Executive Summary: I'm taking a safety-first approach to bonds because today’s yields don’t justify the risks. I’ve shifted from corporate bonds to Treasurys and cash, prioritizing stability over uncertain returns. This article explains why I’ve made this move—and why it’s the right trade-off for now.

Why am I taking a safety-first approach to the bond market in The IVA Portfolios?

I’ve received that question from several IVA readers since I sold my longtime holdings, Short-Term Investment-Grade (VFSTX) and Long-Term Investment-Grade (VFICX), in favor of a money market and Intermediate-Term Treasury (VFITX) last July.

I appreciate where the questions are coming from. For the past two decades (or so), I’ve been very consistent in two suggestions: One, cash doesn’t deserve a place in our investment portfolios. And, two, pick Vanguard’s Investment-Grade funds over their Treasury fund siblings.

But I’m now bucking both of those recommendations. So, before I share my analysis of Vanguard’s bond funds (you can expect the first installment next week), I thought it would be helpful to explain why I’ve taken this safety-first approach with the Portfolios.

I know that bonds occasionally confound even the most experienced investors, so if you need a refresher on bond basics, see here. I also highly recommend reading Balancing Trade-Offs, which describes my framework for approaching the bond market.

And, if you want to take your bond knowledge a step further, check out these additional articles:

Big Picture

The short answer: I’m taking a safety-first approach to bonds because I don’t believe we are being compensated for taking on risk in the bond market.

One “risk” you can take in the bond market is interest rate risk, which stems from rising and falling interest rates' effect on bond prices.

The longer a bond or bond fund’s maturity, the greater its price sensitivity to changing interest rates. A Treasury bond that matures in five years will have a more stable price than a Treasury bond that matures in 20 years.

As of January 31, with Long-Term Treasury ETF (VGLT) yielding 4.87%, I don’t believe that investors are adequately compensated for taking on interest rate risk. In other words, I don’t want to lock in a roughly 5% annual return for the next two decades.

The second risk bond investors must consider is default (or credit) risk. This is the risk that the borrower won’t be able to pay you back.

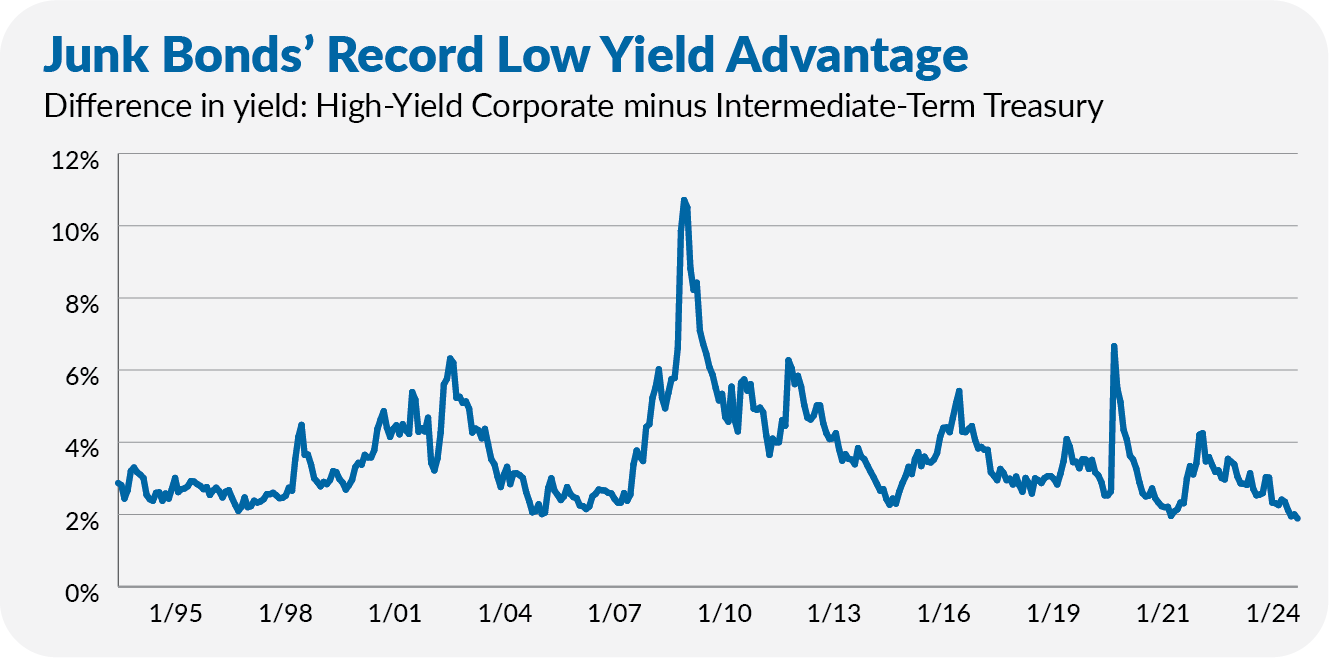

When lending to a less trustworthy borrower (an entity with greater default risk), we investors want to be compensated for this risk, usually in the form of a higher yield. The question is, how much additional income are we getting?

My answer today is, “Not enough.” For example, High-Yield Corporate (VWEHX) only yields 1.89% more than Intermediate-Term Treasury—a record low over the past 30 years.

So, if I’m not being compensated for the risks, I’d rather play it safe and wait for better opportunities.

Of course, just because I don’t want to own long-maturity bonds doesn’t mean I have to sit in cash. Similarly, my aversion to junk bonds (today) doesn’t automatically translate into owning only Treasury bonds. So, let’s dig a little deeper into my thinking behind each position.