“Why do I need to invest in foreign stock funds?”

That’s a question I’ve heard often these past several years. And I understand why—the U.S. stock market has overwhelmingly outperformed global stock markets for a long time now.

For instance, over the past ten calendar years, Total Stock Market Index (VTSAX) has compounded at a 12.1% annual rate while Total International Stock Index (VTIAX) compounded at just 4.1%. That translates into a total return of 213% for U.S. stocks versus 49% for foreign stocks.

Not only have domestic-only investors had recent stats in their favor, but Vanguard founder Jack Bogle was also firmly in their corner, saying he saw little reason to diversify internationally. So, let’s give the question of whether to invest in foreign stocks a full airing. (Note: I will restrict myself to discussing foreign stocks and funds here, not bonds. That’s another topic for another day.)

I will lay out some primary arguments for a U.S.-only approach and the case for a globally diversified approach. I don’t agree with all of these points, but I want you to consider both sides of the argument. Then you can be the judge.

The U.S.-Only Case

Opening statement:

Before his passing, Jack Bogle told Morningstar, “I’m just a great believer in a U.S. portfolio because we’re the most entrepreneurial nation, we’ve got the soundest institutions, financial and otherwise… governance is pretty solid… and a well-diversified economy.” In other words, Bogle made the case that the U.S. is an exceptional country, so U.S. companies were exceptional.

Argument #1: Performance favors the U.S.

U.S. stocks have outpaced foreign stocks, not just recently but for three decades … and counting! From the end of 1989 through June 2023, the S&P 500 index gained over 2,400%, including dividends. Foreign stocks, measured by the MSCI EAFE index (a basket of foreign-developed stocks), returned just over 330%.

Argument #2: Diversification is overrated.

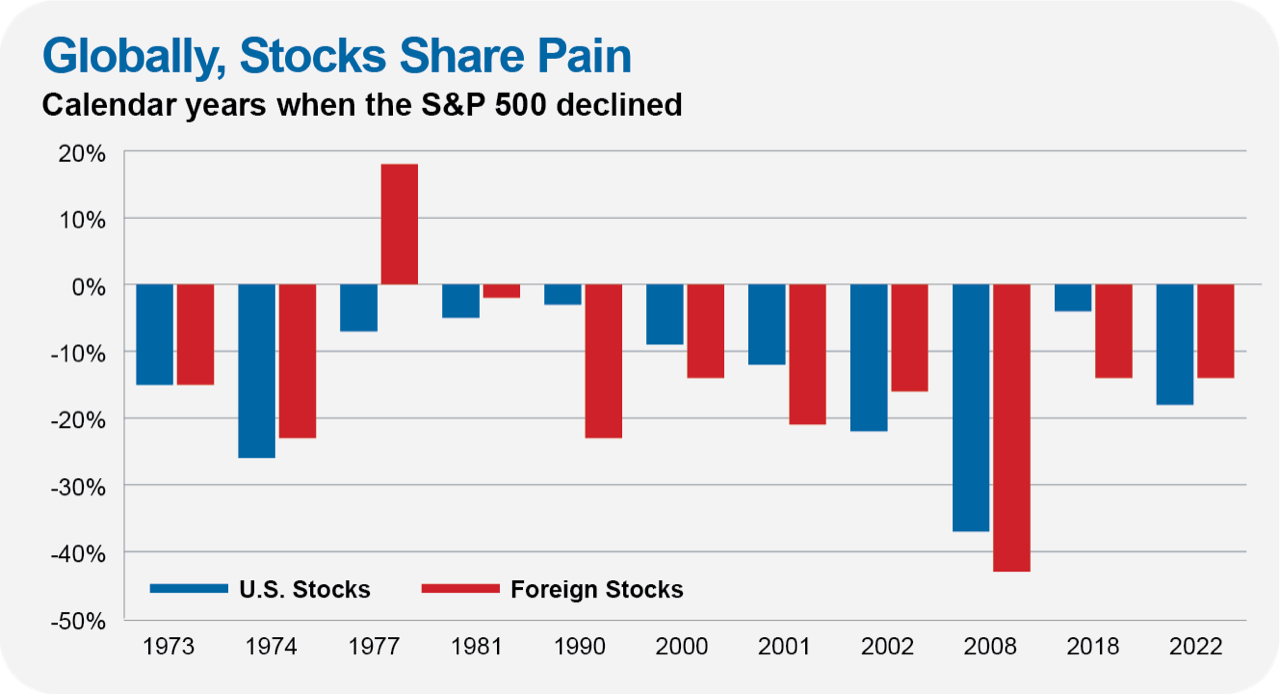

Foreign stocks fall in unison with U.S. stocks. The chart below shows the 11 calendar years since 1973 when the S&P 500 index declined in value. In only one year, 1977, did foreign stocks gain ground. During the other ten years, foreign stocks lost value alongside U.S. stocks; in about half of those years, they dropped more than U.S. stocks.

Bogle believed there was little diversification benefit in owning stock in non-U.S. companies because U.S. companies derive a large share of sales and earnings from overseas business. As a result, U.S. companies benefit from foreign consumer demand and regional diversification.

Based in Atlanta, Coca-Cola, the quintessential U.S. company, is a global franchise earning profits in virtually every market on earth. Why bother buying a European soda maker, Bogle might’ve argued, when you can own Coke?