Hello, and welcome to the IVA Weekly Brief for Wednesday, October 16.

There are no changes recommended for any of our Portfolios.

Stock markets were rising—on Monday, the Dow Jones Industrial Average, the S&P 500 index and the S&P 400 index (a collection of mid-sized companies) reached record highs. Then, on Tuesday, traders tripped over an ASML-shaped wall.

ASML, which produces the machines used to make advanced computer chips, disappointed, only booking half the orders analysts expected. That big miss led to the stock’s worst day in decades, down 16%. Other semiconductor and chip companies (including NVIDIA) dropped in price, too. Information Technology ETF (VGT) fell 1.8% on Tuesday.

Of course, one day doesn’t make or break a bull market. And one disappointing report doesn’t mean the artificial intelligence (AI) story has run its course. However, for analysts to miss the mark as much as they did shows just how high expectations are for any chip-related company. And it can be challenging for a company to live up to sky-high hopes.

Seeing ASML’s stock drop 16% in a day reminds me that even if you are invested in the “right” company, you have to be prepared for meaningful declines. Despite yesterday’s drop, ASML’s stock is still up 186% over the last five years. Not too shabby! By comparison, 500 Index (VFIAX) is up around 110%.

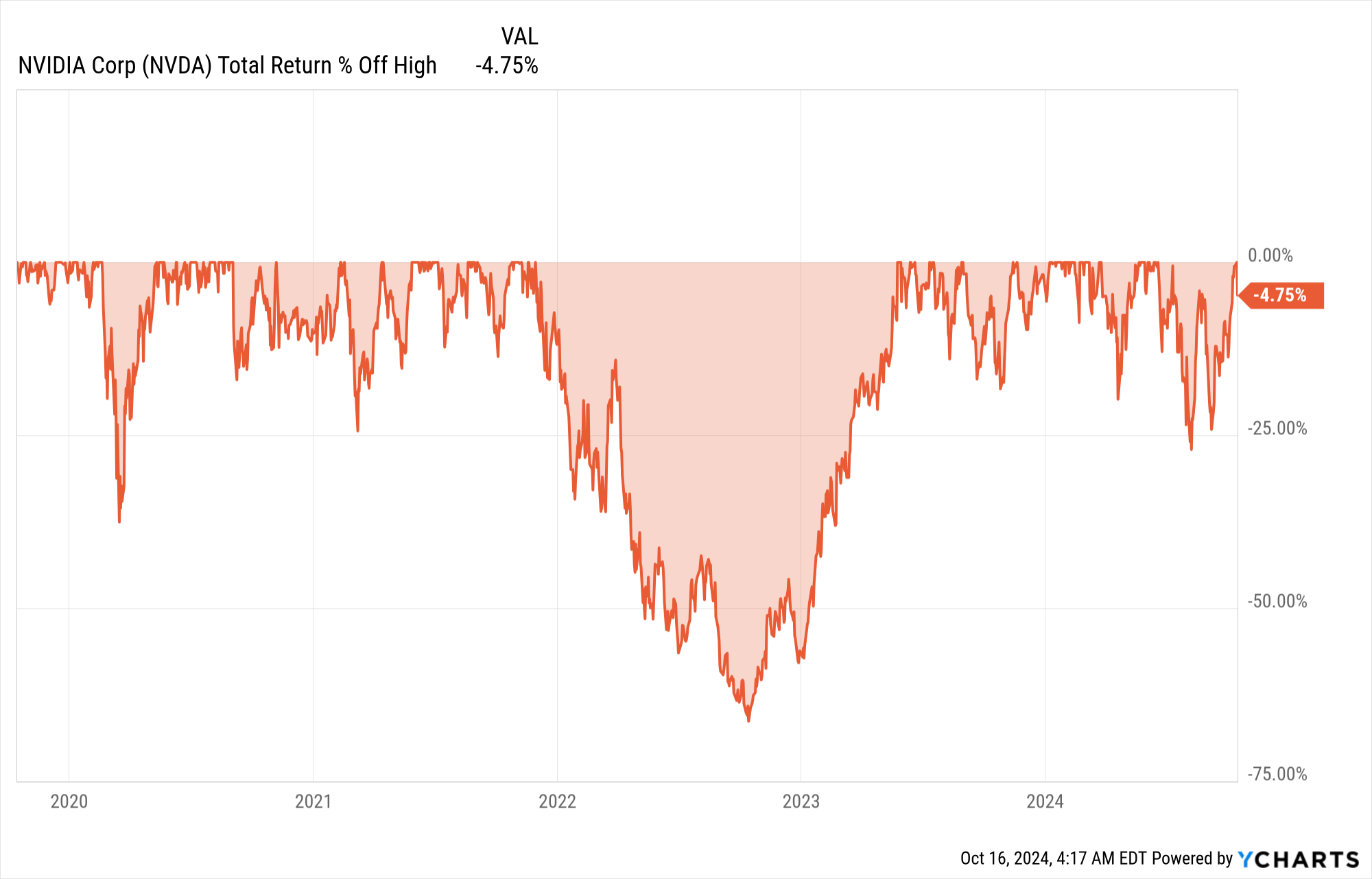

But let’s turn to NVIDIA for a more extreme example. NVIDIA’s stock is up more than 2,500% over the past five years—an absolute homerun.

