Hello, and welcome to the IVA Weekly Brief for Wednesday, September 25.

There are no changes recommended for any of our Portfolios.

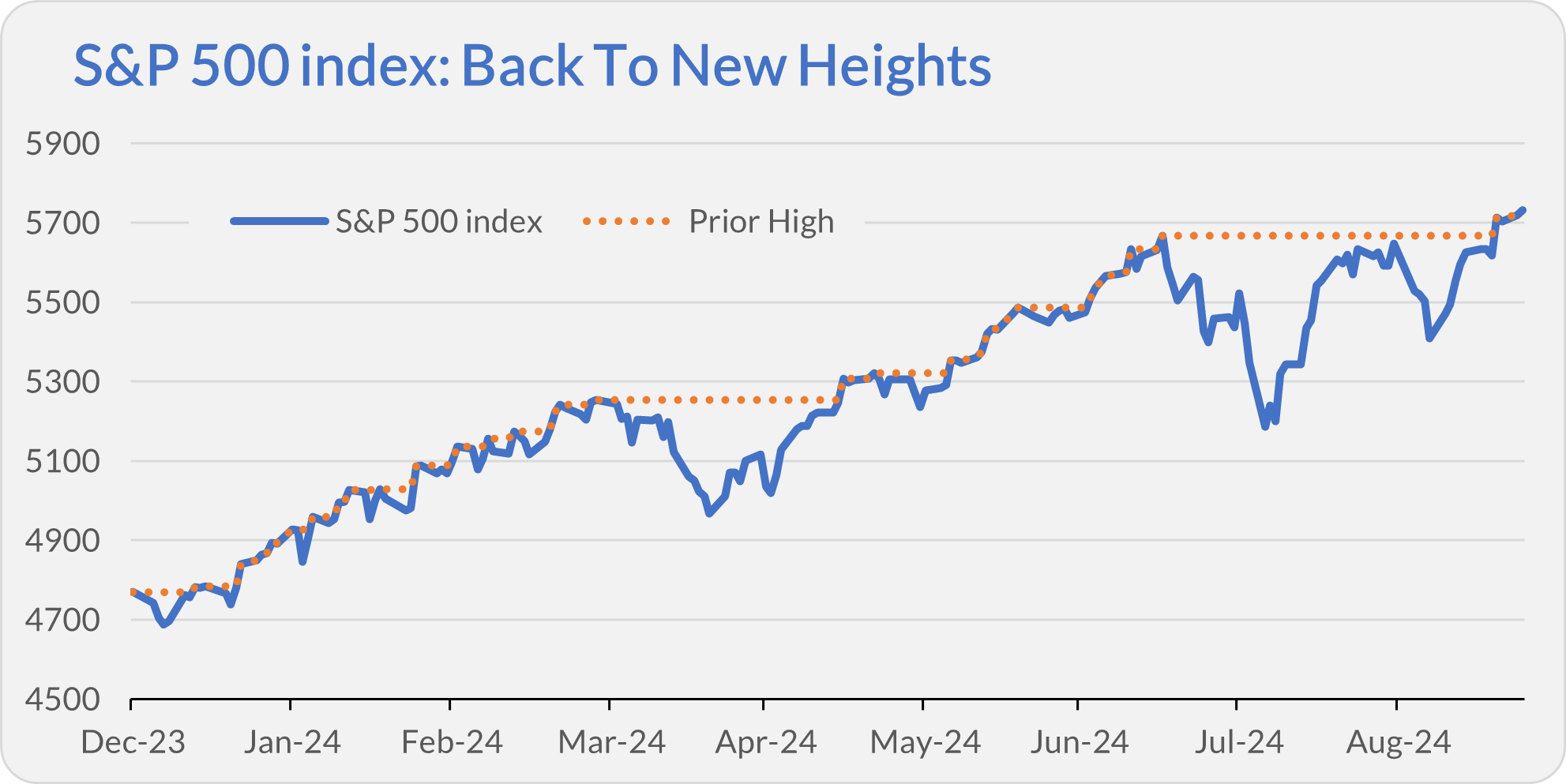

The stock market hit new highs each day this week. On Tuesday, the Dow Jones Industrial Average and the S&P 500 index notched their 31st and 41st highs, respectively, for the year.

Of course, that’s just price returns. When you add in dividends, the S&P 500, for instance, has hit 45 new highs, and shareholders have earned a 20.1% total return. That’s a solid return by any measure, but for a little context, consider that 500 Index (VFINX) has returned 12.5% on average each calendar year since its 1976 inception. The year isn’t over, but stocks are delivering above-average returns so far.

