Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, June 28.

There are no changes recommended for any of our Portfolios.

We’re just a couple days from the end of the month and quarter, and while I don’t think these calendar markers really have any meaning, they are time periods that mutual fund and ETF providers use, by regulation, in reporting performance. I’m sure they’re champing at the bit because the numbers are going to look a whole lot better when June ends.

For instance, at the end of March, 500 Index’s (VFIAX) one-year return was -7.8%. If June ended yesterday, June 27, the one-year return for the index fund would be 17.6%! That’s a big difference. This is yet another example of why I don’t rely on “point in time” data when analyzing performance but, rather, use rolling-returns to get a better sense and understanding of a fund or manager’s long-term record.

We Were Promised a Recession

Prediction is very difficult, especially if it’s about the future.

– Niels Bohr (or maybe Yogi Berra)

Whoever said that predicting the future is hard was spot on. Coming into the year, warnings of a recession ahead were everywhere—heck, I was among those forecasting a recession in 2023. There’s still six months for that call to come true, but so far, it’s been wrong.

Fortunately, I don’t make big bets in our Portfolios on a macro view of the economy. Plus, as I said in my outlook, Just Keep Going, I thought that stocks could deliver positive returns even if the economy slid into a recession.

In fact, so far, two out of my three market-related forecasts are on track: Stocks have gained ground with Total Stock Market Index (VTSAX) up 14.2% for the year. And bonds have found their footing with Total Bond Market Index (VBTLX) up 2.4%.

My one miss when it comes to the market (so far) is that foreign stocks are (once again) trailing U.S. stocks—that said, my preferred foreign stock fund, International Growth’s (VWIGX) 12.0% return this year isn’t far behind the broad U.S. index funds.

We can’t know the future—which is why I hold a diversified portfolio—but, over time markets are driven by earnings and interest rates.

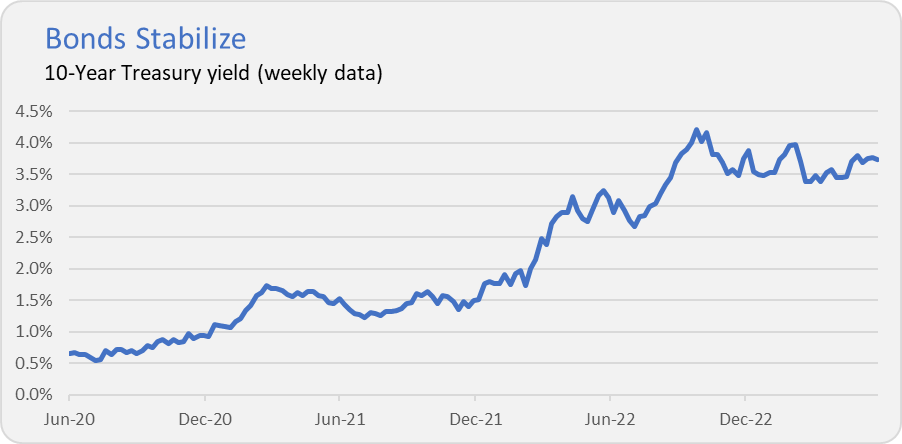

As I told you a month ago, earnings data has been noisy, but it appears that the decline in earnings is behind us. And, as you can see in the chart below of the 10-year Treasury’s yield over the past three years, interest rates have stabilized since last September—the benchmark bond’s yield has traded between (roughly) 3.4% and 4.0% for the past nine months or so.

Earnings are set to rise in the quarters ahead and interest rates appear to have found their level. That’s a recipe for the market to move higher … but, well, making predictions about the future isn’t easy!

The Coup That Wasn’t

The big news over the weekend was the coup (or non-coup) in Russia. I’m not a geopolitical strategist and speculation over what the Wagner group’s brief mutiny means for Putin, Russia and the war in Ukraine abounds, so I’ll leave that aside. When I put on my investor hat, well, nothing has really changed.

Yes, Putin’s control was challenged, but he’s still in charge of Russia. And there is still a war in Ukraine. Hopefully this dysfunction among the Russian armed forces will mean a quicker resolution to the war, but peace is not right around the corner.

The bottom line is that the aborted rebellion was a geopolitical event and for all the headlines the markets barely noticed. Gold didn’t rally big—neither did Treasurys. Oil? Gas? They hardly budged. Stocks were down marginally on Monday but rebounded on Tuesday.

Trading based on geopolitical events and headlines is rarely profitable.

Am I Eligible?

Last week, I wrote to you about Vanguard’s new securities lending program—Fully Paid Lending (FPL). If you are interested in the program, one lingering question that Vanguard hasn’t clearly answered is who is eligible to participate.

I heard last week from a subscriber that only after going through a lengthy signup process, did he learn that he wasn’t eligible. He was told he couldn't enroll for two reasons: First, you need to hold at least $5 million with Vanguard. Second, you can’t be a client of Vanguard’s advisory programs—even if you select your non-managed accounts, you’re still not allowed in the program.

Knowing those restrictions ahead of time could’ve easily saved your fellow subscriber some time!

I asked Vanguard for clarity on the eligibility requirements for the FPL program. I haven’t heard back but when I do, if I do, I’ll let you know. That said, you’d think the eligibility standards would be clearly listed on the website. Why make someone go through a time-consuming signup process if they aren’t going to qualify?

Our Portfolios

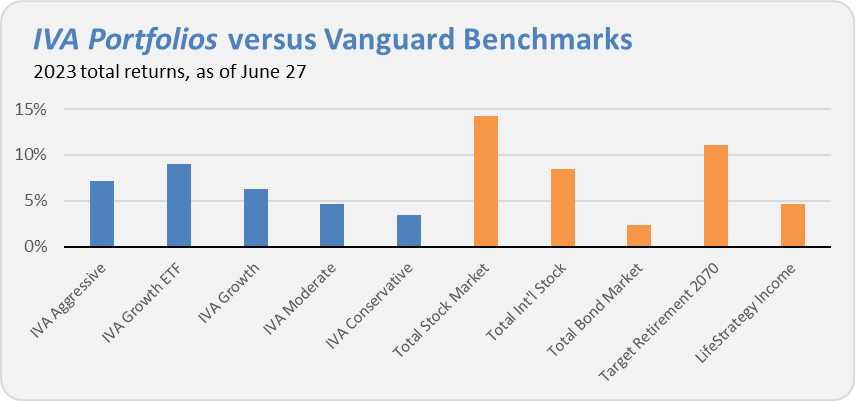

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 7.2%, the Growth ETF Portfolio is up 9.0%, the Growth Portfolio has gained 6.3%, the Moderate Portfolio has returned 4.6% and finally the Conservative Portfolio is up 3.4%.

This compares to a 14.2% return for Total Stock Market Index (VTSAX), an 8.5% gain for Total International Stock Index (VTIAX), and a 2.4% return for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 11.0% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 4.6% for the year.

Until my next Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.