No matter how investors slice it, 2023 will go down as a very good year.

On the macro front, the Federal Reserve achieved the elusive soft landing—inflation dropped from 6.4% to 3.1% while job creation stayed strong, and the economy expanded each quarter of the year. You really couldn’t ask for much better.

Investors profited: Stocks and bonds of all shapes and sizes delivered positive returns. 500 Index (VFIAX) gained 26.2%, while only three of Vanguard’s funds finished in the red—Energy ETF (VDE) fell just 0.03%, while Utilities ETF (VPU) and Commodity Strategy (VCMDX) declined 7.4% and 7.5%, respectively.

But, as I’ve told you, the divergences within 2023’s market were dramatic. So, let’s review the investment year that was and see what worked and what didn’t, using Vanguard as our lens. And, of course, I’ll check in briefly on my Portfolios—though you can find a full rundown on their ups and downs here.

(Note: You can find my Outlook for 2024 here. And here is a month-by-month look at the events that caught our attention in 2023.)

Gains Across the Board

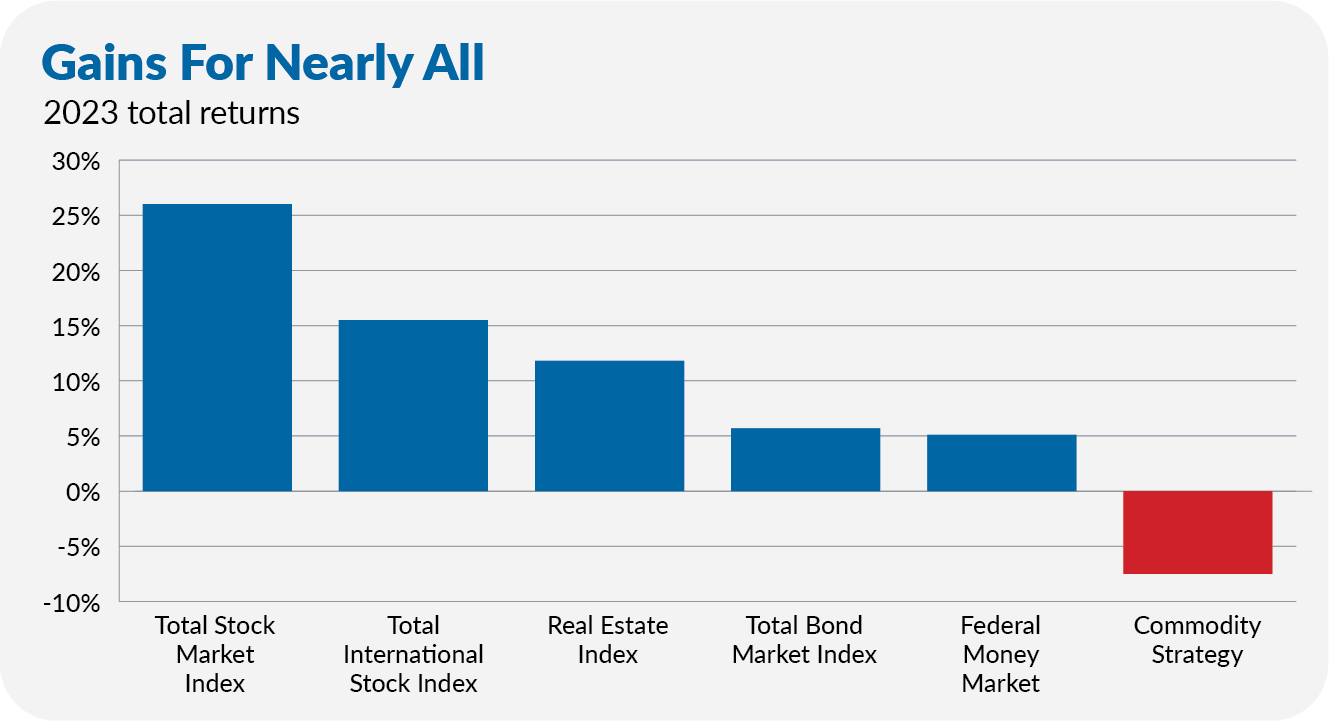

As I said, 2023 was a profitable year for investors. As you can see in the following chart, commodities were the only major asset class to finish in the red. U.S. stocks, foreign stocks, real estate, bonds and cash all gained ground.