Yield Update

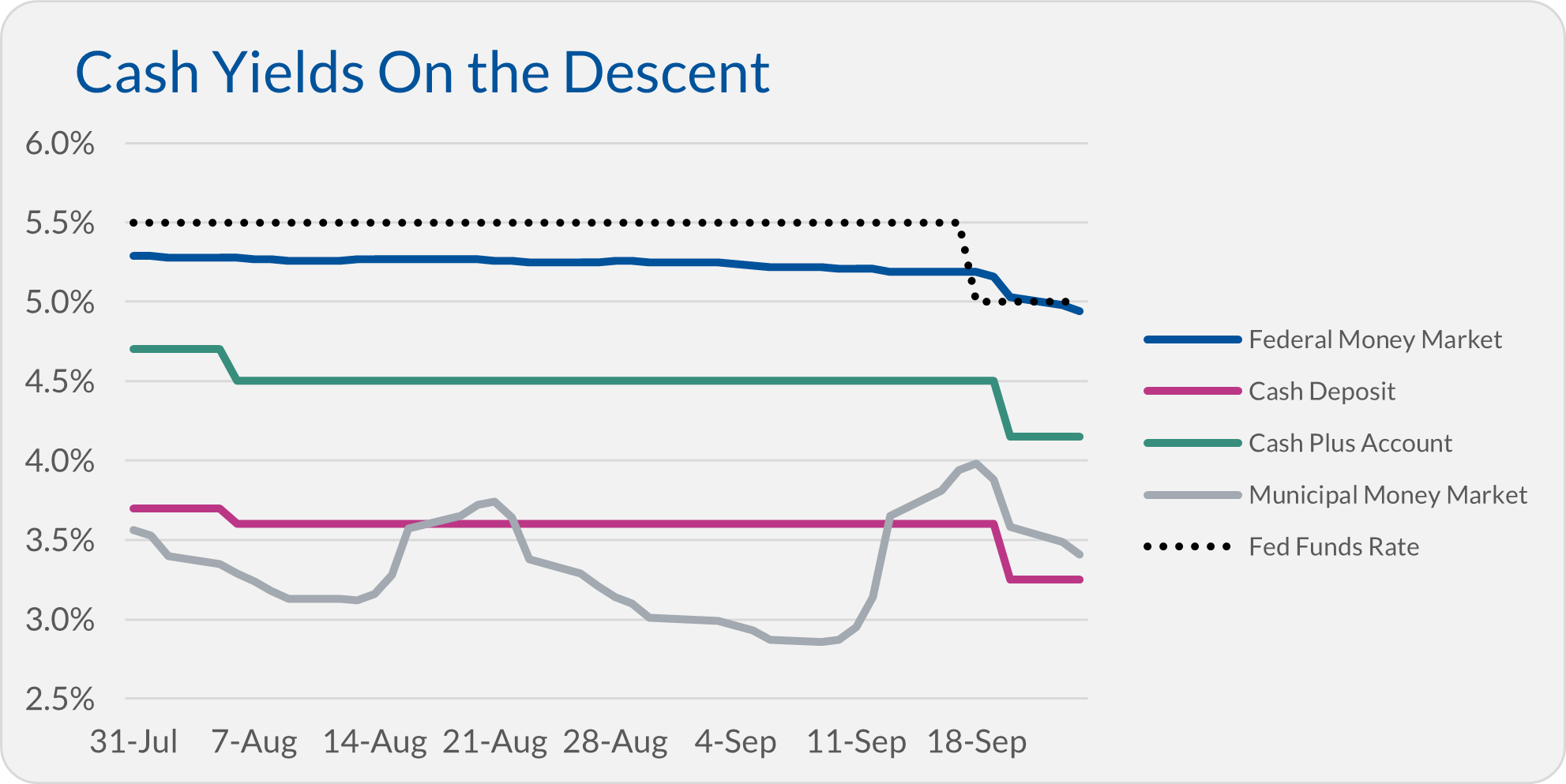

This shouldn’t be a big surprise, but cash yields are heading lower after Federal Reserve policymakers cut interest rates last week. As promised last week, here’s where Vanguard’s cash yields stand now.

In the chart below, I’ve included the fed funds rate (technically, the upper limit of the target range) as well as the yields on Federal Money Market (VMFXX), Municipal Money Market (VMSXX) and Vanguard’s two newer cash solutions—Cash Deposit and Cash Plus Account.

Despite ticking lower in early August, before the Fed cut interest rates, the yields on the two newer cash solutions declined again on Friday. Cash Deposit’s yield now sits at 3.25%, or 0.45% lower than it was at the end of July. Cash Plus Account now yields 4.15%, or 0.55% less than it did two months ago. Federal Money Market still offers a superior yield to both cash programs—4.94% (as of Tuesday). How can you beat that?

