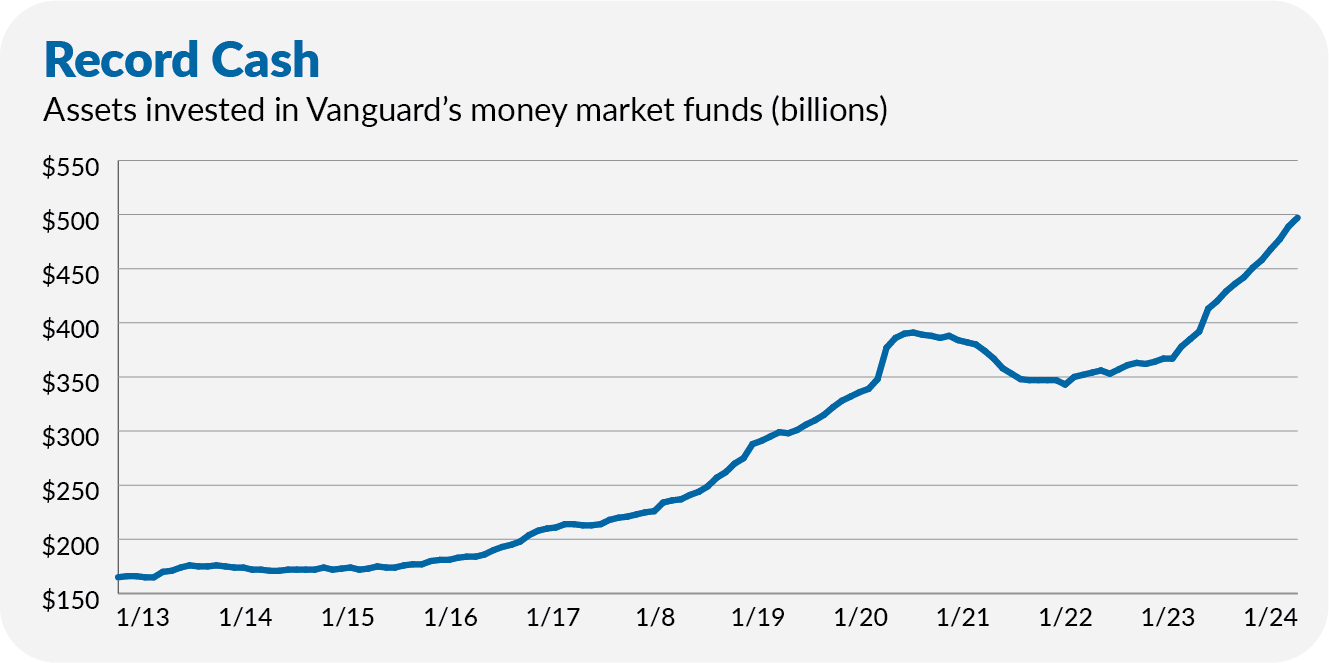

Savers have never had more stashed away in money market funds than they do today. Assets in Vanguard’s money market funds have nearly hit $500 billion for the first time. It’s not just a Vanguard phenomenon. According to the Investment Company Institute (ICI), assets in all money market funds crossed $6 trillion—a record.

Vanguard’s three taxable money market funds offer the ability to earn more than 5% with zero risk—I understand the appeal. But it’s not just money market funds that are getting attention.

Vanguard recently made changes to Cash Plus Account and made it available to all comers. And not to be forgotten, last week, I received an email from Vanguard advertising Cash Deposit—telling me, “Now there's a new option for your settlement fund.”

With the policymakers at the Federal Reserve expecting to cut the fed funds rate in the months ahead and at least one sizeable regional bank under pressure (New York Community Bank), now is an opportune time to review Vanguard’s various cash-management solutions.

Most of our time and attention at The IVA is spent on investing for the long term. As a result, I focus on Vanguard’s stock and bond funds. But it is hard to invest long-term if you don’t have a solid foundation to build upon.

Cash, as a money management tool, forms that foundation. So, I will focus on Vanguard’s cash solutions for the next few weeks.

This week, I will discuss Vanguard’s “immediate cash” options. In my book, that means investments or accounts that provide daily liquidity and dollar-in/dollar-out services. Specifically, I will try to make sense of Vanguard’s five money market funds and its two cash FDIC-insured sweep-account products—Cash Deposit and Cash Plus Account.

Key Points

- Vanguard’s money market funds are rock-solid

- Stick with Federal Money Market over Cash Deposit for your settlement fund

- Cash Plus Account has potential but falls just short

Next week, I’ll analyze the cash options available within Vanguard’s 529 Plan and Annuity programs.

After that, I’ll give you my take on building a cash management program. The critical question is whether you need every penny to be “guaranteed.”

