Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, August 21.

There are no changes recommended for any of our Portfolios.

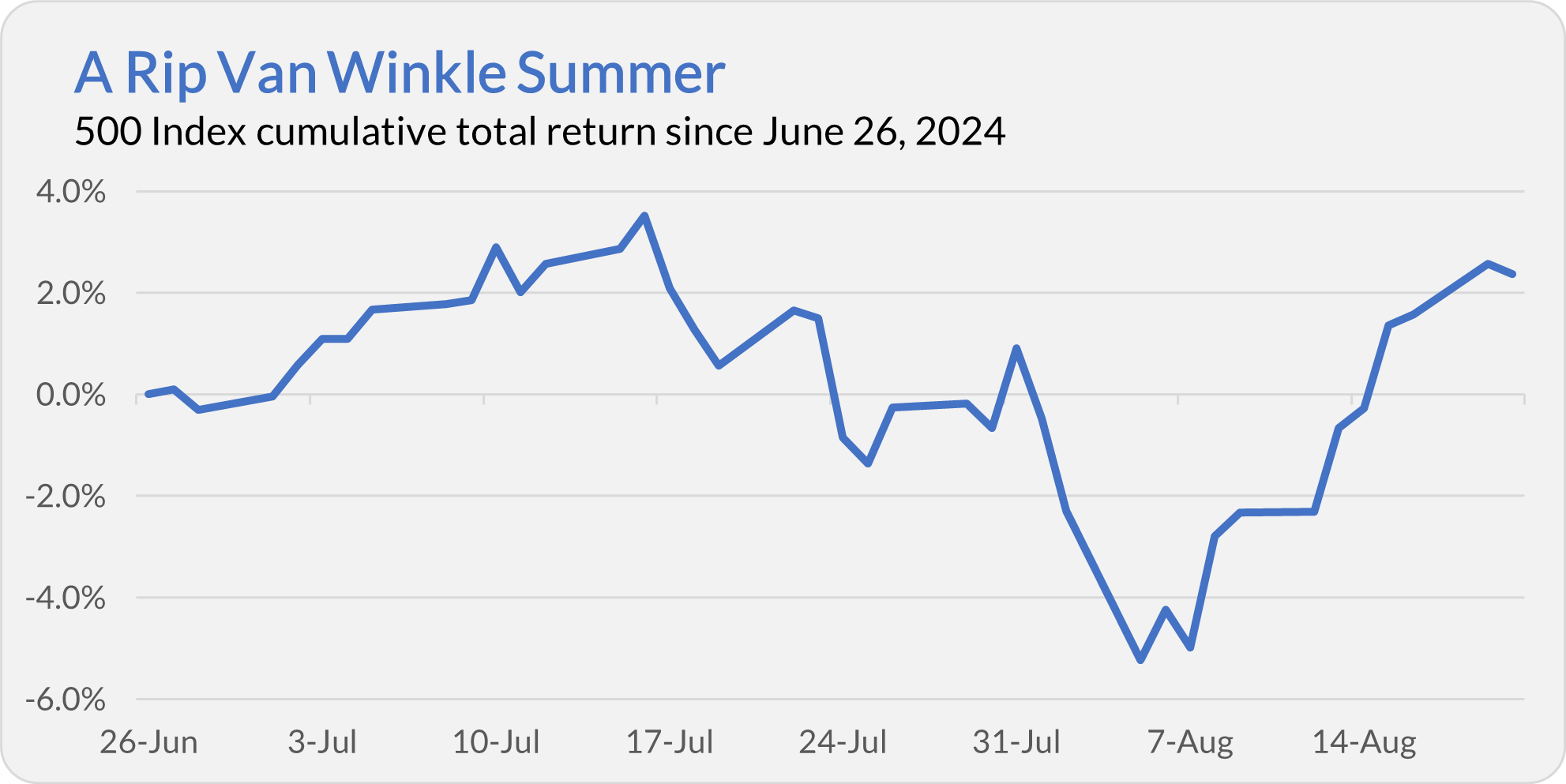

A Rip Van Winkle Summer

Believe it or not, everyday investors have a significant advantage over professional investors: You don’t have to be plugged into the markets and your portfolio every hour of every day.

Professional investors must be at their desks, taking in every data point and deciding whether to react and trade their portfolios on a daily, if not hourly, basis. They also must be immediately accountable to their clients, who may call or text them at any hour, day or night.

This makes it harder for the pros to stick to their guns and spend time in the market, but that’s the job they signed up for.

Think of it this way: If the portfolio manager of your mutual fund took the summer off, you’d probably sell the fund straightaway. But you are your own portfolio manager. Maybe a summer vacation is just what our portfolios need?