Municipal Money Market’s yield initially rose as policymakers cut interest rates, but it eventually joined its siblings in heading lower.

Remember, municipal funds typically offer a lower yield than taxable siblings because the income they pay out is (for the most part) not taxed. Municipal Money Market’s 3.41% tax-free yield translates into a taxable yield of 5.76% for an investor in the top federal tax bracket—not too shabby. Heck, Municipal Money Market offers a better than Cash Deposit, even before factoring in taxes!

I don’t see a compelling reason to choose either "cash " account over a tried-and-true money market fund.

Incentives Matter

If you have a brokerage account at Vanguard, you probably received an email last night stating that Vanguard had updated its Broker-Dealer Client Relationship Form (also known as Form CRS). This isn’t cause for alarm.

I don’t see any new fees here, though Vanguard emphasizes the $25 fee for placing trades over the phone in the Conversation Starters document. (I found that Q&A is a little more digestible than Form CRS.)

The main thrust of this update is a reminder that when a Vanguard representative offers a “point-in-time recommendation” on the phone, they are incentivized to get you to (a) bring assets to Vanguard and (b) use Vanguard’s advice services (like Personal Advisor). (You can read about this on page 2 of the Q&A.)

If you’ve ever had a Vanguard phone rep ask you (out of the blue) if you want to learn more about the firm’s advice services, now you know why—incentives matter!

Automate Your ETF Purchases

I finally got invited to one of Vanguard’s pilot programs! How about that?

As I told you in August, Vanguard recently started testing out automatic recurring purchases of ETFs. Well, on Friday, I got my invite to join the program via email:

I’m a willing test pilot, curious to see how it operates and what prices Vanguard uses when making automated purchases.