Finally, I’ll test my long-held view of cash as a money management tool, not an investment. Is there a place for cash in a long-term investment portfolio?

Or, at least, that’s the plan. I’ve started researching all those topics, but I’m not done yet. So, we’ll see where the data takes us!

Square One

Let’s start at the beginning. For most investors, money market funds are equivalent to cash. Money market funds own high-quality short-maturity bonds and are designed to provide a stable price or net asset value (NAV) of $1.00, day in and day out.

In other words, if you put in a dollar today, you can take out a dollar tomorrow. A significant advantage to owning a money market over stuffing cash under your mattress is that money market funds usually pay income.

Today, money markets offer the opportunity to earn a decent yield (around 5%) with zero price volatility. Earning a yield is nice—and driving the flows we are seeing today—but that stable NAV is the defining attribute of money market funds.

Savers can (and did) stomach earning nothing on their cash holdings. But losing even a penny is not an option. So, let’s start with safety.

Safety First …

Vanguard’s money market funds are rock-solid.

The potential for one of Vanguard’s funds to “break the buck”—trade below the sacred $1.00 NAV—is simply not on my list of worries. In part, you can thank Vanguard’s low-cost advantage, which means the portfolio managers tending to your cash can keep risk low and still offer competitive yields. That’s a win-win for all of us.

Additionally, Vanguard has been running money market funds without a misstep since the 1970s. They are committed to ensuring their money market funds always trade at $1.00. Consider that the firm waived millions of dollars in fees during years when interest rates were near zero to keep money market yields after fees above 0%. (A drop below a 0% yield would’ve pulled their NAVs below $1.00.)

This “sponsor” commitment isn’t idle talk, either.

Technically, only two money markets have ever broken the buck—the Primary Reserve Fund in 2008 and the Community Bankers US Government Fund in 1994. However, according to the New York Fed, 28 other money market funds would’ve broken the buck in September 2008 if the firms behind the funds hadn’t stepped in.

On the one hand, that sounds scary. However, based on this paper from the Federal Reserve Bank of Boston (and confirmed by Vanguard), Vanguard did not have to step in to prop up their money market funds. I find that reassuring.

More broadly, remember that we are talking about the Global Financial Crisis, when the credit markets locked up as never before … and still, only one fund broke the buck.

Plus, the regulatory environment around money markets has tightened since then. Vanguard’s three taxable money market funds—Treasury Money Market (VUSXX), Federal Money Market (VMFXX) and Cash Reserves Federal Money Market (VMRXX)—are now all heavily loaded with government-backed securities.

In short, Vanguard’s money markets are as safe as they come. Let’s talk about yields.