In New York, the last day of public school was June 26. Say you started your summer break then and only checked your portfolio for the first time yesterday (August 20).

Chances are your portfolio is larger today than when you left it.

All but two of Vanguard’s diversified stock funds have gained ground since June 26. 500 Index (VFIAX) is up 2.4%, SmallCap Index (VSMAX) is up 4.6%, Total International Stock Index (VTIAX) is up 3.9%, Balanced Index (VBIAX) is up 3.1% and LifeStrategy Moderate Growth (VSMGX) is up 3.2%. All Target Retirement funds are up between 3.0% and 3.2%.

While the absolute gains haven’t been great, the pace has been decent. For example, 500 Index’s 2.4% gain earned over 38 trading days translates into a 16.9% annual return. Not too shabby.

Of course, those returns weren’t delivered in a steady fashion. 500 Index gained 3.5% between June 26 and July 16 but fell 8.4% over the following three weeks. The flagship fund has rallied 8.0% over the last 11 trading days.

Still, you were on vacation (or at least a vacation from your portfolio). You didn’t have to worry about riding those ups and downs. You didn’t have to decide in early August if it was time to sell. Sure, the flagship index fund is still 1.1% below its all-time high, reached on July 16, but you aren’t measuring your portfolio against that high point.

As an investment newsletter editor, telling people that it’s okay (and maybe even profitable) to take a break from their portfolio isn’t exactly the best sales pitch—it’s not likely to drum up many subscribers. But, well, it’s some of the best advice I can give!

Funds Incoming

Last week, Vanguard announced plans to launch its first two actively managed municipal bond ETFs: Short Duration Tax-Exempt Bond ETF (VSDM) and Core Tax-Exempt Bond ETF (VCRM).

The ETFs are expected to begin trading before the end of the year and will charge 0.12% in expenses. As I explained to Premium Members in my Quick Take when the news broke on Friday, if you’re an “ETF investor,” these are nice additions to your toolkit. However, they don’t exactly break new ground—Vanguard has run active municipal bond mutual funds for decades.

Premium Members can read more here.

