Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, December 6.

There are no changes recommended for any of our Portfolios.

Is the bear market over?

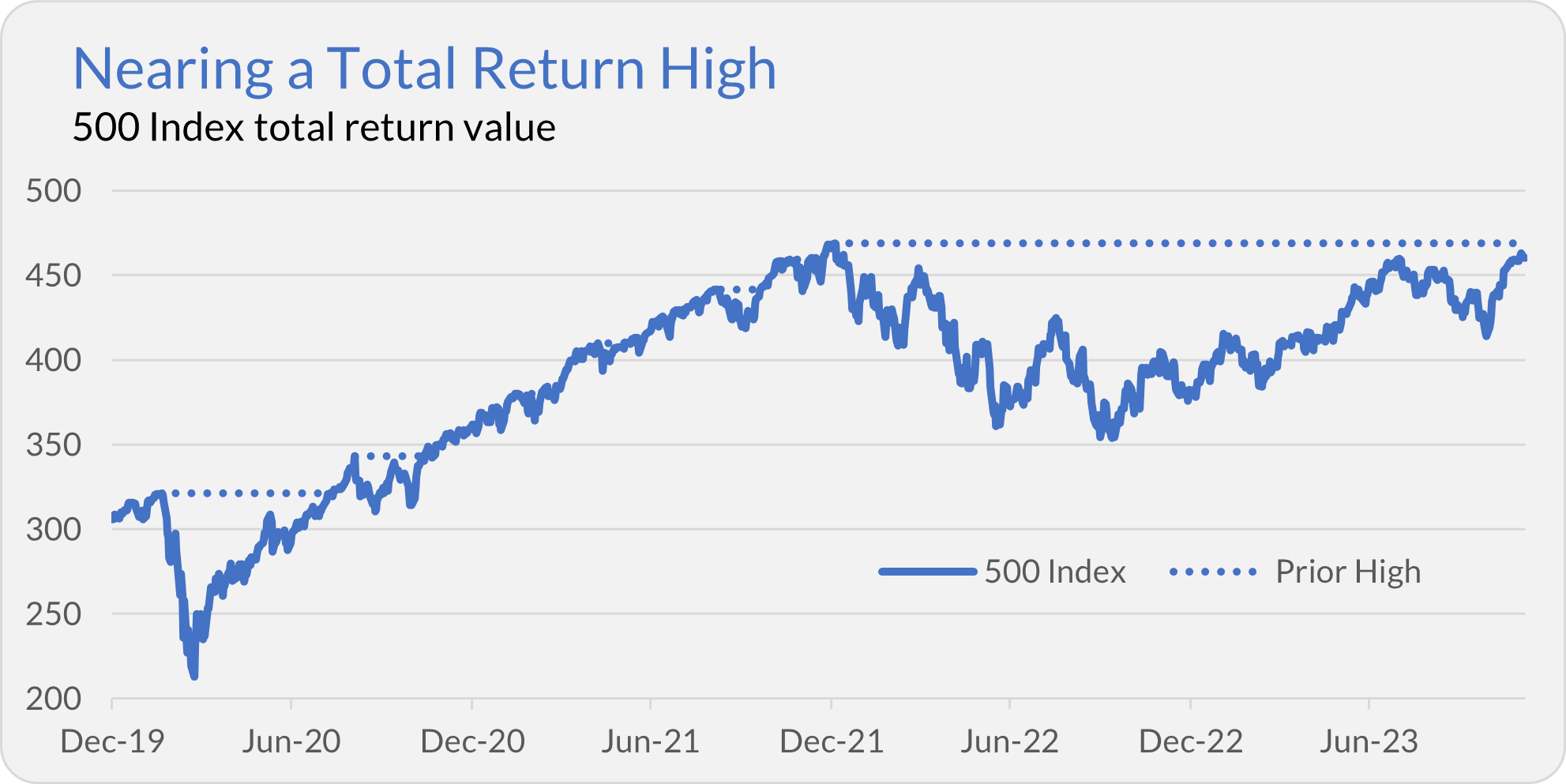

If you count dividends (and you should), the answer is either “yes” or “nearly,” depending on which index you look at. Counting dividends, the Dow Jones Industrial exited bear market territory (hitting a new record high) on November 24—the day before Thanksgiving. 500 Index (VFIAX), Vanguard’s flagship index fund, isn’t quite there yet but is just 1.8% below its January 3, 2021 total return high.

