Hello, and welcome to the IVA Weekly Brief for Wednesday, November 27.

There are no changes recommended for any of our Portfolios.

Investors have much to be thankful for this year as gains have been widespread.

The “big” asset classes—stocks, bonds and cash—are up this year. Total Stock Market Index (VTSAX) has gained 27.4%, Total International Stock Index (VTIAX) has returned 6.6%%, Total Bond Market Index (VBTLX) is up 2.4% and Federal Money Market (VMFXX) has gained 4.8%.

Look beyond the basic portfolio building blocks, and you’ll see gains, too. Real Estate Index (VGSLX) is up 14.2%, and Commodity Strategy (VCMDX) is up 4.9%. Bitcoin has gained a whopping 115% this year.

Only five Vanguard funds are in the red this year, and four are long-maturity bond funds. The worst performer has been Extended Duration Treasury ETF (VDE), with a 6.6% decline. So, if you avoided long-maturity bonds, you’ve likely made money this year. And even the losses haven’t been too dramatic.

As I said, there’s plenty to be thankful for this year. But let’s turn our attention to Malvern, PA. It may be a holiday week, but I have plenty of Vanguard news.

New Cash-like Options

Last week, I told you to expect Vanguard to introduce more exchange-traded funds (ETFs). Well, on Friday, Vanguard filed with the SEC to launch two new bond ETFs in early 2025.

Ultra-Short Treasury ETF (VGUS) will hold Treasuries with maturities of less than 12 months. As the name makes clear, 0-3 Month Treasury Bill ETF (VBIL) will only own the shortest Treasury bills.

Both are index-based, not actively managed, and expected to charge 0.07% in expenses. Vanguard says the ETFs are “intended to help investors manage their short-term liquidity needs.”

Neither of these ETFs is exactly innovative.

For example, 0-3 Month Treasury Bill ETF enters a crowded space. You can already buy SPDR Bloomberg 1-3 Month T-Bill ETF (BIL) or iShares 0-3 Month Treasury Bond ETF (SGOV)—both are around $30 billion funds, which gives you an idea of Vanguard’s “other” motivations here. Also, there’s the U.S. Treasury 3 Month Bill ETF (TBIL), which holds the current 3-month Treasury bill, and WisdomTree’s Floating Rate Treasury ETF (USFR) plays in the same sandbox.

I could go on, but I think you get the idea.

While it’s not groundbreaking, I like the addition of 0-3 Month Treasury Bill ETF to Vanguard’s stable because it offers an alternative to Vanguard’s money market funds. (Not that there’s anything at all wrong with Vanguard’s money market funds.)