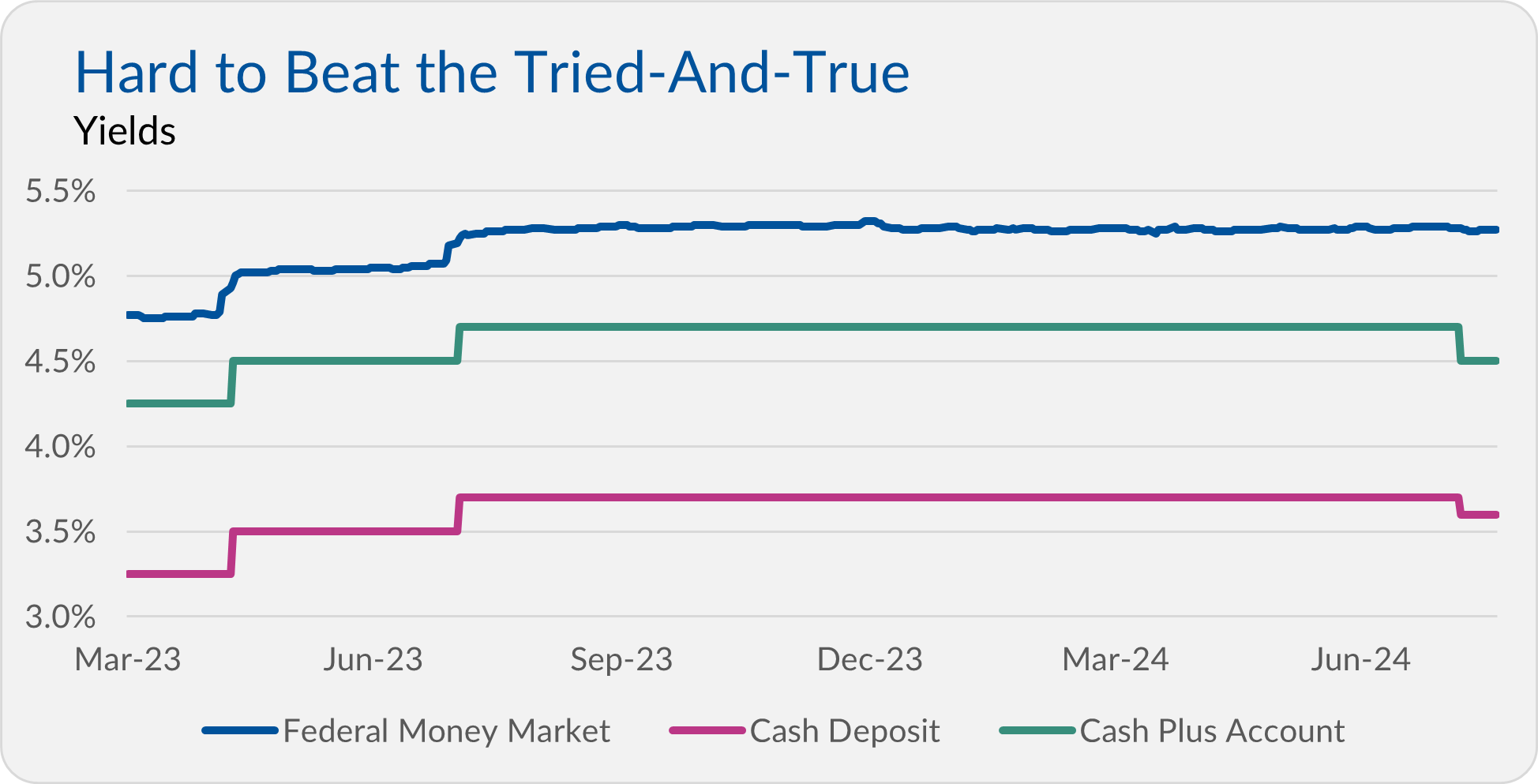

Falling Yields

Vanguard’s two newer cash solutions—Cash Deposit and Cash Plus Account—have been up and running since 2022. As a Vanguard customer, I bet you’ve received at least one email inviting you to join one of these cash programs.

Premium Members can read more about all of Vanguard’s cash options here. The short story is that Cash Deposit is an alternative settlement account for your investment accounts (think brokerage accounts or IRAs). Cash Plus Account is a separate savings account with a few bells and whistles.

The accounts have not been barn-burners.

Over a year ago, on August 1, 2023, Cash Deposit’s yield rose from 3.50% to 3.70%, and Cash Plus Account’s increased from 4.50% to 4.70%. At that time, the yield on Federal Money Market (VMFXX), Vanguard’s default sweep account, was 5.22%. For the next year, yields on the two Cash accounts didn’t budge!

Then, on August 6, the yields on both ticked lower—Cash Deposit now yields 3.60%, while Cash Plus Account is again paying 4.50%. By contrast, on August 6, Federal Money Market’s yield held steady at 5.28%. (The money market fund is currently yielding 5.27%.)

For the record, I’ve been kicking the tires on Cash Plus Account for a few months. I’ll have more to say about it down the road, but my fundamental issue hasn’t changed: it doesn’t make managing my cash any easier.

Given that Federal Money Market has consistently out-yielded its two younger siblings, I don’t see a compelling reason to switch to the newer products.

Filling Seats & Making Promises

On Monday, Vanguard announced a new general counsel. Tonya Robinson will join the firm in October.

I don’t have a hot take for you on this. Since Anne Robinson (no relation, apparently) announced she was leaving for IBM earlier this year, Vanguard was always going to hire a new general counsel. This marks new CEO Salim Ramji’s first big hire. I’m not saying that’s not an important role—it is—but the best-case scenario is that we never speak of Tonya Robinson again!

If you’re like me, you’ve been following Ramji’s comments in the media. Most recently, Ramji did a Q&A with Allan Roth at etf.com—see here. Ramji is saying all the right stuff when it comes to culture. He’s also making some big promises:

I’m determined to make sure the job gets done. We will have the most modern technology infrastructure in the industry. We will continue to make investments. It’s a journey and we will match and then exceed competitors’ capabilities.

The most modern technology infrastructure in the industry? I’m pulling for you, Salim, but I’ll believe it when I see it. Your predecessor claimed to have spent more than a billion dollars upgrading Vanguard’s “tech stack.” Obviously, it wasn’t enough.

Ramji has also hinted at new kinds of retirement-income solutions in several interviews. Given Vanguard’s failed Managed Payout series, I’m curious to see what he’s talking about. Ramji’s alma mater, BlackRock, recently rolled out target date funds that allow investors to convert a portion of their assets to an income annuity. Could that be a blueprint for Vanguard?

529 Follow Up

Last week, I wrote about changes to the Vanguard 529 Plan’s investment lineup. As I hoped (and expected), Vanguard communicated the changes to the 529 Plan ahead of time. (I didn’t get the communication because I use a different Vanguard-based 529 plan.) Attached is that update:

Also, I could’ve been a little clearer last week. I didn’t mean to imply that the assets in STAR (VGSTX) were merged into Social Index (VFTAX). I was speaking more big-picture regarding the options available to investors—replacing a balanced fund with a stock fund struck me as a little weird. But Vanguard was “right” to merge the assets from STAR to Moderate Growth—they have similar allocations to stocks and bonds.

