Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, July 3.

There are no changes recommended for any of our Portfolios.

On Tuesday, the S&P 500 index (5,500) and the NASDAQ-100 index (20,000) set new milestones. As I’ve told you several times this year—here and here—the indexes crossing big round numbers make for nice headlines but are irrelevant to your and my investment success. (They only seem relevant to the media’s success in capturing eyeballs.)

Plus, as I told Premium Members in July’s monthly article, not all stocks are participating equally in this bull market. While 500 Index (VFIAX) is up 16.3% for the year through Tuesday, SmallCap Index (VSIAX) is only up 2.5%. Or consider that Growth Index (VIGAX) is outpacing Value Index (VVIAX) by nearly 14 percentage points, 22.5% to 8.6%. And, once again, foreign stocks are lagging way behind U.S. stocks—Total International Stock Index (VTIAX) is up just 5.7% this year.

Bonds are even farther behind—Total Bond Market Index (VBTLX) is down 0.9% for the year.

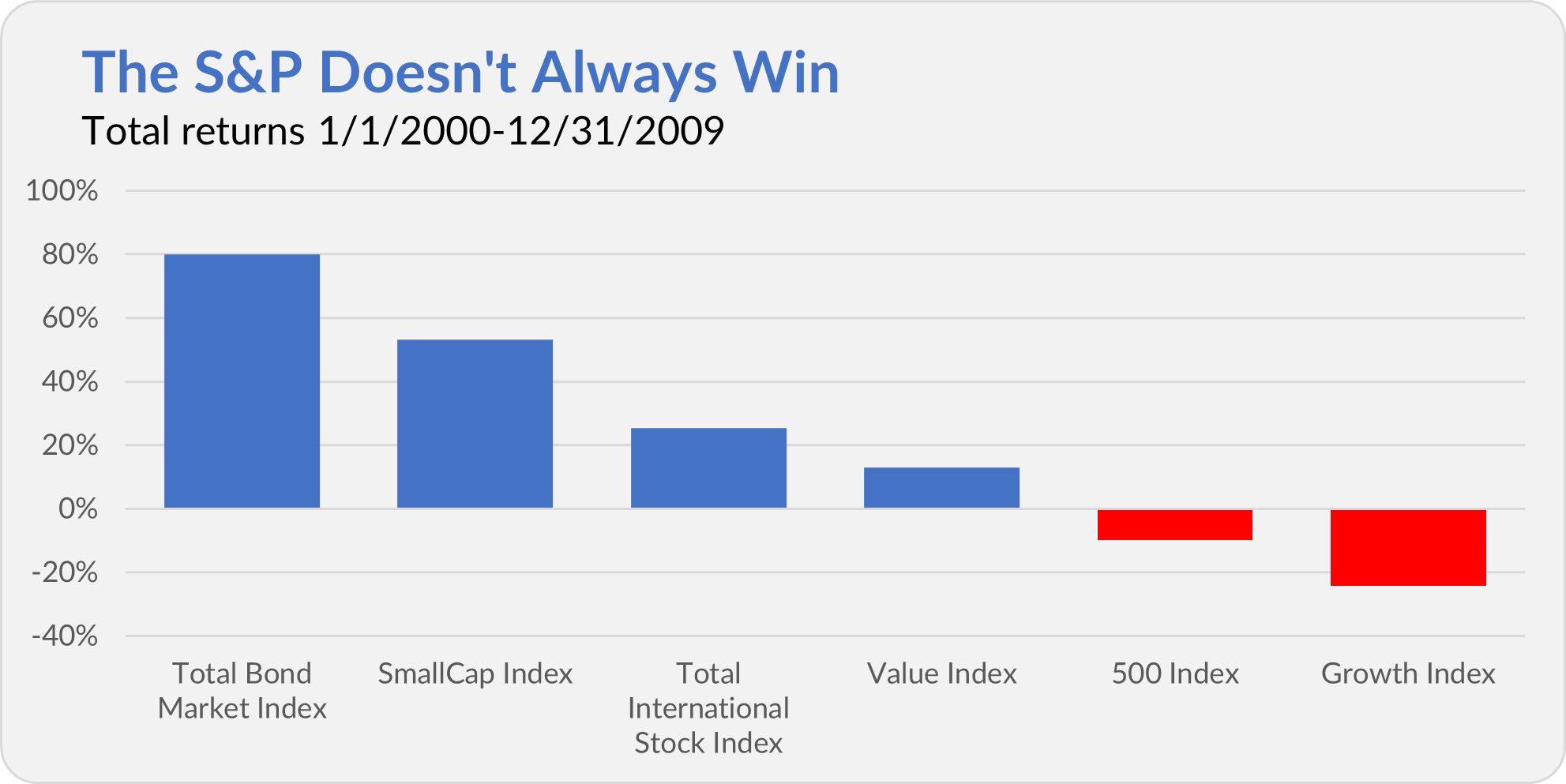

Put it all together, and diversifying your portfolio beyond the S&P 500 index looks silly. Stay disciplined—please. Owning a diversified portfolio will eventually pay off. The S&P 500 index doesn’t win all the time.

