Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, July 5.

There are no changes recommended for any of our Portfolios.

I hope you had a great Fourth of July holiday whether spent with family and friends or solo. Given that the markets were only open for half of a day on Monday and closed on Tuesday, little has transpired since I wrote my first half market recap. So, I’ll keep this Weekly Briefshort.

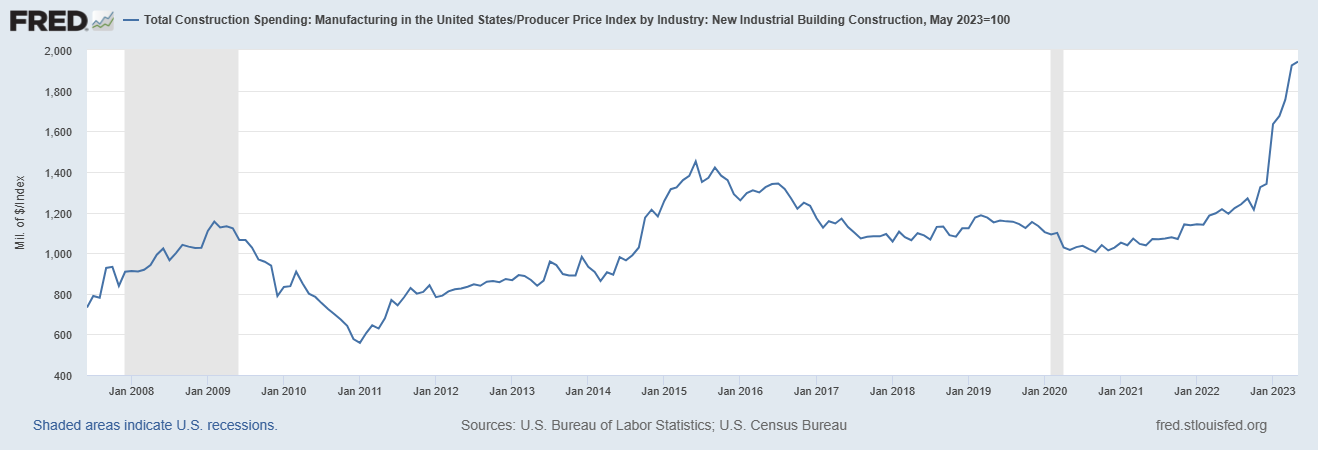

In the spirit of American independence, we are building factories and industrial plants at a faster clip than we did in the past two decades. The chart below shows total construction spending in the manufacturing sector adjusted for inflation specifically tied to building new industrial plants. (Tip of my hat to Noah Smith for pointing this chart out.)

Only the Rich Need Apply

For the past two weeks (here and here), I’ve written to you about Vanguard’s new securities lending program—Fully Paid Lending (FPL). While Vanguard’s website still doesn’t make it clear who is eligible and who is not, this is what I heard back from Vanguard on the matter:

In short, we are in the early stages of rolling out our fully paid lending offer. As I’m sure you’ve noted from the site, it is designed to give eligible investors a way to generate additional income on the securities they already hold without giving up their long-term, buy-and-hold position. At this time, the offer is available to self-directed Vanguard investors with a minimum of $5 million in assets (and a VBA brokerage account). [emphasis added]

So, there you have it. For the time being, you need at least $5 million invested with Vanguard and you have to do it all yourself. If you have hired Vanguard as a “personal advisor” (they call it Wealth Management once you have more than $5 million), you are not eligible. Plus, you also can’t still be using one of the legacy mutual fund accounts—you need a brokerage account.

Given Vanguard is in the “early stages of rolling out” securities lending—and that its competitors make the service broadly available—I wouldn’t be surprised if those eligibility requirements change in the future. As with any tech-based investment option, Vanguard is (and should be) wary of rolling it out too fast to too many clients, given their tech-stack foibles.

Our Portfolios

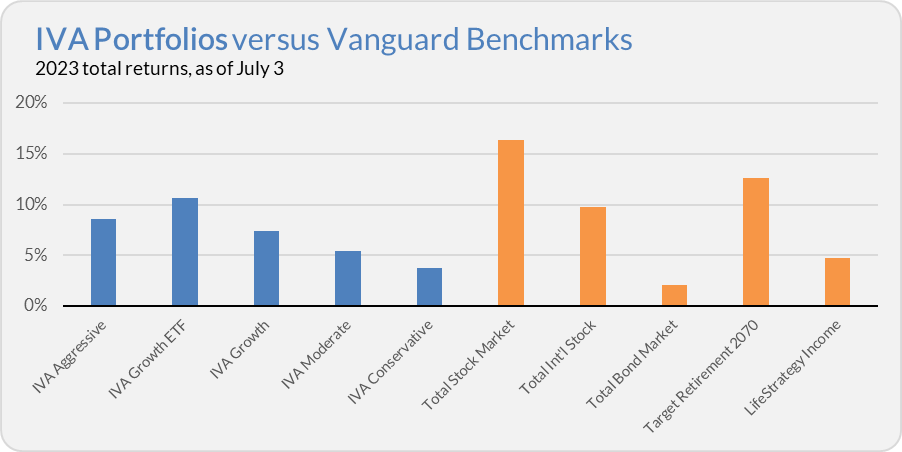

Our Portfolios are showing positive absolute but trailing relative returns for the year through Monday (July 3). The Aggressive Portfolio is up 8.6%, the Growth ETF Portfolio is up 10.7%, the Growth Portfolio is up 7.4%, the Moderate Portfolio is up 5.4% and finally the Conservative Portfolio is 3.8%.

This compares to a 16.4% gain for Total Stock Market Index (VTSAX), a 9.8% return for Total International Stock Index (VTIAX), and a 2.0% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 12.6% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 4.7% for the year.

The Portfolios have delivered decent absolute returns—if we earn those same returns again in the second half of the year, 2023 will have been a good year for compounding. But, candidly, the Portfolios’ relative returns are flagging. Once again, diversification hasn’t delivered … yet. Premium Members can read more about the Portfolios and their first half performance in We Were Promised a Recession.

Until my next IVA Weekly Brief this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.