Hello, and welcome to the IVA Weekly Brief for Wednesday, January 8.

There are no changes recommended for any of our Portfolios.

🚨U.S. stock markets will be closed on Thursday, January 9, to honor former President Jimmy Carter's passing. The bond market will close early at 2 pm EST tomorrow.

Welcome to 2025. I hope your new year is off to a great start.

We are only four trading days into the year, so any analysis should be taken with a grain of salt. So far, for the most part, it appears that 2025 is picking up where 2024 left off, with growth stocks outpacing value stocks and technology stocks leading the way.

These trends will continue until they don’t. As I explained in my 2025 Outlook, there are some good reasons why a new environment may be in the cards this year.

News Out of Malvern (Vanguard)

Here’s the Vanguard news you may have missed during the holidays.

First, Vanguard signed a new “investor passivity agreement” with the FDIC. I shared my thoughts with Premium Members in a Quick Take. The short story is that if Vanguard abides by specific rules (like refraining from shaking up company boards), the FDIC will consider the fund giant a passive owner and allow it to continue buying bank shares.

Frankly, the new agreement isn’t all that different from the 2019 agreement—here. The significant change is that Vanguard must “prove” to the regulators rather than self-certify that it is passive.

Second, Jean Hynes has officially given up her Health Care (VGHCX) portfolio manager duties. Hynes continues as Wellington’s CEO, but Rebecca Sykes is now the sector fund’s sole portfolio manager. Premium Members can read more about the transition here.

Finally, Target Retirement shareholders have begun receiving notices to join a class action lawsuit against Vanguard.

As a reminder, in September, Vanguard agreed to settle with a group of Target Retirement shareholders who sued the fund giant after getting hit with massive tax bills in 2021. In November, the two parties agreed to a $40 million settlement, which is still subject to court approval.

If you want to read more on the topic, I’ve written about it here, here, here and here over the past two years.

To be eligible, you must live in the U.S., have held a Target Retirement fund in a taxable account (or a retirement account where the capital gains were distributed outside the account) and received those outsized capital gains in 2021.

If that’s you, I don’t see a good reason not to join the claim—unless you plan to pursue your own suit. The deadline to enter the claim (to submit your proof) is February 11, 2025. You can find more information and submit a claim here.

If you want to be excluded or object to any part of the agreement, you must do so by February 18, 2025.