For example, the chart below shows the total returns earned by the Vanguard funds I mentioned above during the first decade of the 2000s. As you can see, 500 Index and Growth Index—today’s winners—lost value from January 1, 2000 through December 31, 2009. Meanwhile, bonds, small stocks, value stocks and foreign stocks all gained ground.

Owning a diversified portfolio means that you won’t own only the best-performing part of the market. But you also won’t get caught out when the market turns.

Welcome, Salim

As a reminder, Vanguard will welcome a new CEO on Monday. Salim Ramji will take the reins from Tim Buckley on July 8. You can read my commentary on Vanguard’s first outsider CEO here and here.

Managers Move On

A month ago, I told you that Awais Khan was no longer the co-manager of a dozen Vanguard index funds and ETFs. Vanguard never responded to my inquiry into whether Khan had left the firm or assumed a different role within Vanguard.

I eventually got an answer, as Khan is now the Head of ETF Portfolio Management and Capital Markets at abrdn Inc. (formerly Aberdeen). It’s a promotion in terms of responsibilities for Khan, but abrn’s U.S. ETF business is tiny compared to Vanguard’s—with only $8 billion in assets—and is mainly focused on commodity-related ETFs.

The takeaway for Vanguard investors is simply that Vanguard’s managers switch jobs from time to time. I’m not worried about one manager's departure from Vanguard’s indexing team, but a mass exodus would be a concern.

Dividend Timing

I received a lot of questions from IVA readers about dividend distributions this week. Most of the confusion was around their timing, so here’s a quick reminder:

If you reinvest distributions, whether income or capital gains, into a mutual fund, the transaction occurs on the fund’s reinvestment date (sometimes called the fund’s ex-dividend date). However, if you have distributions going to your settlement fund, the transaction will show up a day later on the fund’s payable date.

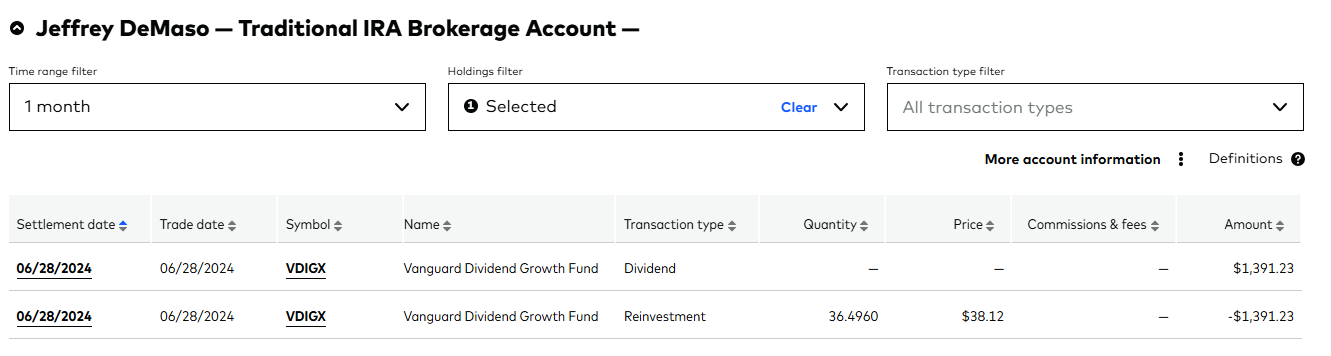

To use a recent example, Dividend Growth (VDIGX) paid out $0.2882 per share to anyone who owned the fund on June 27 (the record date). If you reinvested that distribution (as I did in my retirement account), the transaction was reported with a June 28 trade date. (Below is a screenshot from one of my accounts.)

However, if the distributions were going to your settlement fund, say Federal Money Market (VMFXX), they were recorded on July 1 (the payment date). Quarterly distributions, and in particular the big distribution season in December, can be confusing. It often pays to check the fine print on the distribution calendar and then wait one or two days before sending out an SOS.

