield will likely drop from 3.90% to 3.65%.

- Cash Deposit’s yield will probably fall from 3.00% to 2.75%.

While it will probably take Federal Money Market’s yield a month to reach its new destination, I expect the yields on Vanguard’s cash solutions will drop “immediately”—on Thursday or Friday.

I’ll give an update on my forecast next week.

IVA on Air

Yesterday, I joined Jeff Benjamin on ETF.com’s Advisor Insider Podcast to discuss Vanguard’s recent personnel shake-up and “new” Advice and Wealth Management division.

You can find our 20-minute conversation wherever you listen to podcasts. Or you can use the link below:

https://www.etf.com/sections/podcasts/vanguard-squares-financial-advisors

And if it helps, below is a transcript of our conversation. (A tip of my hat to Jeff and ETF.com for providing the text.)

Distribution Season Is Here

I said this last week, but it’s worth repeating: Vanguard’s mutual funds and ETFs are in the process of paying out capital gain and income distributions. If one of your funds’ price drops dramatically on a given day, it is likely not market-related but due to a payout.

You can find everything you need to navigate distribution season confidently here. And you can find Vanguard’s final estimates here.

Gift Idea

If you’re looking for a last-minute gift idea, how about giving a subscription to The IVA?

I’m pleased to report that giving an annual (or recurring) membership to our service has never been easier. Just click the button below:

Our Portfolios

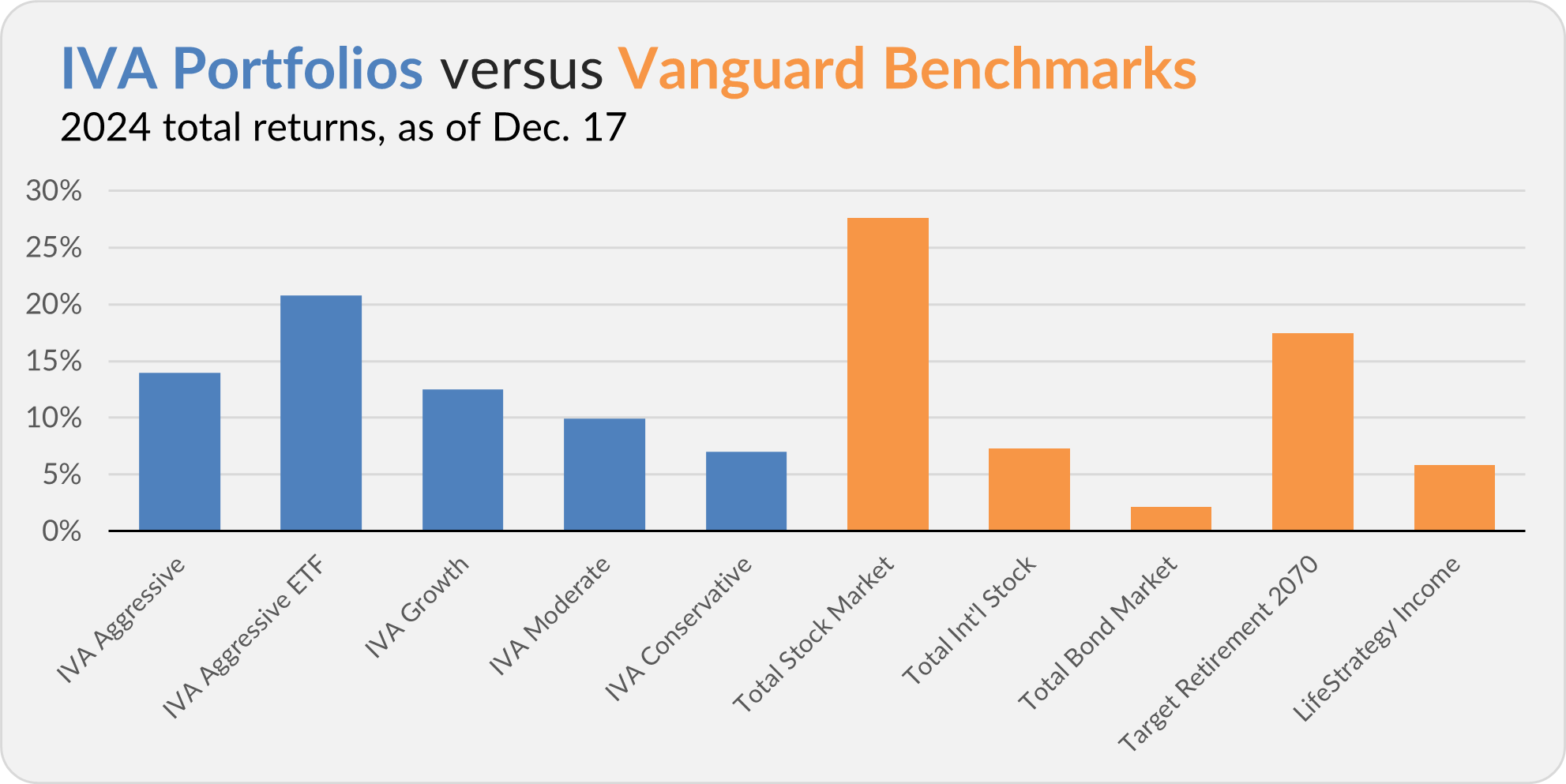

Our Portfolios are showing solid absolute returns for the year through Tuesday. The Aggressive Portfolio is up 14.0%, the Aggressive ETF Portfolio is up 20.8%, the Growth Portfolio is up 12.5%, the Moderate Portfolio is up 9.9% and the Conservative Portfolio is up 7.0%.

This compares to a 27.6% gain for Total Stock Market Index (VTSAX), a 7.3% return for Total International Stock Index (VTIAX), and a 2.1% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 17.4% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 5.8%.

IVA Research

Yesterday, in Diversification Wins Over Time, I shared a deep dive into the IVA Portfolios with Premium Members.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.