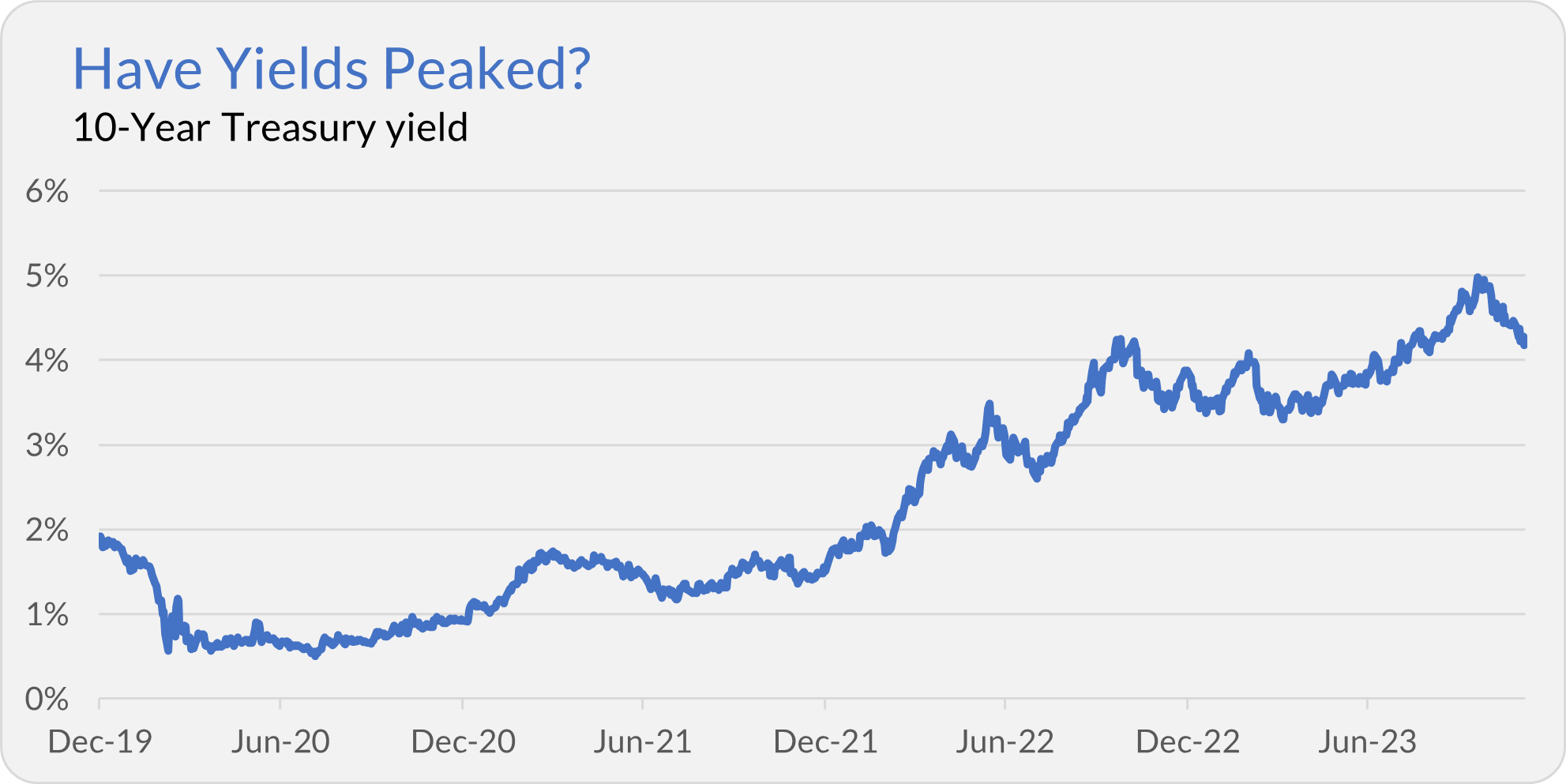

As the stock market nears a new high, bond yields are falling. Since hitting 5% in mid-October, the yield on the 10-year Treasury has fallen to 4.18% as of Tuesday’s close. If “peak bond yields” are behind us, then “peak bond opportunity” may also be behind us.

As bond yields have fallen, bond prices have risen. After gaining 4.5% in November, Total Bond Market Index (VBTLX) is up another 1.1% in December. Runs like this are why, as recently as late October, when yields were near their peak, I advised investors to stick with their bond funds.

While Total Bond Market Index is still trailing Federal Money Market (VFMXX) on the year—3.1% to 4.7%—my top bond fund picks are doing better than the index fund. Short-Term Investment-Grade (VFSTX) has matched the money market fund with a 4.7% gain. Intermediate-Term Investment-Grade (VFICX) is ahead of the pack, up 5.3% this year.