Our Portfolios

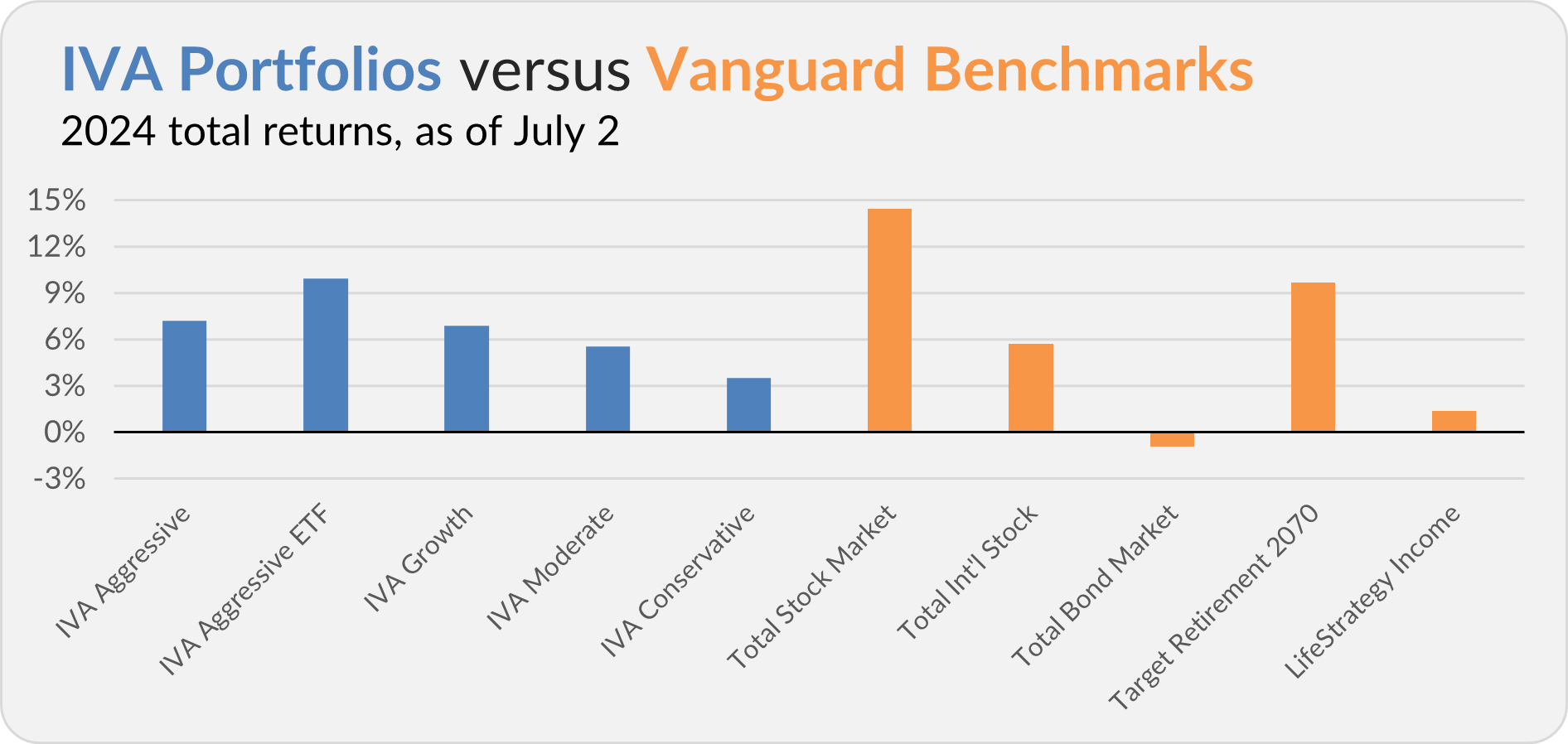

Our Portfolios are showing decent absolute returns but are trailing behind the U.S. stock market for the year through Tuesday. The Aggressive Portfolio is up 7.2%, the Aggressive ETF Portfolio is up 9.9%, the Growth Portfolio is up 6.9%, the Moderate Portfolio is up 5.6% and the Conservative Portfolio is up 3.5%.

This compares to a 14.4% gain for Total Stock Market Index (VTSAX), a 5.7% return for Total International Stock Index (VTIAX), and a 0.9% decline for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 9.7% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 1.4%.

As I said earlier, holding a diversified portfolio sometimes feels like swimming against the tide. But really, being diversified means you’ll benefit no matter how the tide turns next.

IVA Research

Yesterday, in Vanguard’s Profit-Sharing Stalls Out, I shed some light on what Vanguard’s new CEO, Salim Ramji, might be earning. Believe me when I tell you that for all its low costs, Vanguard pays its top dogs handsomely; they just don’t advertise it.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future and a very happy Fourth of July.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.