You’d think after four decades, Vanguard would have STAR’s (VGSTX) portfolio squared away by now. But no. Vanguard’s original fund-of-funds will transition nearly half its portfolio in the first quarter of next year.

STAR will still have the same basic structure: About 63% of its assets will be invested in a mix of actively managed stock funds, while the rest will be in actively run bonds. So, this is more of an evolution than a revolution.

Here are the three changes Vanguard is making:

First, Explorer (VEXPX) is making way for Dividend Growth (VDIGX).

Second, Vanguard is pulling assets from International Growth (VWIGX) and International Value (VTRIX) to make room for International Core Stock (VWICX).

Third, Vanguard is selling all three of STAR’s bond holdings—GNMA (VFIIX), Short-Term Investment-Grade (VFSTX) and Long-Term Investment-Grade (VWESX)—to create space for the soon-to-be-launched STAR Core-Plus Bond (VCPSX).

This new fund should mimic the existing Core-Plus Bond (VCPIX) fund; however, it will only be used as an internal fund within STAR’s portfolio. (This is akin to the “II” funds, like Total Bond Market Index II, that Vanguard uses within its Target Retirement funds.

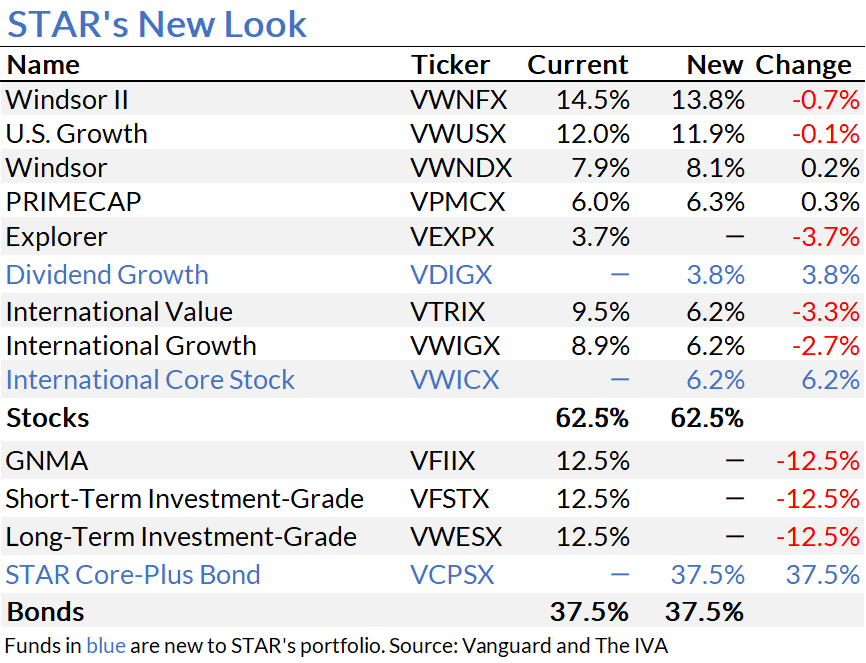

The table below shows STAR’s portfolio today and after the transition.

Vanguard says the moves “are intended to improve outcomes for investors over the long term by bringing additional balance to the fund's equity allocation and increasing flexibility on the fixed income portion.”