Hitting the Bullseye

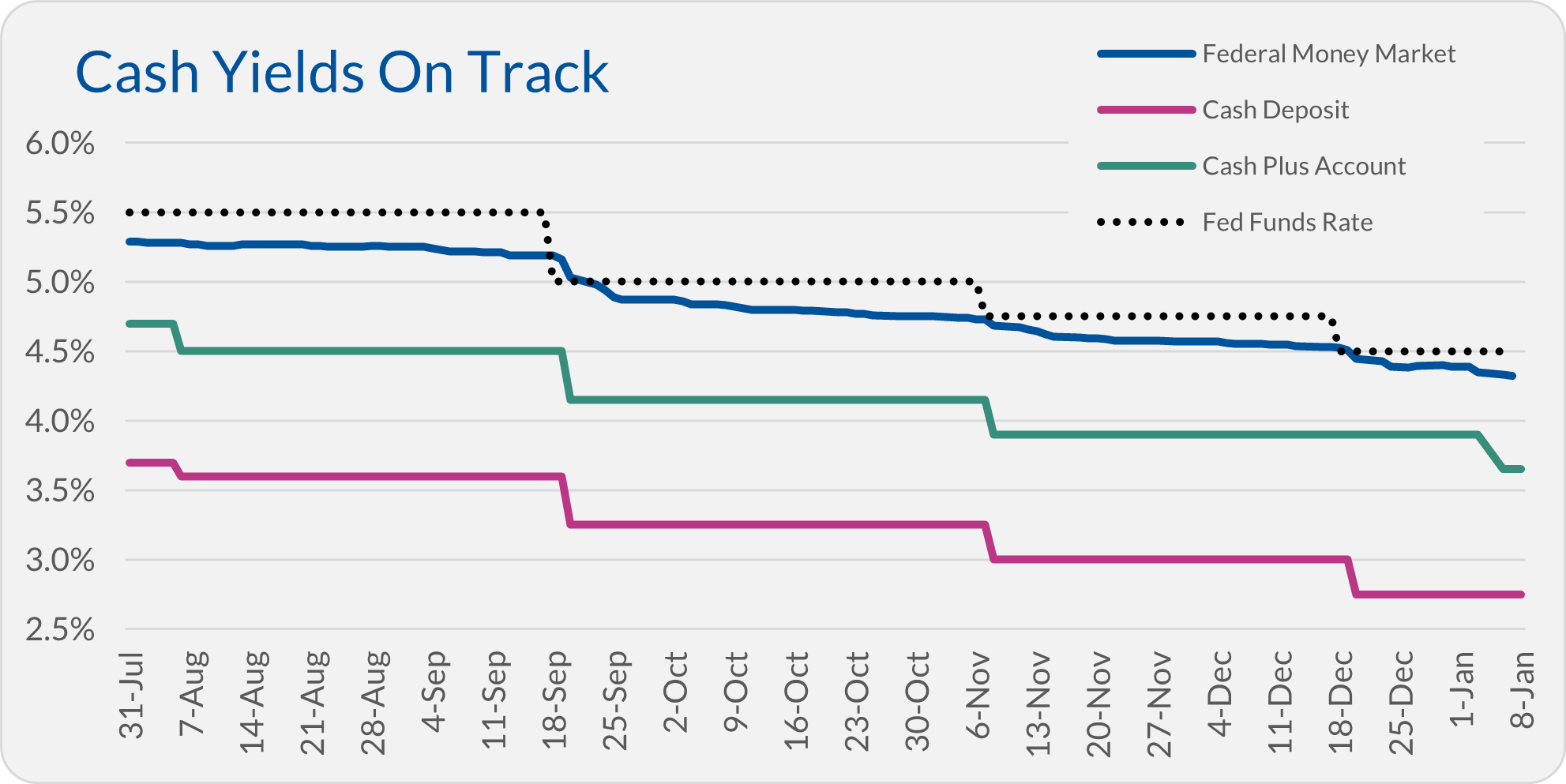

Hours before Federal Reserve policymakers lowered the feds fund rate fed funds target range to 4.25%–4.50% on December 18, I made the following predictions about how the yields on Vanguard’s cash solutions would react:

- I anticipate Federal Money Market’s (VMFXX) yield will fall from 4.53% (today) to 4.25%.

- Cash Plus Account’s yield will likely drop from 3.90% to 3.65%.

- Cash Deposit’s yield will probably fall from 3.00% to 2.75%.

As I told you in my last Weekly Brief, I was spot on with my Cash Deposit forecast—its yield dropped to 2.75% two days after the Fed’s actions.

I was surprised that Cash Plus Account’s yield hadn’t fallen to 3.65% at the same time, but I said it was only a matter of time. Well, on Monday, January 6, Cash Plus Account’s yield fell to … drumroll … 3.65%.

And Federal Money Market's yield is marching to 4.25%—falling from 4.53% to 4.32%. I suspect the money market’s yield will stabilize around 4.25% in the next two weeks.

Predicting how cash yields will respond to changes in Federal Reserve policy isn’t rocket science—the two are closely linked. Unfortunately, it’s harder to forecast how stocks and bonds will react.

For example, you might think that policymakers lowering the fed funds rate would present an ideal time to shift from cash to bond funds. Well, since the end of September (roughly when policymakers lowered interest rates for the first time this cycle), Total Bond Market Index (VBTLX) is down 3.8% while Federal Money Market is up 1.2%.

Cash yields have declined, but that doesn’t mean cash is trash. For now, cash still offers a decent income while providing reliable stability to a portfolio.