More Active Bond ETFs

Vanguard is launching two new (but also not-so-new) bond ETFs today—Core Bond ETF (VCRB) and Core-Plus Bond ETF (VPLS).

Premium Members can read more about the two new funds here.

The short story is that while the ETFs are technically separate legal entities, they are designed to be as similar as possible to the like-named active mutual funds that Vanguard already manages—Core Bond (VCORX or VCOBX) and Core-Plus Bond (VCPIX or VCPAX).

If you have a smaller position in one of the mutual funds (less than $50,000) and can make the swap without incurring a tax bill, you might want to consider moving to the new ETF. You’ll get the same experience at a lower cost as the Investor shares of the mutual funds charge 0.10% more than the new ETFs. (You might want to wait a few days to let the new ETF get up and running before switching, though.)

If you have over $50,000 in the bond funds and are in the Admiral share class, then there are no cost savings to be gained from making the switch. If you prefer mutual funds, stay the course.

Your Vote Counts?

You may recall that during the first half of 2023, Vanguard ran a proxy voting pilot program. The program's end goal is to give mutual fund shareholders more of a say in voting on proposals made by companies their funds hold.

As I told Premium Members in yesterday’s Quick Take, More Proxy Flights Cleared for Takeoff, Vanguard plans to rerun the program in 2024, expanding it to include five funds—S&P 500 Growth ETF (VOOG), ESG U.S. Stock ETF (ESGV), Russell 1000 ETF (VONE), MegaCap ETF (MGC) and Dividend Appreciation Index (VDADX or VIG).

If you decide to participate, you’ll choose among four options that determine how your votes will be cast at the annual shareholder meetings for the 30 largest companies in each fund. Premium Members can read more about the program here.

The pilot program is still very limited in scope—we’re talking about how votes are cast for only the largest holdings in five funds. Vanguard’s entire fleet won’t be cleared for takeoff anytime soon.

The positive spin on this program is that it is a step toward giving mutual fund shareholders more of a “voice.” Some people have been clamoring for more control over how their votes are cast; others are happy to let Vanguard carry that responsibility.

Of course, expanding the program across its lineup would help Vanguard deflect broad criticism that it wields too much influence (or voting interest) over corporations. So, the fund giant is motivated, at least in part, by self-interest.

Brokerage is “Back of the Pack”

A recurring issue at Vanguard is that the company’s technology and service aren’t up to par with peers. Just this week, I heard from a subscriber who placed some trades online but had trouble executing others. By the time he was able to speak with a representative—a 20-minute wait—the market had closed.

But it's not just the anecdotal evidence that says Vanguard needs to improve. Vanguard came in dead last in digital satisfaction among full-service financial firms in J.D. Power’s 2023 U.S. Wealth Management Digital Experience Study. Vanguard got higher marks from self-directed investors, but that didn’t put them at the top of the podium by any means.

It makes you wonder what type of “return on investment” they got on the billion dollars CEO Tim Buckley claims they have spent to improve technology and service. Not surprisingly, it’s impossible to get Vanguard to ‘fess up to the sins of their service foibles.

(If you have had issues yourself, please let me know. Enough publicity around the company’s digital problems could force them to up their game.)

“I Quit”

I can’t help but think that these customer service and technology issues have contributed to Vanguard’s recent decisions to shut down or exit different business lines.

Vanguard is leaving China, closing a business in Germany and ending its partnership with Amex. Now, Vanguard is selling Vanguard Institutional Advisory Services—an OCIO (outsourced chief investment officer) service that advises pension funds, endowments and foundations—to Mercer. You can read Vanguard’s announcement here.

Vanguard Institutional Advisory Services is a big business with 120 employees, over 1,000 clients, and around $60 billion in assets under advisement (according to Pensions & Investments). Or rather, $60 billion is big by most standards but a tiny sliver (less than 1%) of the trillions that Vanguard manages.

Vanguard recently ended several institutional relationships across Asia. Now, they are selling their institutional business here at home. It’s hard to say, but maybe the goal is to free up the capacity to refocus attention on Vanguard’s original customer—the individual investor.

Here’s the question I really want to know the answer to, though: Where is the money going? Assuming Vanguard is being compensated in this transaction and isn’t giving this book of business to Mercer free of charge, does that money come back to us—the fund shareholders—or will it bolster next year’s Partnership Plan distribution?

