Executive Summary: In this article, I show you how you can use shares of 500 Index to recreate High-Yield Corporate’s monthly income stream—and still come out ahead.

Over the past two weeks, I’ve discussed retirement spending and searched for Vanguard’s best income fund. Throughout these articles, I cautioned against a single-minded pursuit of income. Why? Because if you focus only on the “income” you’re generating from your portfolio, you are missing a big piece of the total return equation—capital appreciation. And that capital appreciation may be a better source of “income” than interest and dividends.

Let me show you why this is the case.

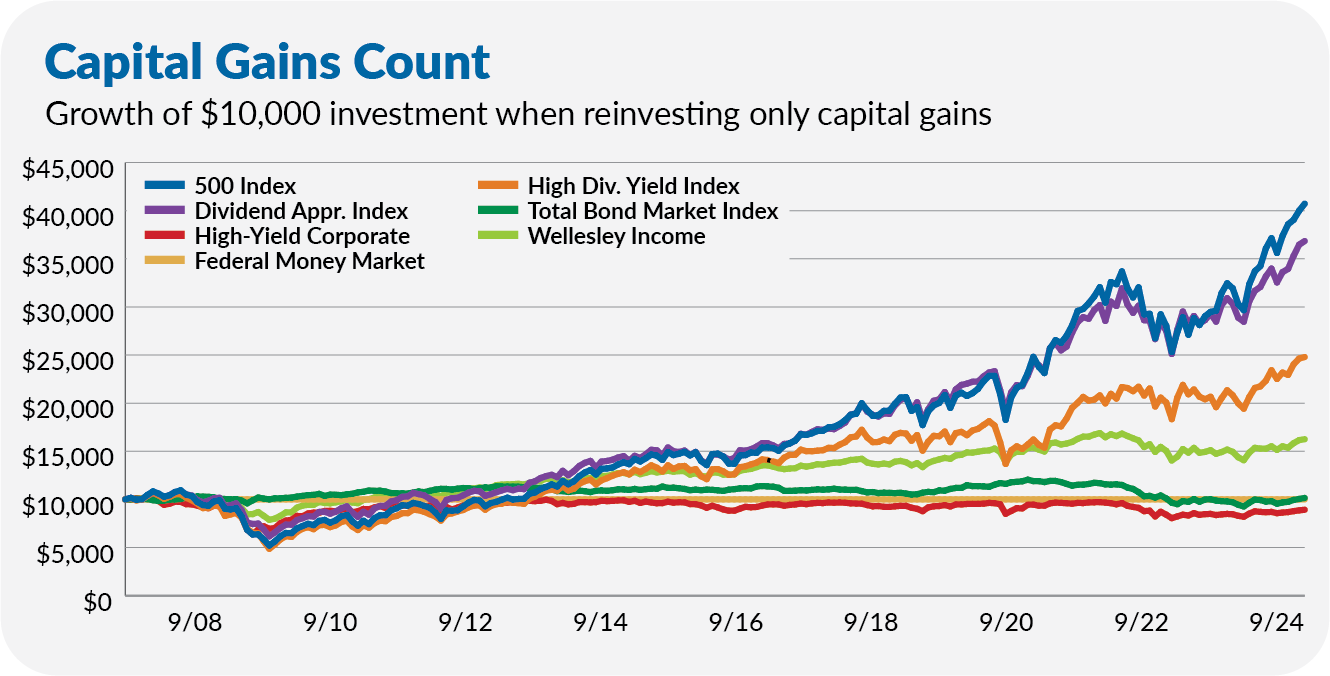

First, the chart below picks up where last week’s article left off. It shows the growth of a $10,000 investment in several Vanguard funds, assuming dividends went to cash and you reinvested the capital gains.

To keep it simple, I haven’t included every fund from last week’s article. I started with 500 Index (VFIAX), Total Bond Market Index (VBTLX) and Federal Money Market (VMFXX) as proxies for stocks, bonds and cash. I then included the “best” income solutions: High-Yield Corporate (VWEHX), which was last week’s “winner” if you’re looking for immediate income, two dividend-oriented stock index funds and Wellesley Income (VWINX), which was Vanguard’s best multi-asset income “solution.”

What’s plain to see is that after nearly two decades, the bond funds haven’t grown capital, while the stocks in Wellesley Income’s portfolio, which is heavily weighted to bonds, enabled a $10,000 investment to grow to more than $16,000 while still paying out a nice income yield.

That’s not a bad result from the old-timer, but it pales in comparison to the performance of the stock-only funds. An investment in High Dividend Yield Index (VHYAX) has grown to $25,000, while the owner of Dividend Appreciation Index (VDADX) has an account worth more than $36,000. The 500 Index investor has more than $40,000 in their account. And remember, this is after all dividends were sent to cash rather than being reinvested.

If you weren’t worried about “living off the income” from your portfolio and were willing to sell shares of your stock funds from time to time, you could recreate High-Yield Corporate’s monthly income stream—and still come out ahead!

For example, after making a $10,000 investment in 500 Index I asked, “How can I match the monthly cash flow of an identical investment in High-Yield Corporate by selling shares from time to time?”