Executive Summary: When markets get rough, cash is your anchor. Vanguard’s money market funds are rock-solid, straightforward, and pay more than your bank. By contrast, Vanguard’s new cash accounts underwhelm, so skip the noise. If you want safety, simplicity and yield, stick with a tried-and-true money market fund.

As I often say, spending time in the market is simple but not easy. Long-term investors have to weather choppy seas daily and a major storm every few years. Even if market declines are a regular part of the journey (see here and here), they can still shake the confidence of even the most disciplined investor. So, I don’t blame anyone for seeking a safe harbor when the market winds start howling.

My go-to recommendation for investors looking to weather a storm has long been to keep it simple: hold cash, typically through a money market fund. Sure, other “safe” assets (like gold or long-term Treasurys) might offer greater returns, but they also come with more risk and uncertainty. For those dropping anchor amid market chop, the predictability and reliability of cash are hard to beat.

I bring this up because, well, foul winds are kicking up again. And, as usual, I’ve been fielding questions from readers looking to batten down the hatches. That makes this a good time to review Vanguard’s cash offerings.

To be clear, I’m not saying investors should abandon their long-term plans (read: stocks) and pile into cash. However, no matter what I say, some investors will seek a temporary refuge for all or some of their portfolio. Plus, as I noted in a recent trade alert, I think cash is a smart choice within your bond allocation. So, it’s worth taking some time to understand Vanguard’s solutions.

All of Vanguard’s cash solutions are safe and provide stability. However, they are not all created equal.

So, in this article, I’ll walk you through Vanguard’s five money market funds and two FDIC-insured sweep-account products—Cash Deposit and Cash Plus Account. I’ll also touch on Vanguard’s new 0-3 Month Treasury Bill ETF (VBIL), a cash alternative without a stable NAV.

You can read about Vanguard’s cash options for 529 plans and annuities here.

Key Points

- All of Vanguard’s money market funds are rock-solid

- Consider a municipal money market if you are in the top three tax brackets

- Stick with Federal Money Market over Cash Deposit for your settlement fund

- Cash Plus Account has potential but still falls short

- 0-3 Month Treasury Bill ETF is a cash-like option for ETF investors

Square One

Let’s start at the beginning.

In my view, money market funds are equivalent to cash. They own high-quality, short-maturity bonds and are designed to provide a stable price or net asset value (NAV) of $1.00, day in and day out. So, if you put in a dollar today, you can take out a dollar tomorrow (or next week or two months later).

A significant advantage to owning a money market over stuffing cash under your mattress is that money market funds pay income (usually).

Today, money markets offer the opportunity to earn a decent yield (a little over 4%) with zero price volatility, which appeals to many investors. So, let’s look at both aspects of a money market fund’s value proposition: stability and yield.

Rock-Solid Reliability, Decades in the Making

First, Vanguard’s money market funds are rock-solid.

In part, you can thank Vanguard’s low-cost advantage, which means the portfolio managers tending to your cash can keep risk low and still offer competitive yields. That’s a win-win for all of us.

Vanguard has been running money market funds without a misstep since the 1970s—and management has made it clear they intend to keep it that way. The firm is committed to maintaining a stable $1.00 NAV for all of its money market funds.

Case in point: During the era of near-zero interest rates, Vanguard voluntarily waived millions of dollars in fees to keep yields from dipping below 0%. Had it not done so, those negative yields would’ve pulled the money market funds’ NAVs below $1.00.

This “sponsor” commitment isn’t just lip service.

Technically, only two money markets have ever broken the buck—the Primary Reserve Fund in 2008 and the Community Bankers US Government Fund in 1994. However, according to the New York Fed, 28 other money market funds would’ve broken the buck during the 2008 crisis if the firms behind the funds hadn’t intervened.

On the surface, that might sound unsettling. But here’s the reassuring part: A Federal Reserve Bank of Boston paper—confirmed by Vanguard—shows that Vanguard did not have to step in to prop up its money market funds. The funds held up on their own.

And let’s not forget the context. Credit markets seized up in unprecedented fashion during the Global Financial Crisis. And still, only one fund broke the buck.

Plus, the regulatory environment around money markets has tightened in recent years. Vanguard’s three taxable money market funds—Treasury Money Market (VUSXX), Federal Money Market (VMFXX) and Cash Reserves Federal Money Market (VMRXX)—are now all packed with government-backed securities.