Total Stock Market Index (VTSAX) gained 26.0% and Total International Stock Index (VTIAX) returned 15.5%. Investors in Real Estate Index (VGSLX) earned 11.8%. Bonds snapped their two-year losing streak, as Total Bond Market Index (VBTLX) returned 5.7%. And, finally, cash, measured by Federal Money Market (VFMXX), earned savers 5.1%.

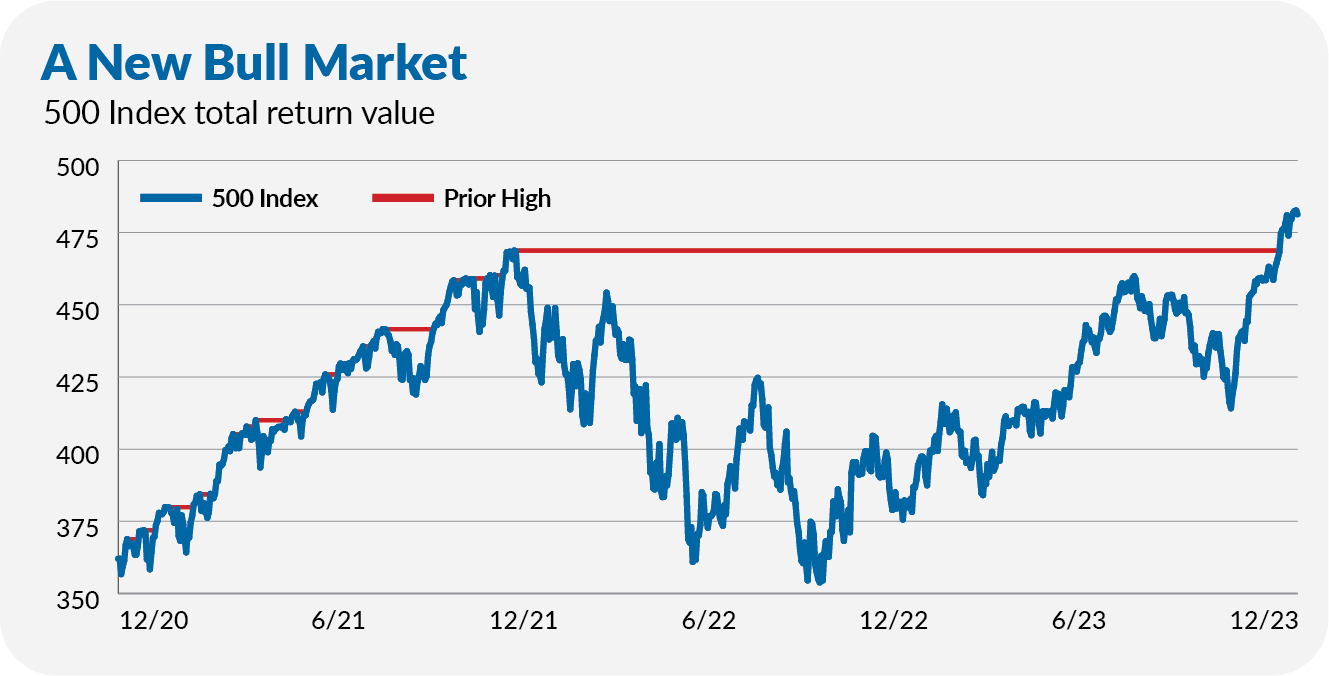

That 26% return for U.S. stocks pulled the index fund out of bear market territory. All-in, it was a relatively mild bear market, lasting just two years from peak to recovery. Stocks fell about 25% over the course of 10 months, and it took just 14 months to recoup those losses.

