Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, April 12.

There are no changes recommended for any of our Portfolios.

Good news on the inflation front: It’s continuing to trend lower. According to the Bureau of Labor Statistics (BLS), consumer prices only increased 0.1% in March, which means over the past year the Consumer Price Index (CPI) is up 5.0%—a full percentage point below Februarys’ annual inflation rate of 6.0%.

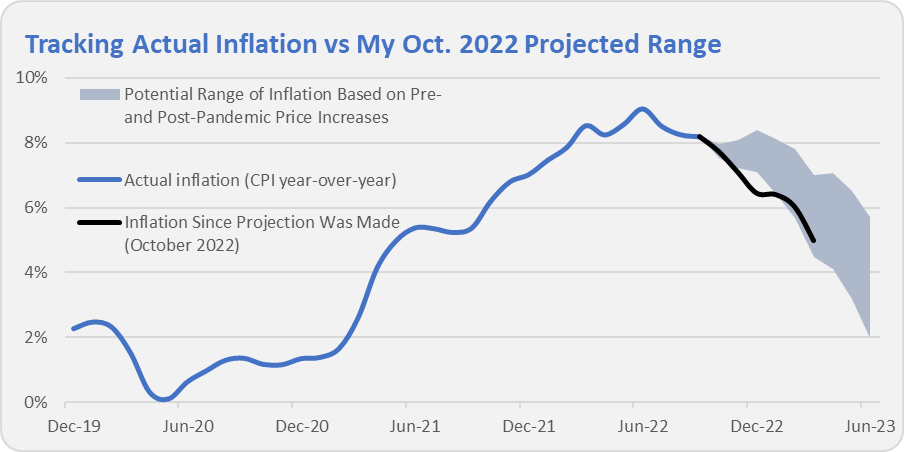

For several months now, I’ve been comparing reported inflation against the range I forecast back in October—below is the latest update. As a reminder, my estimates were based on the levels of inflation we experienced before and after the pandemic. The upper end of my range was calculated assuming post-pandemic levels of inflation would continue while the lower band was determined by inflation returning to pre-pandemic levels.

My base case assumption was for inflation to land somewhere in between—I expected inflation to slow but to stay above pre-pandemic levels. So far, so good. Inflation at 5.0% is at the lower end of my projections for March. If the recent pace of price increases holds steady, we can expect inflation to clock in below 4% year-over-year by the middle of the year.

It’s worth pointing out that I’m tracking so-called “headline inflation,” which includes energy and food prices. I think that’s fair since it’s hard for most of us to avoid spending on food and energy. However, another common measure of inflation, core CPI, excludes those two more volatile components. Core inflation hasn’t fallen as dramatically—granted, it didn’t rise as dramatically, either. In fact, over the past 12 months, core inflation is running hotter (up 5.6%) compared to headline inflation.

Inflation may be trending down, but it’s still running hotter than the Federal Reserve’s (Fed) 2% target. Combine the current 5% inflation with a sub-4% unemployment rate, and I don’t expect to see Fed policymakers cutting interest rates anytime soon.

Enjoying the Ride?

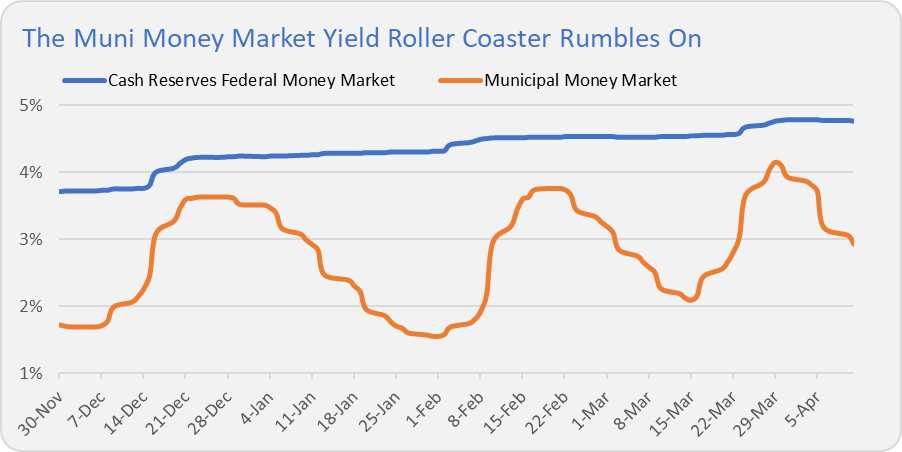

The tax-exempt money-market yield roller coaster rumbles on.

