It’s almost investment gospel that the more risk you are willing to take, the higher your return will be. I’m a believer … up to a point.

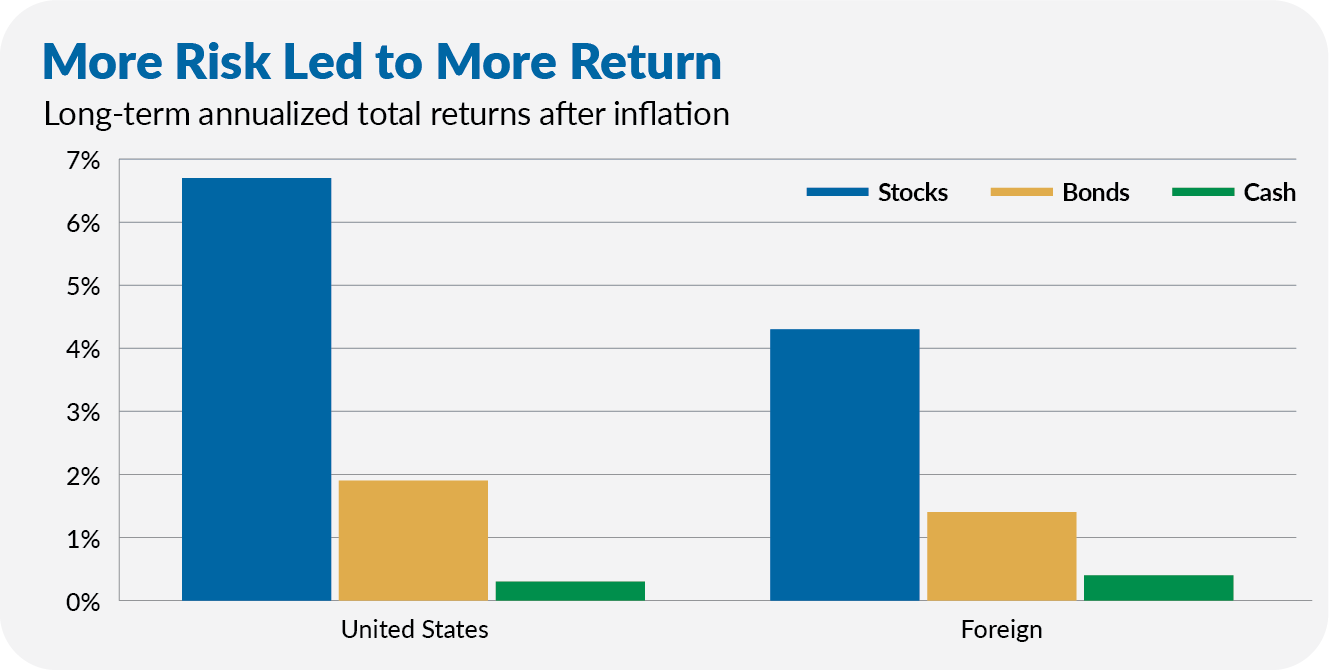

Broadly speaking, it’s true that greater risks lead to greater returns. For example, stocks are riskier than bonds, which are, in turn, riskier than cash. And, yes, over time, stocks have outperformed bonds, and bonds out-earned cash.

The chart below shows the annualized total returns adjusted for inflation for stocks, bonds and cash in U.S. and foreign markets over the last 100-plus years. (It is a reformatted version of a chart I used in my Cash for the Long Run? article. See that article for more information on the methodology and sources used to produce the chart.)

Ask most professional investors (or academic researchers), and they’ll tell you that small stocks outperform larger ones. However, that doesn’t mean you’ll outperform 500 Index (VFIAX) by gritting your teeth and holding an aggressive fund like SmallCap Index (VSMAX). Oh, it may work some of the time, but it won’t work all the time. And it’s not even guaranteed to work over what many of us would consider a long time. Investing isn’t so easy!

