Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, September 18.

There are no changes recommended for any of our Portfolios.

The day that much of Wall Street has been waiting for is finally here. Today, Federal Reserve (Fed) policymakers lowered the benchmark interest rate, the fed funds rate, 50 basis points (or 0.50%) to a range of 4.75%—5.00%. This is the Fed’s first policy change since its final interest rate hike in July 2023, which sent the fed funds rate to 5.25%—5.50%.

All things equal, looser monetary policy (read, lower interest rates), which make loans more affordable, can act as a tailwind for smaller companies and consumers. That’s a good thing.

Maybe that's why, even though everyone "knew" the Fed was going to cut rates today, stock prices still jumped on the actual announcement. (Or at least they did initially. As I go to hit the send on this email, the headline indexes are back to their pre-announcement levels.)

Looking beyond traders' immediate reaction, what does this mean for investors?

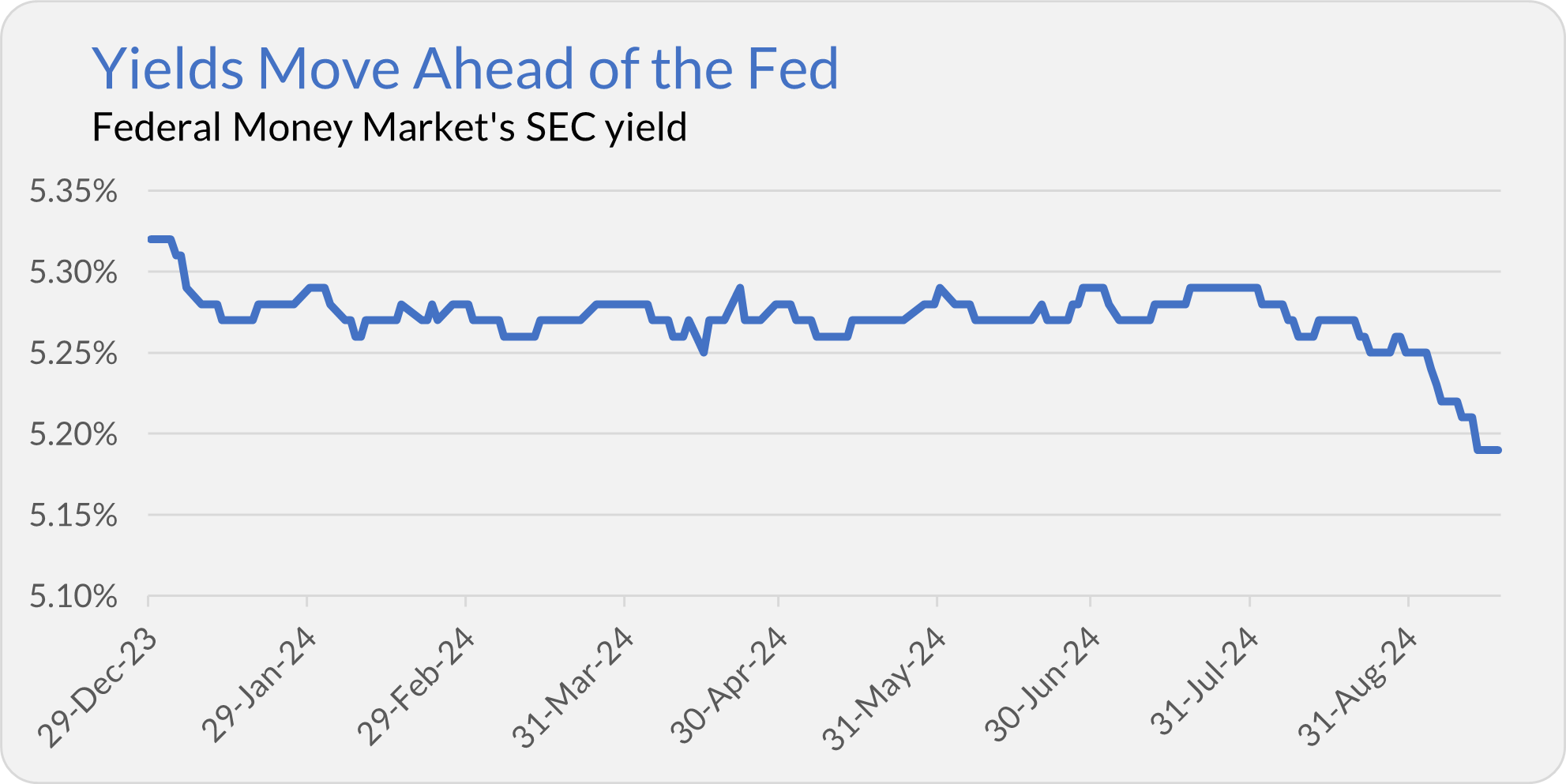

Well, the most direct impact is that those luxurious yields we’ve been earning on our cash will begin to wane. In fact, we are already earning a bit less on our cash positions. Federal Money Market’s (VMFXX) yield has been trending lower for six weeks now. The fund’s yield has fallen from 5.29% at the end of July to 5.25% at the end of August to 5.19% as of Tuesday’s close.