Big Bullies

2023’s so-called Super Seven—Microsoft, Apple, Amazon, NVIDIA, Alphabet (Google), Meta (Facebook) and Tesla—dominated the markets with gains ranging from 49% to 239%. The media has obsessed over these stocks all year, and I’ve already spilled a lot of ink on them, so I won’t belabor the point.

This handful of market darlings drove the divergences between large and small stocks as well as growth and value stocks.

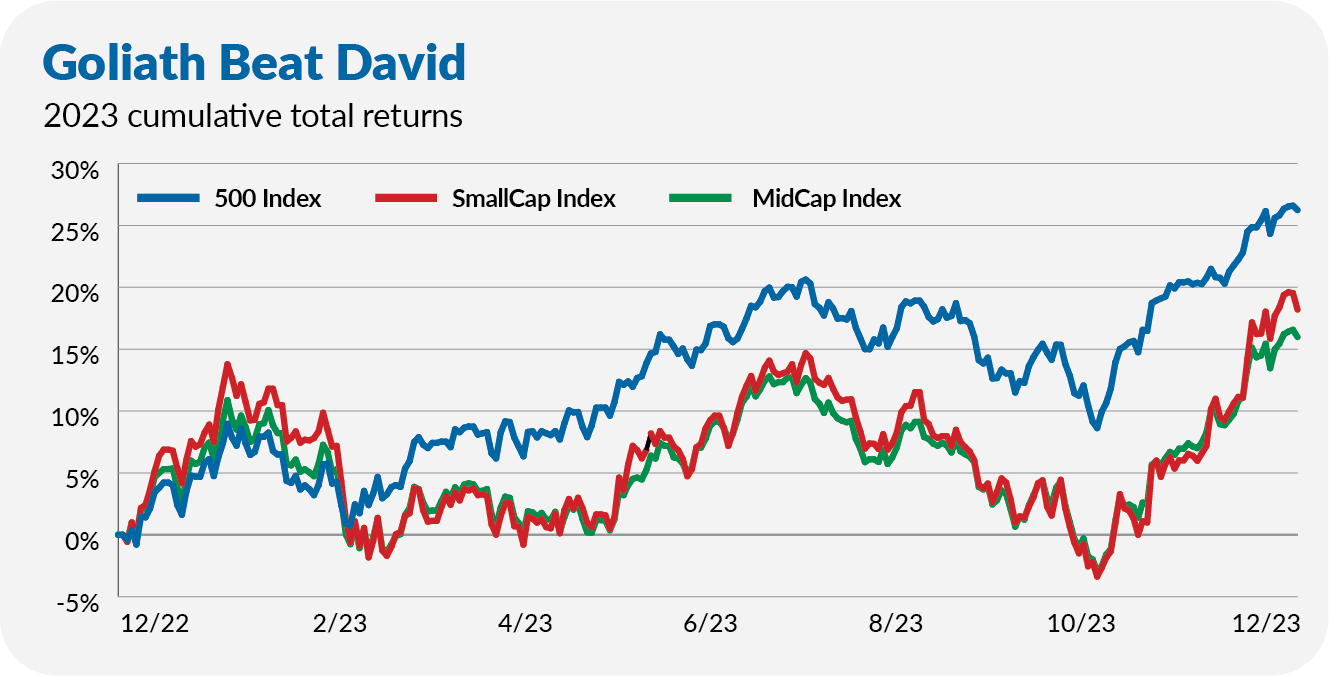

Larger stocks outpaced smaller stocks by around ten percentage points in 2023—500 Index gained 26.2% while MidCap Index (VIMAX) returned 16.0% and SmallCap Index (VSMAX) advanced 18.2%.