… Yield Second

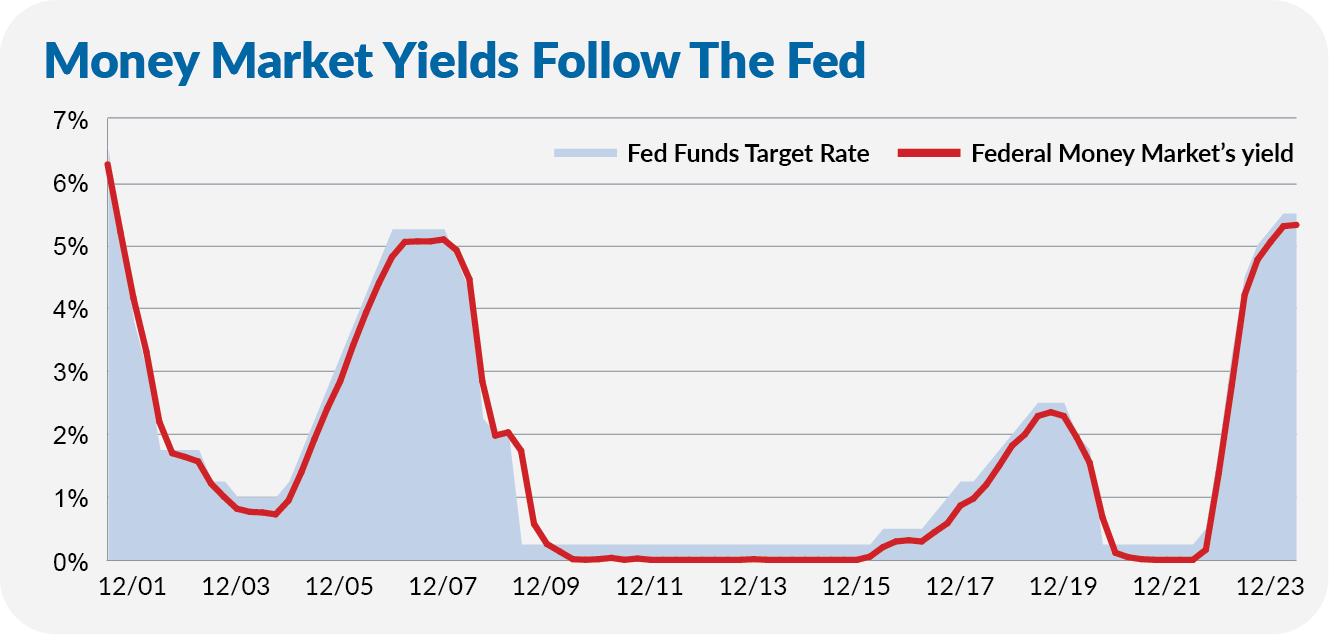

Money market yields closely track the fed funds rate. You can see this clearly in the chart below plotting Federal Money Market’s yield against the fed funds target rate over the past two decades. (I’m using quarterly data here.)

It's good for money market investors when the Fed raises the fed funds rate, but what goes up can also come down. Today’s attractive yields could prove fleeting if the economy stumbles and the Fed begins to cut the fed funds rate.

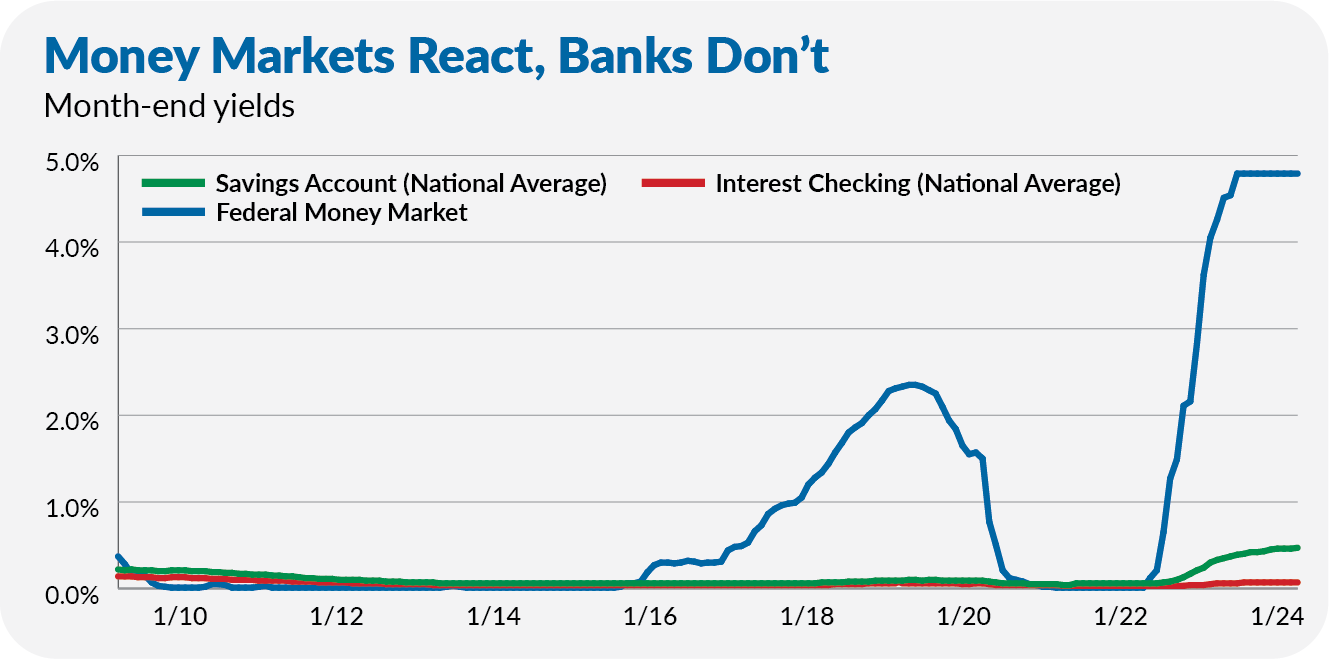

Even if the fed funds rate comes down in the quarters ahead, money market yields are still miles above what you can earn from most bank products—think checking and savings accounts. In the chart below, I’ve compared Federal Money Market’s yield to the average interest rates paid on savings and checking accounts since the middle of 2009, as reported by the FDIC.

Yes, savings accounts paid a tiny bit more interest than Federal Money Market when the fed funds rate was pinned at the near-zero bound. However, when the Fed hiked interest rates from 2016 through mid-2019, Federal Money Market’s yield rose to over 2%. Yields paid by banks barely budged.

This pattern has repeated itself over the last two years. While money markets yield 5%, checking accounts pay a paltry 0.07% on average. Ugh.

As I’ll show you in a moment, thankfully, Vanguard has negotiated a better deal for Cash Deposit and Cash Plus Account. Still, that doesn’t mean they are better than Vanguard’s tried-and-true money funds.