I reported on the rise and fall in Municipal Money Market’s (VMSXX) yield several times over the past five months—see here, here, here and here. And I’m not done yet, as yields continue to swing higher and lower.

Since peaking at 4.15% on March 30, the tax-free money market fund’s yield has fallen 1.22% to 2.93% as of Tuesday night—that’s a big move in just eight trading days. By comparison, as you can see in the chart below, taxable money market fund yields (represented by Cash Reserves Federal Money Market’s (VMRXX) yield) have barely budged over the past week and have been much steadier over time.

And though I’ve been showing you the national tax-free fund’s yield, rest assured, the state-specific money market funds’ yields have been on a similar wild ride.

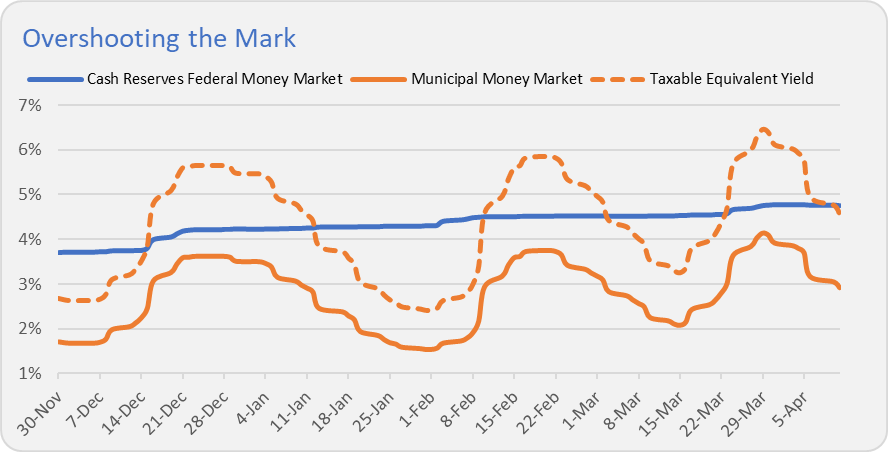

My take is that traders are trying to find an equilibrium between extremely short-term taxable and tax-exempt security prices, but they keep overshooting the mark. If taxable money market funds are yielding around 4.7% as they are today, I would expect a tax-free money market fund to yield 3% or so. Why? Because that would put the after-tax yields on equal footing for someone in the 32% tax bracket (which jumps to 35.8% when we factor in the health care surtax).

The easiest way to visualize this is by calculating a taxable equivalent yield for Municipal Money Market. This is the yield you would need to earn on a taxable fund to give you the same after-tax yield of the tax-free fund.

A week ago, the taxable-equivalent yield for Municipal Money Market was north of 6%. That was too good to last, so it’s no surprise tax-free money market yields have come back down to earth. Will they stabilize at today’s level, or is there another hump in the roller coaster’s camelback to traverse? More importantly, what should you do about it?

It’s tempting to “chase” the swings in relative yields, and if you’re someone who tries to wring every penny out of their cash savings, well, nothing I say is going to change that—and that’s fine. But unless you are sitting on a really large pile of cash, I’m not sure it is worth all the effort. If you played the relative yield game here, you’d have made five trades (and may be considering a sixth right now) in the past five months. That’s a lot of activity for how much gain?

For most of us, there is a much more important question to answer than which money market fund to hold. That question is: How much money should I allocate overall to stocks versus bonds versus cash? That’s going to have a far bigger impact on your portfolio.

Consider that over the past 10 years (as of March 31), Vanguard’s best-performing money market fund, Cash Reserves Federal Money Market, returned 9%—that’s not annualized, that’s 9% in total. Vanguard’s worst-performing money market fund was California Municipal Money Market (VCTXX), with a 5% gain. That’s a 4% difference over a decade … hardly moves the needle. (And that’s before adjusting for taxes.)