And, as I told you before, the yields on Vanguard’s two newer cash solutions—Cash Deposit and Cash Plus Account, already laggards in the yield sweepstakes—ticked lower to 3.60% and 4.50%, respectively, in August.

I’ll keep you apprised of where those yields go now that Fed policymakers have established that they are in the mood to cut rather than hike interest rates.

As for the stock market? It’s hard to establish as direct a link between stock prices and Fed policy as we can with cash yields. You can read my deep dive into this topic here.

Before you make any changes to your long-term plan and portfolio in response to the Fed, remember that the past always looks clear and inevitable with the benefit of hindsight. In a year or two, we’ll look back and say, “Of course, I should’ve done “this” in response to the Fed cutting interest rates.”

But is it obvious what “this” is today?

Consider three different scenarios for the economy and the Fed:

- Today’s interest rate cut isn’t “enough,” the economy slips into a recession, and the Fed eventually takes more aggressive action.

- The Fed only cuts interest rates a few times over the next several months and then stops as the economy makes a “soft landing,” meaning that employment picks up while inflation stays low.

- The Fed is forced to rethink lower interest rates as inflation picks up next year.

All three seem plausible to me—though maybe you’re convinced of one scenario over the other. Of course, even if you know which is the “right” outcome, you now have to correctly predict how millions of traders and investors will respond—easier said than done.

Bonds Over Stocks?

Vanguard’s chief European economist, Jumana Saleheen, recently penned an article in the Financial Times arguing that she sees “bonds offering greater value than equities.” (And here is a link straight to the article itself.)

While I agree with one of Saleheen’s general conclusions that bonds have a role to play in a diversified portfolio, her approach left me scratching my head.

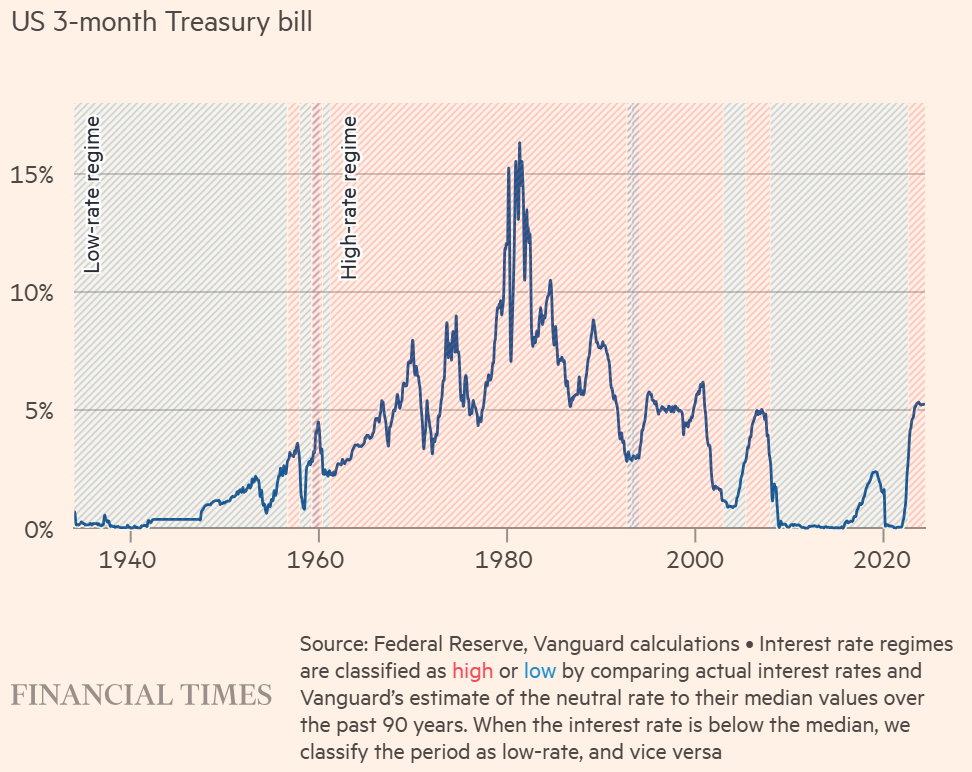

As you can see in the screenshot below, Saleheen and her colleague Dimitris Korovilas used 90 years of history to identify regimes of high and low interest rates.