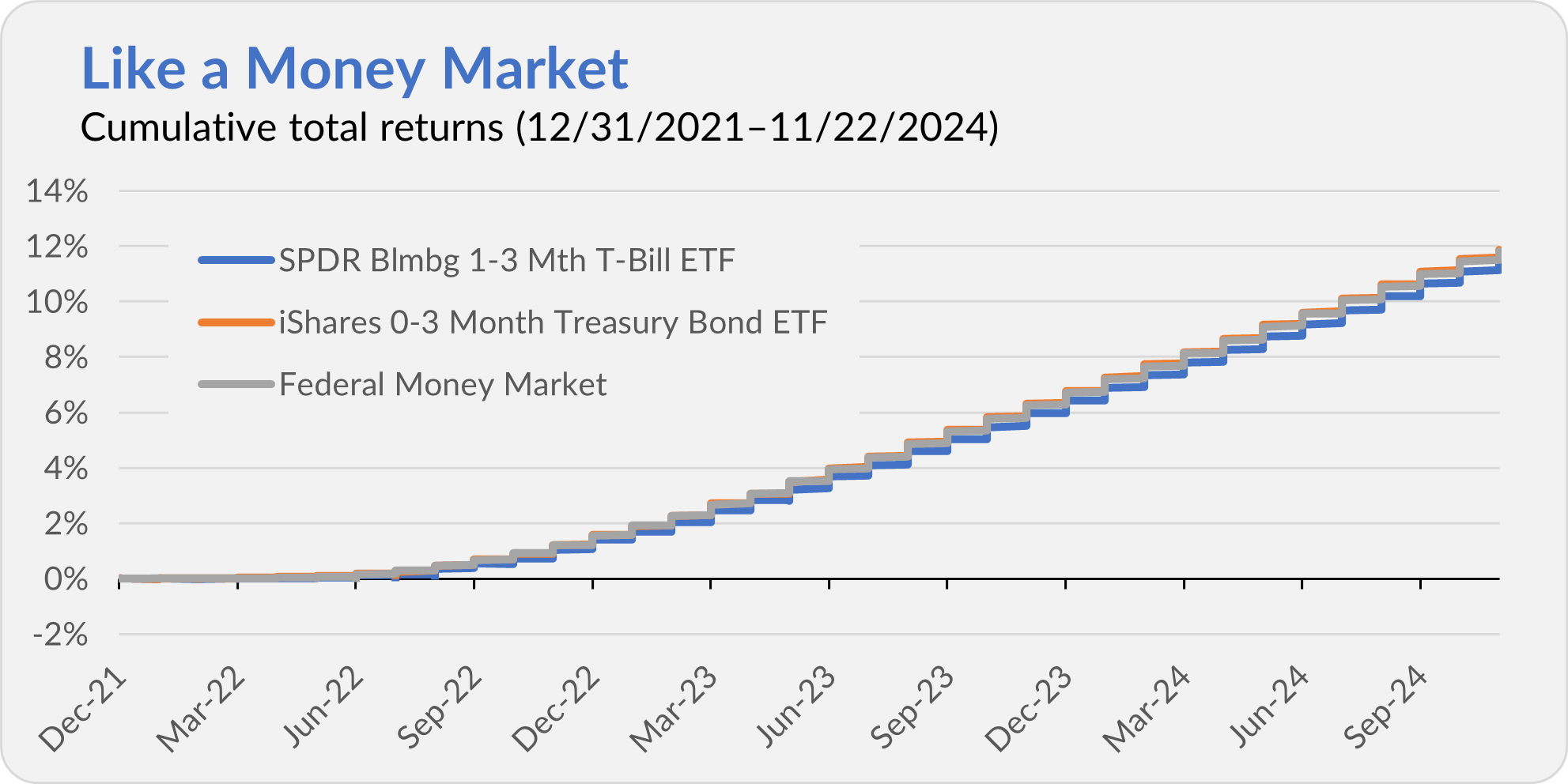

The chart below shows how the SPDR and iShares Treasury bill ETFs performed over the past (roughly) three years alongside Federal Money Market (VMFXX). All three funds followed essentially the same path to the same destination.

So, if you are an ETF investor or don’t want to own a money market fund, then 0-3 Month Treasury Bill ETF will be a solution. (Of course, this solution already exists, just not with a Vanguard label.) To be clear, 0-3 Month Treasury Bill ETF won’t be a money market fund—its price will fluctuate—but the new ETF could fill a similar role in your portfolio.

Ultra-Short Term Treasury ETF might be a good spot to park cash you don’t need immediately but want to keep safe. However, I suspect it will be less popular than its T-bill sibling. Also, why Vanguard didn’t just name it 0-12 Month Treasury ETF is beyond me. So, now we have an “Ultra-Short” Treasury ETF that isn’t the shortest Treasury ETF in Vanguard’s stable. I’m sure that won’t cause any confusion …

I’ll discuss the new ETFs when they launch, but that’s what you need to know for now.

We Get to Vote

We Vanguard owners finally get to vote!

For the first time in my memory, Vanguard is holding a shareholder vote to elect a Board of Trustees for our funds. I’m emphasizing trustees because the Board of Trustees is technically distinct from the Board of Directors.

Vanguard, on its website, says that the board of directors is …

responsible for setting broad policies for the company; monitoring the company’s financials, operations, compliance, risk management; and electing officers.

Meanwhile, in response to my inquiry, Vanguard said that the Boards of Trustees …

oversee the funds on behalf of fund shareholders, including oversight of the funds’ advisors, performance, and risk management.

The distinction is that the directors oversee Vanguard, the company, while the trustees oversee the funds (on our behalf). Frankly, I tend to use the terms (directors and trustees) interchangeably, but I’ll be more careful about this in the future.

