You’ve set aside some savings for a loved one’s education by contributing to a 529 plan. Congrats! Take a moment to pat yourself on the back.

But now, what do you do? How do you invest the money you’ve saved?

That’s the question I’m working toward, but before we consider how to build an investment portfolio for college, we need to take stock of the tools at our disposal. What funds are available to use?

Let’s open the toolbox this week and see what Vanguard has provided college savers with.

If you haven’t started saving for a 529 plan and want to learn more, I covered the basics last week.

Key Points

- Your investment choices are limited, but you can either do it yourself or let Vanguard invest for you.

- Not all Vanguard “plans” are the same.

Where to Find Vanguard

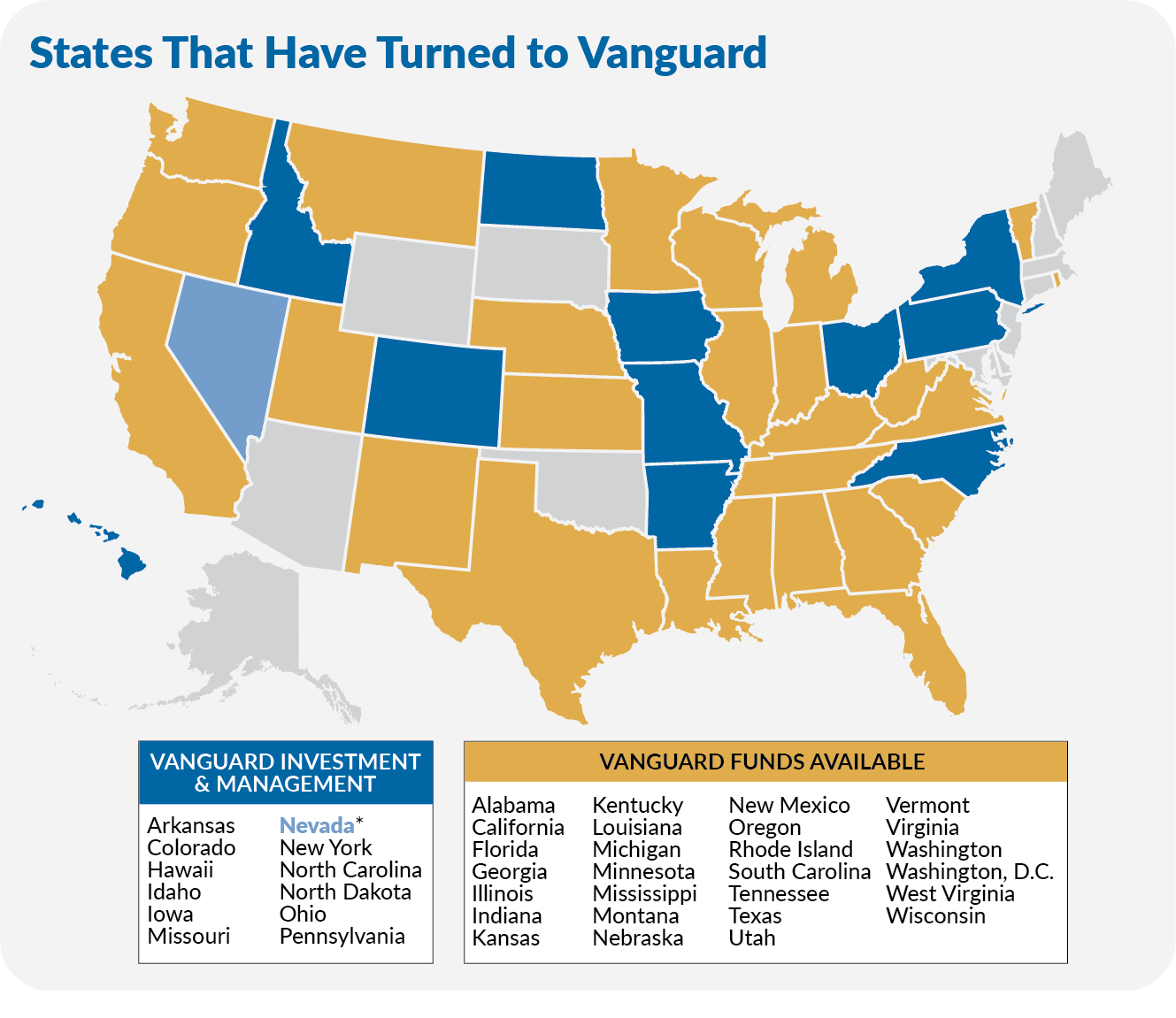

As I told you last week, every state (except Wyoming) offers its own 529 plan. One or more investment groups usually sponsor each plan. Vanguard mutual funds are available in 38 states (plus Washington, D.C.). However, Vanguard is “associated” with plans from 12 states (see the list below), meaning that Vanguard has been hired as the program manager or, as with states like Pennsylvania, is the plan's investment manager.

However, only Nevada’s plan is marketed and sold as “The Vanguard 529 Plan.” I’ll pop the hood on that plan in a moment, but let me first provide an overview of the plans associated with Vanguard.

It’s hard to generalize about Vanguard’s plans because each one is different. To complicate matters, Vanguard changes its mind from time to time on what is the “right way” to invest for college. When it does, it can take years for Vanguard’s latest thinking to permeate all the plans.

For example, in late 2020, in Nevada’s plan (which, again, is “the” Vanguard plan), Vanguard first introduced the Target Enrollment series as a better mousetrap than the age-based track funds. (I’ll discuss these in detail, but think of the Target Enrollment and age-based tracks as Target Retirement funds for college.) It’s now 2024, and half of the plans associated with Vanguard have switched to the Target Enrollment approach while the other half is still using the old age-based tracks.

That said, all of the plans managed by Vanguard offer single-fund choices and multi-fund portfolios. Some multi-fund portfolios are static, while others adjust according to the beneficiary’s age.

You probably won’t be surprised by this, but Vanguard takes an index-heavy approach in the 529 plans it runs. The four total market index funds are the primary building blocks of Vanguard’s age-based tracks, the Target Enrollment series and the pre-built static multi-fund options.

The table below summarizes the 12 plans associated with Vanguard.