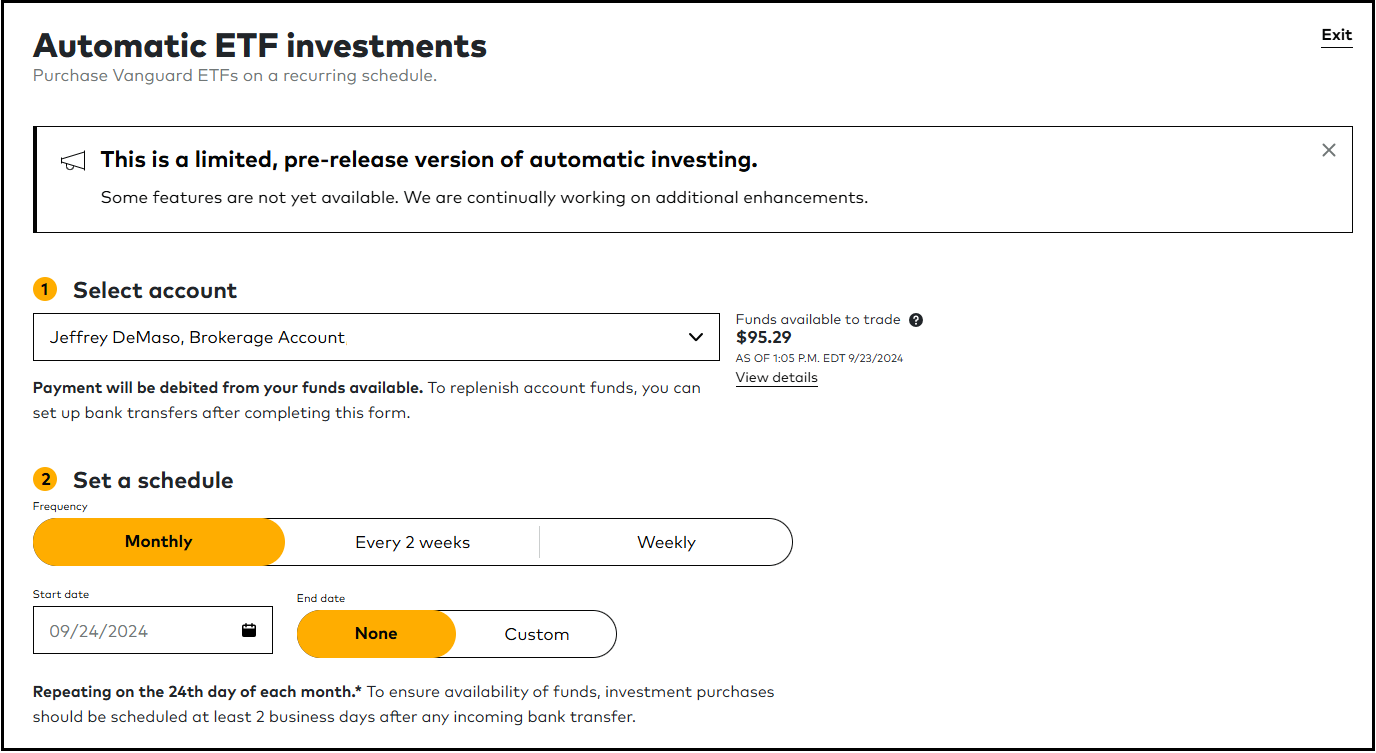

The setup page for automatic ETF investments is in the image below. First, you choose which account to trade. Then, you decide your investment schedule: every month, every two weeks or weekly.

Be aware that you can only set up this automatic investment into an ETF you own. In other words, your first purchase must be made manually.

That’s all fine, but I ran into a snag trying to set this up.

To make the automated purchases, Vanguard uses funds already in your account (read your settlement fund). I typically have very little in my settlement fund—currently, just over $95—so I also need to set up a recurring cash transfer into my brokerage account to make the purchases.

I have a Cash Plus Account at Vanguard as a research vehicle, so you’d think I could automatically pull the funds from the cash account to my brokerage account, right? Wrong! That functionality doesn’t exist for Cash Plus Account.

So, I have a few options: I can manually transfer money from my Cash Plus Account each month or transfer a large(ish) lump sum to cover several months of purchases—both of which defeat the purpose of automating things. A third option is automatically pulling the funds from my outside checking account.

Begrudgingly, I’m pulling the funds from my outside checking account. Here’s my schedule: At the end of each month, draw money from my checking account into my brokerage account. On the 7th of each month, purchase S&P 500 ETF (VOO).

I’ll keep you posted on how it goes.

One additional note. When using this service, the trades are considered “not held.” This means you’re giving Vanguard discretion to make these trades on your behalf. In the fine print, you must agree that Vanguard “is not responsible for any potential market fluctuations, or alleged trading losses, during this time period.” In other words, you won’t be able to complain about the prices at which Vanguard executes your trades.

Crisis Management

Kristina Tully.

There’s a name I hope I never write again.

Tully was hired last week as Vanguard’s newest “Head of Crisis Communications and Issues Management.” In English, she’ll be the point person should Vanguard encounter a PR crisis.

I mean this in the nicest possible way, but the less we hear from Tully, the better!

Vanguard Settles …

Speaking of a PR crisis, Vanguard has agreed to settle with a group of Target Retirement shareholders who sued the fund giant after getting hit with a massive tax bill in 2021.

We’ve discussed this lawsuit before—here and here—but the short story is that Vanguard botched its attempt to lower fees on its Target Retirement funds. As a result, shareholders were unnecessarily handed large tax bills.

The details of this settlement are yet to be determined, but given that Vanguard already forked over $6.25 million to Massachusetts’ regulators over this snafu, I’m not surprised by this result.

Vanguard's motives—to provide more investors access to lower-cost funds—were “good,” but its execution was sloppy. Vanguard is paying a price (again).

… And Gets Fined

Speaking of paying the price for sloppy work, I told you last year that Vanguard’s Australian arm was accused of “greenwashing” its Ethically Conscious Global Aggregate Bond Index fund. In short, the fund held some companies it should’ve excluded based on the ESG criteria the managers said they were following.

Well, Vanguard’s Australian unit has been fined 12.9 million Australian dollars (nearly nine million U.S. dollars) for this misstep. They also must keep a public notice of the transgression on its website for 12 months.

Accessibility Update

Last night, we made two small updates to the IVA website, which should make it more user-friendly.

First, we added the ability to increase (or decrease) the font size in the articles. While the default text size is meant to be easy to read, I know some IVA readers would prefer it to be smaller or larger. Now, you can do that by clicking “Text Size” at the top of any article and choosing your preferred font size.

Second, we added a “Back to Top” button at the bottom of every page. So, if you reach the bottom of any article or page (congratulations and thank you!), you can return to the top with the click of a button.

Please note: These features only apply when on the IVA website. They do not carry over to email.

We’re not done yet. In the next few weeks, we hope to have an AI-enabled text-to-speech feature up and running (at least for future articles). Stay tuned!

