Remarkably calm.

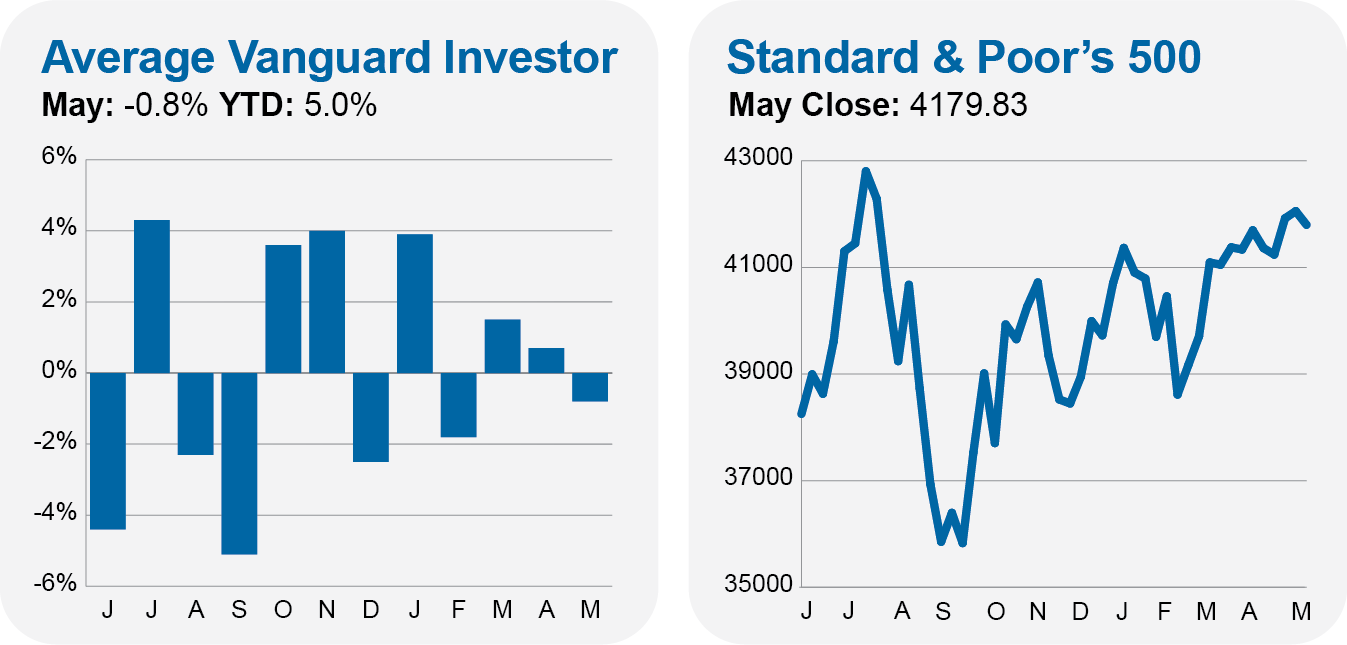

That’s the best way I can describe the markets in May. While politicians took the debt ceiling debate down to the wire (and it’s still not a done deal), Total Stock Market Index (VTSAX) gained 0.4%. And consider that the S&P 500 index did not move by 2% (up or down) on a single day in May—it happened 46 times last year!

In 2011, when the debt-ceiling debate was also front and center and the prospect of a government default was on the table, stocks nearly crossed into bear market territory—see here for a more detailed comparison.

Sure, I can find pockets of weakness in the markets … SmallCap Index (VSMAX) dropped 2.0% in May while Total International Stock Index (VTIAX) fell 3.4%. Bonds actually declined somewhat too, with Total Bond Market Index (VBLTX) down 1.1%—but I wouldn’t call this a scramble for the exits by any means.