And yet, to earn those returns, you had to stick with it through bear markets (a decline of 20% or more) in three of the last five calendar years—including a greater than 60% drop in 2022. In the other two non-bear-market calendar years (2021 and 2023), NVIDIA’s stock price experienced pullbacks of “only” 18% to 19%.

Tuesday’s results also serve as a reminder that there is more to the market than just tech stocks. While tech stocks stumbled, other pockets of the market gained ground. For example, Real Estate ETF (VNQ) gained 1.2%, and Financials ETF (VFH) was up 0.3%.

The takeaway for long-term investors: Stay diversified.

Inflation Check In

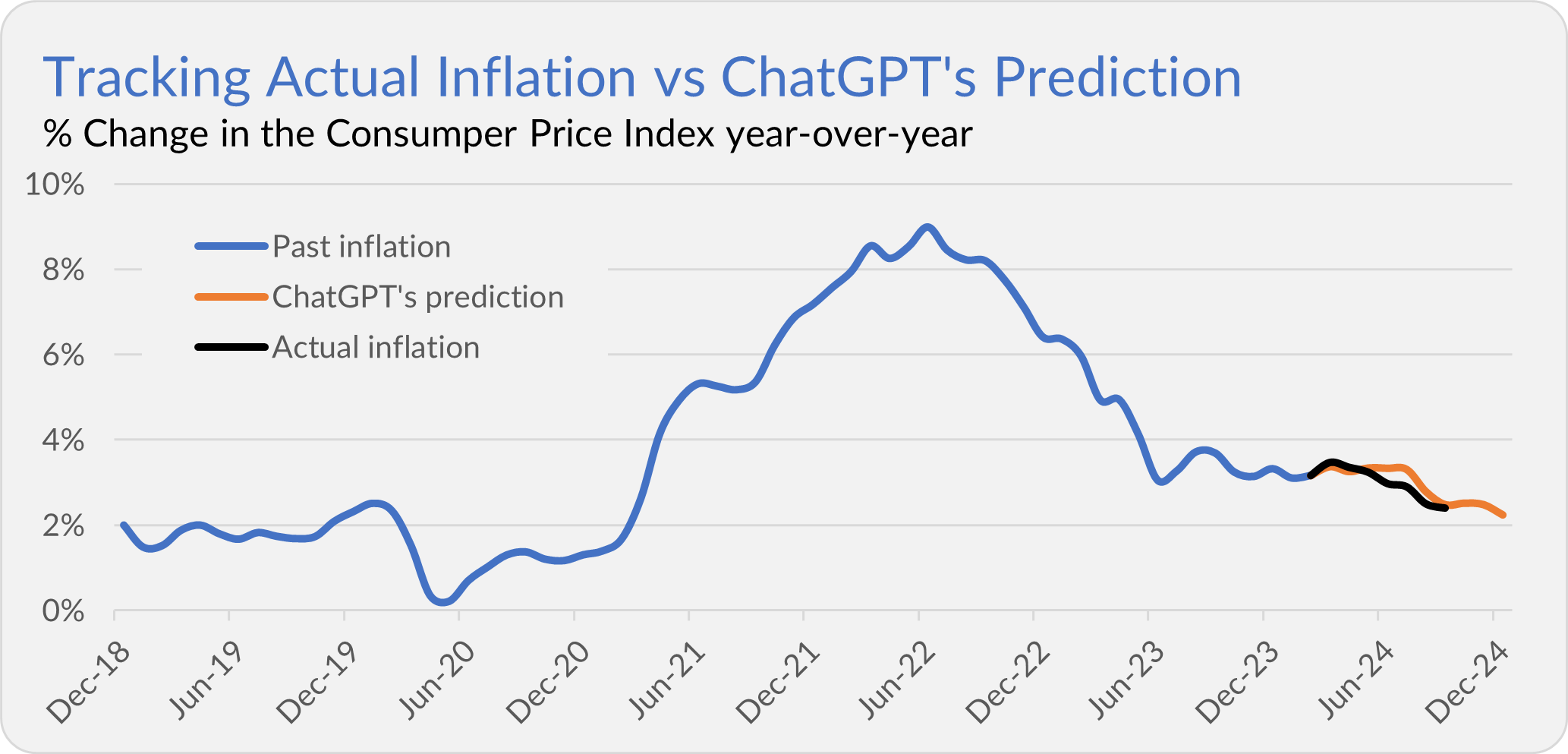

In April, I asked OpenAI's ChatGPT to predict inflation for the rest of the year. Last week, the Bureau of Labor Statistics (BLS) reported that the Consumer Price Index (CPI) was up 0.2% in September and is up 2.4% over the past 12 months.

That’s pretty much spot on with ChatGPT’s expectation of 2.5%. Yes, the computer’s forecast has been pretty darn good. However, as I’ve said, I’m not looking to trade on ChatGPT’s inflation prediction—I’m having a little fun here.