However, “to understand what these regimes have meant for investors historically,” they only analyzed returns since 1984.

What?! Why did they ignore the first 50 years of returns? In particular, why didn’t they analyze bond returns in the 1960s and 1970s?

Of course, bonds are going to look good when you’re measuring a period that saw yields drop from roughly 15% to 0%. But that doesn’t describe today’s environment!

I would argue that today’s setup—with yields only a few years removed from being pinned at the near-zero bound—looks more like the 1960s or 1970s than the early 1980s. So, does their thesis hold (that bonds match stocks during high-rate regimes) during the 1960s and 1970s?

I’ll leave that for Vanguard and Saleheen to address. But remember that economists are notoriously bad seers, and their investment advice is generally off the mark and designed primarily to keep their names in the news. (Publish or perish, as it were.)

Never once have I seen an economist talk about how they are changing (or not changing) their personal portfolios based on the conclusions of their research. Are Saleheen and Korovilas “tilt[ing] their portfolios toward bonds?”

Remember, it wasn’t that long ago that Vanguard’s chief economist in the U.S. said the chances of any interest rate cuts before year-end were slim to none. How’d that work out for their economics team’s track record?

To be clear, I’m not saying you should ditch bonds or bond funds. Rather, I think there’s a much simpler argument for why you should continue to own bonds today.

As I’ve told you, a bond fund’s yield is a good predictor of its future returns—see here. So, with Total Bond Market Index (VBTLX) yielding around 4%, we can expect its owners to earn 4% per year over the next seven to 10 years. If earning that type of return from high-quality bonds helps you achieve your investment goals, well, then there is a place for bonds in your portfolio.

Ascensus Fumble

Earlier this year, I told you that Vanguard had sold its small business retirement accounts to Ascensus—here, here, here, here, and here.

One IVA reader recently told me that the move to Ascensus has been a disaster. Despite multiple emails and more than 15 calls, which have led to spending hours upon hours on the phone with Ascensus (both on hold and on the line), she can’t access her account! She’s been repeatedly promised a callback from a manager multiple times … and never been called back.

The silver lining is that she has confirmed that the money is there. She just can’t do anything with it (like move it somewhere else). The bottom line is that it’s been two months, and she still doesn’t have access to her account.

Unfortunately, a few of Ascensus’s agents admitted to your fellow IVA reader that she was not the only transferee from Vanguard facing this issue. (As if on queue, today, I heard from another IVA reader who had a three-week-long battle with Ascensus to set up his account.) Yikes!

To be clear, this seems like an issue with Ascensus’s systems and support—not Vanguard. I asked Ascensus about the reader’s situation and how the overall transition from Vanguard had gone. Here’s what they had to say:

This situation [with your subscriber] is an exception. We transitioned 340,000 accounts successfully; everyone’s account is safe and was transferred in-kind … [Some] individuals are having challenges, and the main reason has been stale data. Validating who someone is is something that, in today’s world, we have to be very, very cautious about.

Our biggest challenge is ensuring the accounts are safe while providing great service—two things we take very seriously.

Transitioning 340,000 accounts is a big undertaking, so some issues will crop up. Is it a security issue tripping up your fellow IVA reader? I can’t say. However, I think we can all agree—and Ascensus acknowledged—that “it shouldn’t take four weeks to get a resolution.”

If you are having issues with your accounts at Ascensus, below are the best contact options. Ascensus said they’ve “hired a significant team to support the extra 340,000 participants” and are “now at a virtually no-wait time.”

- Individual(k): ikservice@ascensus.com (833) 688-0086

- IRA Plan Sponsor: (833) 889-4554

- IRA Account Holder: (833) 889-9878

If that fails, you can always reach us at support@independentvanguardadviser.com. We’ll do our best to help!

Distributions Ahead

This is a friendly reminder that Vanguard’s funds will begin paying quarterly distributions this week. Premium members can find the September distribution schedule here (scroll toward the bottom). If your fund’s NAV drops more than you expect in the next few weeks, chances are it paid out some income.