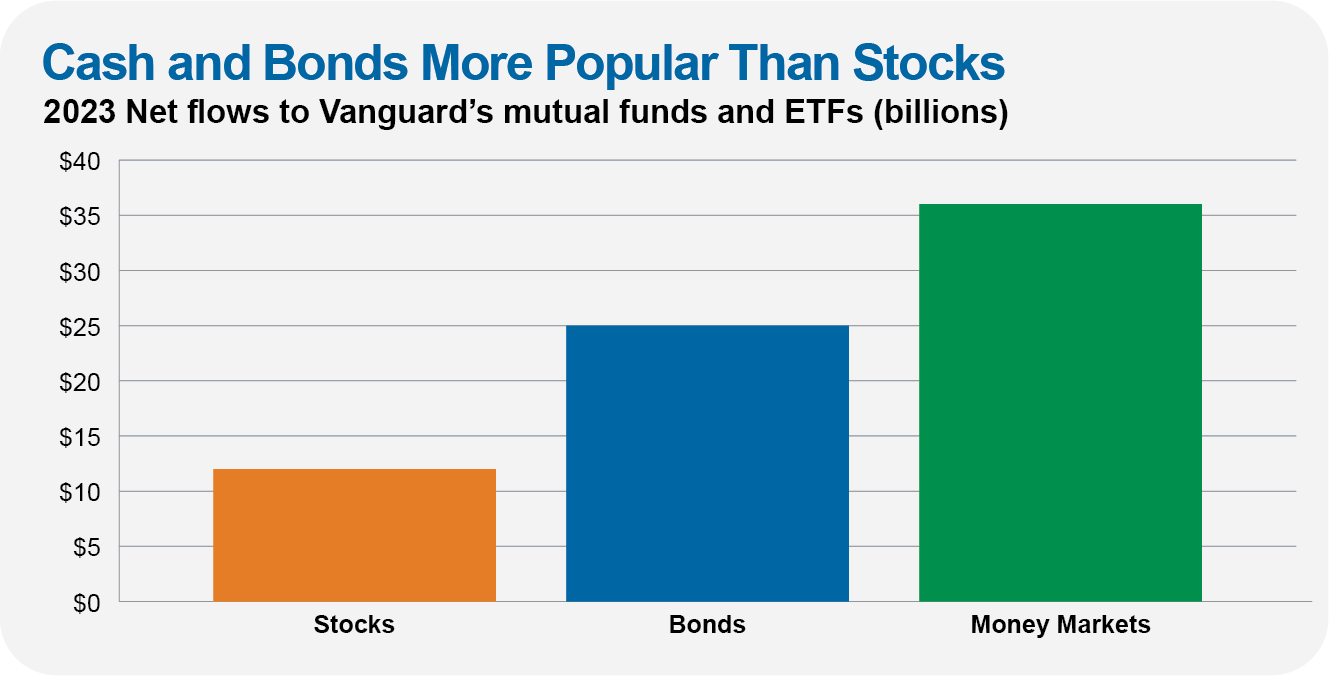

At the same time, investors haven’t been gung-ho about taking on risk, either. Looking at fund flows over the first four months of the year, investors added just $12 billion to Vanguard’s stock funds and ETFs. They’ve added $25 billion (or twice as much) to Vanguard’s bond funds and $36 billion (or three times as much) to their money market funds.

This doesn’t paint a picture of investors buying stocks with reckless abandon.

A word on the big flows into money market funds: At first glance, this looks like investors flocking to cash after last year’s stock and bond market declines. But there’s more to it. I think money market funds got a boost from fear of more bank failures and (coincidentally) the easy decision to shift from a checking account paying fractional yields to a money market paying 4% to 5%.

The point is that the debt ceiling debate was a non-event from most investors’ perspective. May’s results will fade from our memory in short order.

With five months down, the markets have delivered decent returns this year. Total Stock Market Index has gained 8.7%, while foreign stocks, measured by Total International Stock Index, are up 4.8%.

Of course, as I’ve written before, you can find divergent results if you look under the hood of those total market funds.