Ironically, that shift toward safety has some investors on edge. The current administration's willingness to break with precedent and shake up the global trading order has raised a new question: What else might they do?

Confidence in the U.S. government as a dependable borrower is slipping, reflected in the 10-year Treasury yield’s jump from 4.01% on April 4 to 4.48% on April 11. Even so, I don’t see the upside in disrupting the money markets. The chaos that would follow isn’t worth the gamble.

To be clear: I am not worried about the potential for one of Vanguard’s funds to “break the buck” and trade below the sacred $1.00 NAV.

Yield Without Drama

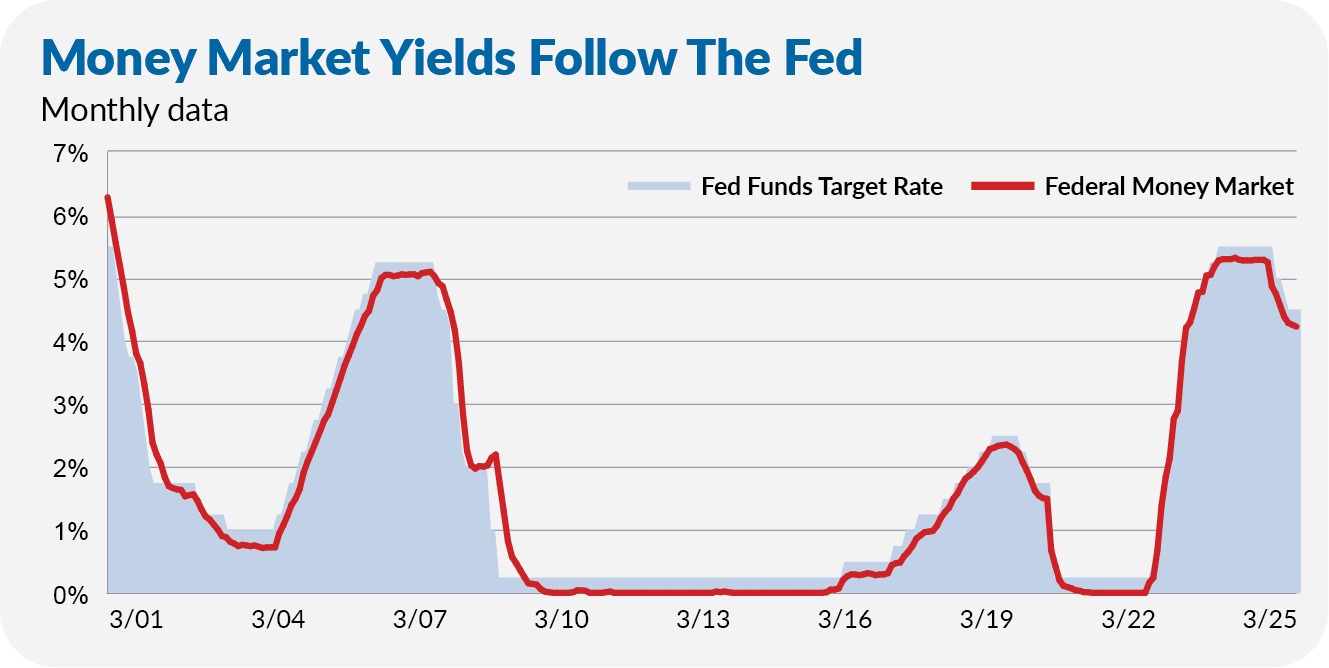

Money market yields closely track the federal (fed) funds rate. The fed funds rate is the interest rate that banks charge each other to borrow money overnight. It’s set by the Federal Reserve and serves as the anchor for interest rates across the economy—from mortgages to bond yields to money market yields.

You can see this clearly in the chart below, plotting Federal Money Market’s yield against the fed funds target rate over the past 25 years.

So, if you’re trying to forecast what money market returns will be in the years ahead, you need to predict what Federal Reserve policymakers will do.

That’s easier said than done. But for now, policymakers seem inclined to wait to see how tariffs impact the economy. If I had to guess, the days of near-zero interest rates (2009–2016 and 2020–2021) are behind us. In other words, I expect to earn at least some return on my cash in the months ahead, not just a return of my cash.

Fortunately for us Vanguard investors, we can earn significantly more income with a money market fund than from most bank products like checking and savings accounts. In the chart below, I’ve compared Federal Money Market’s yield to the average interest rates paid on savings and checking accounts since the middle of 2009, as reported by the FDIC.