Maybe I was just six months early!

At the start of the year, I told you I expected we’d see a rotation within the stock market. A month ago, I admitted my forecast was “dead wrong so far.”

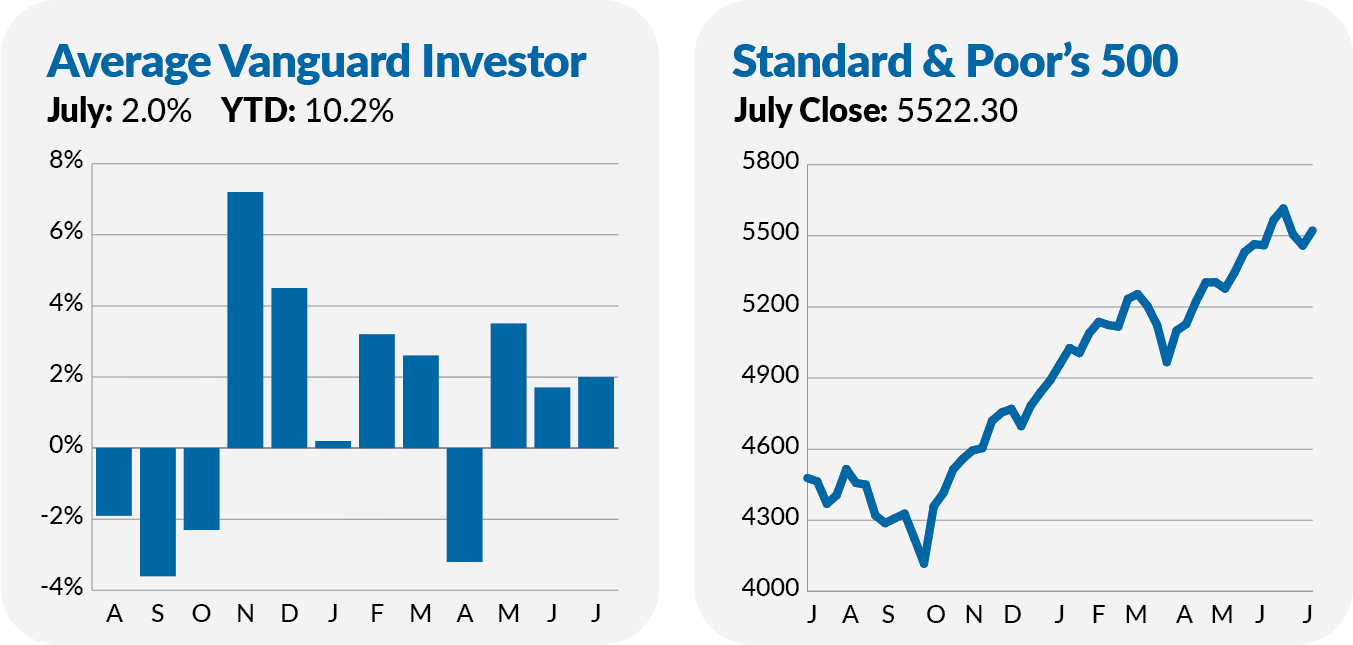

Well, the stock market certainly had heads spinning in July. Overall, 500 Index (VFIAX) gained 1.2%. However, Vanguard’s best-performing fund during the first half of the year, S&P 500 Growth ETF (VOOG), fell 1.3% in July. The first half’s best-performing sector ETF, Information Technology ETF (VGT), dropped 1.3%.

By contrast, SmallCap Index (VSMAX) gained 6.8%. And Real Estate Index (VGSLX) gained 7.8% in July, taking it from zero—even less than zero, as the only sector in the red in the first half of the year—to hero (the best-performing sector in July).

Though small stocks won the month, tech stocks ended on a positive note. This should tell you that any of the myriad talking heads who claim the rotation is permanent are just blowing smoke. No one knows whether the mega-cap techs will come roaring back or not. And that’s why diversification is so important.

So, let me put July’s rotation into context and explain why there may be more market-spinning moments in the months ahead.