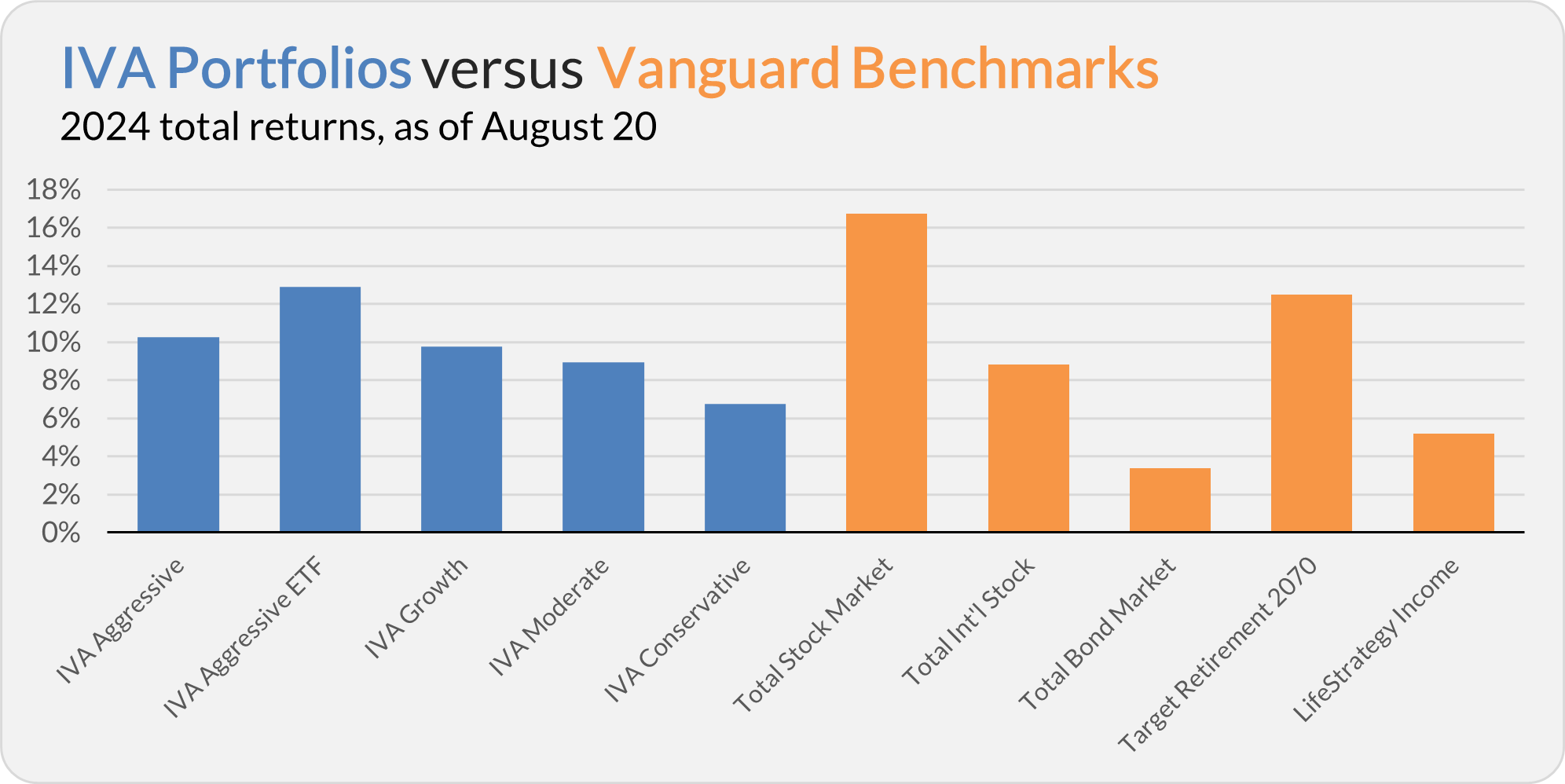

Our Portfolios

Our Portfolios are showing decent absolute but lagging relative returns for the year through Tuesday. The Aggressive Portfolio is up 10.3%, the Aggressive ETF Portfolio is up 12.9%, the Growth Portfolio is up 9.8%, the Moderate Portfolio is up 9.0% and the Conservative Portfolio is up 6.8%.

This compares to a 16.7% return for Total Stock Market Index (VTSAX), an 8.8% gain for Total International Stock Index (VTIAX), and a 3.4% return for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 12.5% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 5.2%.

IVA Research

Yesterday, in The Growth vs. Value Distraction, I shared my answer to whether it is better to be a growth investor or a value investor with Premium Members.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.