I’m still waiting for Vanguard to respond to a few clarifying questions, but here’s how I understand the upcoming proxy vote. I’ll provide an update if needed.

Voting begins today, November 27 and runs through February 26, 2025, when Vanguard will host a virtual “Joint Special Meeting of Shareholders.” Thirteen nominees made the ballot for the Boards of Trustees:

Vanguard CEO Salim Ramji; nine current independent trustees: Tara Bunch, Mark Loughridge, Scott C. Malpass, Lubos Pastor, André Perold, Sarah Bloom Raskin, Grant Reid, David Thomas, and Peter Volanakis; and three new trustees, John Murphy, Rebecca Patterson and Barbara Venneman.

John Murphy, Coca-Cola’s president and CFO, became a director (but not a trustee) this summer. Patterson, who recently served as chief investment strategist at Bridgewater Associates (the world’s largest hedge fund), and Venneman, previously the global head of Deloitte Digital, will join the board of directors in February.

Greg Davis, Vanguard’s CIO and current director, is notably absent from the trustee nominees. Longtime trustees Emerson Fullwood and Joseph Loughrey are also missing from that list. All three appear to still sit on the board of directors.

So, while every trustee will be a director, not every director will be a trustee. Go figure.

You may be wondering why we are voting now. After all, in 2023, when Lubos Pastor joined the fold, he was elected to both the board of directors and the board of trustees. I don’t remember a proxy vote for his election, so the existing board members must have elected for us.

I hope Vanguard will shed some light on this, but if I had to guess, we’re voting now because enough trustee seats are being shuffled that it counts as a material change.

Premium Members can read more about Vanguard’s board and their investment alongside us, the fund shareholders, here.

No Longer an ETF-of-ETFs

Vanguard will slightly tweak its approach at Total Corporate Bond ETF (VTC). To date, Vanguard has held three ETFs—Short-Term Corporate Bond ETF (VCSH), Intermediate-Term Corporate Bond ETF (VCIT) and Long-Term Corporate Bond ETF (VCLT)—in an effort to track the index and provide “total” exposure to the corporate bond market.

Starting in March, the Total fund will no longer own a mix of the three ETFs but will invest directly in individual bonds.

Vanguard should be able to make this transition without any adverse tax implications. First, Total Corporate Bond ETF has a net unrealized loss on the books—even if it sold all its holdings for cash, it wouldn’t pay a capital gain. Second, Vanguard can do an in-kind transfer, which means accepting the underlying bonds in exchange for the ETF shares.

The bottom line for shareholders is that I doubt they’ll even notice the change.

An Incomplete Grade

Over the summer, I told you that Vanguard (in keeping with SEC requirements) had drastically cut down its semi-annual and annual reports.

So far, I’ve only seen semi-annual reports under the new format. I’ve been waiting for the new annual reports to learn how much fund commentary—arguably the most helpful part of the reports—we would get.

Well, I just received a batch of annual reports from Vanguard. I’m pleased to report that the annuals include some commentary, though it is much more “concise” than in the past.

For example, International Core Stock’s (VZICX) annual report is attached.

It’s helpful in some respects. It reaffirms the managers’ intent to let stock picking drive returns:

In each market, outperformance was driven by stock selection, as the Fund’s regional allocations essentially mirrored those of its benchmark.

However, to glean that insight, you must know the fund’s strategy (that the managers typically keep regional bets to a minimum) and read a little between the lines. Vanguard could make this easier—not everyone has spent two decades reading mutual fund commentaries!

A more significant issue is that the commentary does not mention Ken Abrams’ departure from the fund at the end of June 2024. Even if his departure was well-planned for and communicated beforehand, that’s a material event during the reporting period that ought to be mentioned. (If you ask me anyway.)

I’m all for concise reports that shareholders will read, but less isn’t always more.