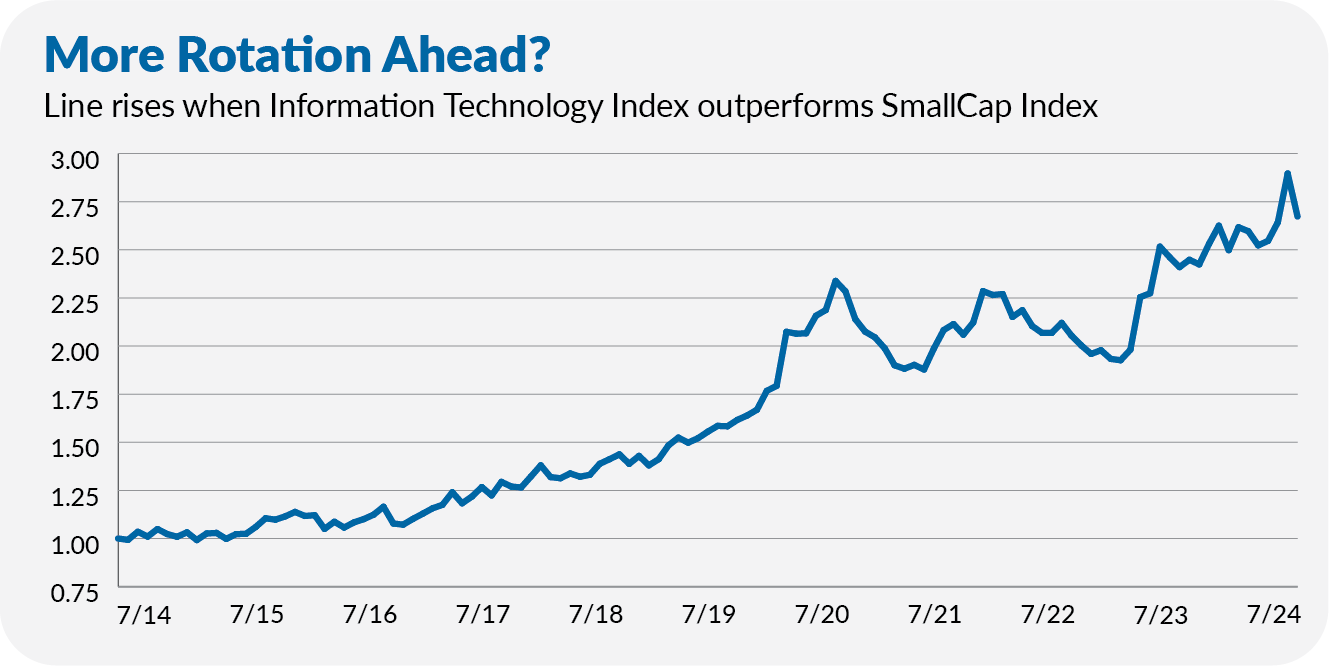

First off, small-cap stocks just had their best month compared to tech stocks in a decade—an 8-percentage point difference. However, the relative performance chart comparing tech and small-cap stocks helps put that one month in context. Over the past 10 years (including July), tech stocks have gained 553%, while small stocks are up just 144%.

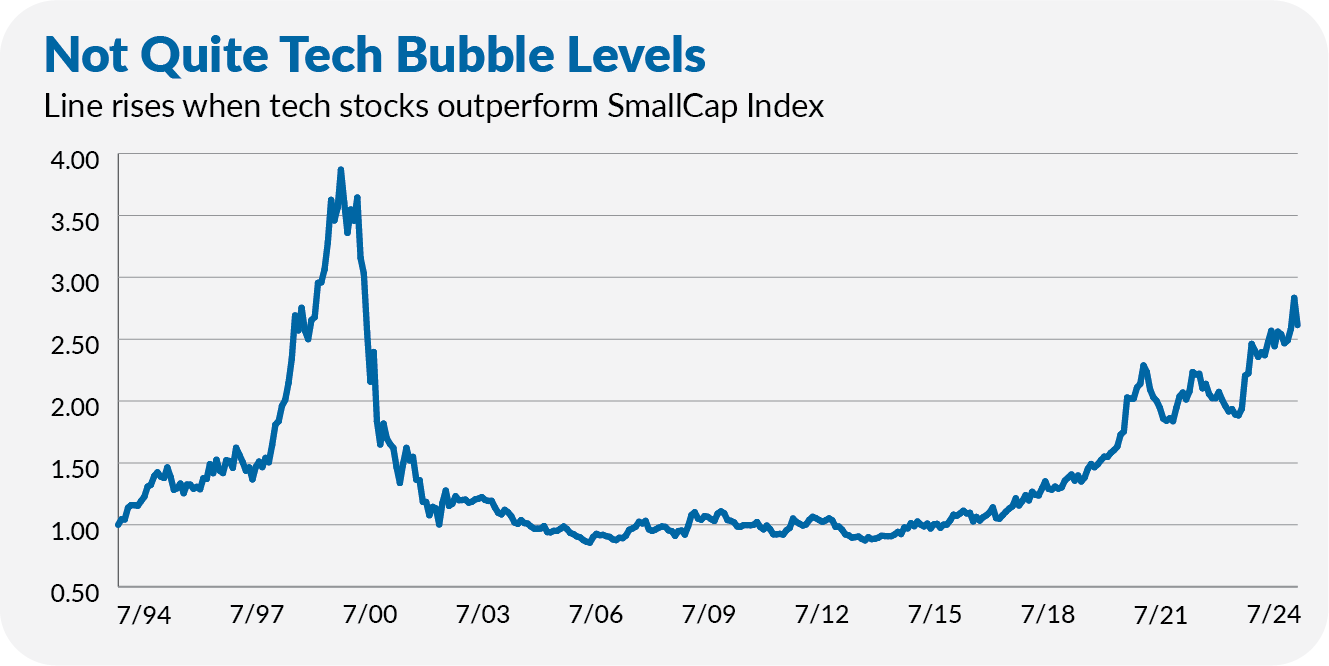

The chart below provides us with more perspective. By linking up index data with the sector fund’s returns, I can compare tech stocks and small-caps over the past three decades.

Technology stocks’ outperformance over small stocks is nowhere near tech bubble levels. The chart shows that while tech stocks outperformed during the tech bubble of the late 1990s (the spiking rise), small caps quickly made up all that ground when the bubble burst (the dramatically falling line).

Put it together, and over the first 10 and 20 years of this analysis, these two slices of the market (techs and small stocks) were on level footing. It’s only the past decade or so that has seen tech stocks race ahead.

That’s not to say that small-caps and tech stocks should deliver the same returns over time. My point is that technology stocks may have gotten somewhat ahead of themselves relative to smaller fare, and there might be an opportunity.

My recent trades were aimed, in part, at pursuing this opportunity.

Switching markets for a moment, I wouldn’t quite describe what’s been going on in the bond market as a rotation, but I bet many bond investors are feeling a bit more comfortable with their holdings lately.