Hello, and welcome to the IVA Weekly Brief for Wednesday, April 23.

🚨🚨Yesterday, I recommended trades in all of the IVA Portfolios. Premium Members received a separate Trade Alert email explaining the trades and my reasoning behind them. 🚨🚨

Are you interested in a Premium Membership? Start your free 30-day trial now.

Keep Perspective

On Monday night, the Wall Street Journal ran a headline warning, “Dow Headed for Worst April Since 1932.” It’s never a good thing from a market or economic perspective if an event is compared to the depths of the Great Depression. But let’s be clear: while headlines like this are attention-grabbing, they’re often more about sensationalism than substance. This is just a case of playing with numbers to craft a dramatic story.

Remember, the Dow Jones Industrial Average (Dow) is an outdated, flawed index. Stocks are weighted based solely on their price. For example, Goldman Sachs and UnitedHealth, which sell for around $545 and $435, respectively, are weighted two to three times higher than Apple and Amazon, which sell for around $205 and $185, respectively.

The tech giants’ trillion-dollar market caps (share price times shares outstanding, a better measure of a company’s size in the market than its share price) count for nothing in this relic of an index. Any stats about the Dow should be taken with a massive grain of salt.

Also, read that headline again. The worst “April.” Who cares if it’s the worst April? That doesn’t really tell us much.

Here’s the correct perspective: The Dow’s 9.1% decline in April (as of Monday’s close when the article was published) clocks in as the 53rd-worst month for the index since 1900. But, well, “Dow Headed for 53rd-Worst Month Since 1900” wouldn’t generate as many clicks!

And of course, the month of April isn’t over. We still had seven trading days to go when the article was written. The Dow rallied 2.7% on Tuesday, trimming its April decline from 9.1% to 7.9%. So, let’s not get ahead of ourselves.

Remember, headlines are designed to entertain, grab attention and drive business for the media outlet, not to provide context and long-term investment perspective or, heaven forbid, advice.

All that said, April has been a challenging month for traders and investors. As of Tuesday’s close, 500 Index (VFIAX) was down 5.7% for the month, pulling its 2025 total return down to -9.7%. And that includes the flagship fund jumping 9.5% on April 9—one of its largest single-day returns.

But global diversification is paying off. While U.S. stocks are in the red this month, foreign stocks are holding on to gains. Total International Stock Index (VTIAX) is up 0.1%.

It’s the same story in the bond market. U.S. bonds are down, but foreign bonds are up: Total Bond Market Index (VBTLX) is down 1.1% in April, while Total International Bond Index (VTABX) is up 1.3%.

Stock markets rallied on Tuesday and are rising this morning while I’m typing, as President Trump backed away from his threat to fire Fed Chair Powell and suggested that nosebleed-level tariffs on China “will come down substantially.”

As I’ve mentioned before, the tariff story is far from over—many chapters are still left to unfold. Negotiating trade deals takes about 18 months, according to Apollo’s Torsten Slok (here). Yet, the administration only has about 75 days left to strike agreements with dozens of nations before higher “reciprocal” tariffs go into effect. And that’s on top of negotiating with China and evaluating tariffs on semiconductors, electronics and pharmaceuticals. That’s a hefty workload!

Meanwhile, the impact of tariffs and uncertainty is starting to show up in the data. For example, recent regional manufacturing surveys from New York and Philadelphia show a slowdown in activity alongside rising prices.

As I’ve said, diversification is a long-term investor's friend in times of uncertainty.

It’s a Bond, Bond World

Vanguard keeps plugging holes in its bond ETF lineup.

Last week, the fund giant filed with the SEC to launch Total Inflation-Protected Securities ETF, set to debut in July. The fund will charge a rock-bottom expense ratio of just 0.05%. Vanguard’s go-to guy for bond indexing, Joshua Barrickman, will run the fund, aiming to track the ICE U.S. Treasury Inflation Linked Bond index. Put simply, the ETF will invest in Treasury Inflation-Protected Securities (TIPS) across the full maturity spectrum.

As I said, the new ETF fills a hole for ETF investors—Vanguard’s only other inflation ETF is Short-Term Inflation-Protected Securities ETF (VTIP). The fund’s launch also sets off a horse race between man and machine—the new ETF will compete with the actively-managed Inflation Protected Securities (VIPSX).