Our Portfolios

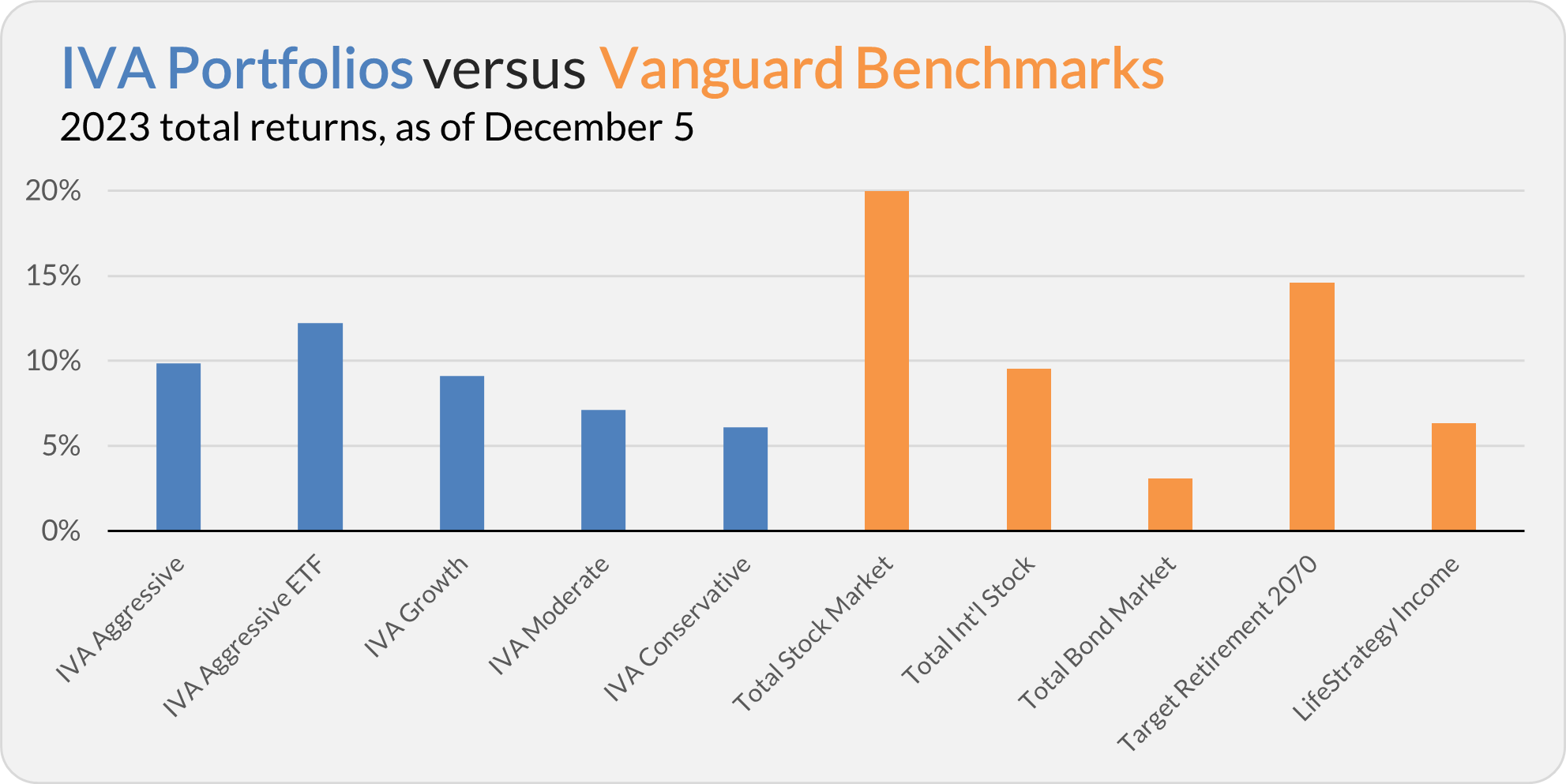

Our Portfolios are showing positive but lagging returns for the year through Tuesday. The Aggressive Portfolio is up 9.9%, the Aggressive ETF Portfolio is up 12.2%, the Growth Portfolio is up 9.1%, the Moderate Portfolio is up 7.1% and the Conservative Portfolio is up 6.1%.

This compares to a 20.0% gain for Total Stock Market Index (VTSAX), a 9.5% return for Total International Stock Index (VTIAX), and a 3.1% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 14.6% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 6.3%.

IVA Research

Yesterday, in When Hot Turns Cold, I shared an annual update on my Hot Hands strategy with Premium Members.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.