In the end, smaller stocks finished with decent (if trailing) returns thanks to a strong rally in the final two months of the year. As you can see in the chart below, MidCap Index and SmallCap Index were flat on the year at the end of October. November put them solidly in the black.

Growth Spurt

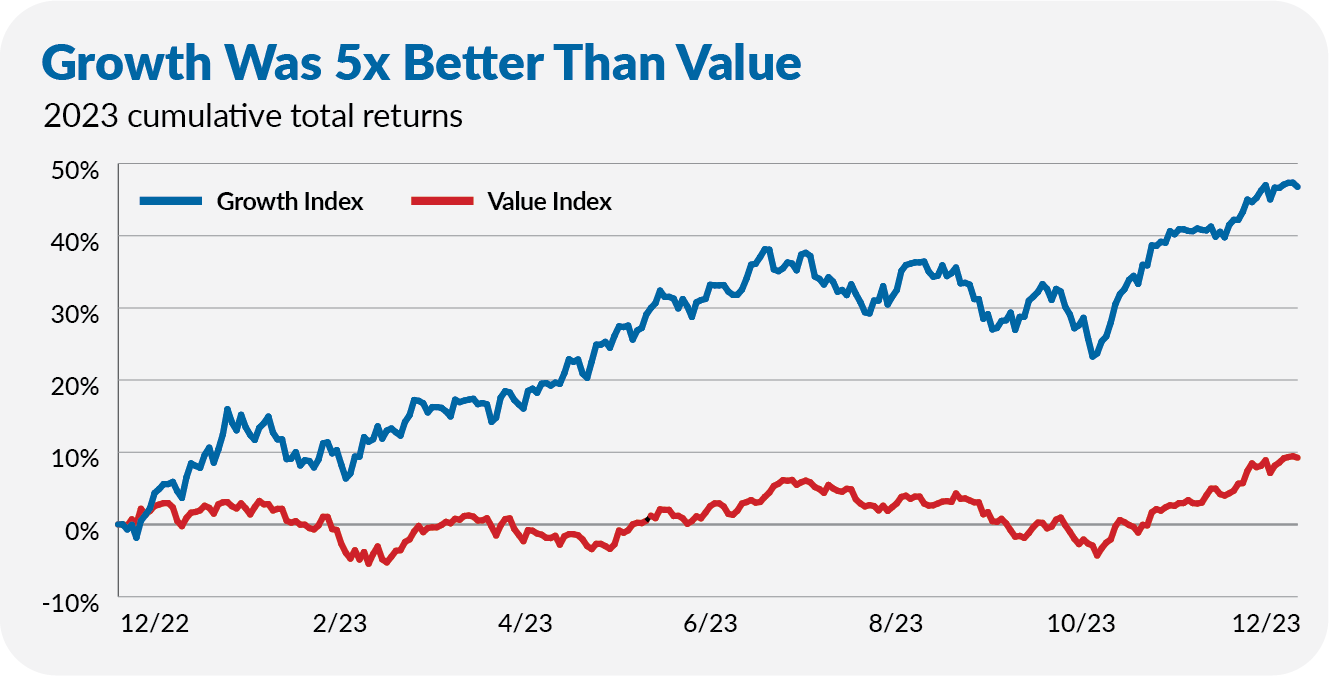

Gains for the mega tech stocks also fueled a growth stock rally in 2023.

While I’m not a big fan of labels like “growth” or “value,” the bottom line is that whether you chose to seek highly-priced companies with above-average profit growth or companies where stock prices don't reflect asset values, that choice made all the difference in your returns last year. Growth Index’s (VIGAX) 46.8% return—nearly 40 percentage points ahead of Value Index’s (VVIAX) 9.2% gain—was a whopper.

The chart below, showing the difference in calendar year returns for the two index funds since their inception, is my chart of the year. The blue bars (above zero) show the level of Growth Index’s outperformance. The red bars (below zero) illustrate when value stocks led the way.