Hello, and welcome to the IVA Weekly Brief for Wednesday, January 29.

There are no changes recommended for any of our Portfolios.

As I’ve said, it’s the risks we aren’t expecting that trip up the market.

For weeks, traders have been second-guessing how many times Federal Reserve policymakers will lower the fed funds rate in 2025. But now, even though Fed Chair Powell and colleagues are meeting today and will most likely sit on their hands (hold interest rate policy steady), hardly anyone is talking about it.

Or take President Trump’s return to the Oval Office and envelope-pushing first week. It has undoubtedly demanded a lot of attention, but everyone knew what was coming, and the markets took it in stride.

What didn’t traders see coming?

DeepSeek—a Chinese artificial intelligence (AI) model as good as anything in the U.S. but (reportedly) built at a fraction of the cost without using the very best chips. There’s some uncertainty around DeepSeek's claims (for example, around which chips they used) as this wasn’t supposed to be possible!

The narrative was that U.S. tech giants had an insurmountable lead in the AI race—in terms of scale, dollars spent and access to the most advanced chips. Over the weekend, that narrative unraveled, and so did the stock market on Monday.

NVIDIA’s stock fell 17% on Monday—erasing nearly $600 billion from the chip marker’s valuation. Information Technology ETF (VGT) fell 5.2% and 500 Index (VFIAX) dropped 1.5% on the day.

As I explained to Premium Members on Tuesday, diversification delivered for disciplined investors as the goose that laid the golden market egg lost its footing. Out-of-favor funds like Dividend Growth (VDIGX), U.S. Value Factor ETF (VFVA) and Real Estate ETF (VNQ) gained ground as the “market” (500 Index) fell. I’m pleased to report that my Portfolios materially outperformed on Monday.

Of course, technology stocks rebounded on Tuesday—Information Technology ETF gained 3.1%. Frankly, that doesn’t come as a surprise. Traders’ initial reaction to the DeepSeek news was overdone, at least in the near term.

The unanswerable question is whether Monday was just a temporary setback for the AI-driven bull market or if it marks a turning point in the market cycle.

In my book, it’s premature to declare the end of the bull market. As of Tuesday’s close, the S&P 500 index is only 0.8% below the record high it reached on January 23. While Monday was an ugly day for the broad market indexes (and the funds that track them), we haven’t even seen a pullback (a 5% decline) in the market, let alone a correction (a 10% drop).

Some traders will see Monday’s sell-off as a buying opportunity. But, in my eyes, it should be a shot across the bow for investors who may be overly concentrated on the market’s highest-flying stocks. It’s never too late to shift to a more diversified portfolio.

Broken Links

Vanguard has spent money on its technology, such as its redesigned web pages. However, those cleaner designs don’t always translate into better functionality.

One persistent problem IVA readers report is that Vanguard’s site no longer reliably automatically updates information on outside accounts. Previously, you could link a Fidelity (or Schwab or E*TRADE or whatever) account to your Vanguard account, and the holdings and values would update automatically. This allowed you to see your entire portfolio in one place in real-time.

While I never took advantage of this “feature” (I’m more of an Excel geek and like customizing how I track my holdings), I can see how it would be handy… assuming it works. Unfortunately, I’ve heard from multiple IVA readers that it’s not working like it used to.

I tried linking an outside account last night and ran into the following error message:

So much for that experiment. (And yes, I tried it on multiple browsers—Chrome and Edge.)

If there was any doubt, Vanguard still has work to do to deliver on CEO Salim Ramji’s promise of “the most modern technology infrastructure in the industry.”