Our Portfolios

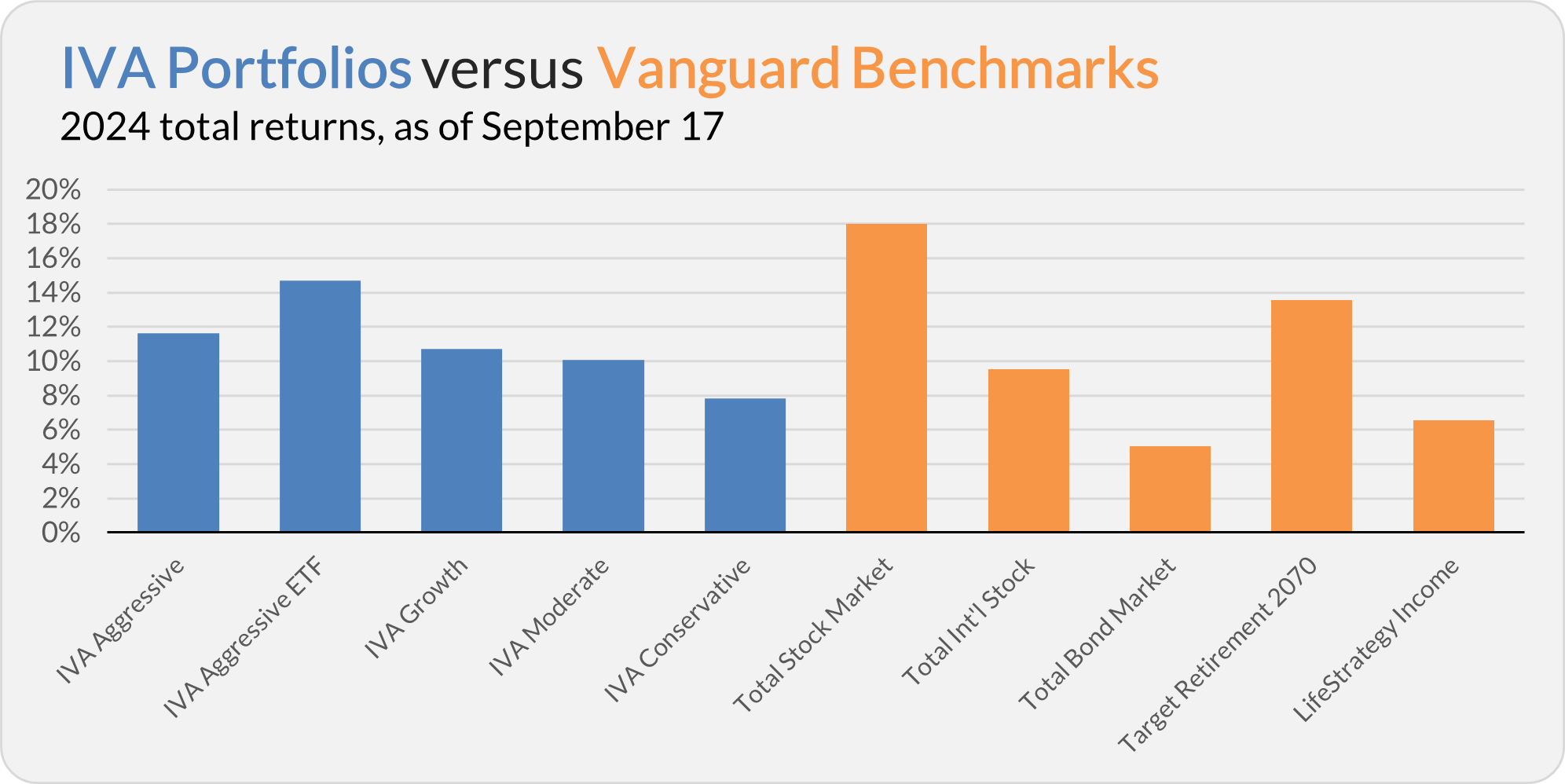

Our Portfolios are showing decent absolute returns for the year through Tuesday. The Aggressive Portfolio is up 11.6%, the Aggressive ETF Portfolio is up 14.7%, the Growth Portfolio is up 10.7%, the Moderate Portfolio is up 10.1% and the Conservative Portfolio is up 7.8%.

This compares to an 18.0% gain for Total Stock Market Index (VTSAX), a 9.5% return for Total International Stock Index (VTIAX), and a 5.0% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 13.5% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 6.5%.

IVA Research

Yesterday, in Check Your Expectations, I shared my analysis of Vanguard’s large-stock growth funds with Premium Members. In the article, I shared my top picks and explained why investors need to keep their expectations in check when it comes to growth stocks.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.