Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, January 18th.

There are no changes recommended for any of our Portfolios.

The phoenix is rising. And by that, I mean that, for an approach that was pronounced dead in 2022, the classic balanced portfolio of 60% stocks and 40% bonds sure is getting a lot of press this year. Last week I reported on Vanguard’s recommendation to move away from the 60/40 portfolio in favor of a 50/50 split. Well, I came across two more articles in The Wall Street Journal talking about the 60/40 portfolio—here and here.

BlackRock is on both sides of the argument depending on which article you read. In one, BlackRock is advocating that you should introduce alternative and private investments into the mix. In the other, they say you should have 65% of your portfolio in bonds!

I’m on the record saying the 60/40 portfolio is not broken. One bad year doesn’t negate decades of evidence. Plus, after a year of falling prices, both stocks and bonds are priced to deliver better returns than they were a year ago.

If I’m in agreement with Vanguard on anything it’s that, like Arvind Narayanan, portfolio manager on Intermediate-Term Investment-Grade (VFICX) and host of Vanguard’s other bond funds, said, you don’t need to load up on long maturity bonds as yields are darned good on short- and intermediate-term funds.

And look, so far, the 60/40 portfolio is off to a good start to the year. Balanced Index (VBIAX) is up 3.8% in 2023 while LifeStrategy Moderate Growth (VSMGX) is doing even better, up 4.4%, thanks to an allocation to foreign stocks. My Moderate Portfolio is trailing behind those bogeys a bit but is still showing a decent gain of 3.1% for the year—the position in Health Care ETF (VHT) has detracted the past few weeks.

Like I said, the phoenix is rising for both stocks and bonds. Don’t get caught on the sidelines. Stay invested. Remember that time in the market, not market-timing, is the key to building or preserving wealth.

Inflation Check Up

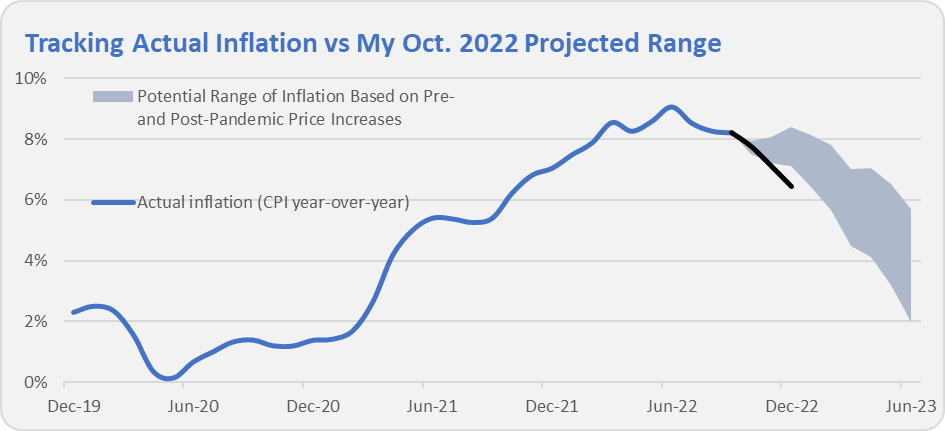

Inflation continues to trend lower. Last week, the Bureau of Labor Statistics (BLS) reported that consumer prices fell 0.1% in December—the first monthly decline since the COVID lockdowns outside of a tiny blip in July 2022. Over the past year the Consumer Price Index (CPI) is up 6.5%. As you can see in the chart below, inflation is tracking below the range I set out two months ago. I’m more than happy see inflation “miss” on the low end in this situation.

Why Can’t Vanguard Get Its Service Right?

I’m fielding more and more calls from Vanguard investors who can’t believe how terrible Vanguard’s service is. And for some, the mistakes Vanguard is making are getting expensive.

For instance, there’s the investor who asked for their RMD to be taken from their Individual 401(k), held at Vanguard, and moved into a taxable account also held there. First Vanguard said “sure,” then came back and said they could only issue a check and the investor would have to reinvest the money. Then Vanguard issued four checks, one each from the funds that were being sold. Two days later they issued four more checks, but this time made out to the 401(k) from which they were being withdrawn.

After calling Vanguard, being assigned a case number and being told it would be fixed and a phone call would be forthcoming, well, you know the story: No resolution. No phone call. No nothing. These shareholders are now considering Fidelity.

Another investor says that Vanguard missed paying out an RMD before year-end because, in moving their accounts from the old mutual fund platform to the brokerage platform, the system shut off the withdrawal mechanism.

Also, another investor says that after a botched transaction, Vanguard promised to fix it and would call them back. Crickets!

Finally, Dan’s wife has had her own issues with Vanguard. She received an email from vanguardinvestments@vanguard.com saying that after multiple attempts to log into her account she was being locked out. Given that she no longer has accounts at Vanguard, having moved all of her investments to Fidelity, this seemed weird.

Dan checked with his Flagship advisor who said to forward the email to phish@vanguard.com and that an answer would be forthcoming. That was on January 3. So far, no answer. But the email was a little weird because its subject line said “Security Disabled” which (obviously) is not what the email said had happened. I’m not holding Vanguard accountable for the bad actor, but where is the follow up and follow through?

Clearly, Vanguard’s service operation is completely overwhelmed, promising call backs and responses and providing none.

As Dan always likes to say, “It’s your money, and no one will pay more attention to it than you. So, stay focused.”

Speaking of our money, our Portfolios are showing decent returns for the year through Tuesday. The Aggressive Portfolio is up 4.6%, the Growth ETF Portfolio has gained 3.8%, the Growth Portfolio is up 4.0%, the Moderate Portfolio has returned 3.1% and, finally, the Conservative Portfolio has advanced 2.7%. This compares to a 4.4% gain for Total Stock Market Index (VTSAX), a 7.2% return for Total International Stock Index (VTIAX), and a 2.8% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 5.2% for the year and its most conservative, LifeStrategy Income (VASIX), is up 3.2% for the year. Vanguard’s poster child for diversified portfolios, representing the firm’s best thinking, Managed Allocation (VPGDX) is up 3.5%.

Until my next Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.