Our Portfolios

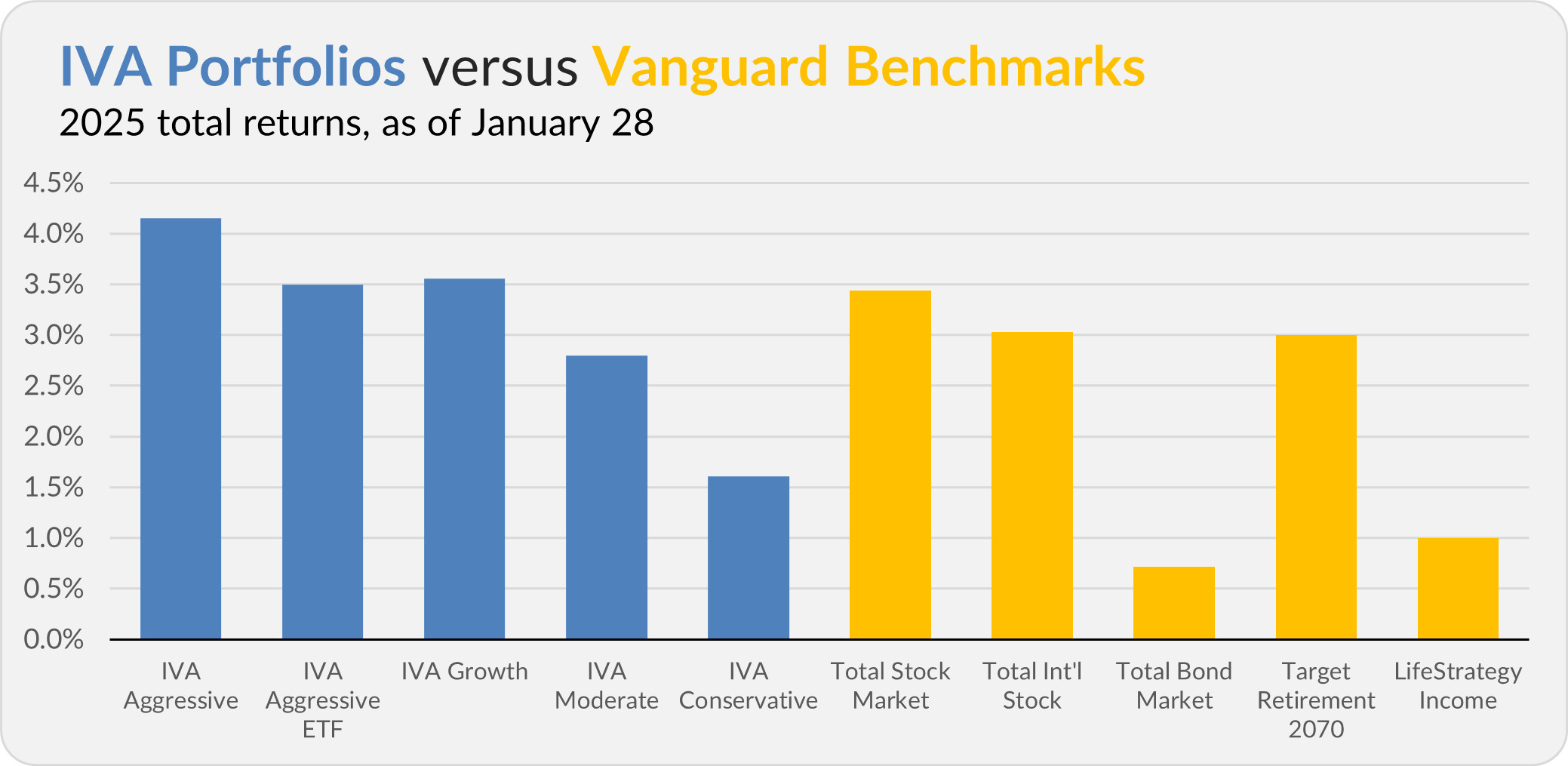

Our Portfolios are off to a strong start this year. Through Tuesday, the Aggressive Portfolio is up 4.1%, the Aggressive ETF Portfolio is up 3.5%, the Growth Portfolio is up 3.6%, the Moderate Portfolio is up 2.8% and the Conservative Portfolio is up 1.6%.

This compares to a 3.4% gain for Total Stock Market Index (VTSAX), a 3.0% return for Total International Stock Index (VTIAX), and a 0.7% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 3.0% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 1.0%.

IVA Research

Yesterday, I published a no-nonsense how-to guide for someone looking to take the first step on their investment journey. The guide was emailed to Premium Members yesterday but is available to anyone. So, please feel free to share it with someone you know—a child, grandchild, neighbor or associate—who needs some help getting started.

In a separate Quick Take, I discussed how my Portfolios fared on Monday’s sell-off with Premium Members.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.