Our Portfolios

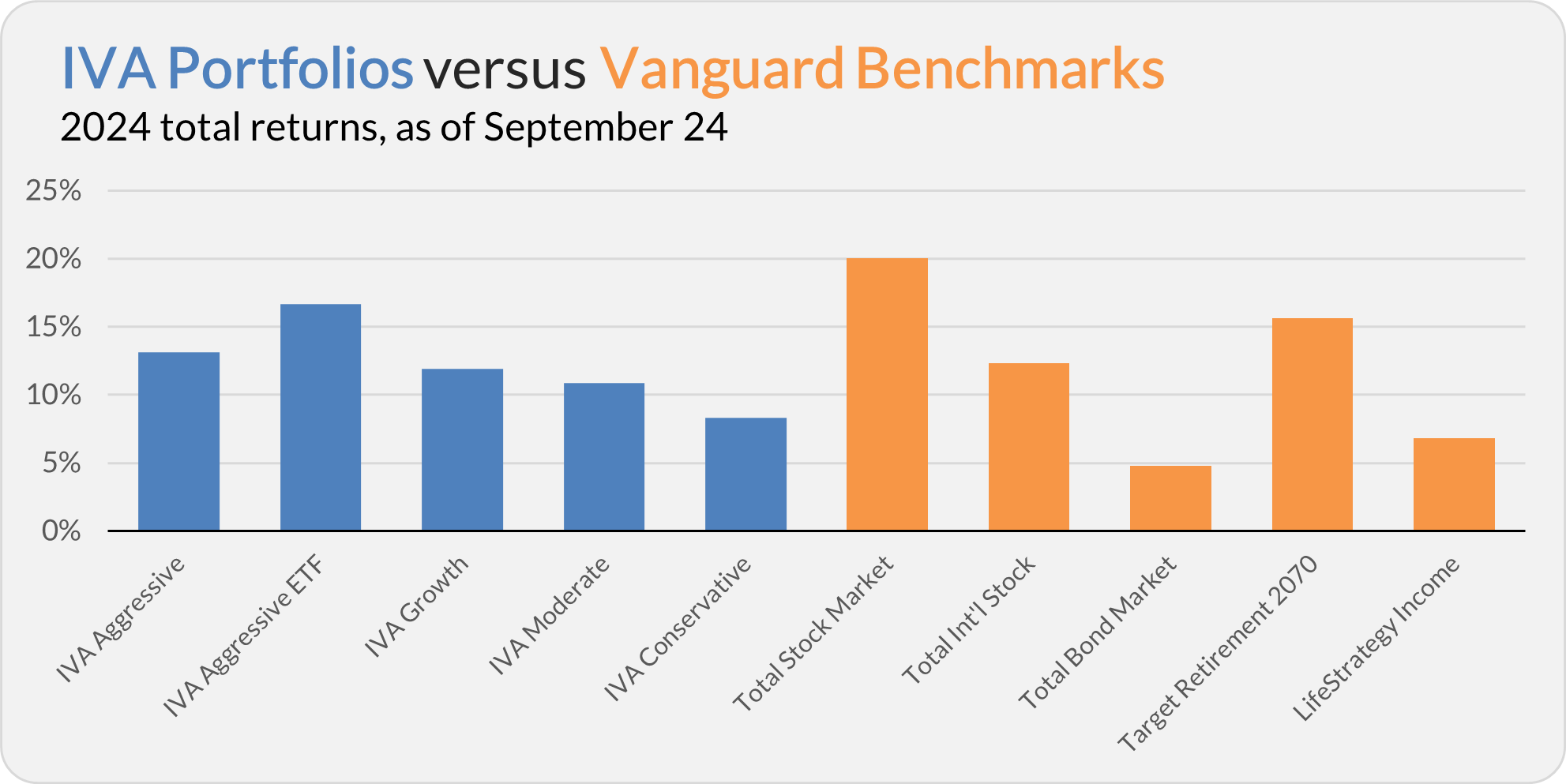

Our Portfolios are showing solid absolute but lagging relative returns for the year through Tuesday. The Aggressive Portfolio is up 13.1%, the Aggressive ETF Portfolio is up 16.7%, the Growth Portfolio is up 11.9%, the Moderate Portfolio is up 10.8% and the Conservative Portfolio is up 8.3%.

This compares to a 20.0% gain for Total Stock Market Index (VTSAX), a 12.3% return for Total International Stock Index (VTIAX), and a 4.8% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 15.6% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 6.8%.

IVA Research

I’m a big believer in investing alongside IVA readers—I call it eating my own cooking. I expect the portfolio managers running the funds I put my hard-earned dollars into to also invest in the funds.

Yesterday, in Nibbling Around the Edges: 2024, I showed Premium Members whether Vanguard-employed portfolio managers are eating their own cooking or not. A few Vanguard portfolio managers are sitting at the table with us, but there are plenty of unfilled seats.

Premium Members can also find the manager ownership stats for Vanguard’s funds here.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.