Our Portfolios

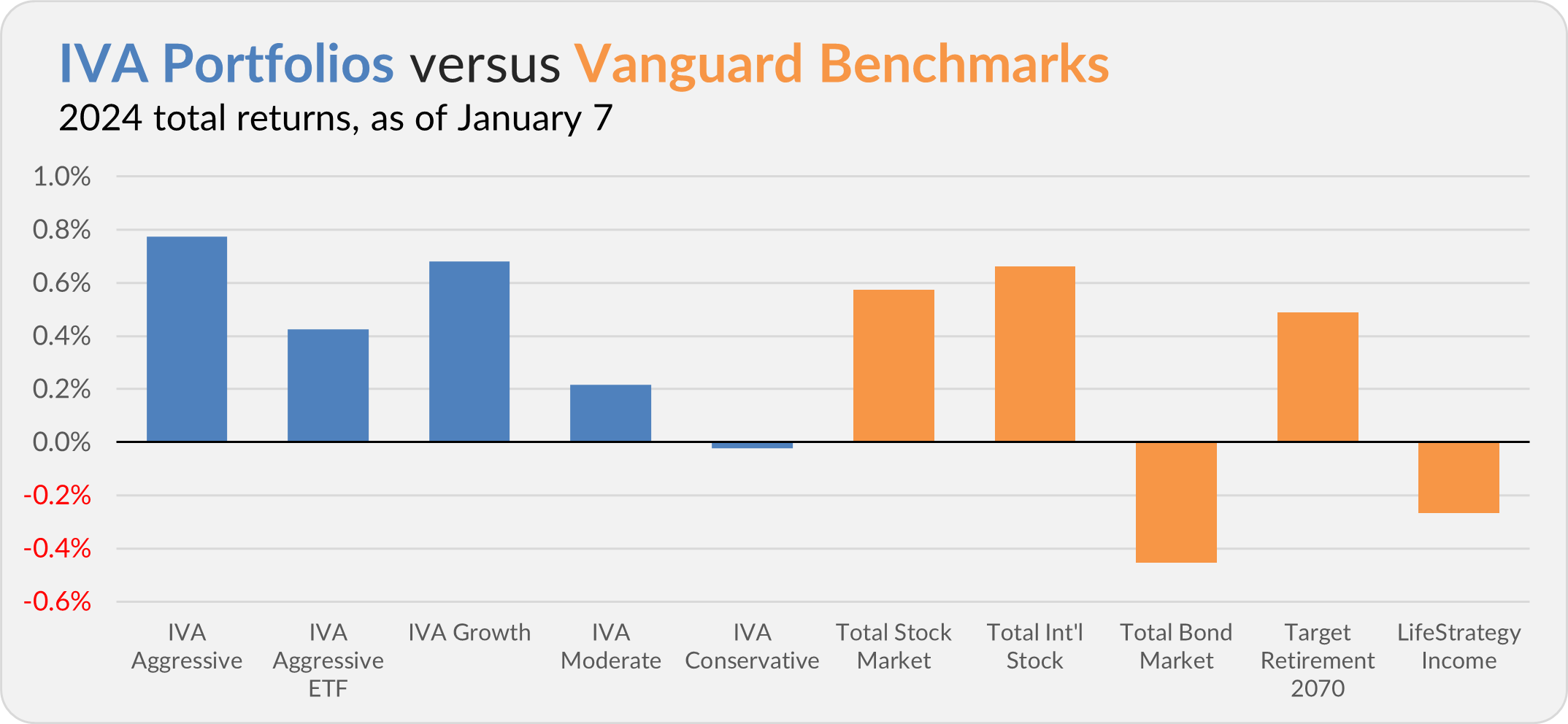

Our Portfolios are off to a decent start in 2025. Through Tuesday, the Aggressive Portfolio is up 0.8%, the Aggressive ETF Portfolio is up 0.4%, the Growth Portfolio is up 0.7%, the Moderate Portfolio is up 0.2% and the Conservative Portfolio is down fractionally (-0.02%).

This compares to a 0.6% gain for Total Stock Market Index (VTSAX), a 0.7% return for Total International Stock Index (VTIAX), and a 0.5% decline for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 0.5% for the year, and its most conservative, LifeStrategy Income (VASIX), is down 0.3%.