Our Portfolios

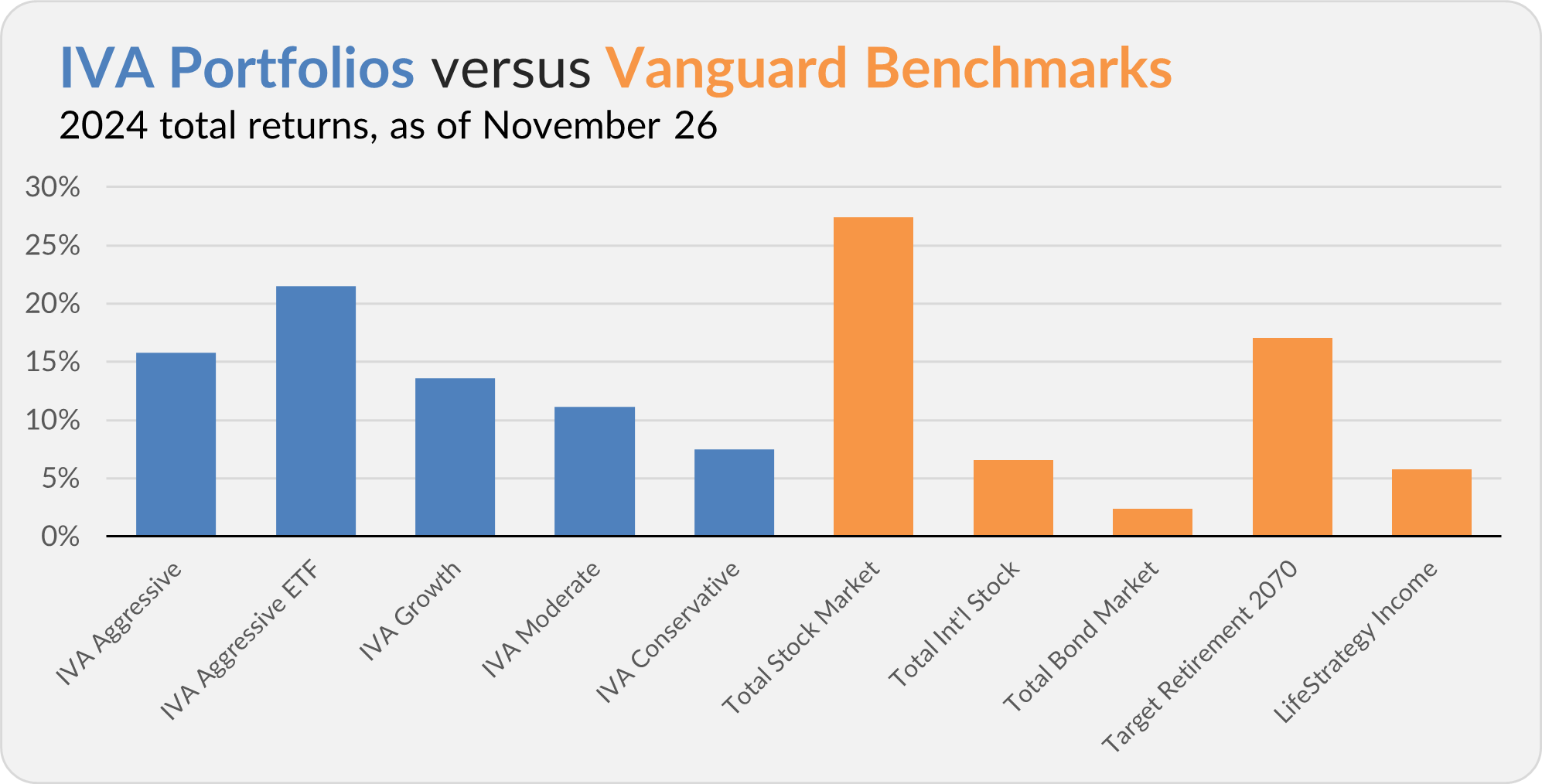

Our are showing solid absolute returns for the year through Tuesday. The Aggressive Portfolio is up 15.8%, the Aggressive ETF Portfolio is up 21.5%, the Growth Portfolio is up 13.6%, the Moderate Portfolio is up 11.1% and the Conservative Portfolio is up 7.5%.

This compares to a 27.4% gain for Total Stock Market Index (VTSAX), a 6.6% return for Total International Stock Index (VTIAX), and a 2.4% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 17.0% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 5.8%.

IVA Research

Yesterday, in Buying’s Easy. Selling Your Bond Fund Isn’t., I showed Premium Members how they’ll receive the income they deserve when selling a bond mutual fund (or ETF) in the middle of the month.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future, and a very happy Thanksgiving.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.