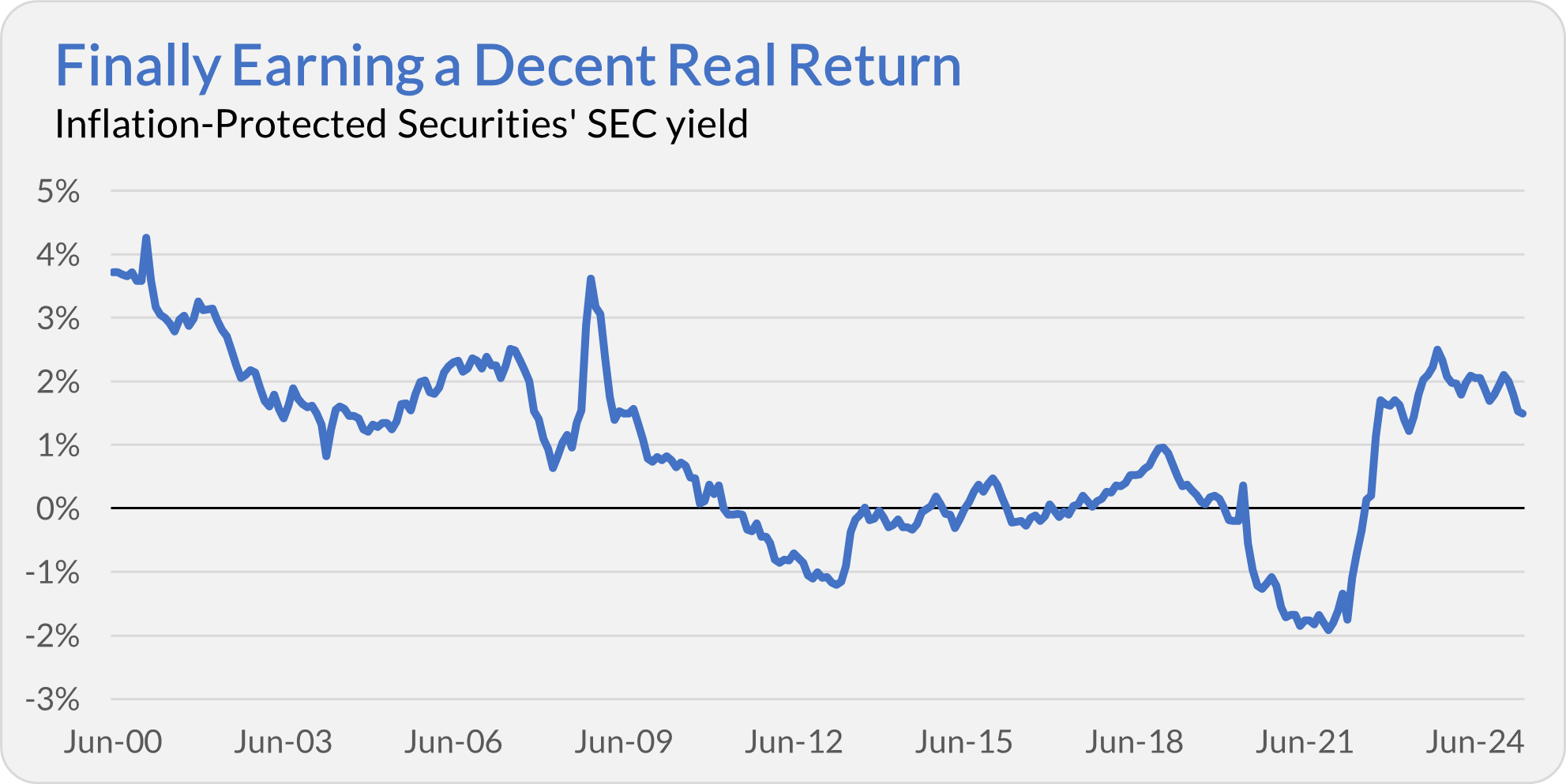

TIPS have become more popular lately because they are priced to deliver inflation-beating returns for the first time in roughly a decade.

Premium Members can read a full rundown on TIPS here. The short story is that TIPS are like traditional Treasury bonds, but their income adjusts to keep up with inflation. So, Inflation-Protected Securities’s 1.49% SEC yield tells you the fund should return 1.5% after inflation in the years ahead.

As you can see in the chart above, for most of the 2010s, when interest rates were pinned at the near-zero bound, Inflation-Protected Securities sported a negative yield. This meant that it was falling short of inflation.

Given the uncertainty in today’s markets, some investors are eyeing TIPS and concluding that locking in a 1.5% return above inflation is a good deal. I agree it’s a better offer than what was on the table. Still, I’m not ready to jump in just yet. That said, I am watching the funds closely.

This isn’t a flashy launch, but giving ETF investors a broad-based TIPS option makes sense. Maybe a Total Treasury Bond ETF is next… Or how about a high-yield bond ETF?

Vanguard’s New PR Chief

Allow me to extend a belated welcome to Rebecca Loveridge, Vanguard’s new head of public relations (PR). Loveridge was reportedly appointed on March 17, though I don’t recall seeing an official press release. She brings two decades of experience to the position, most recently with PR firm Ketchum. She’s also the founder of Bitches Who Brunch—suggesting she’s not just a seasoned professional, but also someone with a personality and a life beyond the office.