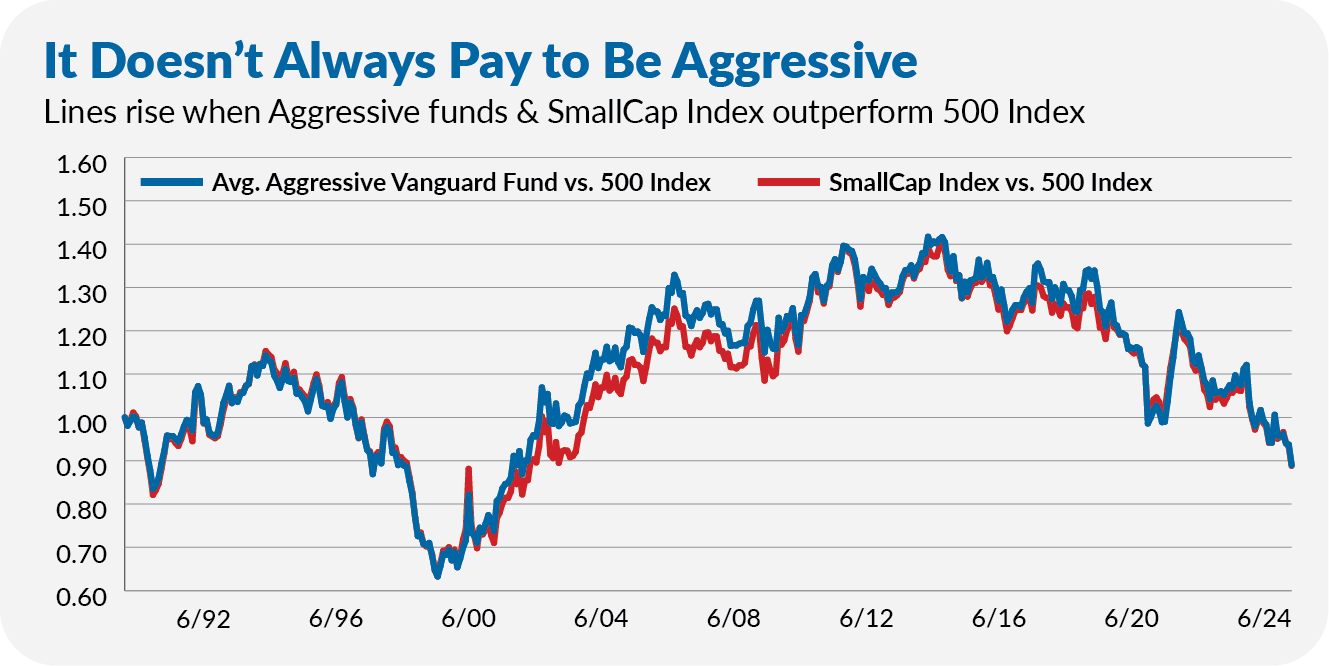

For example, check out the relative performance chart below, where I’ve compared the performance of 500 Index to SmallCap Index and the average return of all the Vanguard funds I classify as “Aggressive” in the Performance Review table.

Small-cap stocks and aggressive funds trailed in the dot-com bubble of the late 1990s (the lines fall) but outperformed for the next dozen years. However, the last decade has seen more aggressive options trail 500 Index. Net-net, over the past nearly 35 years, investors in small-cap stocks and Vanguard’s aggressive funds (collectively) have ended up in the same place as those who held 500 Index!

This leads to the obvious question: Why bother owning any aggressive fund or SmallCap Index?

First, the pendulum may have swung too far in favor of 500 Index. Now may be an opportune time to get more aggressive even though the overall stock market is at an all-time high.

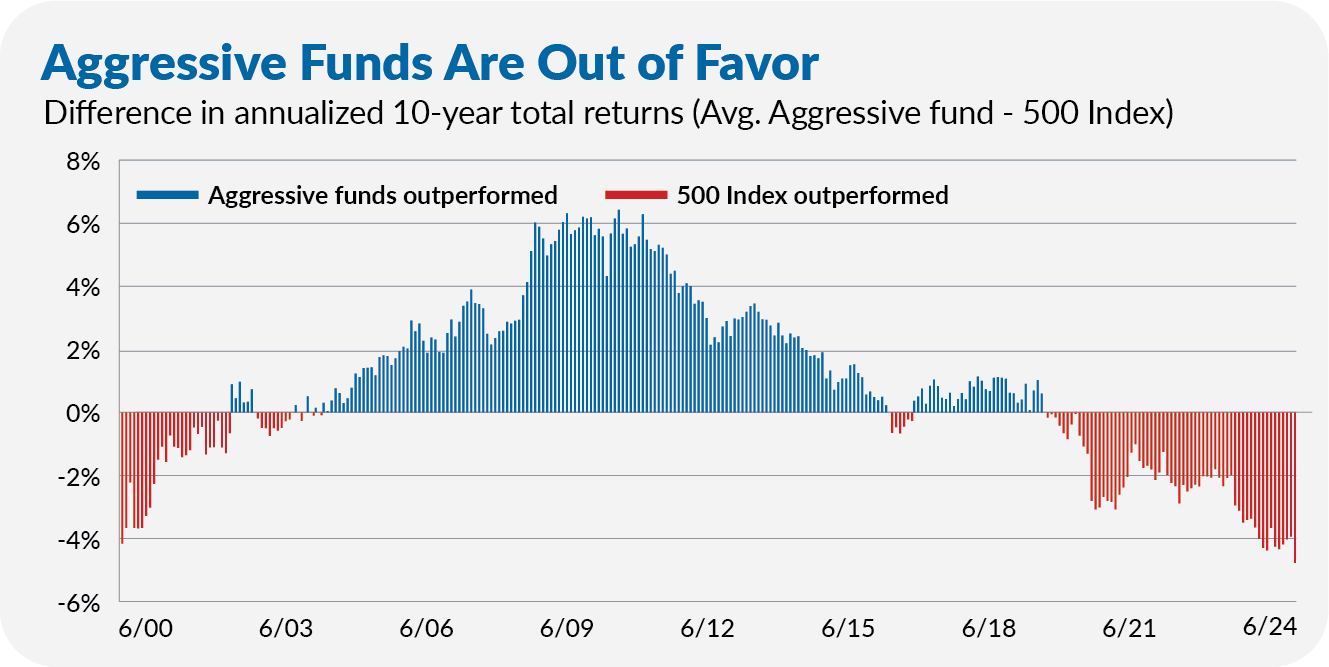

Consider the chart below showing the difference in annualized 10-year returns between 500 Index and Vanguard’s average aggressive fund. Over the past decade, 500 Index has outperformed Vanguard’s aggressive funds by the widest margin in the past 35 years. That’s an outlier.

Second, if you choose wisely and partner with a genuinely talented active manager running an aggressive fund, you can earn outsized returns.