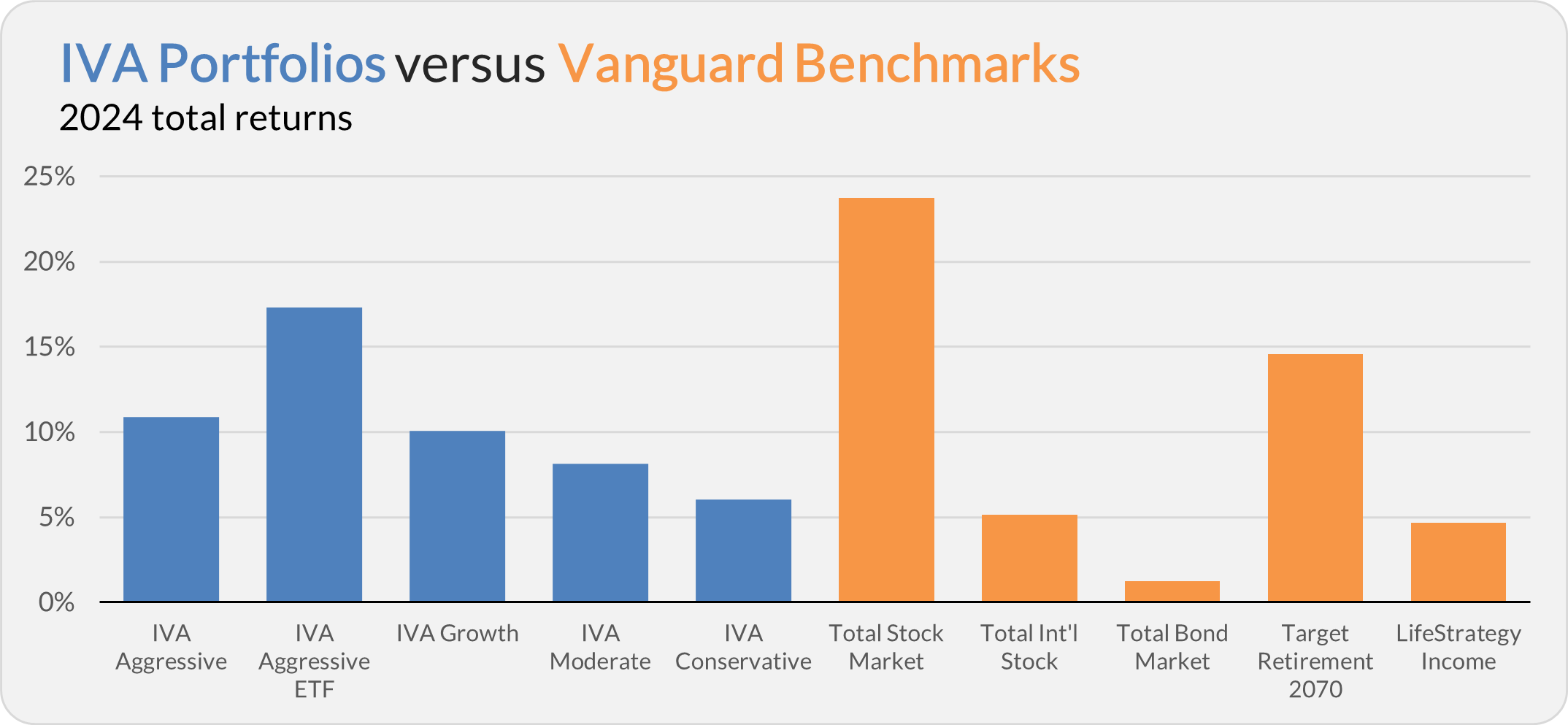

As this is my first Weekly Brief of the year, below are the 2024 results of my Portfolios.

The Aggressive Portfolio gained 10.9%, the Aggressive ETF Portfolio returned 17.3%, the Growth Portfolio advanced 10.1%, the Moderate Portfolio gained 8.1% and the Conservative Portfolio returned 6.0%.

This compares to a 23.7% return for Total Stock Market Index (VTSAX), a 5.1% gain for Total International Stock Index (VTIAX), and a 1.2% return for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), gained 14.6% in 2024, and its most conservative, LifeStrategy Income (VASIX), returned 4.7%.

Premium Members can read an in-depth review of my Portfolios here.

IVA Research

Premium Members have heard a lot from me in the past week. In addition to a December recap (here), I shared a month-by-month review of 2024 (here) and a deeper dive into the markets last year (here). I also published my 2025 Outlook, Bull Run or Turning Point?, and looked back at my 2024 Outlook (here).

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.