Perhaps the most intriguing detail is that Loveridge will be based in New York. In the past, senior roles like this were tethered to Vanguard’s Malvern, PA headquarters. Could this signal a shift in approach under new CEO Salim Ramji? Or is it simply a reflection of the times, as remote work and dispersed teams become the norm?

As usual, the answer is likely a bit of both.

Our Portfolios

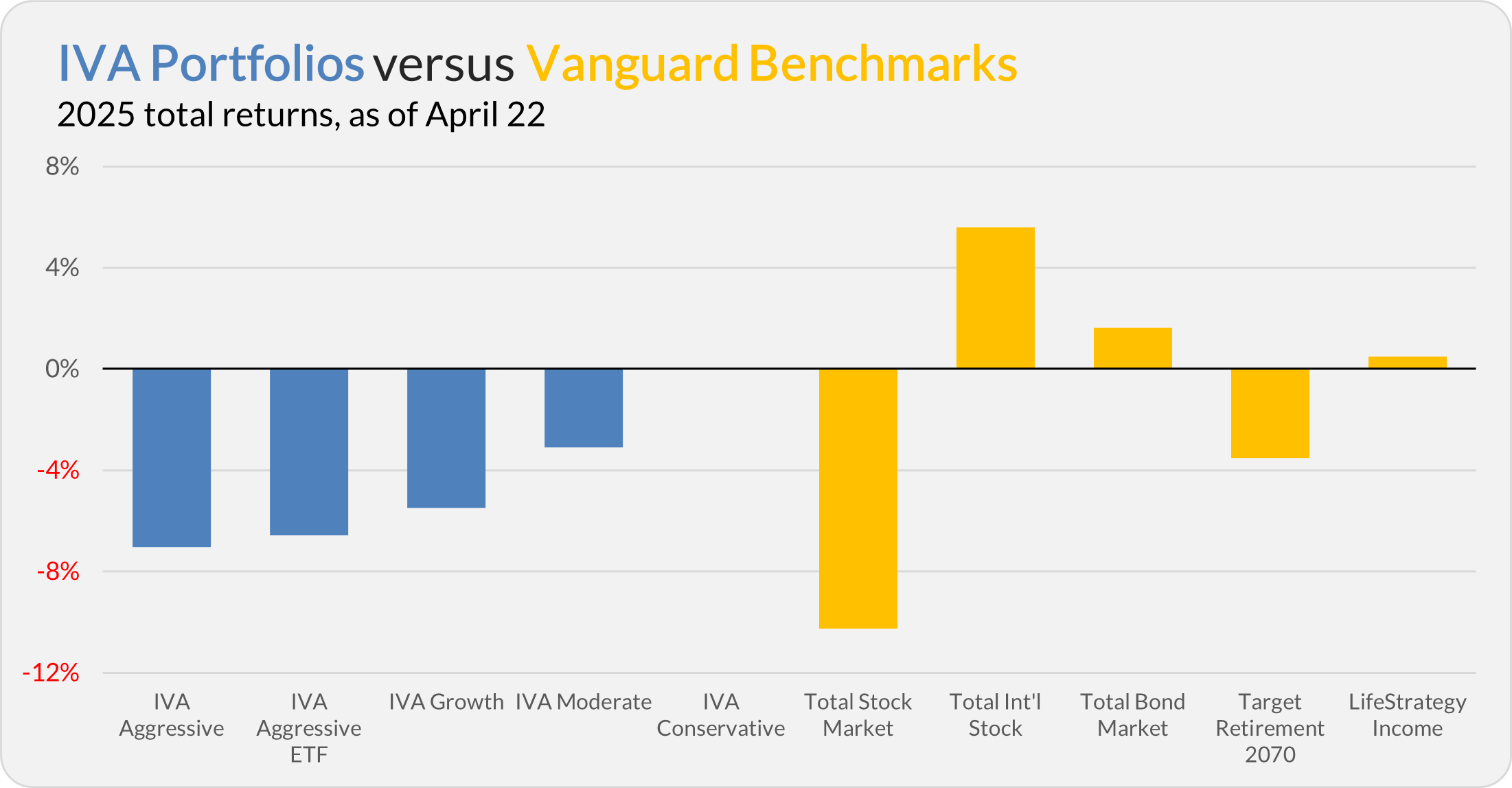

Our Portfolios are down but holding up relatively well this year. As of Tuesday’s close, the Aggressive Portfolio is down 7.0%, the Aggressive ETF Portfolio is off 6.6%, the Growth Portfolio is down 5.5%, the Moderate Portfolio is off 3.1% and the Conservative Portfolio is flat (0.0%).

This compares to a 10.2% decline for Total Stock Market Index (VTSAX), a 5.6% gain for Total International Stock Index (VTIAX), and a 1.6% return for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is off 3.5% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 0.5%.

IVA Research

Yesterday, I sent Premium Members a Trade Alert and analyzed Vanguard’s cash solutions.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.