As I said last week, the U.S. economy has made a soft landing—inflation has cooled significantly without a big hit to employment. The recent inflation report doesn’t change that narrative. It also shouldn’t have you making any changes to your long-term investment portfolio!

Our Portfolios

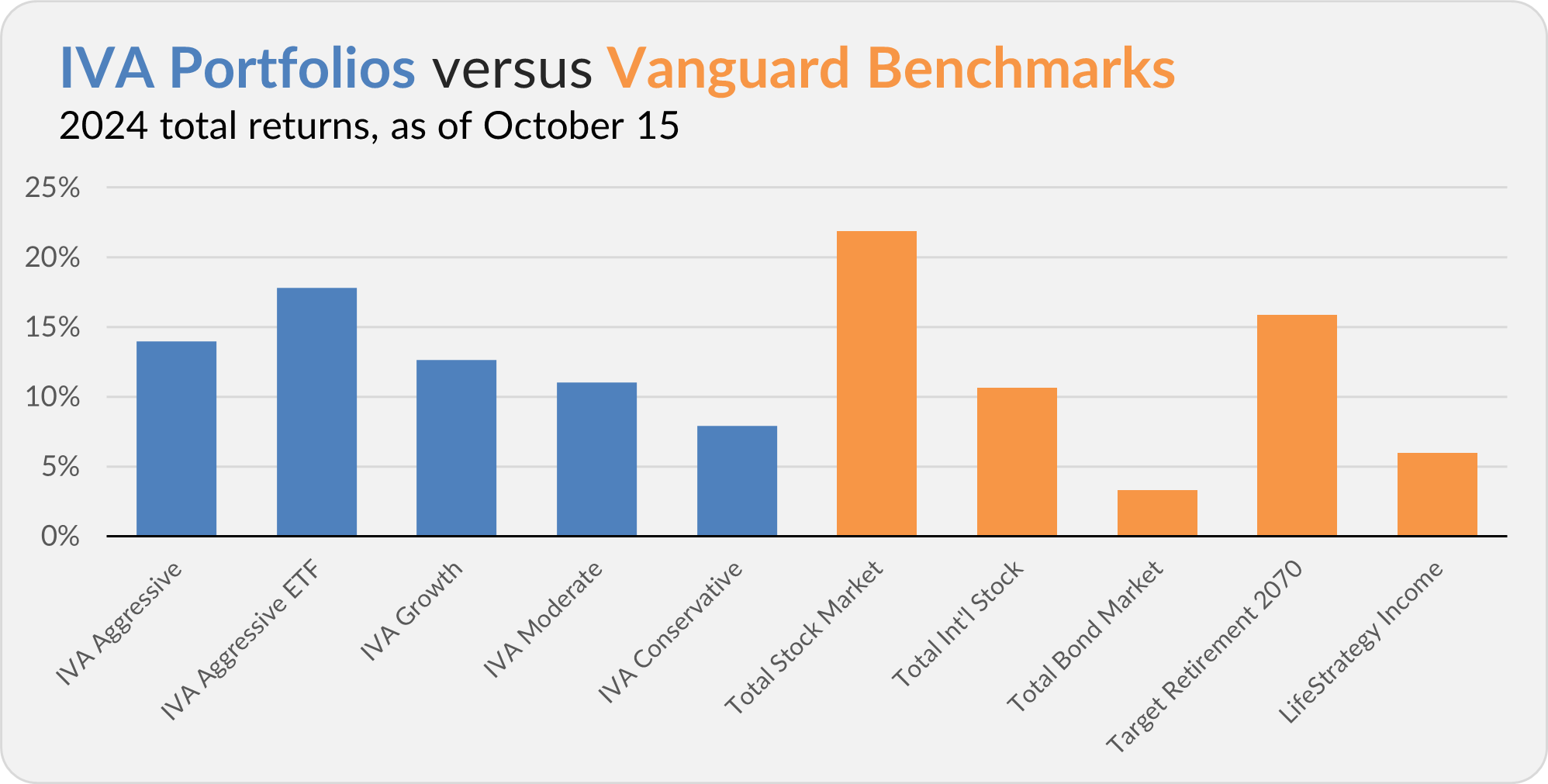

Our Portfolios are showing decent absolute but lagging relative returns for the year through Tuesday. The Aggressive Portfolio is up 14.0%, the Aggressive ETF Portfolio is up 17.8%, the Growth Portfolio is up 12.6%, the Moderate Portfolio is up 11.0% and the Conservative Portfolio is up 7.9%.

This compares to a 21.9% gain for Total Stock Market Index (VTSAX), a 10.6% return for Total International Stock Index (VTIAX), and a 3.3% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 15.9% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 6.0%.

IVA Research

Yesterday, in Total Return Eats Income’s Lunch, I showed Premium Members how to use shares of 500 Index to recreate High-Yield Corporate’s (VWEHX) monthly income stream—and still come out ahead.

And if you missed it, check out last week’s article detailing my search for Vanguard’s best income fund.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.