In comparison, consider the difference in returns investors earned in LifeStrategy Growth (VASGX) versus LifeStrategy Income (VASIX) over the past decade. The growth fund allocates 80% of its assets to stocks and 20% to bonds. The income fund does the reverse—20% to stocks and 80% to bonds. Over the last decade LifeStrategy Growth returned 107% to LifeStrategy Income’s 34% gain.

To put dollars to those percentages, that’s the difference between turning $100,000 into nearly $207,000 versus having just under $135,000.

My goal here is that make sure you are focusing on the big things—and, hopefully, getting them right. How you allocate your overall portfolio is one of those big things. Chasing money market yields is not.

The End of the Ride

Just a quick reminder: This time next week (Wednesday, April 19), Alternative Strategies (VASFX) is liquidating. If you own the fund, you’ll receive cash for your shares—but not many people do.

I’ll be curious to see what Vanguard does with the cash in Managed Allocation’s (VPGDX) portfolio. The alternative fund was a 6.5% position in the allocation fund at of the end of March. The keepers of Managed Allocation have small (less than 1%) positions in Market Neutral (VMNFX) and Global Minimum Volatility (VMVFX) … maybe they’ll use the cash to build those positions back up?

Our Portfolios

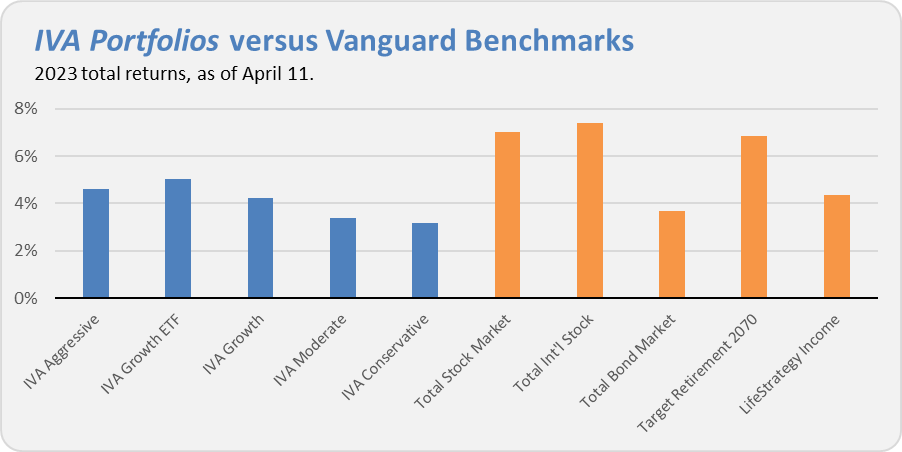

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 4.6%, the Growth ETF Portfolio has gained 5.0%, the Growth Portfolio has returned 4.2% the Moderate Portfolio is up 3.4% and finally the Conservative Portfolio is up 3.2%.

This compares to a 7.0% return for Total Stock Market Index (VTSAX), a 7.4% gain for Total International Stock Index (VTIAX), and a 3.7% return for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 6.8% for the year and its most conservative, LifeStrategy Income(VASIX), is up 4.3% for the year.

On the year, lackluster returns from Dividend Growth (VDIGX) and Health Care ETF (VHT) explain our Portfolios’ relative underperformance. However, both funds are helping our Portfolios gain back some ground in April. While Total Stock Market Index is down 0.1% so far this month, Dividend Growth is up 0.9% and Health Care ETF has gained 3.1%.

It’s also worth noting that the stock indexes’ performance this year has been driven, once again, by a tiny sliver of large tech companies. While the S&P 500 index, for example, returned 7.5% during the year’s first quarter, an equal-weight version of the S&P 500 returned just 2.9%.

And speaking of Dividend Growth, if you missed it, I encourage you to check out my conversation with the fund’s managers Don Kilbride and Peter Fisher.

Premium Members can find the interview here. And if you’re not yet a Premium Member but want access to the interview, you can sign up for a free 30-day trial here.

Until my next Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.